What Is a Revolving Credit Account? A Complete Guide

Ever wonder what people mean when they talk about "revolving credit"? It’s a term you hear a lot, especially with credit cards, but the concept is pretty simple. Think of it as a flexible credit line that you can dip into, pay back, and then use again without having to reapply every time.

It’s completely different from a one-and-done loan, like a car loan or a mortgage. With those, you get a lump sum, pay it back over time, and when it’s paid off, the account closes. Revolving credit is more like a financial resource that's always on standby. The most common examples you'll see are credit cards and lines of credit.

The Core Concept of Revolving Credit

At its heart, revolving credit is all about that continuous cycle of borrowing and repaying. This is what makes it such a go-to tool for everything from daily coffee runs to managing unexpected expenses.

And it’s everywhere. As of June 2025, total revolving consumer credit in the U.S. ballooned to roughly $1.3 trillion. That number alone shows just how deeply these accounts are woven into our financial lives. If you're a data nerd, you can dig into the latest Federal Reserve data on consumer credit to see these trends for yourself.

To really get it, you just need to understand a few key features that make it different from other types of debt.

Key Features Explained

Getting a handle on these components is the first step to making revolving credit work for you, not against you.

Here’s a quick breakdown of what makes a revolving credit account tick.

Each of these features plays a big part in how the account works day-to-day.

Essentially, a revolving credit account offers a reusable pool of funds. You draw from it as needed, and as you pay it back, you replenish the amount available to you for the future.

How Revolving Credit Works in the Real World

To really get a feel for revolving credit, let's move past the definitions and look at a simple, everyday example.

Imagine you've just been approved for a new credit card with a $5,000 credit limit. Think of this limit as the total amount of money the bank is willing to let you borrow at any given time.

Since the card is brand new, your available credit is the full 5,000. You spot a great deal on a flight for an upcoming vacation and decide to book it for **300**, paying with your new card.

The moment you make that purchase, your account changes. You now have a balance of $300, and your available credit—the amount you can still spend—has gone down.

This constant give-and-take between your credit limit, your spending, and what’s left to borrow is the heart of how revolving credit works.

Understanding Your Monthly Statement

When your billing cycle closes, you'll receive a statement. It will show a statement balance—in this case, the $300 for the plane ticket. You'll also see a minimum payment, which is the smallest amount you must pay to avoid penalties and keep your account in good standing.

This is where you have a critical decision to make. You can pay the entire $300 balance, or you can pay just the minimum, or any amount in between.

If you pay off the full **300** before the due date, you won't owe a penny in interest. Your balance goes back to zero, and your available credit is restored to the full 5,000. Simple. You've borrowed, you've paid it back, and you're ready to go again.

But what if you only pay the **25 minimum payment**? Your available credit only goes up by the 25 you paid back. The remaining $275 gets "revolved," or carried over, to the next month's bill. The bank will then charge interest on that leftover balance, making your original purchase more expensive over time. This is the "revolving" part in action—flexible, but potentially costly if you don't manage it carefully.

Revolving Credit Compared to Installment Loans

To really get a handle on revolving credit, it's helpful to see how it stacks up against its more rigid cousin: the installment loan. Both are common ways to borrow money, but they work in completely different ways and are built for different jobs. The core difference really boils down to flexibility versus predictability.

Think of an installment loan as a one-and-done deal. You get a lump sum of cash upfront for a specific, big-ticket item—like a car or a house. You then pay it back in equal, fixed monthly payments over a set amount of time. Once it's paid off, the account is closed. It’s a straightforward path for a single, planned purchase.

Revolving credit, on the other hand, is more like a financial well you can dip into whenever you need to. A lender gives you a credit limit, and you can borrow, repay, and borrow again from that same pool of money without having to reapply. Your payments aren't fixed; they change each month depending on how much you owe.

