What Is a Good Credit Utilization Percentage?

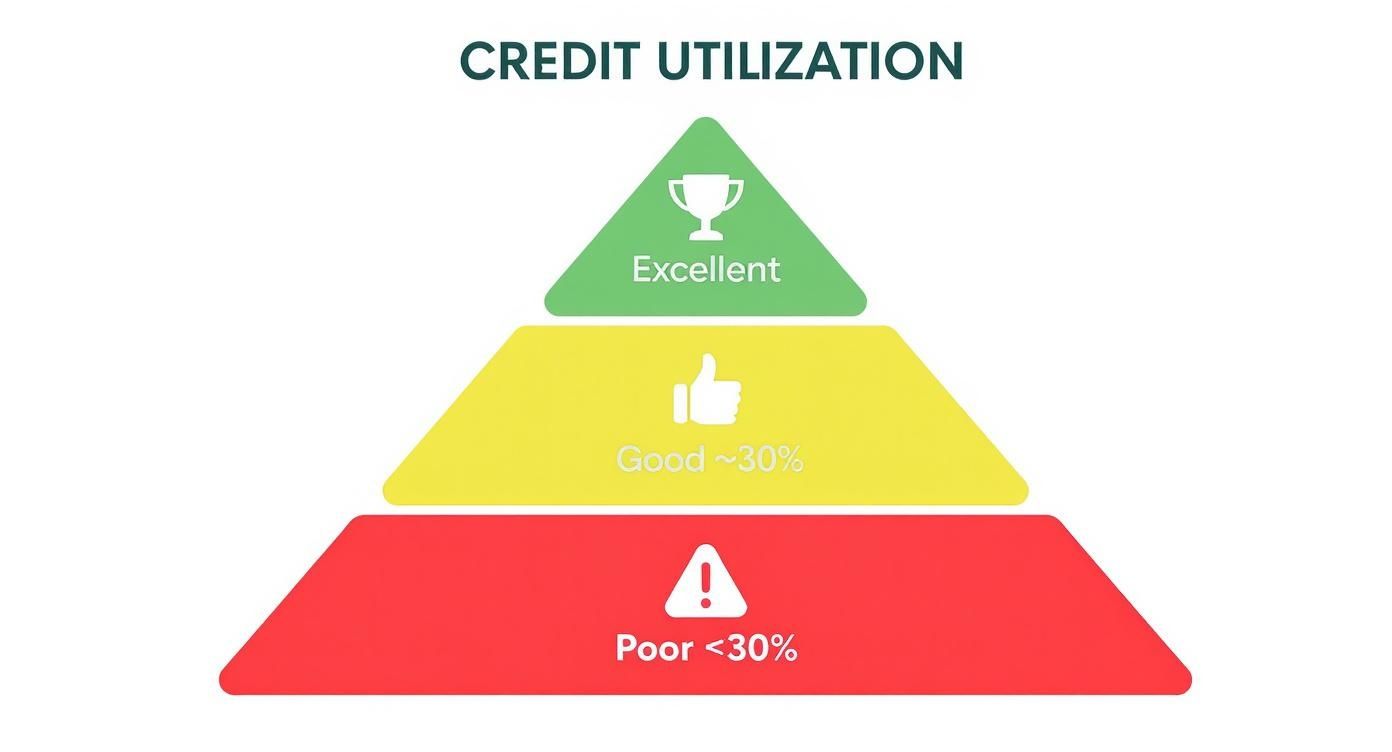

So, what's the magic number for credit utilization? While there isn't one single perfect figure, the golden rule is to keep your usage below 30%.

If you're really aiming to maximize your credit score, getting that number under 10% is even better. Low utilization sends a powerful signal to lenders: you're managing your finances responsibly and not relying too heavily on borrowed money to get by.

What’s Considered a Good Percentage?

Think of your total available credit like a fuel tank. Lenders feel a lot more confident if they see you're consistently running on a full tank, only using a small amount of fuel when you need it. If you're constantly running on empty, it looks risky.

Credit scoring models, like FICO and VantageScore, slice utilization into different tiers. Each tier has a different effect on your score. Staying in the lower-risk tiers is one of the fastest and most effective ways to build or protect your credit health.

As you can see, the lower you go, the better off you are. Once you cross that 30% threshold, your credit score can start to take a hit.

To make this even clearer, let's break down how different utilization levels are generally perceived.

Credit Utilization Tiers and Their Impact on Your Score

This table really highlights why sticking to the lower percentages is so crucial for maintaining a healthy credit profile.

