What Is a Secured Credit Card & How It Builds Credit

So, what exactly is a secured credit card? Think of it as a real credit card with a set of training wheels. It's backed by a refundable cash deposit you make when you open the account. This deposit usually sets your credit limit, making it a fantastic, low-risk way to start building credit or get back on your feet financially.

How Secured Credit Cards Really Work

If you've ever felt like the traditional credit system has its doors closed to you, a secured card can be the key to getting in. Standard "unsecured" cards are approved based on your past credit performance. Secured cards flip that around—they're approved based on your ability to provide a cash deposit.

This simple but powerful difference is what makes them so accessible, especially for people with a limited or damaged credit history. They are specifically designed as tools to build or rebuild your financial reputation. In fact, there's a strong demand for these cards, which shows just how many people are using them to get started.

The Role of Your Security Deposit

The process is refreshingly simple. Your own money secures the credit the bank extends to you. If you put down a 300** deposit, you get a **300 credit limit. Simple as that.

This deposit takes nearly all the risk off the lender’s shoulders. That’s why approval odds are so high, even if you have no credit history to speak of.

This setup makes a secured card the perfect first step. If you're just starting out, learning how to establish credit history is your first mission, and a secured card is one of the best tools for the job.

Secured vs. Unsecured Credit Cards at a Glance

To really get a handle on this, it helps to see the two types of cards side-by-side. The table below breaks down the core differences in a straightforward way.

As you can see, each card serves a different purpose. One is designed to help you build a financial foundation, while the other is for those who have already built one.

Your Step-by-Step Guide to Using a Secured Card

So, how does a secured card actually work in the real world? It's a lot more straightforward than you might think. Let's walk through the entire journey, from the day you apply to the day you "graduate" to a regular credit card.

Starting with the Application and Deposit

The first step feels just like applying for any other credit card—you’ll fill out an application with your personal and financial details. The big difference comes right after you're approved: the security deposit. You'll need to send the bank a refundable cash deposit, usually starting around 200** or **300.

This deposit is your collateral. It’s what makes the card "secured." In nearly every case, the amount you deposit becomes your credit limit. Put down 500**, and you get a **500 credit limit. Your money just sits in a special savings account held by the bank. It's not a fee; it's a safety net for the lender, which is why it's so much easier to get approved.

Using the Card for Everyday Purchases

Once your deposit is paid and the physical card arrives in the mail, you use it exactly like any other credit card. Buy groceries, shop online, pay your phone bill—it works everywhere. To the cashier or the online checkout system, it's just a regular Visa or Mastercard.

Your mission here is simple: prove you can handle credit responsibly. This means making small, regular purchases that you can easily afford. More importantly, it means paying your bill on time, every time.

Building Credit Through Reporting

This is where the real work gets done. Every month, the credit card company reports your payment habits to the three major credit bureaus: Experian, Equifax, and TransUnion. This reporting is the entire reason you're using a secured card in the first place.

