What Is Credit Building and How Does It Work?

Credit building is really just the process of proving you can handle borrowed money responsibly. Think of it as building a financial reputation. You're creating a track record that tells lenders, "I'm a safe bet."

A solid credit history doesn't just happen; you have to build it intentionally. But once you have it, it opens up a world of better financial opportunities.

Your Financial Journey Starts with Understanding Credit

Imagine your credit history as a financial report card. Every time you pay a loan on time or use a credit card wisely, you get a good mark. Over time, all those marks are compiled by credit bureaus and distilled into a single number: your credit score.

This score is a quick snapshot for lenders that tells them how likely you are to pay back your debts. A high score can be a huge advantage, unlocking everything from lower interest rates on a mortgage to more favorable car insurance premiums.

The good news is that anyone can start this journey. Whether you're starting from scratch with no credit history or looking to repair a bruised one, the core principles are exactly the same. It all comes down to demonstrating consistent, responsible financial behavior.

The Foundation of Financial Trust

Let's get one thing straight: building credit isn't about encouraging you to go into debt. It's about showing you can manage debt effectively. This process involves a few key behaviors that signal your reliability to banks and other financial institutions.

Your actions are reported to the three major credit bureaus—Equifax, Experian, and TransUnion—which are the companies that create that financial report card we talked about.

Building a strong credit profile boils down to a few essentials:

To get a real handle on where you stand, it helps to understand your own cash flow. Tools like a Finance Bank Statement Analyzer AI agent can offer powerful insights by breaking down your income and spending habits, giving you a clearer picture of your financial health.

The Five Pillars of Your Credit Score

The system used to calculate your score might seem mysterious, but it's based on five key factors. Understanding how each one contributes can help you focus your efforts where they matter most.

While all five components play a role, your payment history and how much you owe carry the most weight by far. Focusing on these two areas will give you the biggest bang for your buck when trying to improve your score.

Why a Strong Credit Score Is Your Financial Superpower

It’s one thing to know what credit building is, but it’s another to see what a strong score can actually do for you. Stop thinking of it as just a number. Instead, picture it as a key that unlocks better financial opportunities and puts real money back in your pocket. A good credit score is your passport to lower costs and better deals on almost everything.

The most obvious win? You save a ton of money on interest. When lenders see you have a high score, they view you as a reliable borrower. To get your business, they'll offer you their best interest rates, or Annual Percentage Rates (APRs). We're not talking about a small discount here—this can add up to thousands of dollars saved over the life of a loan.

For anyone new to the American financial system, especially ITIN holders, this is a game-changer. Building credit isn't just about getting loans; it’s about laying the groundwork for your financial future in the U.S.

How a Good Score Saves You Thousands

Let's break this down with a real-world example. Imagine two friends, Alex and Ben, both buy the exact same car for $25,000. They each finance it with a 60-month (5-year) loan, but their credit scores are worlds apart.

Over those five years, the difference in what they pay is staggering. Alex will pay about 3,300** in total interest. Ben, for the very same car, will end up paying around **8,300. That's a $5,000 difference, all because of his credit score.

This isn't just for cars, either. The same logic applies to mortgages, personal loans, and even refinancing student debt. The better your credit, the less you pay to borrow. It's that simple.

The Hidden Perks of Excellent Credit

But the benefits don't stop with loans. A strong credit profile makes your whole financial life smoother and more affordable in ways you might not even think about. It’s a signal of financial responsibility, and a lot of companies pay attention to that.

These less obvious advantages can save you money and headaches day in and day out. Honestly, these are often the perks that make the effort of building credit feel so worthwhile.

Here are some of the "hidden superpowers" that come with a great credit score:

In the end, building credit is about so much more than a three-digit number. You're building a financial reputation that gives you power, choice, and freedom. It opens doors that might otherwise be shut, paving the way for a more stable and prosperous future.

