What is FICO Score vs Credit Score? Key Differences Explained

It’s easy to get these terms mixed up, but think of it this way: "credit score" is a general category, like "car," while a "FICO Score" is a specific, dominant brand, like "Ford." So, while every FICO Score is a type of credit score, not every credit score you see is a FICO Score.

This distinction is more than just semantics. When you're applying for a mortgage, a car loan, or even a basic credit card, the specific brand of score a lender uses can make all the difference.

Understanding The Core Difference

"Credit score" is really just an umbrella term for any number that tries to predict how likely you are to pay back a loan. Lots of companies have developed their own algorithms to do this, but the model created by the Fair Isaac Corporation—the FICO Score—is the one that truly matters in the lending world.

First rolled out in 1989, FICO quickly became the gold standard. Today, an overwhelming 90% of top lenders rely on a FICO Score when they're deciding whether to approve your application and at what interest rate.

That’s why getting familiar with the FICO model is so crucial for your financial health. Other scores, like VantageScore, are great for tracking your general progress. But when it's time to make a major financial move, the FICO Score is almost always the one in the driver's seat.

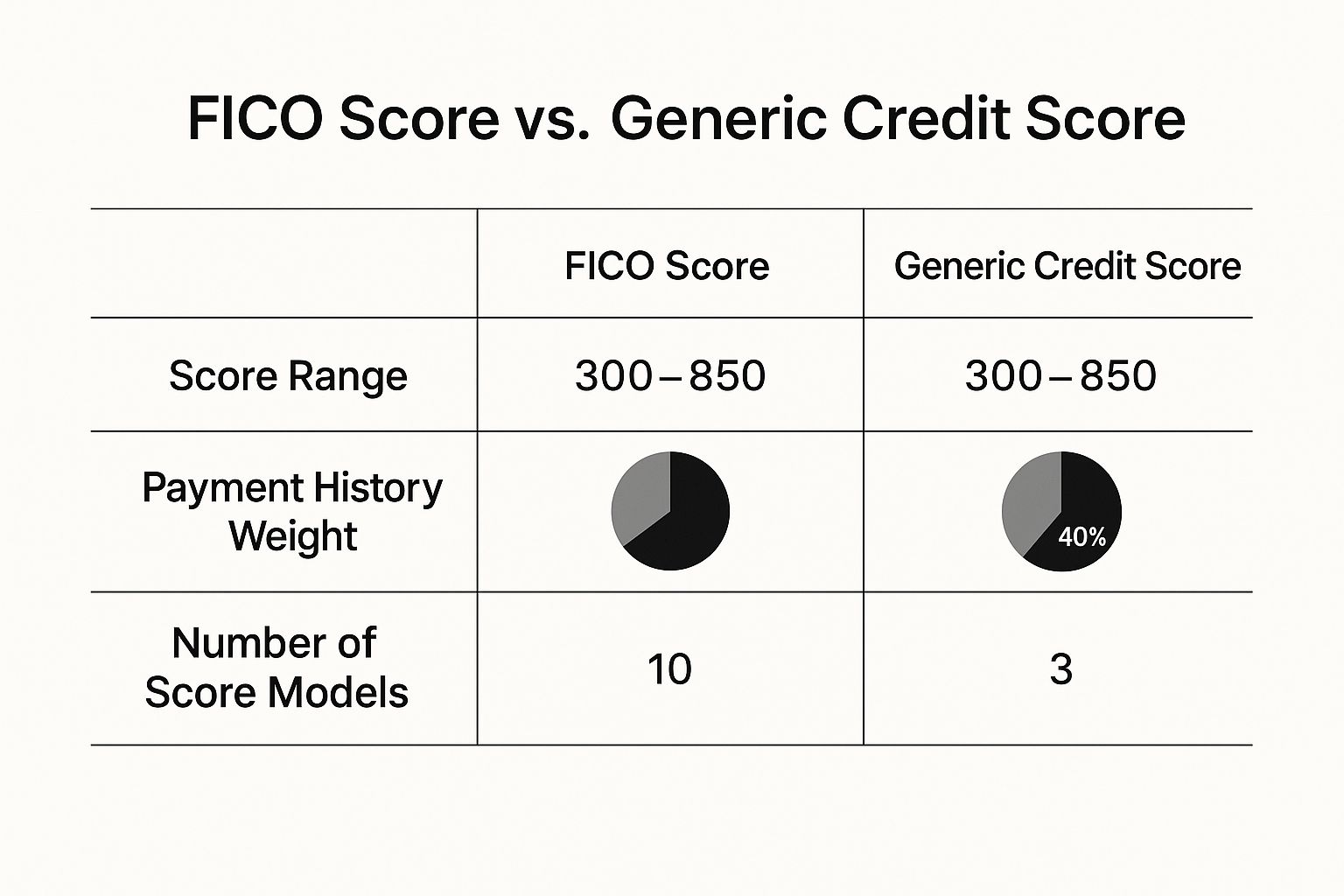

FICO vs General Credit Score at a Glance

Let's lay out the key differences to make it crystal clear. This table contrasts the generic concept of a credit score with the specific FICO brand that lenders overwhelmingly prefer.

