What Is Debt to Income Ratio? Understand Your Loan Power

Let's get right to it. Your debt-to-income (DTI) ratio is one of the most important numbers in your financial life, whether you realize it or not. In simple terms, it's a percentage that shows lenders how much of your monthly income is already spoken for by debt payments.

This single metric gives lenders a quick, clear picture of your ability to handle a new loan. It’s their go-to number for gauging risk.

What Your DTI Ratio Really Means

Think of your DTI as a financial stress test. It tells a story about the balance between what you earn and what you owe. A low DTI shows that you have a healthy cushion between your income and your expenses, making you an attractive, low-risk borrower.

On the flip side, a high DTI sends up a warning flare. It suggests your budget is stretched thin, and taking on more debt could push you over the edge.

When a lender pulls your file, one of their first questions is, "Can this person realistically afford another monthly payment?" Your DTI ratio gives them the answer. It’s a direct measure of your capacity to manage new debt alongside your current obligations.

The Big Impact of This One Number

This isn't just banker-speak; understanding your DTI ratio gives you real power over your own financial future. It has a direct impact on your ability to reach huge milestones, like buying a house, financing a car, or getting a personal loan for a big project. Knowing this number is the first step to truly owning your financial narrative.

Lenders rely on your DTI to decide a few critical things:

This number is especially crucial when you're trying to buy a home. For years, the magic number in the U.S. mortgage world has hovered between 36% and 43%. If your DTI goes much higher than that, you'll find it incredibly difficult to get approved for a mortgage. The global scale of debt is a massive topic, and you can see some interesting visualizations of it on VisualCapitalist.com.

At the end of the day, a good DTI is proof of your financial stability. It shows you're not living beyond your means and that you manage your money with discipline—exactly the kind of confidence a lender needs before they hand over their money.

