When Do Credit Cards Report to Bureaus?

Let's get right to it: your credit card company doesn't report your every move to the credit bureaus. Instead, they typically send a monthly update. This isn't just some random day on the calendar; it's almost always tied directly to your statement closing date.

Think of it as a monthly snapshot. On that specific day, the issuer takes a picture of your account—your balance, your payment status—and sends that photo off to the big three credit bureaus (Equifax, Experian, and TransUnion).

Your Credit Reporting Calendar Explained

Getting a handle on this monthly cycle is one of the most powerful things you can do for your credit score. Why? Because it’s less about when you pay your bill and more about what your balance is on that one specific day of the month—the day your statement closes.

This single number has a huge impact on your credit utilization ratio, which makes up a massive 30% of your FICO® Score. It’s the difference between looking like you’re maxing out your cards and showing that you use credit responsibly.

The process isn't instant, though. There are a few key steps between you swiping your card and that information showing up on your credit report.

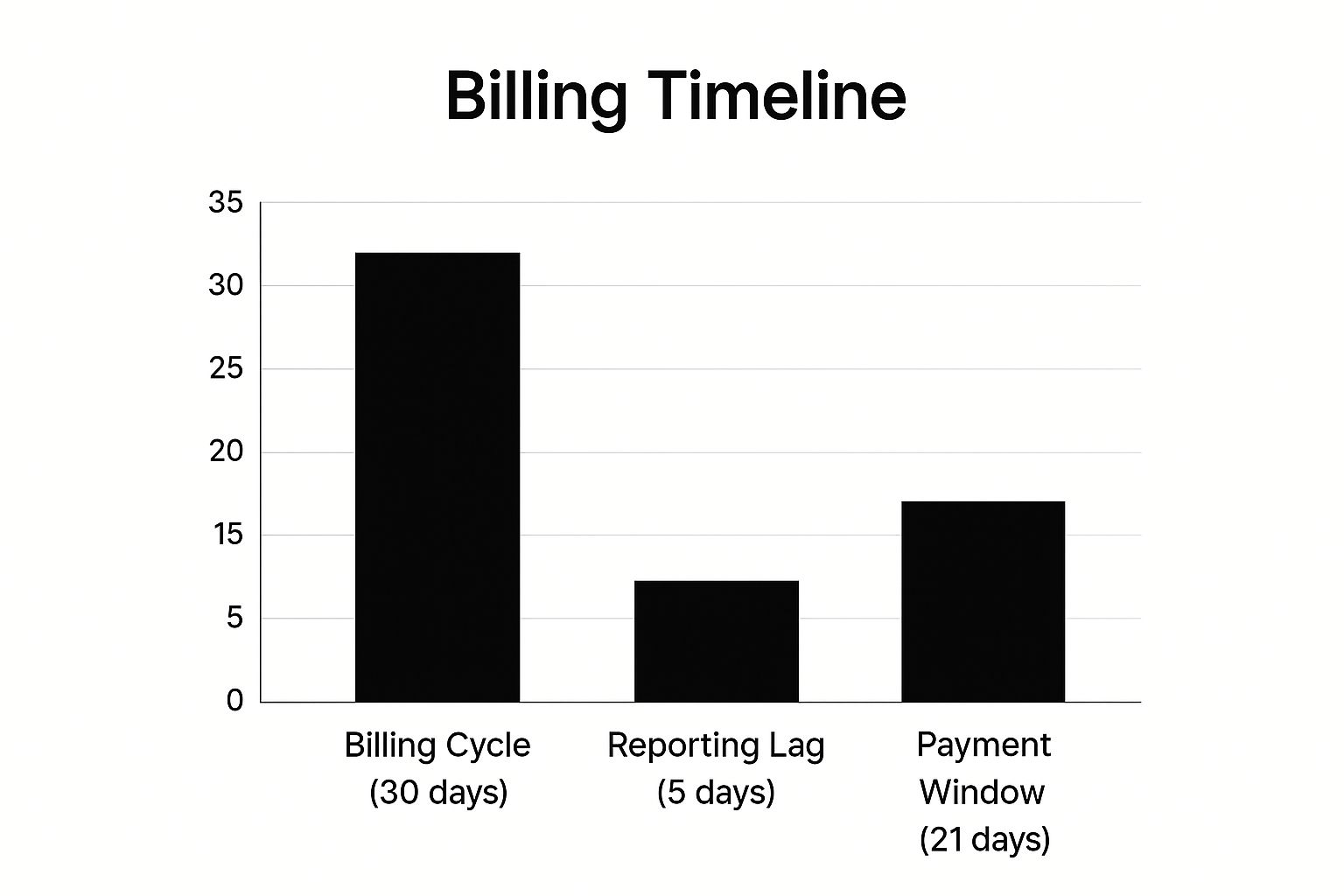

This chart breaks down the typical timeline, showing how your billing cycle, payment due date, and the actual reporting date all connect.