How Your Credit Score Is Actually Calculated

Ever wondered what goes into that three-digit number that seems to control so much of your financial life? Your credit score isn’t just pulled out of thin air. It’s a grade, carefully calculated from the information on your credit report.

Think of your credit report as your financial resume. It tells the story of how you've handled borrowed money over time. This "resume" is put together and updated by the three major credit bureaus: Equifax, Experian, and TransUnion. When you use a credit card or take out a loan, lenders report that activity to these bureaus.

From there, scoring models—with the FICO Score being the most widely used—do the math, turning your entire financial history into a single score. It's a shorthand for lenders to quickly see how reliable you might be with their money.

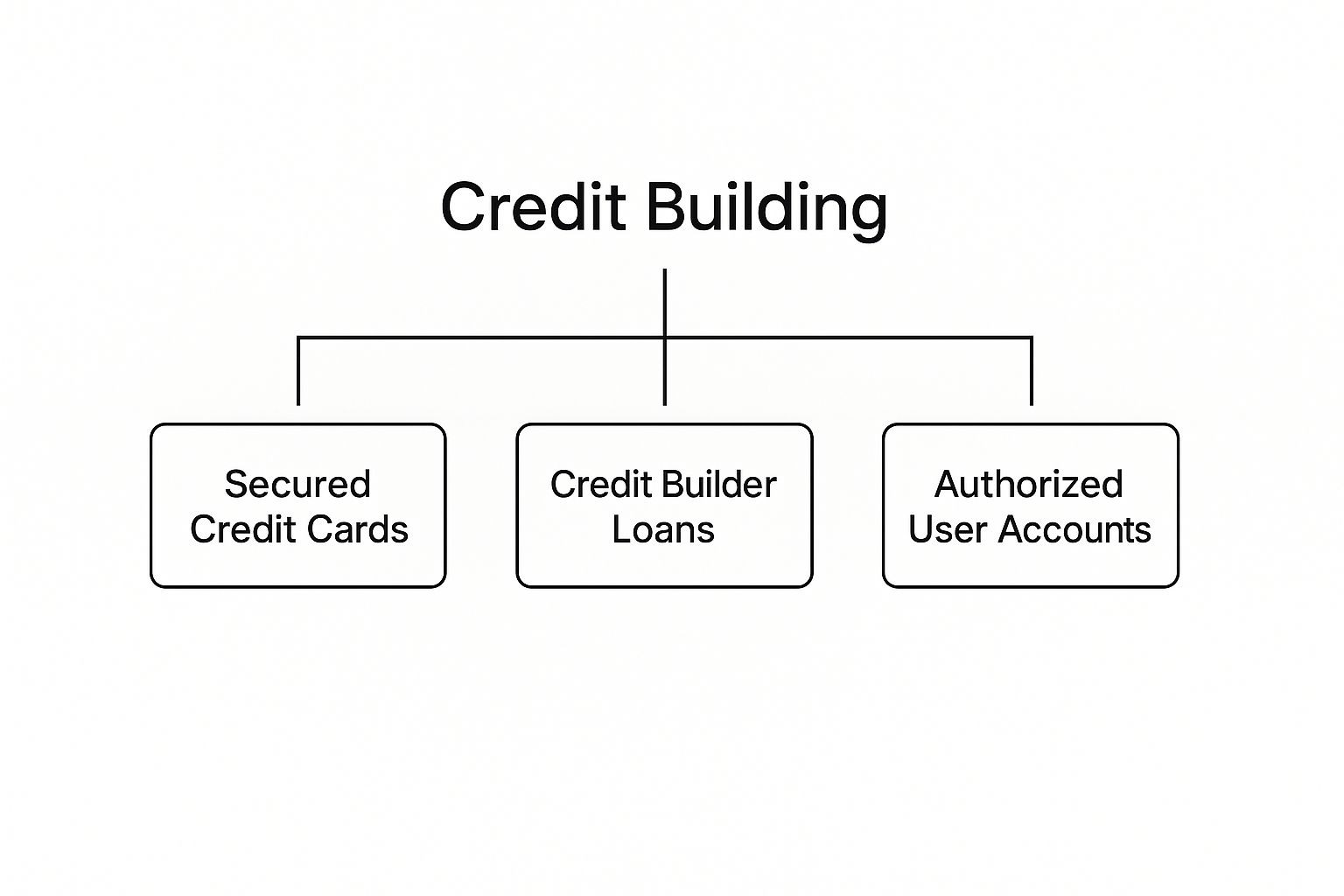

The image below highlights a few common tools people use to get started on building that positive financial story.

As you can see, things like secured cards and credit-builder loans are fantastic first steps for anyone looking to establish their financial reputation.

Payment History (35% of Your Score)

This is the big one. It’s simple, really: do you pay your bills on time? Lenders are looking for a consistent, reliable pattern of on-time payments. A history peppered with late payments, accounts in collections, or bankruptcies can do serious damage to your score.

Just one late payment can linger on your credit report for up to seven years. The more recent they are, the more they’ll pull your score down.

Amounts Owed (30% of Your Score)

Right behind payment history is how much debt you're carrying, especially compared to how much credit you have available. This is your credit utilization ratio, and it's a huge deal. It simply measures what percentage of your credit card limit you’re using at any given time.

Let's say you have one credit card with a 1,000** limit and you've charged **300 to it. Your utilization is 30%. Most experts agree you should aim to keep this number below 30%—both on individual cards and across all your accounts combined. High utilization can make lenders nervous, as it suggests you might be stretched too thin financially.

Length of Credit History (15% of Your Score)

Lenders feel more comfortable when they can see a long, established track record. This part of your score looks at a few things: the age of your oldest account, your newest account, and the average age of all your accounts combined. A longer history just gives them more data to go on.

