What is an ITIN Number? Essential Guide for 2024

If you have income in the United States but aren't eligible for a Social Security Number (SSN), you might be wondering how you're supposed to file your taxes. The answer is the Individual Taxpayer Identification Number, or ITIN.

Think of it as a special key to the U.S. tax system, created by the IRS to make sure everyone who needs to file taxes can do so, regardless of their immigration status.

Understanding Your ITIN and Its True Purpose

At its heart, an ITIN is purely a tool for tax compliance. It gives foreign nationals, non-resident aliens, and their families a way to file federal tax returns and settle any taxes they owe the U.S. government.

It's just as important to understand what an ITIN is not. It doesn't give you permission to work in the U.S., it offers no immigration benefits, and it's not meant to be a primary form of ID outside of tax-related matters. Its one and only job is to track tax information.

The Anatomy of an ITIN

An ITIN is a nine-digit number issued by the Internal Revenue Service (IRS). The program was created back in July 1996 to provide a pathway for people without an SSN to fulfill their U.S. tax duties.

You can spot an ITIN easily because it’s formatted like an SSN (XXX-XX-XXXX) but always begins with the number 9. The middle two digits are also a giveaway, usually falling within the ranges of 50-65, 70-88, 90-92, and 94-99. For a deeper dive into its background, the American Immigration Council offers some great insights.

To make the distinction crystal clear, let's break down the key differences between an ITIN and an SSN.

ITIN vs Social Security Number (SSN) at a Glance

This table highlights the core separation: an SSN is tied to work authorization and social benefits, while an ITIN is exclusively for tax administration.

Who Typically Needs an ITIN?

So, who are the people who actually need to apply for an ITIN? You’ll likely need one if you find yourself in one of these common situations:

Do You Actually Need an ITIN?

Alright, so we've covered what an ITIN is. Now for the million-dollar question: do you actually need one? It really boils down to two things: you have a specific U.S. federal tax obligation, and you don’t qualify for a Social Security Number (SSN).

Think of an ITIN not as a "nice-to-have" document, but as an essential tool for very specific financial responsibilities. Applying for one without a real need just creates a mountain of paperwork for no reason. So, let's make sure your situation truly calls for it.

Common Scenarios That Require an ITIN

Let's get practical and move away from the theory. If any of these situations sound familiar, you probably need to apply for an ITIN.

These examples show how the need for an ITIN is almost always linked directly to a tax filing duty. While its main job is handling taxes, it can sometimes pull double duty as a secondary ID. For a deeper dive on that, check out our guide to banking without a Social Security Number, which explores how an ITIN can open other financial doors.

Before jumping into the application, take a hard look at your financial life. Are you earning income in the U.S.? Claiming a tax treaty benefit? Being claimed as a dependent on someone else's tax return? The answers to these questions will tell you loud and clear whether an ITIN application is your next step.

