What Is Credit Builder? Learn How It Works & Benefits

Getting a "denied" notice on an application because you have no credit history feels like hitting a brick wall. But what if there was a tool designed specifically to give you that start? That's exactly where credit builders come in.

Simply put, a credit builder is a financial product—think of a special type of loan or a secured credit card—designed to help you prove you're a reliable person to the credit bureaus.

What Is a Credit Builder

Think of a credit builder as a stepping stone into the world of credit. It's a tool created for people with little to no credit history, a group that often includes students, young adults, and immigrants using an ITIN. Unlike a typical loan where you get cash upfront, a credit builder focuses on establishing a record of positive payments first.

The goal is straightforward but incredibly powerful: create a verifiable track record of responsible financial habits that the credit bureaus can see. This positive history is the very foundation of your future credit score.

How These Tools Actually Build Your Credit File

So, how does it work in practice? When you open a credit builder account, the company you're working with starts reporting your monthly payments to the three main credit bureaus: Experian, Equifax, and TransUnion.

Every single on-time payment you make acts as a signal to them, demonstrating that you can be trusted with financial obligations. This positive activity is the raw material used to construct your credit history from the ground up.

This isn't just a theory; it's proven to be highly effective for people starting from scratch. Research from the Consumer Financial Protection Bureau (CFPB) found that individuals without a credit score who used a credit builder loan increased their likelihood of having a score by 24%. You can review the full study on their website to see just how effective these tools are.

Ultimately, using a credit builder isn't just about borrowing money. It's about actively constructing the financial identity that future lenders will look at when you apply for a car loan, an apartment, or even a mortgage.

How Credit Builders Help You Build Trust

Think about trying to land a job with a totally blank resume. It's tough, right? Lenders face the same problem when you have no credit history—they have nothing to go on to see if you're a reliable borrower. A credit builder is designed to fill that financial resume with positive, trustworthy experiences.

It doesn’t throw you into the deep end with a big, complicated loan. Instead, it starts you with a simple, low-risk task that proves you can be counted on. The whole point is to create a positive paper trail that future lenders can look at and feel confident about.

The Mechanics of Building Trust

At its heart, a credit builder works in a really straightforward way. You make a series of small, regular payments over a certain amount of time. The company you're working with then reports these on-time payments to the three major credit bureaus: Equifax, Experian, and TransUnion.

That reporting step is the magic ingredient. Every single payment you make on time acts like a gold star on your financial record, slowly but surely creating a history that screams "dependable." It's a structured way to prove you can handle credit responsibly before you even ask for a traditional loan or credit card.

Let's look at the two main types:

Turning Small Actions into a Strong Credit Score

Every payment you make feeds into the single most important part of your credit score: your payment history. A long, consistent track record of paying on time is the best way to show lenders you’re not a risk.

And this process absolutely works. The Federal Reserve has found that the credit-building market in the U.S. includes nearly 3 million accounts. On top of that, secured credit cards account for almost 60% of the total outstanding balance. These tools are a proven on-ramp for millions of people looking to build the trust they need for bigger financial goals.

Ultimately, a credit builder takes your responsible actions and translates them into a language that banks and lenders understand. It's a low-risk, methodical way to lay the groundwork for a healthy financial life, one small payment at a time.

