What Is a Good Age of Credit History?

Think of your credit history a bit like a professional resume. A short, spotty work history might raise a few eyebrows, but a long, stable record of employment shows you’re reliable. It’s the same with credit—the longer you’ve managed it well, the more trustworthy you look to lenders.

What Is the Age of Your Credit History

When lenders talk about what makes a good age for your credit history, they’re not looking at a single number. They're actually piecing together a story from two key metrics.

The Two Pillars of Credit Age

First up is the age of your oldest account. This is the anchor of your entire credit file. It’s the account that started it all, and a really old one shows you have long-term experience with financial responsibility.

Then there's the average age of all your accounts. This is calculated by taking the age of every single account you have (credit cards, loans, everything), adding them all up, and dividing by the number of accounts. A high average age tells lenders you’ve been successfully juggling multiple credit lines for a good while.

For instance, if you have a credit card you opened 10 years ago and a car loan you took out 2 years ago, your average credit age is six years. It's a simple bit of math that gives lenders a quick, at-a-glance idea of your experience.

When You Start Matters

Interestingly, the timing of when you first open an account can have a real impact down the road. Research from the Federal Reserve found that people who start building credit around age 23 often have higher credit scores by age 30 compared to those who start earlier or later.

This just goes to show that getting a thoughtful, strategic start can really set the stage for a stronger financial future.

Why a Longer Credit History Matters to Lenders

Let's imagine a loan officer looking at two applications. One person has a single credit card they've managed for six months. The other has juggled multiple accounts—a car loan, a few credit cards—for over ten years. Who do you think looks like a more reliable borrower?

This simple comparison gets right to the heart of why the age of your credit history is such a big deal. For lenders, a long, well-managed history is like a detailed performance review of your financial habits. They’re looking for predictability.

A lengthy track record simply gives them more data to work with. It proves you can handle financial commitments through thick and thin, showing stability and experience. This one factor alone makes up about 15% of your FICO® Score, which is a pretty hefty slice of the pie that can easily bump you into a better lending category.

The Power of Predictability

At the end of the day, lending is all about managing risk. The more data a lender has on you, the more confident they can be in predicting how you'll act in the future.

A longer history gives them a clearer picture.

Of course, age is just one piece of the puzzle. To see how it all fits together, you can learn more about the key factors affecting your credit score in our full guide.

Ultimately, a long credit history builds trust. The longer you’ve been responsibly using credit, the more proof you have that you're a low-risk borrower. This translates directly into better loan terms, lower interest rates, and more financial doors opening for you. A short history won’t automatically get you denied, but a long one is a powerful advantage to have in your corner.

Credit History Age Benchmarks You Should Know

So, what’s the magic number for a “good” credit age? Truthfully, there isn't one. Instead, lenders and credit scoring models, like FICO and VantageScore, tend to think in terms of tiers or brackets. Knowing where you fall can give you a pretty clear idea of how lenders see you.

If your credit history is less than two years old, you're generally considered to have a new or thin file. Everyone has to start somewhere, but this short track record doesn't give lenders much data to work with, which can make getting approved for prime loans and credit cards a bit tougher.