Calculating Your DTI Step by Step

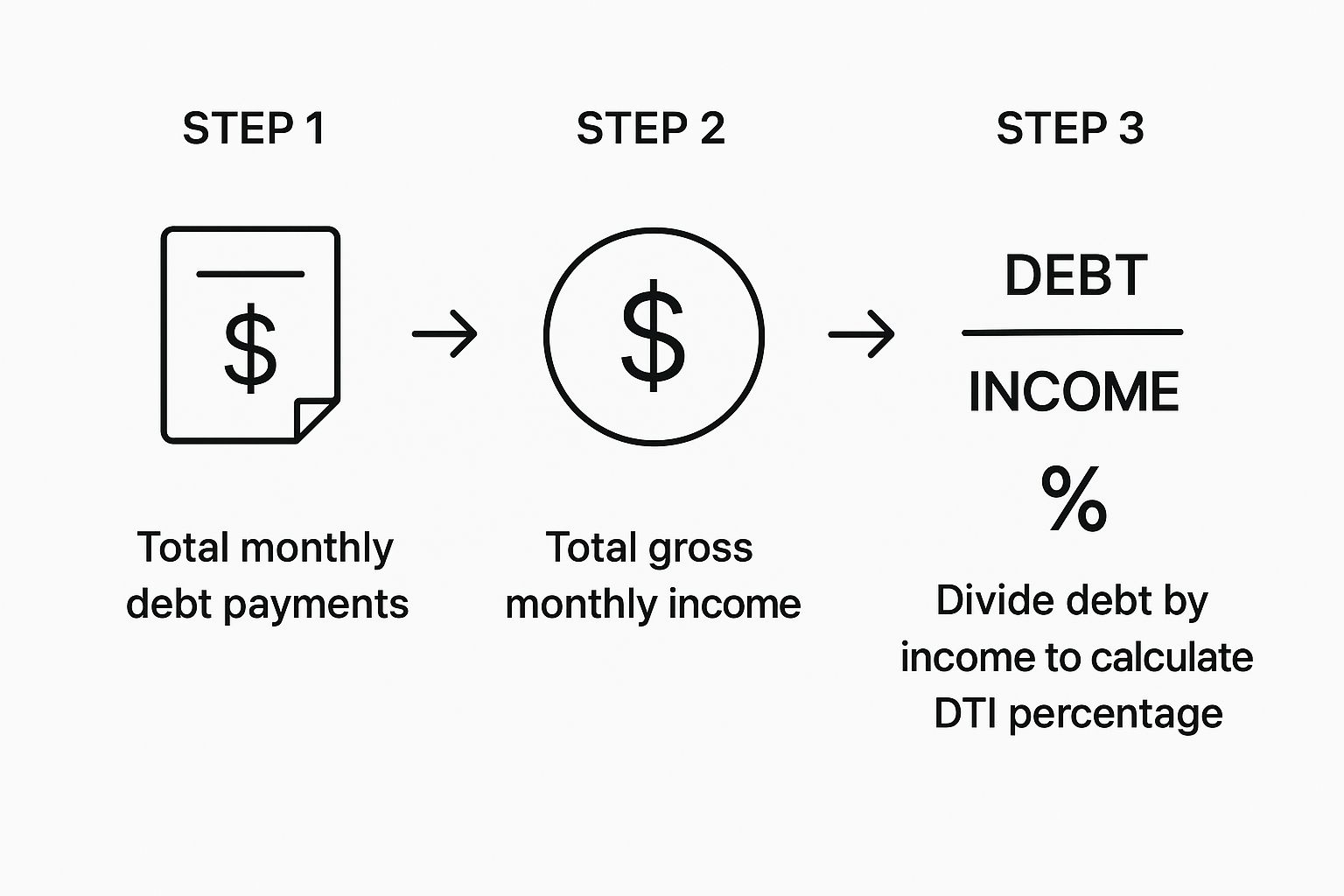

Ready to figure out your own debt-to-income ratio? It’s not nearly as complicated as it might sound. At its core, the calculation is just two simple steps: adding up what you owe each month and then dividing that number by what you earn each month. The result is a single, powerful percentage that gives you a crystal-clear snapshot of your financial health.

First things first, you need to get a handle on all your recurring monthly debt payments. We're talking about the fixed, contractual payments you’re obligated to make—not your everyday spending.

Tallying Your Monthly Debts

Think of this as taking a quick inventory of your financial commitments. Your goal is to find the minimum monthly payment for every single one of your debts. Make sure your list includes:

Just as important is knowing what not to include. Lenders don't count everyday living expenses like groceries, utilities (water, electricity, internet), gas for your car, or insurance premiums in this calculation.

Finding Your Gross Monthly Income

Once you have your total monthly debt figure, you need the other half of the equation: your gross monthly income. This is simply your total earnings before anything is taken out—no taxes, no 401(k) contributions, no health insurance deductions.

If you’re a salaried employee, this is easy—just divide your annual salary by 12. For those who are paid hourly or work as a freelancer with a fluctuating income, a good approach is to average your earnings over the past several months to arrive at a solid, representative figure.

This simple visual helps show how these two numbers come together.

As you can see, the final step is a quick division problem. That one calculation reveals your financial leverage in a single, easy-to-understand percentage. Now, let’s walk through a concrete example to see it in action.

What Lenders Consider a Good DTI Ratio

So, you've crunched the numbers and have your debt-to-income ratio. That percentage is more than just a number—it’s the first thing a lender will look at to gauge your financial health. Think of it as their sneak peek into how you manage your money.

To really understand what your DTI means, you have to see it through their eyes. Lenders actually look at two different types of DTI, especially when you're applying for a home loan.

The DTI Benchmarks That Matter

While the exact rules can vary a bit from one lender to another, there are some generally accepted standards in the industry. These benchmarks don't just decide if you get a "yes" or "no"; they often influence the interest rate you'll be offered.

A lower DTI tells a lender you have plenty of breathing room in your budget, making you a less risky borrower. A higher DTI signals you might be stretched thin.

Now, these numbers aren't absolute. Life is more complex than a simple percentage. A fantastic credit score, a hefty down payment, or a solid savings account can make a lender feel more secure, even if your DTI is a little on the high side.

These other positive factors can help offset the perceived risk. If you're trying to figure out where you fit in, especially with unique circumstances, our guide on how to qualify for a mortgage offers a much deeper dive into the entire process.

How Your Personal Debt Is a Lot Like a Country's National Debt

It’s one thing to understand your debt-to-income ratio in a vacuum, but to really appreciate its power, let's zoom out. Way out. Think on a global scale.

Your personal DTI is a snapshot of your financial health. Well, countries have something very similar: the debt-to-GDP ratio. Seeing how these two concepts mirror each other really drives home the fundamental principle of balancing what you owe with what you earn.

A Country's DTI

Think of a country's Gross Domestic Product (GDP) as its total annual income—the combined value of all goods and services it produces in a year. The debt-to-GDP ratio, then, is simply a comparison of the country's total national debt to its economic output. A high ratio suggests the country might be under economic stress, just like a high DTI can signal that your personal budget is stretched too thin.

When a country’s debt starts to balloon faster than its economy can grow, problems arise. Lenders (in this case, other countries and major investors) might get nervous and demand higher interest rates on new loans. This makes it more expensive for the government to pay for everything from roads and bridges to social programs. Sound familiar? It's exactly what happens when a high DTI makes it tougher and more costly for you to secure a mortgage or a personal loan.

