What Is a Hard Credit Pull? Understand Its Impact Today

So, what exactly is a hard credit pull? Think of it as a formal, in-depth background check on your financial life that a lender performs when you apply for new credit.

It happens when you're trying to get a mortgage, an auto loan, or a new credit card. Because you're asking someone to trust you with their money, they need to do their due diligence. This formal request requires your explicit permission and can cause a small, temporary dip in your credit score.

What a Hard Credit Inquiry Really Means

When you give a lender the go-ahead, they're not just taking a quick peek at your credit. They're conducting a thorough review to gauge your creditworthiness and decide if you're a good risk. Lenders look at your payment history, current debt levels, and how long you've been managing credit to make their decision.

This official inquiry gets logged on your credit report, where other potential lenders can see it. This is important because a flurry of hard inquiries in a short time can look like a red flag. Lenders might see it as a sign of financial distress or that you're trying to take on more debt than you can reasonably manage.

This is the key difference between a hard pull and a soft pull. A soft pull is like checking your own score or getting pre-qualified offers—it doesn't affect your score at all. A hard pull, on the other hand, is a formal application with real consequences.

To break it down, here are the essential details of a hard credit pull in a simple table.

Hard Credit Pull Quick Facts

Understanding these basics is the first step in managing your credit responsibly. Knowing when a hard pull will happen and how it works lets you plan your credit applications strategically to protect your score.

Hard Pull vs. Soft Pull: What's the Difference?

Not all credit checks are created equal. In fact, they fall into two distinct categories, and knowing the difference is crucial for keeping your credit score healthy. Think of a soft pull as a quick glance in the mirror—it’s just for informational purposes and doesn't change anything. A hard pull, on the other hand, is like a full-blown physical exam that goes on your permanent record.

Soft inquiries, or soft pulls, happen all the time behind the scenes. They occur when you check your own credit score, during background checks for a new job, or when a credit card company sends you one of those "pre-approved" offers in the mail. These are harmless and don't signal to lenders that you're in the market for new debt. For a deeper dive, check out our guide to soft credit pulls.

A hard pull (also called a hard inquiry) is the real deal. It only happens when you give explicit permission by formally applying for credit—think mortgages, car loans, new credit cards, or personal loans. When you ask to borrow money, the lender needs to do a thorough review of your credit history to assess their risk.

Each time this happens, it can cause a small, temporary dip in your credit score.