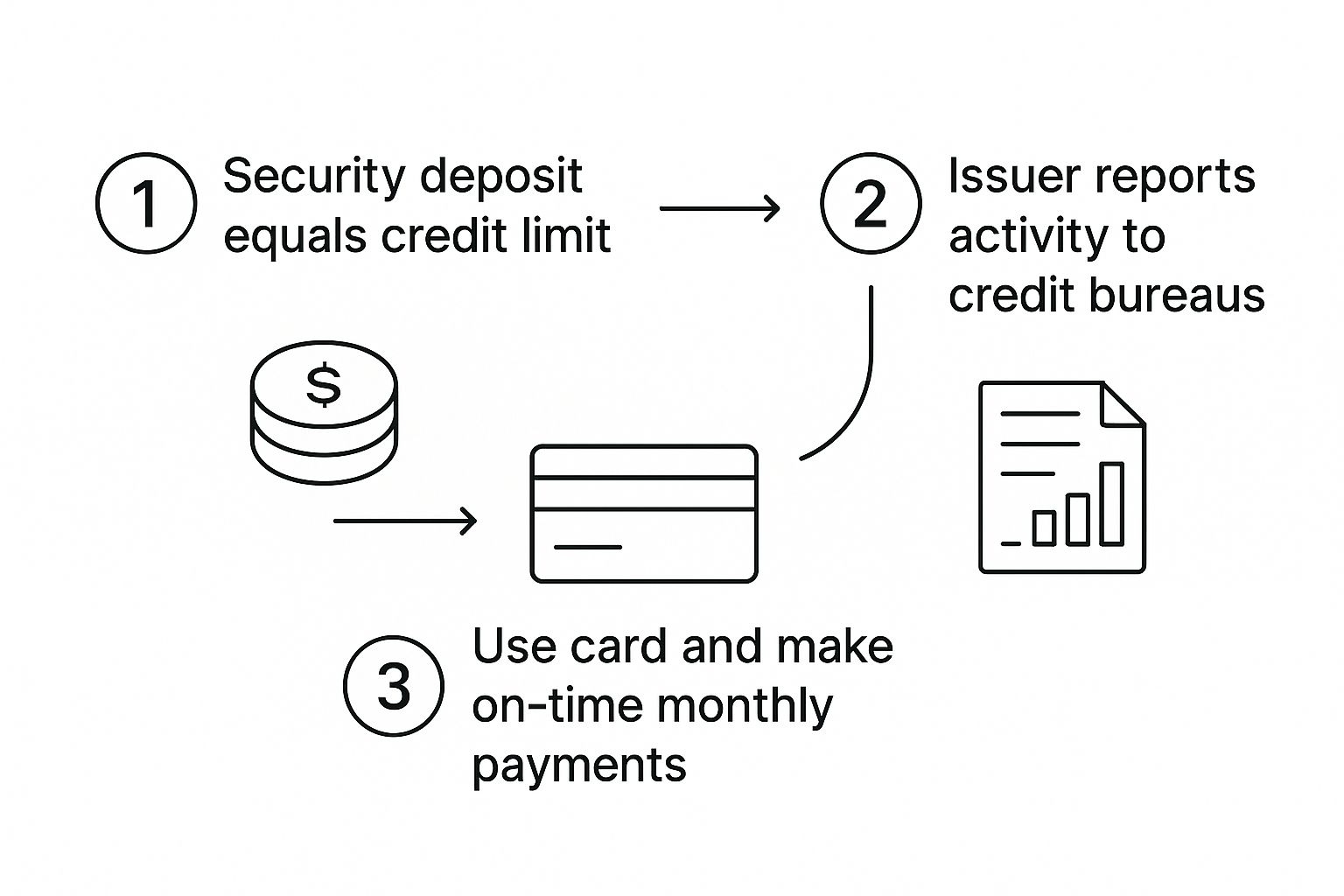

This simple cycle is the key to building your credit history.

As the visual shows, your deposit unlocks the card, your responsible spending creates a payment history, and that history gets reported to build your credit score.

Graduating to an Unsecured Card

The ultimate goal with a secured card is to not need it anymore. This final step is called "graduation." After you've shown a pattern of responsible use—typically for 6 to 18 months—many banks will automatically review your account. If you’ve kept up with your payments, they’ll often do two things:

This is a huge win. It means you’ve successfully proven your creditworthiness, and lenders now see you as a reliable borrower. The training wheels are off, and you're now holding a line of credit based on trust, not your own cash.

The Real Benefits of Building Credit This Way

When you’re working to build or rebuild your credit, a secured card isn't just another piece of plastic. It's a powerful tool designed for exactly this purpose. The biggest advantage isn't just getting access to a credit line; it's that you get a direct connection to the three major credit bureaus.

Every single time you pay your bill on time, that positive action gets reported to Experian, Equifax, and TransUnion. This consistent reporting is the lifeblood of a healthy credit profile. In fact, your payment history is the single most significant factor, accounting for 35% of your FICO score. You're essentially turning good habits into a better credit score, one month at a time.

