What Is Debt Consolidation? Simplify Your Finances Today

Staring at a mountain of bills every month can feel overwhelming. It's like trying to juggle a dozen different things at once—credit cards, a car payment, maybe some medical debt. Each one has its own due date, its own interest rate, and its own minimum payment. It's confusing, stressful, and easy to let something slip through the cracks.

That's where debt consolidation comes in. It's a financial strategy designed to bring all that chaos under control by combining your various debts into a single, straightforward loan. Think of it as a reset button, not an escape hatch. The goal isn't to magically erase what you owe, but to make paying it back a whole lot simpler.

Untangling Your Finances With Debt Consolidation

Let's use an analogy. Imagine all your individual debts are small, messy streams flowing in every direction. You've got your credit card stream, a personal loan stream, and a medical bill stream. Debt consolidation is like building a channel that merges them all into one clear, manageable river.

Suddenly, instead of tracking multiple payments, you have just one. One due date to remember. One interest rate to worry about. This new loan pays off all your old debts, so you're left with a single payment to a single lender. The real win? If you can lock in a lower interest rate on this new loan than the average of your old ones, you could save a ton of money and pay everything off much faster.

The Core Concept Explained

This isn't some niche financial trick; it's a widely used tool. The global market for debt consolidation is expected to hit roughly USD 1.92 billion by 2033, a significant jump from USD 1.27 billion in 2024. Just last year, in 2023, more than 15 million people in the U.S. turned to consolidation services to get their finances in order. That tells you just how many people are in the same boat.

As you explore your options, remember to look into specialized avenues that might fit your situation, like student loan relief programs, which can work alongside a broader consolidation strategy.

For a quick overview, this table boils down the essentials of debt consolidation.

Debt Consolidation at a Glance

At the end of the day, the table shows how this strategy is all about creating a clear path forward.

Choosing Your Path to a Single Payment

Okay, so you understand the "what" of debt consolidation. Now comes the "how." Think of it like choosing the right tool for a home repair project—you wouldn't use a hammer to turn a screw. The best way to combine your debts depends entirely on your unique financial picture, from your credit profile to your comfort level with risk.

The perfect consolidation method for a homeowner with a lot of equity is probably not the right fit for someone with a great credit score who's just trying to tackle some credit card debt. Let's break down the most common tools in the debt consolidation toolbox.

Personal Loans: The All-Purpose Tool

One of the most popular and direct routes is a personal loan. It’s pretty simple: you apply for a new loan from a bank, credit union, or online lender that covers the total amount of all the debts you want to pay off.

Once you’re approved, you get a single lump sum of cash. You use that money to wipe the slate clean with all your other creditors. Suddenly, instead of juggling multiple payments and due dates, you have just one. Most personal loans have a fixed interest rate and a clear repayment schedule, usually from two to seven years. That means your monthly payment never changes, which makes budgeting a whole lot easier.

The catch? These loans are typically unsecured, so the lender is basing their decision almost entirely on your credit. A solid credit history is your ticket to a lower interest rate, which is the key to making this whole thing worth it.

Balance Transfer Credit Cards: The Strategic Sprint

What if you could just hit "pause" on your credit card interest for a year or more? That’s the magic of a balance transfer credit card. Many of these cards offer a 0% introductory Annual Percentage Rate (APR) for a set time—think 12, 18, or even 21 months.

Here’s how it works: you move your high-interest balances from your existing cards over to this new one. Say you owe $7,000 spread across three different cards. You transfer that entire amount to the new 0% APR card. Now, for the next year or so, every single dollar you pay goes straight to chipping away at the actual debt, not just feeding the interest beast.

This option is a fantastic fit for people with good-to-excellent credit who have a rock-solid plan to crush that debt before the 0% APR window closes. You can play around with different scenarios using a debt repayment calculator to see how much you could save.

Home Equity Loans: A High-Stakes Option

For homeowners, the equity you’ve built up in your property—the difference between your home’s value and your mortgage balance—can be a powerful consolidation tool. You can tap into it with either a home equity loan or a home equity line of credit (HELOC).

The biggest advantage here is that because your home is the collateral, these loans often have much lower interest rates than any unsecured loan. But that collateral is also the biggest risk. If you can't make the payments, the lender has the right to foreclose on your home. This is a path to consider only if your income is stable and you are absolutely certain you can handle the new payment.

Weighing the Real Pros and Cons

Debt consolidation often gets pitched as a magic bullet for your financial woes, promising a single, simple payment to solve everything. But it's not quite that simple. Making an informed choice means you need to look at this from all angles—the good, the bad, and the potential risks.

Think of it like this: you have a dozen small, overflowing shopping bags. Consolidation is like getting one giant, sturdy tote bag to carry everything in. It's definitely easier to manage and less likely you'll drop something. But if that new bag has a hole in it (high fees) or you just keep stuffing more things inside (racking up new debt), you'll end up in a bigger mess than when you started.

Let's unpack what this really means for you.

The Upside: Why People Choose Consolidation

The biggest and most immediate win is simplicity. Instead of juggling five different due dates, minimum payments, and interest rates, you have one. Just one payment to one lender on one day of the month. This alone can lift a huge weight off your shoulders and dramatically reduce the chance of accidentally missing a payment.

