What Is a Payment History? Key Insights & Tips

When lenders consider you for a loan or a credit card, what's the first thing they look at? It's not your income or your savings, but something much more fundamental: your payment history.

Think of it as your financial reputation, boiled down to a simple track record. It’s a detailed log of how you've handled your bills—from credit cards and car loans to mortgages. Have you paid on time, every time? Or have there been a few bumps in the road?

This record is the single most important piece of your financial puzzle.

Your Payment History Tells a Story

Imagine your entire financial life is a book. Your payment history would be the chapter that banks, landlords, and even some employers read first. It's a straightforward account of your past behavior when it comes to repaying what you owe.

But it’s more than just a list of dates and numbers. It tells a story about your reliability. Each on-time payment is a positive entry, showing you're a responsible borrower. On the other hand, late or missed payments can raise red flags, making lenders hesitant.

This isn't just a minor detail—it's the heavyweight champion of credit scoring factors. In most scoring models, like the FICO score, your payment history accounts for a massive 35% of the total score. It's the foundation of your entire credit profile.

Key Components of Your Payment History

To really understand its impact, you need to know what information this record actually contains. It's not just about one or two late payments; it's a comprehensive look at your habits over time.

As you can see, every action (or inaction) matters. Understanding these components is the first step toward taking control of your financial narrative. These details are compiled into a larger document, which you can learn more about in our guide on how to read and understand your credit report.

Why Your Payment History Carries So Much Weight

If you think of your credit report as a story about your financial life, your payment history is the main plot. It's not just another chapter; it’s the single most influential element that dictates how the story ends. Lenders look at this track record above all else because it’s their best guess at how you'll handle future payments.

A solid history of paying bills on time is like a golden ticket. It unlocks better deals on everything from car loans and credit cards to insurance policies, potentially saving you a small fortune over the years. It signals to lenders that you're a reliable borrower.

On the flip side, a pattern of late or missed payments can slam those doors shut. Lenders might see you as a risk, which can lead to flat-out rejections for loans or, if you are approved, much higher interest rates. This can directly get in the way of achieving big life goals.

The Direct Line to Your Credit Score

Your payment history and your credit score are directly linked. Think of it as the foundation of a house—every on-time payment you make adds another solid brick, strengthening your entire financial profile. Every late payment, however, cracks that foundation.

This becomes incredibly important when you're aiming for major milestones. For example, understanding what credit score is needed for a mortgage often comes down to how consistently you've paid your bills in the past.

It’s a powerful reminder of why you need to understand the different https://www.itinscore.com/blog/factors-affecting-credit-score/, and payment history is always at the top of the list.

And things are getting even more detailed. With the rise of real-time payments, which made up 19.1% of all electronic transactions in 2023, the picture of your financial habits is sharper than ever. Information from mobile wallets and even buy-now-pay-later services can now contribute to how lenders see your reliability.

How to Check Up on Your Payment History

Think of reviewing your payment history like a regular health check-up, but for your finances. It’s the best way to see what lenders see, catch any errors before they become big problems, and make sure you’re on track with your goals.

The most straightforward method is to pull your credit reports. You can actually get all three of your credit reports for free, and they’ll show you the complete payment history that each credit bureau has on file for you. For anyone with a Social Security Number (SSN), this is your go-to source of information from Equifax, Experian, and TransUnion.

What If You Use an ITIN?

But what about the millions of people in the U.S. who use an ITIN instead of an SSN? Accessing this crucial financial information has always been a major hurdle. Thankfully, that's changing. New platforms have emerged to fill this gap, giving ITIN holders the tools they need to see where they stand.

Services built specifically for ITIN users let you link your financial accounts to build a clear, verifiable picture of your payment track record. Instead of being invisible to the traditional credit system, you can finally prove your history of responsible financial habits. If you're curious about how this works, our guide explains how to check your credit report for free using an ITIN.

This screenshot from itinscore, for example, shows how a simple dashboard can bring all your financial information together in one easy-to-read place.

When you have this kind of data right in front of you, you can track your progress in real-time and pinpoint exactly where you can improve.

Turning this into a routine habit puts you in the driver's seat. You get to ensure the story your payment history tells is accurate, positive, and helps you get where you want to go. It’s a simple action that makes a huge difference in achieving long-term financial health.