While you might encounter many different scores from various apps and services, the FICO Score is the one with the most direct impact on your borrowing power.

For a deeper dive into the fundamentals, check out our guide on what a credit score is and how it shapes your financial life. Mastering this basic knowledge is the first step toward building a strong financial future, especially if you're navigating the U.S. credit system for the first time.

Comparing the Two Major Scoring Models

When you start digging into the world of credit scores, you quickly realize it's not just one number. You'll find two big names at the center of it all: FICO and its main rival, VantageScore. Both are trying to answer the same question—how likely are you to repay a loan?—but they come up with their answers in slightly different ways.

This is exactly why the score you see on your credit card statement might not be the same one a car dealership pulls. It’s not that one is "wrong"; they're just calculated using different recipes. FICO is the old guard, the original model that has been the industry benchmark for decades. VantageScore came later, created by the three major credit bureaus (Experian, Equifax, and TransUnion) to create a more consistent and predictable model for lenders and consumers alike.

The biggest difference comes down to the secret sauce—the algorithm. While both models look at the same five key factors, they don't give them the exact same weight. A single late payment, for instance, could ding your FICO Score a little more or less than it would your VantageScore.

Key Calculation Differences

The exact formulas are kept under lock and key, but we have a good idea of what each model prioritizes. This nuance is at the heart of the "FICO score vs. credit score" conversation.

One of the most important distinctions is the length of credit history required to generate a score. VantageScore is designed to be more inclusive and can often produce a score for someone with just one month of credit history and one reported account. On the other hand, a traditional FICO model usually needs at least six months of credit activity before it will calculate a score.

This infographic gives a great high-level view of the differences between the FICO model and a generic credit score, which is often a VantageScore.

As you can see, even slight tweaks in how factors like payment history are weighed can cause your scores to diverge.

Score Versions and Their Impact

To add another wrinkle, it’s not just "one" FICO score or "one" VantageScore. There are multiple versions of each. Most consumers are familiar with FICO Score 8, but lenders often use older or industry-specific versions. For example, a mortgage lender might use FICO Score 2, 4, or 5, while an auto lender might pull a FICO Auto Score, which has a range of 250 to 900.

VantageScore also has updates, with VantageScore 3.0 and 4.0 being the most widely used versions today. This is why you can apply for two different types of loans on the same day and have two different FICO scores pulled by the lenders. They’re simply using different tools for the job.

If you want to dive deeper into this, we have a complete breakdown of the difference between FICO and VantageScore.

At the end of the day, both models are built on the same foundation: your payment history, how much debt you carry, the age of your accounts, your mix of credit types, and recent applications. The real takeaway is that solid financial habits—paying bills on time and keeping balances low—will lift all your scores, no matter which model is being used.

The Five Factors That Shape Your Credit Score

No matter if you're pulling a FICO Score or a VantageScore, they're both built on the same five pillars of your financial life. Getting a handle on these components is the first step to taking control of your credit. And while each scoring model has its own secret sauce, the basic ingredients are always the same.

The two heavy hitters are your payment history and how much credit you're using. If you can get those two right, you've won most of the battle. The other three—your credit history's age, your mix of credit types, and any new credit—are important, but they play more of a supporting role.

Payment History: The Most Important Factor

Your payment history is, without a doubt, the biggest piece of the puzzle. For a FICO Score, it accounts for a massive 35% of the calculation. At its core, this factor answers one simple question for lenders: Do you pay your bills on time? Every on-time payment you make builds a track record of reliability.

Just one payment reported as 30 days late can send your score tumbling, particularly if your record was spotless before. More serious problems, like accounts sent to collections or a bankruptcy, will have an even more devastating and long-lasting impact.

Credit Utilization: How Much You Owe

Coming in at a close second is credit utilization, making up about 30% of your FICO Score. This is all about how much of your available revolving credit—think credit cards—you’re using at any given moment. It’s a simple ratio: your total card balances divided by your total credit limits.

You’ve probably heard the rule of thumb to keep your utilization below 30%, and that’s solid advice. But honestly, the lower, the better. Lenders can get nervous if they see high balances, even if you pay them in full every month, as it might suggest you're stretched thin financially.

Imagine you have one credit card with a 5,000 limit and a 2,500 balance. Your utilization is 50%, which is definitely in the high-risk zone. It’s important to know that scoring models look at the utilization on each individual card and your overall utilization across all your accounts.

The Supporting Factors

While payment history and utilization are the stars of the show, three other elements round out your credit profile.

By keeping your focus on these five areas—especially paying on time and keeping those card balances low—you’ll build a powerful foundation for a great credit score, no matter which model a lender happens to use.

Why You Have So Many Different Credit Scores

It's a common point of confusion. You check your score on your banking app, then on a free credit monitoring service, and finally, a mortgage lender gives you a completely different number. You're left wondering which one is "right."

The truth is, they all are. You don't have one single credit score; you have many, and the variations boil down to a few key reasons. Once you understand them, you'll know exactly which numbers matter for your specific financial goals.