Then there's the money aspect. If you can lock in a consolidation loan with a lower interest rate than what you're currently paying across your credit cards and other debts, you start saving money immediately. Every single month, more of your payment goes toward chipping away at the actual debt instead of just feeding interest charges. That's how you get out of debt faster.

Finally, don't underestimate the psychological boost. Having a clear plan with a finish line in sight gives you a powerful sense of control. Knowing that you'll be debt-free by a specific date is incredible motivation to stay on track.

The Downside: Potential Pitfalls to Watch Out For

While the benefits are real, you have to go in with your eyes open. The single biggest trap is the temptation to spend again. When you use a loan to pay off your credit cards, those balances drop to zero. Suddenly, you have all that available credit staring back at you. Without changing your spending habits, it's incredibly easy to run those cards right back up, leaving you with the new loan and a fresh pile of credit card debt.

You also have to watch the total cost and the loan term. Some loans come with origination fees or other closing costs that can cancel out your interest savings. Be careful with stretching the loan out over a long period, too. A longer term means a lower monthly payment, which sounds great, but it could also mean you pay far more in total interest over the life of the loan. Always run the numbers.

To help you see it all clearly, here’s a straightforward comparison of the trade-offs.

Pros vs. Cons of Consolidating Debt

At the end of the day, debt consolidation is a financial tool—not a magic cure. When you understand the risks and use it wisely, it can be a fantastic way to get back in the driver's seat of your financial life.

Is Debt Consolidation the Right Move for You?

Deciding to consolidate your debt is a big deal. It's not some magic wand you wave to make financial problems disappear, and it's definitely not the right path for everyone. Before you even think about applying for a loan, you need to take a hard, honest look at your financial situation and your own habits.

What works wonders for your neighbor might be a total disaster for you. This is about more than just moving numbers around on a spreadsheet; it’s about making a strategic choice that sets you up for real, long-term financial health. Let’s break down the signs that consolidation could be a great tool for you—and the warnings that you should probably steer clear.

Green Flags It Might Be a Good Fit

If you're nodding along to the points below, debt consolidation could be a powerful move. These are the positive signs that show you’re in a great position to make this strategy work for you.

You're probably a good candidate if you:

The need for smart debt strategies is more pressing than ever. By the end of 2023, total household debt in the U.S. jumped by USD 212 billion, hitting an incredible USD 17.5 trillion. This surge shows why so many people are looking for a way out. For a broader look at debt trends around the world, check out the analysis on IMF.org.

Red Flags That Signal Caution

On the flip side, there are some serious warning signs that consolidation might do more harm than good. Be brutally honest with yourself here—ignoring these red flags can dig you into an even deeper hole.

Think twice if:

How ITIN Holders Can Consolidate Debt

Trying to get your finances in order in the U.S. with an Individual Taxpayer Identification Number (ITIN) can feel like you're playing the game on hard mode. But when it comes to debt consolidation, it's absolutely doable. You just need the right game plan to turn that pile of bills into one, simple payment—even without an SSN.

The core idea is the same for everyone: combine multiple debts into a single new loan. The real difference for ITIN holders is finding lenders who get it. This means pulling together the right documents and, most importantly, building a U.S. credit history that lenders can actually see and trust. Without that, getting a loan with a decent interest rate is a serious uphill battle.

Finding Lenders Who Work with ITINs

First things first, you need to find the right financial partners. Not every bank or lender works with ITINs, so knowing where to look saves a ton of time and avoids unnecessary frustration. Your best bet is often with community banks, credit unions, and certain online lenders that have experience serving immigrant communities.

These places tend to be more flexible and know what kind of paperwork you'll have. When you start talking to them, have this info ready to go:

Building Your U.S. Credit History Is Crucial

This part is non-negotiable. A solid U.S. credit history is the key that unlocks the door to a good consolidation loan. Without it, lenders are just guessing about how reliable you are with money. This is exactly where a service designed for ITIN holders makes a world of difference.

For instance, a platform like itinscore is built specifically to help you establish and track your credit history.

A dashboard like this gives you a clear, up-to-the-minute look at how you're doing, so you can watch your score climb. By using a service that reports your on-time rent and utility payments to the major credit bureaus, you're actively showing lenders you're financially responsible. That positive data gives your loan application the muscle it needs.