Key Differences in How They Work

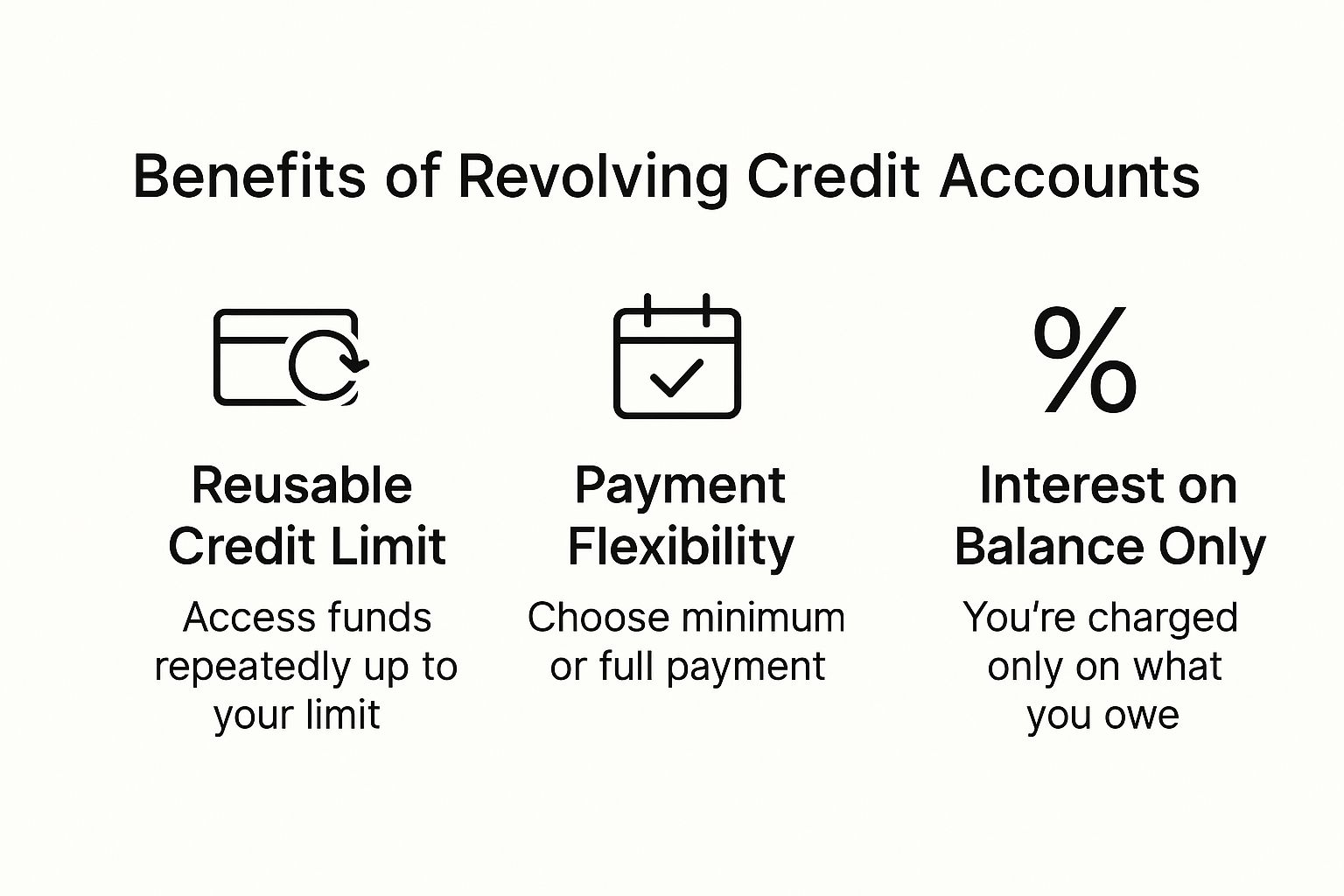

This image breaks down a few of the standout benefits you get with a revolving account.

As you can see, revolving credit shines when it comes to having reusable funds and flexible payment options. Plus, you only pay interest on the amount you actually use, making it a great tool for handling ongoing or surprise expenses.

So, which one is right for you? It all comes down to your goal. If you’re making a single large purchase and want the discipline of a clear repayment plan, an installment loan is usually the way to go. For those curious about this route, you can dive deeper into using installment loans for building credit in our detailed guide.

To make it even clearer, let's put them side-by-side.

Revolving Credit vs. Installment Loans at a Glance

This table offers a direct comparison to help you quickly see the main distinctions between these two types of credit.

Knowing these differences is the first step in picking the financial tool that truly fits your life and your goals.

Here is the rewritten section, designed to sound completely human-written and natural.

The Two Sides of Revolving Credit

Think of revolving credit as a powerful financial tool. In the right hands, it can build amazing things for your financial life. But like any powerful tool, it needs to be handled with respect. One slip, and it can cause some serious damage.