As you can see, there's a natural lag. The information from your statement doesn't appear on your credit report the very next day. It takes time for your card issuer to package the data and for the bureaus to process it.

The Standard Reporting Timeline

While no federal law nails down the exact date an issuer must report, the industry operates on a pretty consistent schedule. The major players—Chase, Amex, Citi, and others—all update your credit information at least once a month.

This regular, predictable rhythm is what keeps your credit report fresh and allows lenders to get a reliable, up-to-date picture of your financial habits. To really understand how this works, let's walk through the key moments in any given month.

To give you a clearer picture, this table breaks down the sequence of events every single month.

Key Events in Your Credit Card Reporting Cycle

Understanding these three distinct dates is the secret. By knowing when your statement closes, you can strategically pay down your balance before that snapshot is taken, keeping your reported utilization low and your score healthy.

Statement Closing Date vs. Payment Due Date

This is one of the most common trip-ups I see people make when they're trying to build credit. Getting these two dates straight is your secret weapon for managing your score.

Think of it like this: your statement closing date is the moment the credit card company takes a "snapshot" of your account for the month. It captures everything—your purchases, your payments, and most importantly, your balance on that specific day.

Your payment due date comes later. That’s just the deadline for when you need to pay the bill that was generated on your closing date.

For your credit score, that "snapshot" day is what really counts. The balance captured on your closing date is the number that gets sent over to the credit bureaus.

Why the Closing Date Is More Important for Your Score

Don't get me wrong, your payment due date is still incredibly important. You absolutely must pay on time to avoid late fees and protect your payment history, which is the biggest piece of your credit score pie.

But when we're talking about your credit utilization—how much of your available credit you're using—the closing date is king.

Let's say you have a 500** balance when your statement closes. That **500 is what gets reported. Even if you pay the entire balance off the very next day, that higher balance is already locked in and reported for the month.

This is a subtle but powerful detail that many people miss. To see how this plays out on your own account, it helps to understand how to read credit card statements where both of these dates are clearly listed.

Using This Knowledge to Your Advantage

Okay, now you're in on the secret. If your goal is to keep your reported credit utilization low, you need to pay down your balance before the statement closing date arrives. You don't have to wait for the bill.

Here’s a simple, practical example:

By making a payment a couple of days early, you ensure a much lower balance gets reported to the bureaus. Do this consistently, and you can give your credit score a significant, lasting boost.

The Journey of Your Credit Card Data

So, what exactly happens after your credit card statement closes each month? It’s not like your card issuer sends a quick text to the credit bureaus. The process is a bit more involved.

Your bank gathers up all your recent account activity—your current balance, payment history, and credit limit—and bundles it into a massive, standardized data file. This file contains the same info for millions of their other customers, too.

Think of it as a carefully packed cargo shipment. Once all the information is batched together, this huge digital package is sent securely to the big three credit bureaus: Experian, Equifax, and TransUnion.

From Bank to Bureau to Your Report

Once that massive data file arrives at the bureaus, the work is just getting started. It isn't instantly uploaded to your file. The bureaus have to "unpack" this shipment, sort through all the information, and then carefully update each person's individual credit file. This adds another layer of processing time to the whole operation.

This entire journey—from your bank to the bureau's processing queue—explains why there’s always a delay. Your credit report isn't a live feed of your account; it’s more like a monthly snapshot.

This built-in delay is why paying off your card today doesn't mean a mortgage lender will see a $0 balance tomorrow. The system is built on this methodical, monthly cycle. Every piece of data, from your payment status to your credit limit, becomes one of the credit report tradelines that tells your financial story over time.

Understanding this timing is crucial, especially if you're getting ready to apply for a big loan for a car or a house. Your credit report reflects the past, not the immediate present. If you want your credit profile to look as strong as possible, you need to make your moves well before your statement closes to account for the entire data travel and processing time.

Why Reporting Dates Aren't One-Size-Fits-All

If you've ever checked your credit report, you've probably noticed something a little odd. Your Chase card might update on the 5th of the month, but your Capital One card doesn't show up until the 20th. This isn't a mistake—it's just how the system works. There's no single, universal date when all credit cards report.

So, why the inconsistency? It really boils down to logistics for the card issuers. Imagine a giant like American Express trying to process millions of customer statements all on the first of the month. It would be a complete operational meltdown. To keep things running smoothly, they stagger billing cycles across their entire customer base.