A Step-by-Step Guide to the ITIN Application

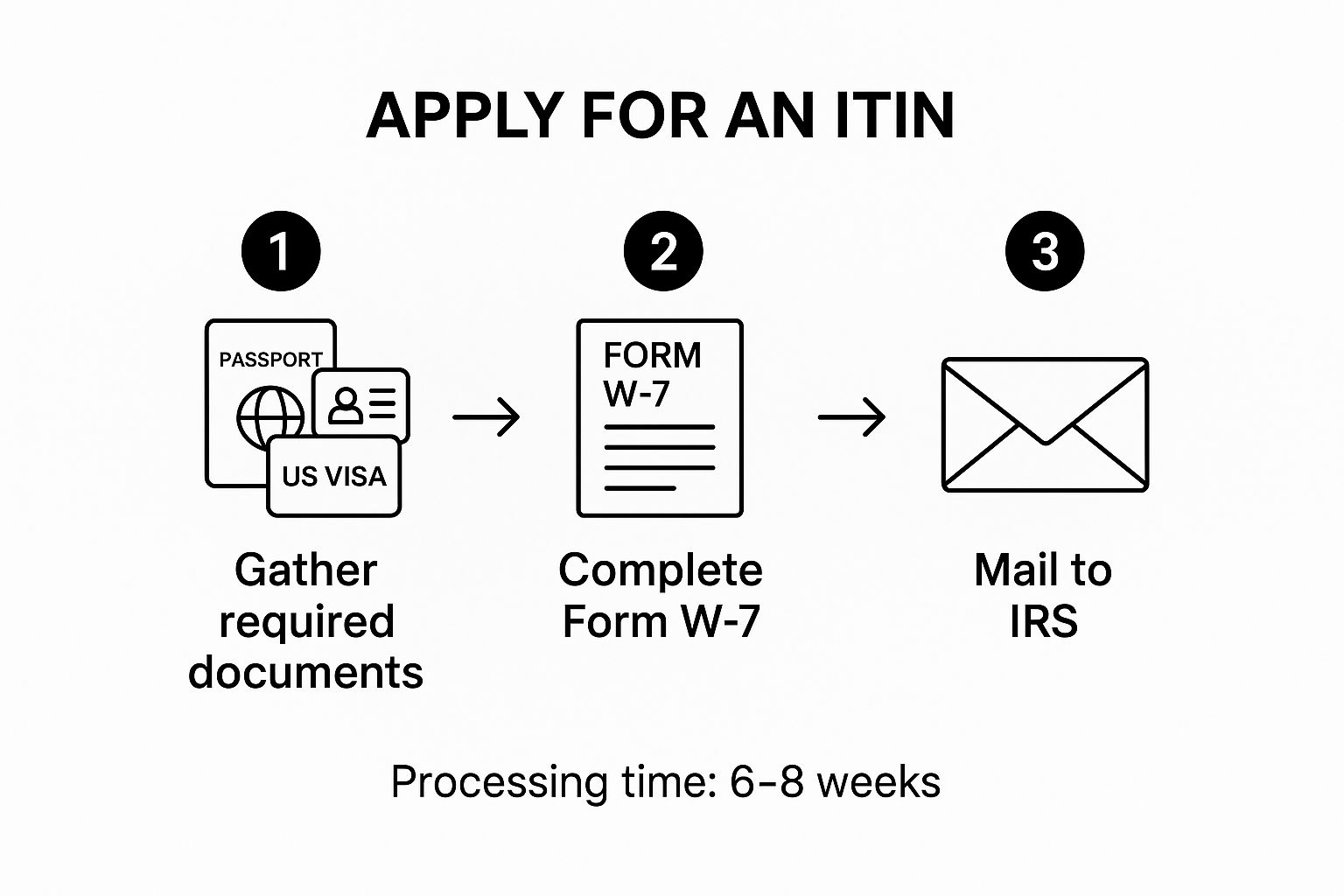

Getting an ITIN might feel like a huge task, but when you break it down, it's a very clear-cut process. The journey starts with one key document: Form W-7, Application for IRS Individual Taxpayer Identification Number. This is your official request to the IRS.

But here’s the most important thing to remember: you can't just send in a Form W-7 by itself. It must be attached to a valid federal income tax return. Why? This is how you prove to the IRS that you have a legitimate tax reason for needing a number. Sending the form without a tax return is a surefire way to get your application rejected.

Getting Your Documents in Order

Before you even think about mailing anything, you need to prove your identity and foreign status. The IRS is very particular about this. The simplest route is to use an original or certified copy of an unexpired passport—it's the only document that proves both things on its own.

No passport? No problem, but you'll need to provide at least two other current documents from a specific list. Some common combinations include:

For a full rundown of acceptable documents, make sure you check our comprehensive guide on ITIN application requirements.

The infographic below gives you a bird's-eye view of the entire application journey.

Think of it as your roadmap—from collecting the right paperwork to finally mailing your application and waiting for the IRS to process it.

How to Submit Your Application

Once your Form W-7, tax return, and proof of identity are all ready to go, you have three ways to get them to the IRS. Each one comes with its own set of pros and cons, so it’s worth thinking about which is best for you.

Let's look at the options side-by-side.

The data shows just how much your choice matters. In 2023, the IRS processed nearly 900,000 new ITIN applications but also rejected more than 250,000 of them. Interestingly, applicants who worked with an IRS-certified acceptance agent (CAA) were over 15% more likely to get approved compared to those who just mailed their original documents. If you want to dive into the numbers yourself, you can read the full research on ITIN application trends from the Taxpayer Advocate Service.

Avoiding Common Application Rejection Pitfalls

It’s a frustrating moment: after weeks of waiting, you get a rejection notice for your ITIN application. This isn't just annoying—it can throw your entire financial and tax planning into disarray. The good news is that most rejections are completely avoidable.

The number one reason applications get denied is shockingly simple: an incomplete or incorrectly filled-out Form W-7. The second biggest mistake? Forgetting to attach the U.S. federal tax return that proves you actually need the ITIN in the first place.