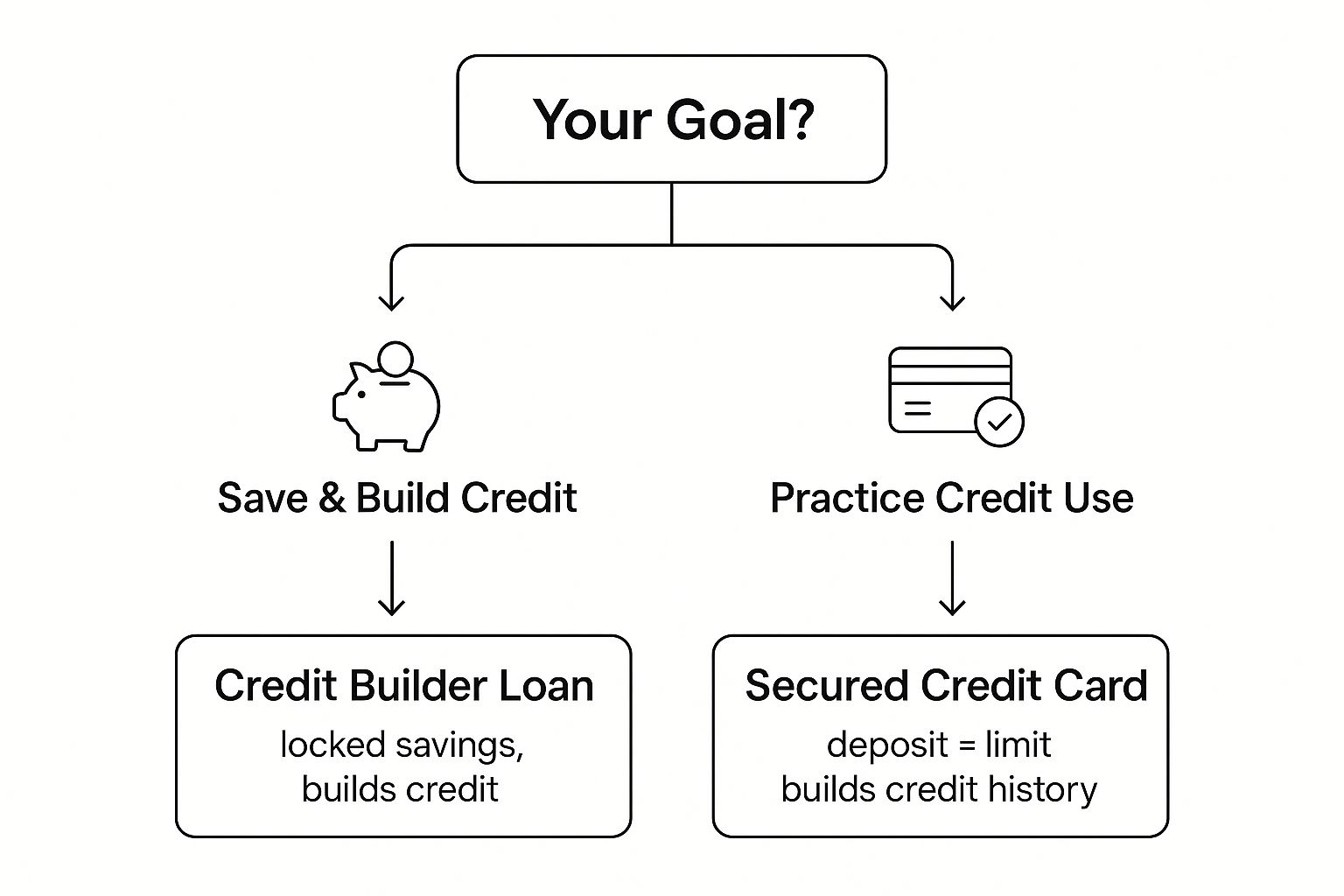

Choosing Your Path: Credit Builder Loans vs. Secured Cards

When you're ready to start building credit, you'll quickly run into two main options: credit builder loans and secured credit cards. Both are fantastic tools for proving your creditworthiness, but they work in very different ways. Figuring out which one is right for you comes down to understanding how each one operates and what you want to achieve.

A credit builder loan is a bit like a loan in reverse. You don't get any money upfront. Instead, you make regular payments to a lender, who holds the money in a locked savings account for you. Once you’ve paid off the full loan amount, you get the cash. It’s a brilliant way to build a positive payment history and force yourself to save money at the same time.

A secured credit card, on the other hand, acts more like a traditional credit card. The "secured" part means you put down a refundable cash deposit, and that amount typically becomes your credit limit. This deposit removes the risk for the lender, allowing you to use the card for purchases, pay your bill, and build your credit file from scratch.

Understanding the Core Differences

So, what's the real difference? It boils down to your main goal. Are you looking for a disciplined way to build your savings while you build your credit? Or do you need the flexibility to make purchases and practice managing a revolving credit line?

A credit builder loan is perfect if your priority is saving. It creates a structured plan that results in a lump sum of cash at the end. A secured card is your best bet if you want to learn how to handle a credit card responsibly for everyday spending. You can learn more about how secured credit cards work in our detailed guide on the topic.

Think of it this way—both paths lead to a stronger credit score, they just take different routes to get there. This decision tree can help you picture which one fits your situation.

As you can see, if saving is your top priority, the credit builder loan is a clear winner. If you want to get comfortable using credit for purchases, the secured card is the way to go.

Market Size and Product Popularity

These aren't just niche products for a handful of people. They are a major part of the financial world, helping millions get started. In the United States alone, the credit builder market has an outstanding balance of around $845 million. This is spread across 3 million accounts held by 2.8 million people.

What’s really interesting is that secured credit cards account for nearly 60% of that balance, which shows just how popular they are. These tools are proven, effective ways for people to establish their financial footing.

Ultimately, both are structured, low-risk methods for showing the credit bureaus that you're reliable. Picking the one that fits your lifestyle is the first real step toward building a solid financial future.

The Real-World Benefits of a Better Credit Score

Let's be honest, the whole point of using a credit builder isn't just to watch a number on a screen creep higher. The real prize is what that number does for you in the real world. It’s about turning financial roadblocks into open doors.

At its core, a credit builder helps you nail the single most important part of your credit score: your payment history. Making those small, consistent payments is the clearest way to show lenders you’re someone they can trust.

Once you’ve built that positive track record, you start to unlock some serious financial advantages—the kind that can save you a ton of money over time.

Saving Money and Unlocking Opportunities

The biggest immediate win? Qualifying for better interest rates. A good credit score can be the difference between a sky-high interest rate on a car loan and one that’s actually affordable. We're talking about a difference that can save you thousands of dollars over the life of the loan.

The same goes for buying a home. A higher score often means a lower mortgage rate, which could lead to a smaller monthly payment and tens of thousands in savings. These aren't just small wins; they're life-changing.