On one hand, you get incredible flexibility and the opportunity to build a solid credit history. On the other, there's the very real risk of falling into a cycle of expensive debt. Getting a handle on both sides is the secret to making revolving credit work for you, not against you.

Let's break down the good and the bad.

The Benefits of Revolving Credit

The biggest win with a revolving credit account is its sheer flexibility. It's like having a financial safety net on standby. You have a pool of money you can dip into whenever you need it—for groceries, a surprise car repair, you name it—all without filling out a new loan application every time.

That convenience is huge. Plus, every time you make a consistent, on-time payment, it gets reported to the credit bureaus. This makes these accounts one of the best ways to build a positive payment history and watch your credit score climb. And let's not forget the perks many cards offer:

When you use them wisely, these little extras can really add up.

The Risks to Watch Out For

Now for the flip side. The number one danger with revolving credit is getting buried in high-interest debt. According to 2025 Federal Reserve data, the average Annual Percentage Rate (APR) on credit cards hit a staggering 21.16%. If you only pay the minimum each month, that kind of interest rate can make your balance swell surprisingly fast, trapping you in a debt cycle that's tough to escape. To see just how common this is, you can dig into these credit card debt statistics and trends.

Another thing to keep a close eye on is your credit utilization ratio. This is just a fancy term for how much of your available credit you're actually using. If you consistently carry high balances, your ratio goes up, and your credit score can take a nosedive. It sends a signal to lenders that you might be stretched too thin, which could make it harder to get approved for a car loan or mortgage down the road. The key is to balance the convenience with these potential costs.

Common Types of Revolving Credit Accounts

Chances are, you’ve used a revolving credit account before, maybe without even thinking about it in those terms. These incredibly flexible financial tools come in a few different flavors, each built for a specific purpose.

The most obvious one? The good old credit card. It's the go-to for just about everything these days, from grabbing groceries to booking a flight. You buy now, and you settle the bill later. It's no surprise they're a cornerstone of personal finance—in the U.S. alone, there were roughly 631 million active credit card accounts at the start of 2025.

Unsecured and Secured Lines of Credit

But revolving credit isn't just about plastic cards. There are a couple of other powerful options you should know about.

Getting a handle on these consumer-focused products is a critical step in building a strong financial foundation, especially if you're working on how to build a credit score without a Social Security Number. Businesses use similar financial tools, too, and seeing how unsecured business loans work gives you an even better sense of just how important revolving credit is across the entire economy.

How to Manage Revolving Credit Wisely

Knowing what a revolving account is and where the traps lie is one thing. Actually mastering it is another. With just a few smart habits, you can transform that flexible line of credit from a potential headache into a serious asset for your financial future. It’s all about playing offense, not defense.

Let’s start with the golden rule of revolving credit: pay your balance in full every single month. This one habit lets you enjoy all the perks—the convenience, the rewards points, you name it—without ever paying a dime in interest. I know it’s not always possible, but making this your goal is the key to keeping debt from piling up.

If you can’t wipe out the whole balance, at least pay more than the minimum. The minimum payment is basically a trap designed to keep you paying for as long as possible, which means more interest for the lender. Chipping in even an extra 25 or 50 a month can make a huge difference, cutting down the total interest you’ll pay and getting you out of debt faster.

Keep a Close Eye on Your Utilization

One of the biggest factors that can make or break your credit score is your credit utilization ratio. Think of it as the percentage of your available credit you're using at any given moment. When lenders see a high ratio, they get nervous—they see it as a sign you might be stretched too thin, which can drag your score down.

This doesn't mean you can't spend more than that throughout the month. It just means you should try to pay it down below that 30% mark before your statement closes. Keeping this ratio low shows lenders you know how to handle credit responsibly.

Smart Habits for Long-Term Success

A few simple strategies, applied consistently, can make all the difference. These aren’t just about avoiding costly mistakes; they're about actively building a strong credit profile over time. For anyone just getting started, learning how to establish credit the right way from day one is absolutely crucial.

Stick to these principles, and you'll be the one in control of your revolving credit, not the other way around.

Ready to build your credit with confidence? itin score provides the tools and insights ITIN holders need to establish a strong financial future, all for free. Get your personalized action plan today and start your journey toward financial freedom at https://www.itinscore.com.