Actionable Strategies to Improve Your Payment History

Building a strong payment history is one of the most powerful financial moves you can make. It’s not about grand gestures but small, consistent actions that prove your reliability over time. The journey begins with simple, practical steps that anyone, including ITIN holders, can start taking today.

The golden rule is simple: never miss a due date. The easiest way to stick to this is by putting your payments on autopilot. Set up automatic transfers for at least the minimum amount due on all your recurring bills, from credit cards to loans. Think of it as a safety net that guarantees you're always on time.

Another great habit is to sync your budget with your billing cycles. Grab a calendar or open a spreadsheet and map out all your payment due dates and amounts. This simple visual cue helps you plan your spending and ensures you have the cash on hand when bills come knocking, cutting out that last-minute stress.

Prioritize Consistency and Communication

When it comes to your payment history, consistency is your greatest ally. Lenders would much rather see a long track record of small, on-time payments than a few big, sporadic ones. It shows you're dependable.

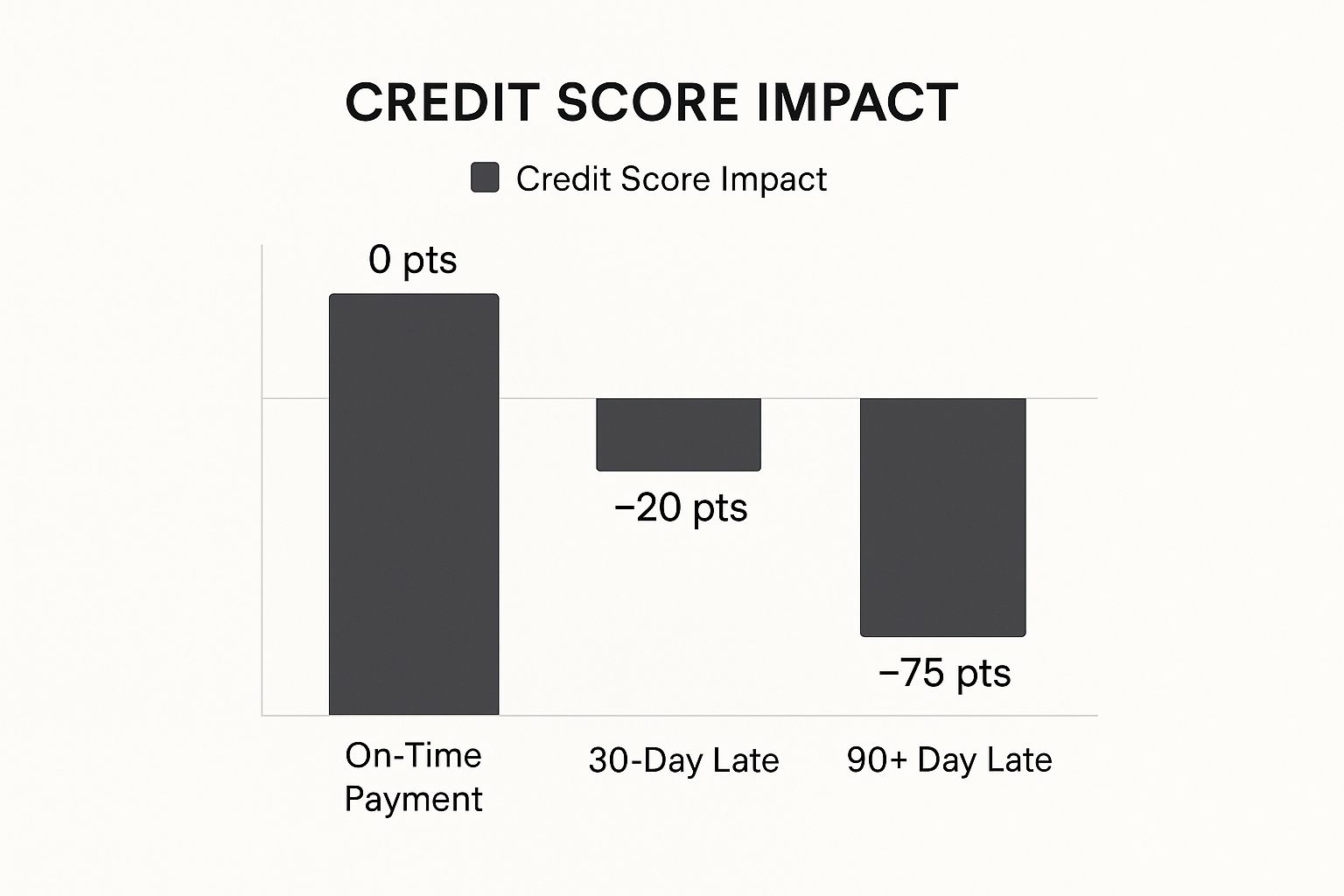

Just look at how much a single late payment can derail your progress compared to a history of paying on time.

As you can see, staying current keeps your score stable. But a payment that's just 30 days late can cause a significant drop, and a 90-day delinquency does even more damage.

So, what happens if you know you’re going to be late?

Don't let past-due accounts linger. Tackle them strategically, focusing on the newest or highest-interest ones first. For ITIN holders using a tool like itinscore, every positive step you take helps build a verifiable financial identity that can open up new opportunities.

To make it even clearer, let's break down the actions that help versus those that hurt your payment history. Think of this table as your cheat sheet for building a stronger financial future.

Positive vs Negative Payment History Factors

Ultimately, the goal is to make the "Positive Actions" column a reflection of your regular financial habits. The more consistently you do that, the healthier your payment history will become.

Setting the Record Straight on Payment History Myths

When you're trying to build a strong financial future, bad advice can really set you back. There's a lot of misinformation out there about payment history, so let's clear up a few of the most common—and damaging—myths.

One of the biggest ones? The idea that closing an old credit card account will help your score. It seems logical, but it's actually the opposite of what you want to do.

Fact vs. Fiction

Closing an old account can actually shorten the length of your credit history, a significant piece of your overall score. Lenders want to see that you have a long, consistent track record of handling credit well, and that old account is proof of your experience.