But the perks don't stop with loans. A solid credit history can also mean:

How It Plays Out in Real Life

Picture this: you apply for your first car loan but get turned down flat because you have no credit file. Fast forward a year. After making steady payments with a credit builder, you apply again. This time, you don't just get approved—you get a rate that fits perfectly into your budget.

Think of a credit builder as the key to this world of opportunity. It gives you a straightforward, structured way to prove you’re financially responsible, turning small, consistent actions into massive long-term rewards.

Who Can Benefit Most from a Credit Builder?

Credit builders aren't a niche product for just one type of person. They’re really a versatile tool for anyone who needs a straightforward, structured way to get into the formal credit system, whether you're starting from scratch or just need a fresh start.

Think of it as a universal key that can unlock financial doors for people who have traditionally found them locked. The demand for these kinds of tools is growing, showing just how many people need an accessible way to build credit.

People Starting Their Credit Journey

For young adults, students, or anyone who's "credit invisible," a credit builder is the perfect first step. If you have zero credit history, getting approved for a standard credit card or loan is a classic chicken-and-egg problem.

A credit builder solves this by creating a low-risk environment where you can build a positive payment history. It's about laying a solid foundation for your future financial life—things like getting a car loan or even just renting an apartment.

Newcomers and ITIN Holders

Immigrants and individuals using an Individual Taxpayer Identification Number (ITIN) often run into a unique brick wall. You could have a perfect financial track record in your home country, but none of it follows you to the U.S. credit system.

This is where credit builders are truly essential. They offer a direct path to establishing a U.S. credit file, often without requiring a Social Security Number. By using a product that accepts an ITIN, newcomers can start building the credit they need for housing, transportation, and other vital services.

You can explore a variety of credit builder products designed for this exact purpose.

Individuals Rebuilding Their Credit

Life happens. A job loss, unexpected medical emergency, or even a bankruptcy can tank a credit score, and clawing your way back can feel impossible.

For anyone in this situation, a credit builder offers a safe, controlled method for re-establishing a positive track record. The regular, on-time payments add recent, positive history to your credit report, which can start to outweigh some of the negative marks from the past.

This isn't just a small group of people. According to research from TransUnion, about 52% of new-to-credit consumers in the U.S. expect their need for credit to increase. That makes tools like this more important than ever.

Finding the Right Credit Builder for Your Goals

With so many credit builders out there, picking the right one can feel a little daunting. But spending a little time upfront to do your homework can make all the difference, ensuring you've chosen a powerful tool for your future—not a costly mistake.

The absolute first thing you need to check is that the company reports your payments to all three major credit bureaus: Experian, Equifax, and TransUnion. This is non-negotiable. If they only report to one or two, all your responsible payments won't get the full recognition they deserve, which seriously limits how much your credit profile can grow.

Evaluating the Costs and Terms

Once you've confirmed they report everywhere, it's time to get into the nitty-gritty of the costs. Some lenders try to hide high fees in confusing terms, so you have to read everything carefully.

Be on the lookout for a few specific costs:

Think about the loan amount or security deposit, too. Can you comfortably afford the monthly payment or the initial deposit? Missing a payment is the quickest way to damage the very score you're trying to build, so be realistic about what fits in your budget.

If you want to see how different products compare, our guide to choosing a credit builder account is a great place to start.

Finally, stick with providers you can trust. Your local credit union or a community bank is often a fantastic choice because their focus is on helping people in the community. There are also a number of trusted fintech companies that have designed excellent, easy-to-use products specifically for people who are new to credit. A little bit of selective shopping will help you find the perfect partner for your credit-building journey.

Common Questions About Building Credit

It's one thing to understand how a credit builder works in theory, but you probably have a few practical questions before you jump in. That's smart. Getting clear on the timeline, potential downsides, and who can actually get one will help you set the right expectations from the get-go.

How Fast Will My Credit Score Go Up?

Let's start with the big one: "How quickly will I see a difference?" While every credit profile is different, you can generally expect to see positive movement on your credit reports within 6 to 12 months of making consistent, on-time payments.

The magic word here is consistency. Each payment you make on time is like laying another brick in your financial foundation. It's a slow and steady process that proves to lenders you're reliable, which is exactly what builds a strong score over time.

Are There Any Risks I Should Know About?

It's also crucial to ask about the potential pitfalls. The main risk with a credit builder is the same one that comes with any credit product: missing a payment. Just one late payment can put a dent in your score, and it can feel like a major setback after months of progress.

This is why it's so important to choose a payment amount you know you can handle without stress. Think of a credit builder as a tool for financial growth—and like any tool, it has to be used responsibly to work properly.

This approach not only protects your score but also helps you build the kind of solid financial habits that will serve you for years to come.

Can I Get a Credit Builder if I Already Have Bad Credit?

Finally, a lot of people worry, "Is this even an option for me if my credit is already in rough shape?" The answer is a definite yes. In fact, these tools were designed specifically for people with no credit history or a damaged one.

Because they're usually secured with your own money, credit builders are much easier to get approved for than traditional loans or credit cards. This makes them the perfect starting point for anyone looking to build or rebuild their credit, no matter what their past looks like. A credit builder meets you exactly where you are and gives you a clear path forward.