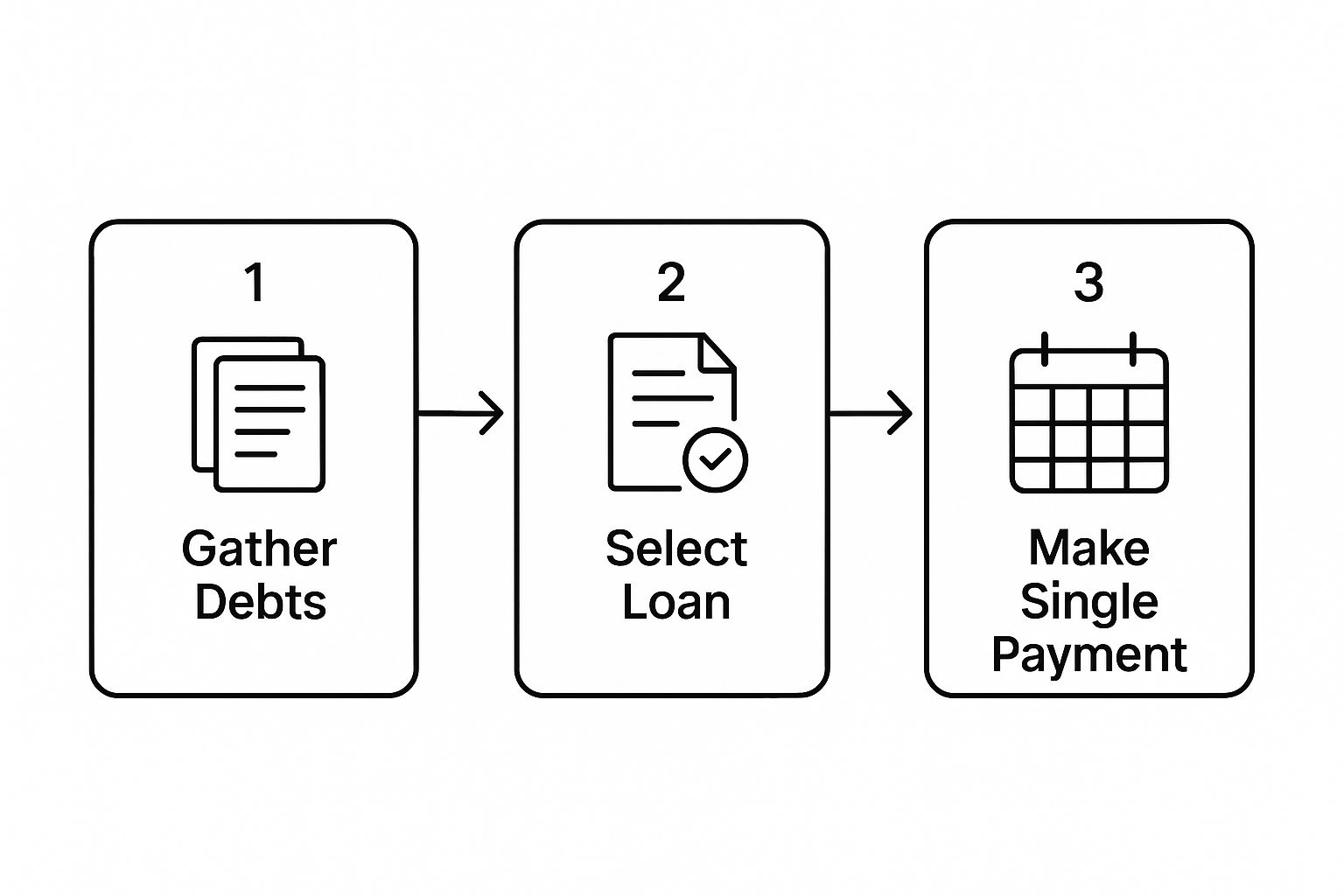

A Step-by-Step Consolidation Roadmap

Once you start building that credit, the rest of the process falls into place. Think of it as a simple, three-stage flow: gather your debts, get the right loan, and then enjoy a single monthly payment.

Here’s a breakdown of what that journey looks like for an ITIN holder:

For ITIN holders, consolidating debt isn’t just about making life easier today. It's a strategic move to build a strong U.S. credit footprint. By following these steps, you’re not only simplifying your budget—you're opening doors to better financial opportunities down the road.

Building Your Credit During Consolidation

Let's clear up a common myth: debt consolidation won't automatically tank your credit score. Yes, applying for a new loan or credit card will trigger a hard inquiry, which might cause a small, temporary dip. But think of it as taking one small step back to take five giant leaps forward.

The real story of how debt consolidation affects your credit unfolds in the months that follow. This isn't just about making your life easier with a single payment; it's a golden opportunity to build a much stronger financial profile, which is especially powerful if you have an ITIN.

Turning Payments into Progress

Your new consolidation loan is more than just a way to manage debt—it's your new best friend for building credit. Every single on-time payment you make gets reported to the credit bureaus. This builds a consistent, positive payment history over time.

And that’s a huge deal. Your payment history is the single most important factor in your credit score, making up about 35% of the entire calculation. By swapping many scattered due dates for one predictable monthly payment, you dramatically lower the odds of ever accidentally missing one. It’s a simple change that shows lenders you’re reliable and can handle credit responsibly.

The Power of Lowering Credit Utilization

Here’s another big win for your credit score: lowering your credit utilization ratio (CUR). This is just a fancy term for how much of your available credit you're currently using. When you pay off multiple credit cards with your new consolidation loan, their balances drop to or near zero almost overnight.

This instantly slashes your overall credit utilization. Lenders love to see a low ratio—ideally under 30%—because it signals that you aren't maxing out your cards to get by. The result? A potentially significant boost to your credit score. If you want to dive deeper into this, check out our guide on what is a credit utilization ratio.