This is exactly why the old advice to never close your oldest credit card is so common. Shutting down that account can shorten your credit history and ding your score. If you're new to credit, this one just takes time. For some practical tips, check out this guide on how to establish credit for the first time.

New Credit (10% of Your Score)

This factor keeps an eye on how often you're applying for new credit. Every time you fill out an application for a loan or credit card, it usually results in a "hard inquiry" on your report. A flurry of these in a short time can be a red flag for lenders.

It can signal that you're in financial trouble or about to take on a lot of new debt all at once. While opening new accounts is a key part of building credit, it's best to be strategic and space out your applications.

Credit Mix (10% of Your Score)

Finally, lenders like to see that you can handle a variety of credit types responsibly. A healthy credit mix shows you can manage both revolving credit (like credit cards) and installment loans (like a car loan, mortgage, or a credit-builder loan).

You definitely don't need one of every kind of loan, and you should never take on debt just to try and boost your score. But over time, as you naturally finance a car or use different credit products, having a diverse mix shows you're a versatile borrower, and that can give your score a nice little bump.

Proven Strategies for Building Credit From Scratch

Alright, you understand the "why" behind credit. Now for the "how." It's time to take that knowledge and put it into action by choosing the right tools to build your financial reputation.

The good news? You don't need a high income or a long history with money to get started. There are a handful of fantastic, beginner-friendly methods designed for people with a thin file or no credit at all. Think of them as different starting points on your journey to a strong credit score.

This is your playbook. We're going to walk through the most effective and accessible options out there, giving you a clear toolkit to kick things off.

H3: Start With a Secured Credit Card

A secured credit card is probably the most common starting point, and for good reason. Lenders see them as low-risk, which makes them much easier to get approved for, even if you have zero credit history.

Here’s the deal: the "secured" part comes from a small, refundable security deposit you pay upfront. This deposit, usually a few hundred dollars, sets your credit limit. So, if you deposit 300**, your credit limit is **300. This cash collateral protects the lender, so they're more willing to give you a shot.