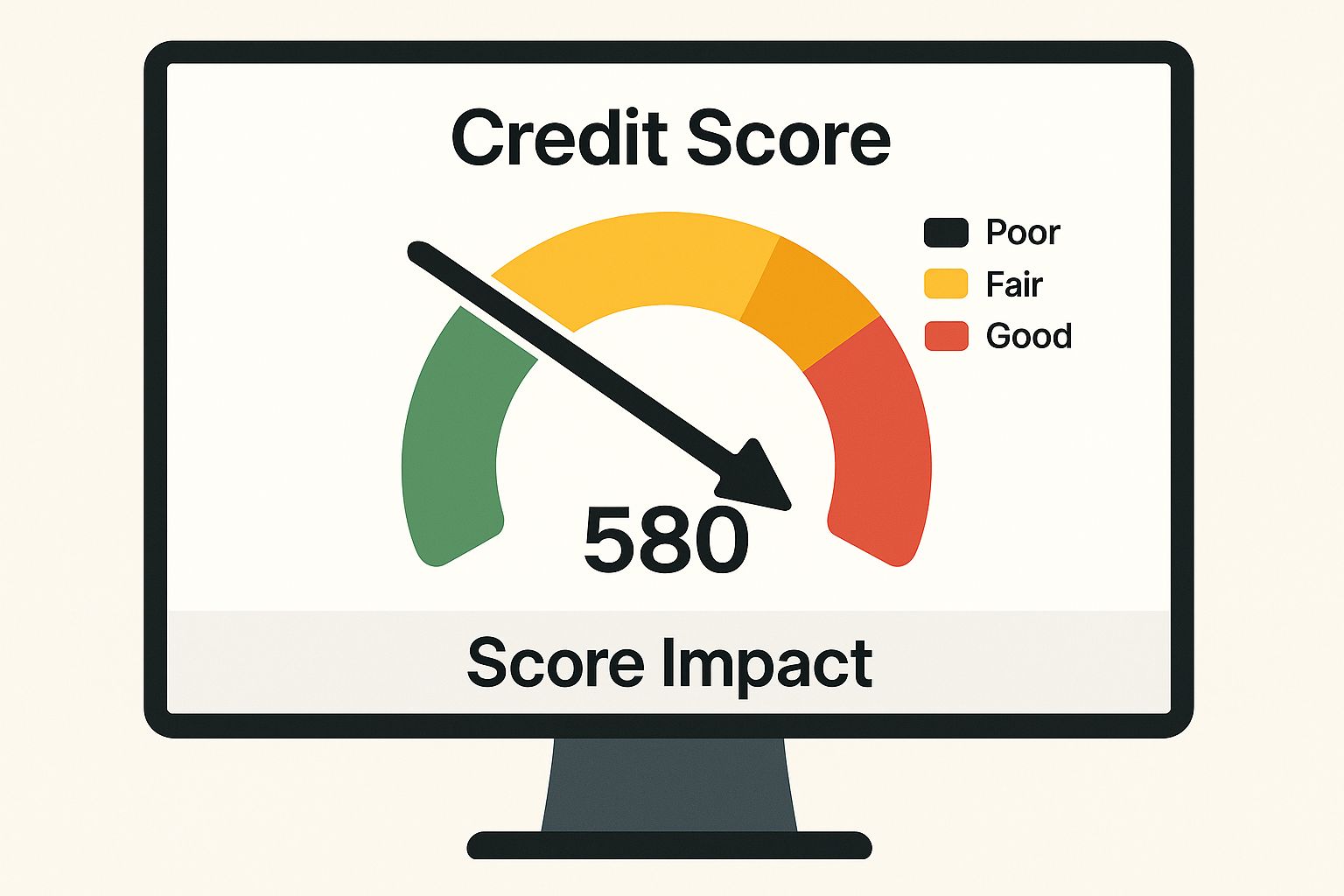

As the image shows, the act of applying for new credit is what triggers the hard inquiry, which can ding your score for a little while.

Comparing Hard and Soft Inquiries

To make it even clearer, let's break down the key differences between a hard inquiry and a soft one in a simple table.

Hard Inquiry vs Soft Inquiry Comparison

Essentially, the main distinctions boil down to your permission, who can see the inquiry, and whether it affects your score. A hard pull needs your consent, is visible to anyone who pulls your credit, and can knock your score down. A soft pull, however, has zero impact on your score and is only visible to you.

According to FICO, while a hard inquiry stays on your credit report for two years, its effect on your score usually disappears after the first 12 months. So, while you want to be mindful of them, a single hard pull isn't something to lose sleep over.

How Hard Inquiries Impact Your Credit Score

It’s completely normal to see your credit score take a small hit after you apply for a new loan or credit card. A single hard credit pull usually only causes a temporary dip, often less than five points. Honestly, it's rarely enough to knock you into a lower credit tier or get your application denied.

The real trouble starts when you rack up a bunch of hard inquiries in a short amount of time. To a lender, seeing a flurry of applications looks like a red flag. It might signal that you're in financial trouble or trying to take on more debt than you can realistically manage. That perception of risk is what can lead to a more serious drop in your score.

Why New Credit Matters

Your FICO score is built on five key factors, and "New Credit" makes up 10% of that puzzle. This is exactly where hard inquiries come into play.

The scoring model is essentially asking:

A lot of sudden activity in this area makes lenders nervous. It suggests your financial situation might be changing, which makes them more cautious. To get the full picture on how these factors work together, check out our guide on what a credit score is.

It's a big deal—around 90% of FICO scoring models look at inquiry data to figure out risk. While one inquiry might not seem like much, several bunched together can tell a story of higher risk, leading to a bigger score drop.

The Smart Way to Rate Shop

Thankfully, the system isn't designed to punish you for being a smart consumer. When you're in the market for a big-ticket item like a mortgage, a car loan, or a student loan, comparing offers is the best way to lock in a good interest rate.

Credit scoring models get this, so they have a built-in "rate-shopping" window.

This means you can apply with several different mortgage lenders within a couple of weeks, and it will only count as one hard pull against your score. This little feature lets you shop for the best deal without worrying about wrecking your credit in the process.