The Scoring Model Factor

First off, the scoring model being used makes a huge difference. The two giants in the industry are FICO and VantageScore, and their formulas just aren't the same. They look at the same raw credit data but weigh different pieces of information more heavily.

For example, your bank might show you a FICO Score 8, while a free app probably uses VantageScore 3.0 or 4.0. Because their algorithms have different priorities, the same credit history will spit out two distinct scores. VantageScore, for instance, tends to be a bit more forgiving for people with "thin" credit files, which can be a real advantage if you're just starting out.

The Model Version Factor

Just to make things more interesting, both FICO and VantageScore regularly update their models. Think of it like software versions—some lenders upgrade quickly, while others stick with what they know works. This means the financial world is using a patchwork of different score versions at any given time.

This is why your score can change dramatically just based on the type of loan you're applying for. If you want to dive deeper into a specific version, you can learn more about the widely used FICO Score 9.

The Credit Bureau Factor

Finally, the data itself isn't always identical. The three major credit bureaus—Experian, Equifax, and TransUnion—are completely separate companies. They each collect your information on their own.

While most of your lenders report your payment history to all three, it's not a universal rule. Some creditors might only report to one or two. On top of that, there are often slight delays or differences in when each bureau gets updated information.

Here’s a simple way to think about how these pieces fit together:

A car dealership could pull your FICO Auto Score 8 using your Experian report, while your credit card app shows a VantageScore 4.0 based on TransUnion data. Each combination results in a different, but equally valid, credit score designed for a specific purpose.

How Lenders Actually Use Your Credit Scores

It's one thing to understand the technical differences between FICO and VantageScore, but it's another to know which one a lender will actually pull when you apply for a loan. This is where the rubber meets the road, and it’s why the "FICO vs. other credit scores" debate is so crucial to your financial life.

The simplest way to put it is that FICO is still the undisputed king. An estimated 90% of top lenders rely on a FICO Score to make their decisions. This is especially true when you're talking about major life purchases that carry a lot of risk for the lender, like buying a house or financing a new car.

That said, the landscape isn't static. VantageScore has been gaining ground, particularly in certain parts of the financial world. Knowing which model holds sway in which arena can give you a real strategic advantage when you’re getting ready to apply for credit.

Where FICO Scores Reign Supreme

When it comes to the big, traditional loans, FICO is almost always the gatekeeper. Its decades-long track record for reliability and predictability has made it the bedrock of risk assessment for established lenders.

Here are the areas where you can bet on a lender pulling a FICO Score:

The Rise of VantageScore

While FICO has a firm grip on traditional lending, VantageScore is carving out a significant niche, especially with more modern financial companies and consumer-facing services. Its ability to generate a score for people with "thin" or young credit files makes it a compelling alternative for a broader audience.

You'll most often encounter a VantageScore in these situations:

Which Scoring Model Lenders Typically Use

To give you a clearer picture, here’s a breakdown of what to expect when you apply for different types of credit. While there are always exceptions, this table reflects the general industry standard.

Knowing which score is likely to be used for your specific goal helps you focus your credit-building efforts where they'll have the most impact.

For context, the average FICO score in America is 714. People who achieve the highest scores consistently demonstrate key behaviors—like keeping credit card balances extremely low and never missing a payment—that all scoring models reward. You can find more data on national credit trends in Experian's research on average credit scores.

Answering Your Top Credit Score Questions

Once you start digging into credit scores, a lot of practical questions pop up. We've covered the different models and how they're calculated, but now it's time to tackle the questions I hear most often. Let's get you some clear, straightforward answers.

Is a VantageScore as Important as a FICO Score?

This is a great question. While FICO is the undisputed heavyweight—used by over 90% of top lenders for big decisions like mortgages—you shouldn't ignore your VantageScore. Think of it this way: your FICO Score is what the lender pulls for the final decision, but your VantageScore is your daily, go-to training tool.

Since both scores are built on the same core credit report data, a high VantageScore is a strong indicator of a high FICO Score. It's an excellent way to keep tabs on your credit health without having to pay for your FICO score constantly.

Why Did My Score Drop When Nothing Changed?

It’s frustrating to see your score dip when you feel like you’ve done everything right. More often than not, the culprit is timing.

Your credit card issuer might report your $1,500 balance to the bureaus a day before your payment clears, temporarily spiking your credit utilization. Or maybe you closed an old, unused credit card, which can shorten the average age of your accounts. Even just applying for new credit adds a hard inquiry. These small, seemingly insignificant events can cause temporary fluctuations.

Where Can I Check My Official FICO Score for Free?

Many people don't realize they can often get their real FICO Score for free. A lot of major banks and credit card issuers—like Discover, Citibank, and Bank of America—now include it as a complimentary perk for their customers. Just log into your online account, and it's usually right there on your dashboard.

The key thing to remember is that the free scores you see on popular credit monitoring apps are almost always a VantageScore. They're incredibly useful for tracking your progress, but they aren't the FICO Score a lender will see.