Double-Checking Your Documents

The IRS scrutinizes every single document you send. A frequent tripwire is submitting paperwork that doesn't properly prove both your identity and your foreign status according to their very specific rules. A valid, unexpired passport is your golden ticket here—it's the only standalone document that checks both boxes.

If you don't have a passport, you'll need to submit a combination of other documents. Make absolutely sure they are current and on the IRS-approved list. Sending originals is risky, and plain photocopies will get your application thrown out immediately. This is exactly why working with a Certifying Acceptance Agent (CAA) is often the smartest move.

Just how big is that mountain? At one point, the backlog of unprocessed paperwork at an IRS department was reportedly so large that if you stacked it, it would be 11 times taller than the Statue of Liberty. This really drives home why you need to make your application flawless and easy to approve. You can learn more about the challenges of ITIN processing and see why getting it right the first time is so important.

To keep your application out of the rejection pile, focus on these four things:

By carefully checking these points before you mail anything, you dramatically boost your chances of a smooth approval and cut down the long wait time for your ITIN.

Keeping Your ITIN Active and Compliant

Getting your Individual Taxpayer Identification Number is a huge step, but the journey doesn't stop there. Think of your ITIN less like a permanent ID and more like a tool that needs a little bit of upkeep to stay in good working order.

Your main job is simple: use it. Every time you file a federal tax return, make sure your ITIN is on it. This regular use is how you signal to the IRS that your number is still active and necessary for your tax responsibilities.

Understanding ITIN Expiration Rules

An ITIN won't last forever if it just sits on a shelf collecting dust. The IRS has a pretty straightforward "use it or lose it" policy to keep their records clean and ensure ITINs are being used for their intended purpose.

This rule makes sense—it helps the IRS make sure that only people with a current need to file taxes are holding an active number. Keeping your ITIN active is key to avoiding headaches and delays with future tax filings. Plus, while its main job is for taxes, an active ITIN can also open doors to building your financial life in the U.S. You can learn more about this by reading our guide on using an ITIN number for your credit report.

How to Renew an Expired ITIN

If your ITIN does expire, don't panic. The renewal process is much simpler than a brand-new application because you're already in the system.

Here’s a quick rundown of what to do:

A little bit of proactivity goes a long way. By keeping an eye on your ITIN's status, you can save yourself a lot of stress and make sure you're always ready when tax season rolls around.

Common Questions About ITINs, Answered

Even after covering the basics, you probably still have some specific questions about how an ITIN works day-to-day. That's perfectly normal. Let's tackle some of the most common things people ask so you can feel confident about using your ITIN.

Can I Use an ITIN for a Bank Account or a Driver's License?

This is a big one, and the answer is: it depends. The main job of an ITIN is to handle federal taxes. But sometimes, it can be used for other things.

Many banks will actually let you open an interest-bearing account with an ITIN. Why? Because the bank has to report the interest you earn to the IRS, and your ITIN is the number they need to do that.

Getting a driver's license is a different story. An ITIN isn't a government ID for anything outside of taxes. Whether your state's DMV will accept it varies wildly. Some states might allow it as part of your application if you don't have a Social Security Number, but many won't. Your best bet is to check directly with both your bank and your local DMV to get their specific rules.

Does Having an ITIN Affect My Immigration Status?

This is a crucial point that causes a lot of anxiety, so let's be crystal clear: No, it does not.

Getting and using an ITIN has absolutely no impact on your immigration status. The IRS is its own separate world focused entirely on tax collection. They have strict confidentiality rules and are not in the business of immigration enforcement.

Think of it this way: An ITIN is simply a tool that lets you follow U.S. tax law. It doesn’t grant you legal status, but it also won't be used against you. It just shows you're doing your part to be a responsible taxpayer.

What Should I Do if My ITIN Application Is Rejected?

First off, don't panic. If your application gets rejected, the IRS will mail you a letter explaining why. Read that letter carefully—the reason for the rejection will be right there.

Most of the time, it's a simple, fixable mistake. The most common slip-ups include:

Once you figure out what went wrong, you'll need to fix the issue and resubmit the entire application package from scratch. If the IRS's explanation is confusing, don't hesitate to call them. You could also work with a Certifying Acceptance Agent (CAA). They're experts at this and can spot the problem quickly, making sure your next application is perfect.

Take control of your financial future as an ITIN holder. With itin score, you can build and monitor your U.S. credit history for free. Get personalized insights, an AI-driven credit coach, and access to ITIN-friendly financial products. Sign up in minutes and start your credit journey today at https://www.itinscore.com.