Access When You Need It Most

Let's be honest, one of the toughest parts of having a thin or damaged credit file is getting approved for anything. Most traditional lenders will see you as a risk and shut the door. This is where a secured card completely changes the game.

Your approval odds are incredibly high. Why? Because you secure the credit line with your own cash deposit, which practically eliminates the risk for the bank. This provides a crucial pathway for people who are often left out, like students, new immigrants using an ITIN, or anyone recovering from a tough financial spot. It’s your foot in the door to the credit world.

A Clear Path to Unsecured Credit

Think of a secured card as a temporary stepping stone, not a permanent fixture in your wallet. The entire point is to use it to demonstrate that you can manage credit responsibly.

After you've shown a pattern of consistent, on-time payments—this usually takes anywhere from six to 18 months—most card issuers will automatically review your account. If you've managed it well, they'll often "graduate" you to a regular, unsecured credit card. This is a huge milestone. Your security deposit is returned, and you now have a line of credit based on trust, not collateral.

This process does more than just raise your score; it teaches you financial discipline. Starting with a small, manageable credit limit forces you to learn how to budget and make payments a priority. If you're just getting started, our guide on how to build credit from scratch provides even more tips to help you on your way.

These are the foundational skills that pave the way for long-term financial success, leading to better interest rates, bigger loans, and a whole lot more freedom. It’s a structured way to build both your credit and your confidence at the same time.

What to Watch Out For with Secured Cards

While a secured card is a fantastic tool for building credit, it's not without its quirks. It’s smart to go in with your eyes wide open, knowing the potential drawbacks. This way, you can pick the right card and avoid any bumps on your financial road.

The most immediate hurdle is the upfront security deposit. Unlike a standard credit card, you have to put down your own money—usually somewhere between 200 and 500—just to open the account. Even though that money is fully refundable, coming up with a few hundred dollars can be a real challenge if you're on a tight budget.

That deposit directly influences your spending power, which brings us to the next point.

Lower Credit Limits and Your Utilization Ratio

Because your credit limit equals your deposit, secured cards almost always have lower limits than traditional unsecured cards. If you deposit 300**, you get a **300 credit limit. Simple. This is great for preventing overspending, but it creates a challenge when it comes to your credit utilization ratio.

Your credit utilization—the percentage of your available credit you’re using—is a huge piece of your credit score. With a low limit, even small purchases can make that percentage jump. For instance, charging just 90** on a card with a **300 limit puts you at 30% utilization, which is the absolute maximum most financial experts recommend.

Watch Out for Unnecessary Fees

Finally, you absolutely have to read the fine print and hunt for fees. Many of the best secured cards have no annual fee, but some lenders, particularly those that cater to people with poor credit, pack their cards with extra charges.

Keep an eye out for these common culprits:

A good secured card should be a simple, effective tool for building credit, not a product designed to nickel-and-dime you. Always look for a card with few or no fees. Your money should be working to build your financial future, not just paying for the privilege of having an account.

Is a Secured Credit Card Right for You?

Think of a secured credit card as a specific tool for a specific job. To know if it's the right tool for you, it helps to see how it works in real-world situations. Let's walk through a few common scenarios. You might just see yourself in one of these stories, which can make it much clearer if a secured card is the right move for your financial journey.

We can look at these as different financial profiles, each facing a unique challenge that a secured card is perfectly suited to address.

The Credit Newcomer

Picture a recent college grad or a young adult landing their first real job. They've managed their money well—no debt, clean slate—but they also have absolutely no credit history. In the world of lending, this is called having a "thin file." When they go to apply for a basic credit card or even a small loan, they often get rejected. It's not because they're a risk, but because lenders have zero data to prove they're reliable.

For someone in this boat, a secured credit card is the perfect on-ramp. It offers a straightforward, low-risk way to start building that all-important payment history from scratch. They can put down a small deposit, then use the card for simple, planned purchases—like a Netflix subscription or a tank of gas. Each month, that positive activity gets reported to the credit bureaus, and just like that, they're on their way.