A Global Balancing Act

This isn't just some abstract economic theory; it has real-world consequences we can see every day. Different countries take vastly different approaches to managing their finances. For instance, projections for 2025 show advanced economies holding debt that's around 110% of their GDP, while emerging markets hover closer to 74%.

Take a look at the specifics:

You can dig into these global economic health stats for yourself over at WorldPopulationReview.com.

This big-picture comparison brings us back to a simple, crucial truth: responsible debt management is a universal law of financial health. Whether you’re a person figuring out if you can afford a new car or a government funding its future, the basic challenge is identical. You have to make sure your debts don't overpower your income. For you, understanding what is debt to income ratio is the first step toward mastering that exact same balancing act.

Actionable Strategies to Improve Your DTI

If your debt-to-income ratio is higher than you’d like, don't sweat it—that number isn’t set in stone. You absolutely have the power to change it. Improving your DTI is one of the most effective ways to build a stronger financial profile, and it all comes down to a two-part mission: cutting your monthly debt payments and boosting your gross monthly income.

Think of your DTI like a seesaw. You can either lighten the load on one side (your debts) or add more weight to the other (your income). Either move will start to tip the balance back in your favor. But doing both at the same time? That’s how you make real, noticeable progress, fast.

Mission One: Reduce Your Monthly Debt

The quickest path to a lower DTI is to shrink the total amount you’re sending to creditors every month. This isn’t about just throwing money at the problem; it’s about being strategic with how you pay down what you owe.

Here are a few proven tactics that work:

Mission Two: Increase Your Gross Income

The other side of the DTI coin is your income. Even a small increase in what you earn can make a surprisingly big difference. Because your DTI is calculated using your gross monthly income—the amount before taxes and other deductions—every single extra dollar you bring in works directly to lower your ratio.

Here are some realistic ways to get it done:

For anyone building their financial life in the U.S., especially with an ITIN, these strategies are incredibly powerful. A strong DTI is a cornerstone of your financial foundation. If you're looking for more guidance tailored to your situation, check out our guide on how to build credit with an ITIN number.

What DTI Means When You're an ITIN Holder

For the millions of people in the U.S. building their financial lives with an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number, your DTI is more than just a metric. It's one of the most powerful tools you have to prove your financial stability.

When you don't have a long U.S. credit history for lenders to review, they look for other signs of reliability. This is where a low, well-managed debt-to-income ratio shines. It steps up to show, in black and white, that you have the capacity to handle your financial commitments responsibly.

This puts a spotlight on the importance of meticulous financial tracking. When you apply for a loan, being able to prove your income and document your debts with absolute clarity is non-negotiable.

Telling Your Financial Story

Getting a loan is all about presenting a convincing financial narrative. Think of your DTI as the headline, but the details in the rest of the story are just as critical. Since ITIN holders often face extra scrutiny, having your paperwork perfectly organized can make all the difference.

Managing debt is a challenge everyone faces, from individuals to entire countries. In fact, by late 2024, total global debt climbed to an estimated $323 trillion. This massive figure, tracked by the Institute of International Finance, shows how everyone is constantly balancing borrowing to grow against the risk of getting overextended. Just like nations have to prove their economic health, you have to prove your personal financial reliability.

By keeping your DTI low and presenting organized, thorough documentation, you build a powerful case for your financial strength. This approach helps you clear the hurdle of a limited credit history and opens the door to the financing you need to build your future in the U.S.

Got Questions About DTI? We’ve Got Answers.

Even after you get the hang of the basics, it's natural for a few more questions to pop up about how your debt-to-income ratio works in the real world. Nailing down these details can make a massive difference when you’re planning your finances or getting ready to apply for a loan.

Let's walk through some of the most common sticking points to make sure you're feeling confident.

Does My Rent Payment Count Toward My DTI?

Yes, absolutely. Lenders almost always count your monthly rent payment when they calculate your DTI. They view it as a major, ongoing financial commitment, just like a car loan or credit card payment.

Here’s the interesting part: when you apply for a mortgage, they do a little switch. They’ll replace your current rent payment with the proposed monthly mortgage payment. This gives them a snapshot of your future DTI, which is crucial for their decision. It helps them gauge whether you can comfortably manage the new, and often larger, housing cost.

A lender needs to see both. They want to know you’re willing to pay (that's your credit history) and able to pay (that's your DTI). This is especially critical if you're building your credit, as every data point counts. To understand what lenders see, it’s helpful to learn about an ITIN credit report and how it tells your financial story.