As far as the credit bureaus are concerned, it functions just like a regular credit card. You make small purchases, pay the bill on time, and the card issuer reports that positive activity. This consistent reporting is the absolute core of credit building and helps you establish a solid payment history from day one.

H3: Become an Authorized User

Another powerful strategy is becoming an authorized user on a credit card belonging to a trusted family member or friend. This lets you essentially "piggyback" on their good credit.

When the main cardholder adds your name to their account, the card's entire history—its age, limit, and payment record—can show up on your credit report. If that card has a long history of on-time payments and a low balance, it can give your score a significant, almost immediate boost.

But there’s a big "if." This only works if the primary cardholder is incredibly responsible. If they miss payments or run up a high balance, that negative history will show up on your report and drag your score down. Only do this with someone you trust completely who has rock-solid financial habits.

H3: Use a Credit-Builder Loan

A credit-builder loan is a clever tool that flips the whole idea of a loan on its head. Instead of getting cash upfront, you make fixed monthly payments into a locked savings account over a set period, like 6 to 24 months.

The lender reports every single one of your on-time payments to the credit bureaus. Once the loan term is over, you get all your money back, sometimes with a little interest. It’s a win-win: you build a positive payment history and you’re forced to save money at the same time.

This is a great fit if you're not ready for a credit card but still need to prove your financial discipline. For a deeper look at getting started, our complete guide on https://www.itinscore.com/blog/how-to-build-credit-from-scratch/ has even more detailed steps.

H3: Comparing Credit Building Tools for Beginners

Choosing the right tool is a personal decision. It all comes down to your financial situation, your habits, and what you’re trying to achieve. To make it easier, let's break down the most common methods side-by-side.

Ultimately, it doesn't matter which path you take as much as how you take it. Consistency is everything. No matter what, making your payments on time, every single time, is the golden rule. A great way to guarantee this is by exploring the benefits of setting up auto-pay for your bills, which takes the guesswork out of due dates.

Common Mistakes to Avoid on Your Credit Journey

Getting started on building your credit is a huge step toward taking control of your financial future. But just like learning any new skill, knowing what not to do is as important as knowing what to do. Building good credit is a marathon, not a sprint, and a few common missteps can easily wipe out months of your hard work.

Think of it like tending a garden. You can plant the best seeds and water them every day, but if you let the weeds take over, all that effort goes to waste. By getting ahead of these common mistakes, you can protect the solid financial foundation you're working to build.

Overlooking Your Credit Utilization Ratio

One of the biggest and most common mistakes is getting a new credit card and immediately maxing it out. It's easy to get excited about that new credit limit, but running it up right away sends a huge red flag to the credit bureaus. Doing this skyrockets your credit utilization ratio—that's the percentage of your available credit you're currently using—and it’s the second-most important factor in your credit score.

Let's say you get a card with a 500** limit and spend **450 in the first month. Your utilization is a whopping 90%, which suggests you might be in over your head financially.

Applying for Too Much Credit at Once

When you’re eager to get going, it might seem like a good idea to apply for a few credit cards or loans at the same time. This is a classic mistake that almost always backfires. Every time you apply for new credit, the lender pulls your credit report, which results in a hard inquiry.

One or two inquiries here and there won't hurt much. But a bunch of them in a short time frame makes you look desperate for cash, which scares lenders off. This can lead to rejections, which might tempt you to apply for even more credit, creating a vicious cycle of inquiries and denials. A much smarter approach is to apply for one product, use it responsibly for a few months, and then consider your next move.

Closing Your Oldest Credit Accounts

After you've opened a few cards, you might think about closing an older account you don't use anymore, especially if it has an annual fee. Think twice before you do this. Closing an old account can damage your score in two key ways:

Before closing any account, always weigh the pros and cons. If the card doesn't have an annual fee, it's almost always better to keep it open. You can just use it for a small recurring charge, like a streaming service, to keep it active.