Common Scenarios That Trigger a Hard Credit Pull

Knowing the textbook definition of a hard credit pull is one thing. Knowing when to expect one in the real world? That’s how you actually protect your credit score.

Think of it this way: a hard inquiry happens whenever you formally ask to borrow. Whether it's a loan or a new line of credit, the lender needs to do their due diligence before handing over their money. That formal application is you giving them the green light to take a deep dive into your credit history.

You can almost always count on a hard pull when you're applying for major financial products.

Simply being aware of these triggers helps you plan your applications strategically, so you're never caught off guard.

Less Obvious Hard Pull Triggers

While big loans and credit cards are the usual suspects, a few other situations can lead to a hard inquiry. These are the ones that tend to surprise people the most.

For instance, asking for a credit limit increase on an existing card often results in a hard pull. From the issuer's point of view, they're re-evaluating their risk before giving you more spending power. Even opening a new cell phone plan or signing up for cable can sometimes trigger one, because the provider is essentially fronting you the service.

Renting an apartment can be another sneaky one. Many landlords just run a soft check for background purposes. But some larger property management companies will perform a full hard inquiry to make sure you're financially stable before they trust you with their property. It never hurts to ask which type of pull they'll be doing before you submit the application.

How to Manage and Minimize Hard Credit Inquiries

Knowing what a hard credit pull is is one thing; knowing how to manage them is what truly protects your score. Since each one can cause a temporary dip, a little strategy goes a long way toward keeping your credit healthy.

The best defense is a good offense. Be selective and apply for new credit only when you actually need it. Spreading your applications out over time, rather than all at once, is also a smart move. It shows lenders you're thoughtful, not desperate for credit.

Be Smart Before You Apply

Want the single best trick for minimizing hard inquiries? Use pre-qualification tools. Most major lenders and credit card companies offer a pre-qualification or pre-approval step that relies on a soft pull.

This is your secret weapon. It lets you shop around for the best rates and terms to see what you’re likely to be approved for—all without dinging your credit score.

Think of it as looking at the menu before ordering. You get to see all your options and make an informed choice, so the final hard pull is for something you genuinely want.

Regularly Review Your Credit Reports

Make it a habit to check your credit reports from all three bureaus—Equifax, Experian, and TransUnion. You can get free weekly copies from AnnualCreditReport.com, so there's no excuse not to.

Scan the inquiries section for any names you don't recognize. An unfamiliar hard inquiry might just be a clerical error, but it could also be a warning sign of identity theft.

If you spot an inquiry you didn't authorize, you have the right to dispute it. For a complete walkthrough, check out our guide on how to remove inquiries from your credit report. Acting fast is key to keeping your credit history accurate and protecting yourself from fraud.

Answering Your Top Questions About Hard Credit Pulls

Alright, let's clear up some of the common questions that pop up around hard inquiries. Knowing the answers will help you navigate the credit world with a lot more confidence.

How Long Does a Hard Credit Pull Stay On My Report?

Think of it in two stages. A hard inquiry will physically show up on your credit report for two full years (24 months), so any lender pulling your file during that time will see it.

But here's the good news: its power to hurt your score fades much faster. For FICO scores, the most common type lenders use, a hard pull only affects your score for the first 12 months. After that first year, it's still visible on the report, but it no longer dings your points.

Can I Get a Hard Credit Pull Removed?

This is a big one. You can only remove a hard inquiry if you didn't authorize it. If you filled out that application and gave the lender the green light, the inquiry is a legitimate part of your credit history and has to stay.

However, mistakes happen. If you spot an inquiry from a company you've never heard of or a pull you know you didn't approve, you absolutely have the right to challenge it.

Do All Lenders See Hard Pulls the Same Way?

Not quite. While any lender can see the inquiries, the context matters a lot. For instance, scoring models are smart enough to recognize when you're rate-shopping for a big loan.

Every lender has their own internal standards, but the general rule of thumb is that a pattern of too many recent inquiries is almost always a red flag.

Ready to build and monitor your credit history with confidence? itin score provides free, unlimited credit monitoring and personalized insights designed specifically for ITIN holders. Take control of your financial future today. Learn more at https://www.itinscore.com.