The 30% Rule of Thumb

That widely-cited advice to keep your balances below 30% of your credit limit isn't just a random suggestion. It’s a well-established benchmark that major credit scoring models pay close attention to.

But it’s important to remember this isn't a hard line in the sand.

According to the experts at myFICO, people with the highest credit scores often have an average utilization rate below 10%. Keeping your balances low, combined with a solid history of on-time payments, is a winning formula. For a deeper dive, you can find a lot of great expert insights on credit utilization and how it shapes your financial standing.

Why Your Credit Utilization Ratio Matters So Much

So, why is this one number such a big deal? Think of your credit utilization ratio as a key indicator of your financial health. It makes up a huge chunk of your credit score because it tells lenders how much you rely on borrowed money to get by.

High utilization can look like a red flag. It might suggest you're stretched thin, which makes lenders a bit nervous.

Imagine a lender gives you a credit limit. That’s a sign of trust. If you only use a small fraction of it and pay it back consistently, you're proving you can be trusted with more. But if you're constantly maxing out your cards, it signals risk, and lenders will be wary of extending you more credit.

A Major Factor in Your Credit Score

Your utilization isn't just a minor detail; it’s one of the heavy hitters in your credit profile. The amount you owe compared to your available credit tells a powerful story to anyone who pulls your report.

The golden rule, recognized by major credit bureaus, is to keep your credit utilization at or below 30%. This isn't just friendly advice; this single factor accounts for roughly 30% of your entire credit score. That’s a massive piece of the pie.

It sits right up there with your payment history as one of the key metrics that impacts what affects your credit score most. Simply put, a low ratio tells lenders you’re a responsible borrower who doesn’t live on credit.

Keeping an eye on this is essential. If you're building credit with an ITIN, you can find ways to check your ITIN credit score and see how you’re doing. A lower percentage shows you're in control of your finances, which ultimately opens doors to better loans and lower interest rates down the road.

How to Calculate Your Credit Utilization in Two Simple Steps

Figuring out your credit utilization ratio sounds complicated, but it's not. Think of it as a quick health check for your finances—one that gives you the exact number lenders see when they look at your credit.

It really only takes two simple steps to get your overall ratio.

Step 1: Add Up All Your Balances

First, grab your latest statements for all your revolving credit accounts. This includes all your credit cards and any lines of credit you might have. Jot down the current balance for each one and add them all together to get your total debt.

Step 2: Add Up All Your Credit Limits

Next, do the same thing, but for your credit limits. Look at each account and find its total credit limit, then add all of those limits together. This number represents your total available credit.

Once you have those two totals, you're ready to do some simple math.

The Basic Formula

The formula itself is straightforward: you just divide your total balances by your total credit limits and then multiply that number by 100 to turn it into a percentage.

Let's say your total balances come out to 3,000**, and your total credit limits add up to **10,000. Your calculation would be 3,000 ÷ 10,000 = 0.3. Multiply that by 100, and you get a credit utilization ratio of 30%. It’s that easy.

Of course, if you'd rather not do the math yourself, you can always use a credit utilization ratio calculator to do the heavy lifting for you.

Let’s walk through a real-world example. Imagine Sarah has three different credit cards:

If we add up her balances (1,500 + 500 + 0**), we get a total of **2,000. Her total available credit is 10,000** (**3,000 + 5,000 + 2,000).

So, even though one of her cards is at 50%, her overall credit utilization is a very healthy 20% (2,000 ÷ 10,000). And that's the number that lenders really care about.

Finding the Sweet Spot: What's the Ideal Credit Utilization?

You’ve probably heard the classic advice: keep your credit utilization below 30%. It’s solid guidance and a great starting point. But if you're aiming for an elite credit score, the real magic happens when you get that number even lower.

The true sweet spot, the gold standard that tells lenders you’re a master of your finances, is keeping your utilization under 10%.

Think of it this way: staying under 30% puts you in the "healthy" green zone. But dropping into the single digits? That’s the deep green, the high-performance zone that gives your score the biggest possible boost. It shows lenders you aren’t just getting by—you have plenty of financial breathing room.

The Surprising Reason 1% Can Beat 0%

Here’s a little secret that might seem backward at first: a 1% utilization ratio is often better for your score than a 0% one. How can that be?

While a zero balance is fantastic for avoiding interest charges, it doesn't give credit scoring models any recent activity to evaluate. A 0% rate can look the same as an unused card.