The Credit Rebuilder

Now, let's consider someone who's been through a tough time financially. Maybe a job loss, a medical crisis, or a divorce threw their finances into chaos, leading to missed payments and a nosediving credit score. They’re eager to get back on their feet, but their past financial struggles are now a roadblock, preventing them from getting approved for new credit.

This person is a classic "credit rebuilder." Their primary mission is to show lenders they can be trusted with credit again. A secured card gives them that exact opportunity.

The New Resident and ITIN Holder

Finally, think about someone who has recently moved to the United States. They might have a great financial track record in their home country, but unfortunately, that history doesn't travel with them. Lacking a Social Security Number (SSN), many newcomers use an Individual Taxpayer Identification Number (ITIN) instead. In the eyes of the U.S. credit system, they are starting from square one.

For this group, a secured card is often one of the most accessible and effective tools for establishing a U.S. credit file. A growing number of banks and credit unions now accept ITINs for secured card applications, making it a critical entry point. If this situation sounds familiar, learning how to build credit with an ITIN number is your most important first step, and a secured card is almost always a central piece of that strategy.

The need for these kinds of financial products is huge and growing. The market for starter credit cards was valued at around 348.4 billion** and is expected to hit **587.1 billion by 2030, largely thanks to new users like students and immigrant communities. You can discover more statistics on credit card trends to get a sense of just how common this is.

Whether you're building from scratch, rebuilding after a setback, or starting fresh in a new country, a secured card offers a structured and proven path toward a better financial future. It helps level the playing field, giving your responsible actions today the power to shape your opportunities for tomorrow.

Got Questions? We’ve Got Answers.

Even after you get the basic idea of how secured credit cards work, a few questions always seem to pop up. It’s completely normal to want to iron out the details before you commit. We've gathered the most common questions we hear and answered them directly, so you can move forward feeling confident.

Let's dive into the practical stuff that really matters, from how you get your deposit back to what this all means for ITIN holders.

Will I Get My Security Deposit Back?

Yes, absolutely. That security deposit is fully refundable. It’s not a fee the bank keeps; think of it more like a security deposit on an apartment. It’s still your money.

You’ll get it back under two common circumstances: you close the account in good standing (meaning you've paid off your balance), or the bank graduates you to a regular, unsecured credit card. The deposit is simply there to give the lender peace of mind. If you stop making payments, they can use it to cover what you owe. But as long as you pay your bill, that money is yours to get back.

Does a Secured Card Hurt Your Credit Score?

Quite the opposite, actually. A secured credit card is one of the most effective tools designed to help you build or rebuild your credit score. The magic happens when the card issuer reports your payment activity to the three major credit bureaus—Equifax, Experian, and TransUnion.

As long as they’re reporting your on-time payments, your credit score will benefit. After all, your payment history is the single biggest piece of your credit score puzzle. Of course, this street runs both ways. Just like any other credit card, making late payments or carrying a balance that’s maxed out can definitely pull your score down.

How Long Does It Take to Build Credit with One?

There’s no magic number, but most people start to see positive changes on their credit report within the first few months. Real, meaningful improvement, however, usually takes a bit longer. Most financial experts agree that you’ll need at least six months of consistent, on-time payments to see a solid boost.

Consistency is the name of the game. If your goal is to graduate to an unsecured card, many banks will start reviewing your account after 12 to 18 months of responsible use. The longer you maintain that positive track record, the stronger your credit profile will become.

Can I Get a Secured Card with an ITIN?

You sure can. A growing number of banks and credit unions offer secured cards to people who use an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number. This is fantastic news, as it makes these cards one of the best ways for immigrants and other non-citizens to start building a U.S. credit history.

The application process is pretty straightforward. You'll generally need to provide:

For anyone looking to plant financial roots in the U.S. without an SSN, a secured card is an incredibly valuable first step.

Ready to build your U.S. credit history with your ITIN? itin score offers the first platform designed for you. Get free credit monitoring, personalized advice from our AI coach, and a clear path to your financial goals. Sign up for free and start your journey today at itinscore.com.