Your personal timeline plays a big part, too. The reporting date for each card is directly linked to when you first opened the account. That approval date sets the starting point for your unique billing cycle, which is why every card in your wallet has its own reporting calendar.

Different Issuers, Different Schedules

The size and type of the bank also matter. A massive national player like Bank of America has a highly automated, almost clockwork-like reporting system. On the other hand, your local credit union might have a more manual process, which could lead to slight variations in their timing.

This kind of operational diversity is standard practice. While reporting monthly is the baseline in most major economies, the specific day it happens can vary. Even within the U.S., which is the world's largest credit card market, there’s no uniform schedule. For a broader look at how this compares globally, Statista offers some great research on worldwide credit card usage.

Understanding this is crucial for managing your credit score effectively. If you know each card's statement closing date, you can time your payments to ensure a low balance is reported, which is a game-changer when you're preparing for a big loan like a mortgage.

The Real-World Impact of Reporting Delays

Knowing when credit cards report to the bureaus isn't just trivia—it's a critical piece of your financial puzzle, especially when big life goals are on the table. Your credit report isn't a live, up-to-the-second dashboard. Think of it more like a photograph taken at a specific moment in time. The lag between what you do and what a lender sees can have huge consequences.

Let’s walk through a classic example. You've worked hard for months, maybe even years, and you finally pay off a hefty credit card balance. Your main goal was to slash your credit utilization and get ready to apply for a mortgage. You submit your application feeling great, only to get a denial letter in the mail.

What happened? The mortgage lender pulled your credit report before your new, zero-balance account was reported. On their end, it still looks like you're carrying a mountain of debt, which flags you as a risk. This simple timing mismatch can be the single thing standing between you and the keys to a new home.

How Delays Affect Major Purchases

This isn't just about mortgages, either. The same frustrating scenario can play out when you're applying for a car loan, a personal loan for a home renovation, or even just a new rewards credit card. Lenders depend entirely on the information they have at the exact moment they pull your file.

Even though the approval process is often automated and incredibly fast, it's all based on the freshness of the data from the credit bureaus. According to the Consumer Financial Protection Bureau's market report, most updates are still tied to that monthly billing cycle. So, a delay of just one month could mean a loan denial because all your recent financial discipline hasn't shown up yet.

At the end of the day, these reporting lags highlight just how important it is to plan ahead. If you're gearing up for a major financial move, you absolutely have to give the credit reporting system time to catch up with your actions. For instance, a single late payment can stick around long after you've settled the bill, and understanding how long late payments affect a credit score is key. Timing your payments and applications around reporting cycles isn't just smart—it's essential for getting what you want.

Answering Your Top Credit Reporting Questions

Once you get the hang of how credit reporting works, you'll probably still have a few specific questions. Let's tackle some of the most common ones people run into when they're trying to manage their credit.

Can I Get My Card Company to Report My Balance Early?

This question comes up all the time, usually when someone is about to apply for a big loan like a mortgage and wants their report to look perfect. The simple answer is almost always no.

Credit card companies use massive, automated systems to send out data for millions of customers at once. It all happens on a strict monthly schedule, and they just aren't equipped to pull one person's account out of the pile for a special, off-cycle report. The best way to handle this is to work with their schedule, not against it. If you want a lower balance to show up, make a payment right before your statement closing date.

Do All Credit Cards Report to All Three Bureaus?

You'd think so, but it's not a legal requirement. While most major national banks report to all three big bureaus—Experian, Equifax, and TransUnion—not every lender does.

Some smaller players, like local credit unions or certain store-specific cards, might only send your information to one or two.

What Happens if I Pay My Bill After the Statement Closing Date?

Paying your bill after your statement closes but before the due date is what most people do, and it's crucial for your credit health. It gets you that all-important "on-time" payment history, which is the biggest piece of your credit score puzzle.

Just remember, the balance that gets reported for that month is the one from your statement closing date. Your new, lower balance won't show up on your credit report until after the next statement cycle closes and the updated data is sent. If you're looking for a refresher on the basics, you can find some helpful general information on credits.

How Long Does It Take for a New Card to Show Up on My Credit Report?

It's tempting to want to see a new card appear on your report right away, but it's a process that takes a little patience. You can typically expect a new credit card to show up on your credit report within one to two full billing cycles, which usually means about 30 to 60 days.

Think about the steps involved: your new card company has to let you use the card for a month, close out that first billing cycle, package up the new account info, and then send it off. After that, the bureaus have to process it and add it to your file. It's a standard delay, so just factor it into your plans.

At itin score, we give you the tools and knowledge to take charge of your credit. Sign up in just a few minutes for free, unlimited credit monitoring and get personalized insights to build your financial future with confidence. Get started today at https://www.itinscore.com.