On the other hand, letting a tiny balance report to the bureaus—and then paying it off in full—proves you're actively and responsibly using your credit. It sends a clear message: "I use my credit wisely and always pay it back." For a scoring algorithm, that’s a much more powerful signal than silence.

Aiming for Single-Digit Status

Keeping your utilization in the single digits is a hallmark of top-tier credit management. It might sound challenging, but the data doesn't lie about the rewards.

Consider this: historical data shows the average American's credit utilization often lands somewhere between 26-28%. That means most people are consistently using over a quarter of their available credit.

By keeping your ratio below 10%, you’re not just following good advice; you're putting yourself in a far stronger position than the average consumer. If you want to dive deeper into these trends, you can discover more insights on credit utilization from Experian.

Actionable Strategies to Lower Your Credit Utilization

Knowing your credit utilization percentage is one thing, but actually lowering it is where the magic happens for your credit score. Taking charge of this number puts you firmly in control of your financial health. The good news? There are several straightforward ways to get that ratio down.

Here’s a powerful little trick: make payments before your statement closing date. Most card companies only report your balance to the credit bureaus once a month, right around that closing date. By paying down your balance a few days early, you make sure a lower number gets reported. It's a simple move that can directly boost your score.

To get the timing just right, it helps to understand exactly when credit card companies report your activity.

Smart Payment and Debt Reduction Tactics

The most direct path to a better ratio is, of course, paying down what you owe. But you can be strategic about it. Instead of one big payment at the end of the month, try making a few smaller payments throughout. This keeps your running balance lower at all times.

Of course, aggressively tackling your balances is key. If you need a solid game plan, check out a practical guide on how to pay off debt. Every single dollar you pay off shaves a bit more off your utilization percentage.

Increasing Your Available Credit

Here's another way to look at the problem: you can also lower your ratio by increasing your total credit limit. This works even if your balance doesn't change because you're making the "total available credit" part of the equation bigger.

You have a couple of options here:

Both of these tactics work by boosting the denominator in the utilization formula, making your current balance look smaller by comparison. It can be a surprisingly quick way to give your score a healthy lift.

Time to Bust Some Common Credit Utilization Myths

When it comes to credit, there's a lot of "advice" floating around that can do more harm than good. Getting the facts straight about credit utilization is one of the quickest ways to protect your score from common mistakes. Let's clear the air on a few persistent myths.

The biggest and most costly myth? That you need to carry a balance on your credit cards month-to-month to build good credit. This one is absolutely false. You establish a strong payment history by using your cards and, most importantly, paying the statement balance in full by the due date.

Carrying a balance doesn't earn you any extra points with the credit bureaus. All it does is force you to pay interest, which is just giving your money away.

More Myths You Can Safely Ignore

Here's another one I hear all the time: closing old, unused credit cards is a good way to "clean up" your credit profile. While it might feel like tidying up your finances, this move can backfire in a big way.

And finally, there’s the idea that using your debit card has some sort of impact on your credit. It doesn’t. Debit cards are linked directly to your bank account; they aren't a form of credit, so your spending on them is invisible to the credit bureaus.

Let's break it down simply:

Common Questions About Credit Utilization

Even when you think you've got credit utilization figured out, a few specific questions always seem to pop up. Let's get you some straight answers to the most common ones so you can manage your credit with confidence.

Does My Credit Utilization Reset Every Month?

Yes, for the most part, it does. Think of credit utilization as having a very short memory. Most credit scoring models only look at the most recent balance reported by your credit card issuer. This usually happens once a month, right around your statement closing date.

This is actually great news. It means that a high utilization rate from last month won't dog you for years to come. Once you pay down your balance and your issuer reports that new, lower number, your score can bounce back surprisingly fast.

Can Just One Maxed-Out Card Really Hurt My Score?

You bet it can. Lenders don't just look at your total utilization across all your cards; they also zoom in on the utilization for each individual card. Maxing out even a single card sends up a red flag, suggesting you might be stretched thin, even if your other cards are completely paid off.

How Quickly Can My Score Improve?

The impact of credit utilization is almost immediate, which is one of the best things about it. Once you've paid down your balances, your card issuers will report the new, lower numbers to the credit bureaus.

You can often see a positive jump in your credit score in as little as 30-45 days. It's one of the fastest ways to give your score a boost.

Ready to take control of your credit journey? With itin score, ITIN holders can access free credit monitoring, personalized insights, and a step-by-step plan to build a strong financial future. Sign up for free and start building your credit today.