Then there's the confusion around collection accounts. Many people think that once they pay off a collection, it just disappears from their credit report. If only it were that simple.

While paying the debt is absolutely the right move, the record of the collection can stick around on your report for up to seven years. A paid collection definitely looks better to a lender than an unpaid one, but its negative mark only fades with time and a flood of new, positive payment information.

Let's tackle a couple more quick-fire myths:

By getting past these myths, you can focus on what actually works and make decisions based on solid facts, not financial fiction.

Your Payment History Questions Answered

Even when you know what payment history is, a few tricky questions always seem to pop up. Let's tackle some of the most common ones head-on. Think of this as your quick FAQ for building a solid financial reputation.

How Long Do Late Payments Stay on My Record?

This is a big one, and the answer can feel a little intimidating. Generally, a late payment or any other negative mark can stick around on your credit report for up to seven years.

But here's the good news: its impact isn't set in stone. The sting of that mistake fades over time. A late payment from five years ago means a lot less to your score than one from just last month. Your best bet is to focus on what you can do now—build a new track record of consistent, on-time payments.

Do My Rent and Utility Bills Count?

Traditionally, no. Your standard credit reports didn't really care if you paid your rent or electricity bill on time. But things are starting to change. New services are popping up that let you report your on-time rent payments directly to the major credit bureaus.

This can be a game-changer for building a positive history, especially if you're just starting out and don't have many credit cards or loans. While utility payments still aren't usually reported, not paying them is a different story. If that bill goes to collections, it will show up on your record and hurt your standing.

Can I Build a Good History with an ITIN?

Yes, absolutely. This is a crucial point for millions of people. The credit system was originally built around Social Security Numbers, but your financial actions tell a story no matter what ID you use.

For anyone with an Individual Taxpayer Identification Number (ITIN), this is where specialized platforms make all the difference. They're built specifically to help you document your financial responsibility and prove your creditworthiness.

Your payment history is your financial story. With the right tools, you can make sure it’s a story that opens doors.

Ready to take control of your financial story? With itinscore, you can monitor your credit, get personalized insights, and start building the positive payment history you deserve. Sign up for free and see where you stand today!