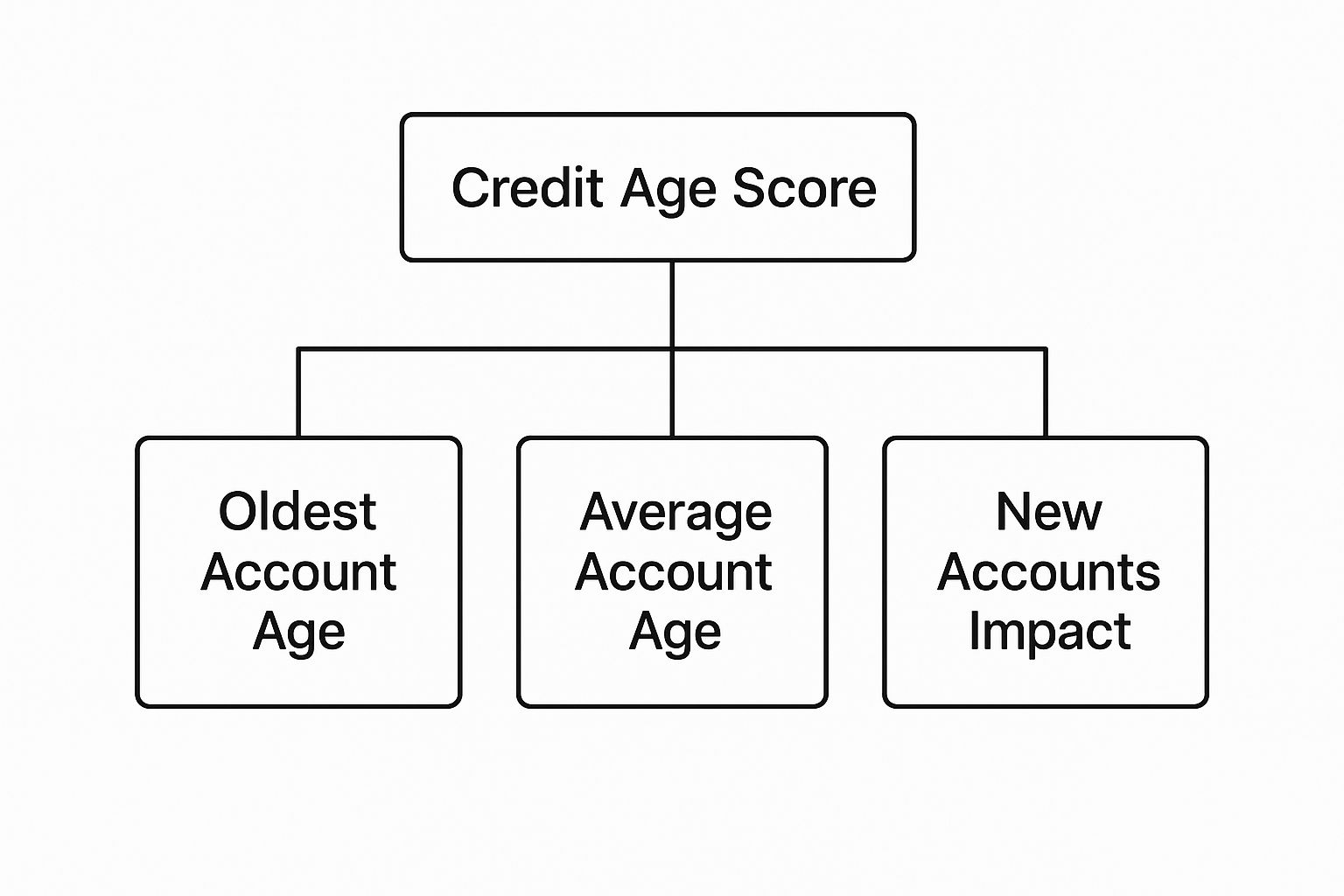

This visual breaks down how the age of your oldest account, the average age of all your accounts, and any recently opened accounts all roll up into your overall credit age.

As you can see, it’s not just about one number but how these different factors work together to tell a story about your experience with credit.

From Fair to Excellent Credit Age

Once you cross that initial two-year threshold, your credit history starts to carry more weight. A history of 2-4 years is usually seen as fair. You’re no longer a complete unknown, but in the world of credit, you're still considered relatively young.

Things really start looking up when you hit the five-year mark. Lenders typically view a credit history of 5-7 years as good. By this point, you’ve shown you can handle credit responsibly over a significant amount of time, which often opens the door to better interest rates and more favorable terms.

To help you visualize this journey, here’s a breakdown of how these tiers typically translate into lending decisions.

Credit History Age Tiers and Their Impact

Building an excellent credit age is a marathon, not a sprint. If you're just starting, it helps to know what to expect. Check out our guide on how long it takes to build credit to get a realistic timeline for your journey.

The key takeaway is simple: strive to reach these benchmarks and, most importantly, protect the age of your oldest accounts. It's one of the most powerful things you can do to build a strong financial future.

How Credit Scores Evolve Across Generations

Ever wonder why your parents or grandparents seem to have enviably high credit scores? It's not magic, and it’s usually not a coincidence. It's a real-world example of how a long, well-managed credit history works its magic over the years.

Think of it like this: building a great credit score is a marathon, not a sprint. As people go through life, they naturally pick up different types of credit—maybe a car loan, then a mortgage, and a few credit cards along the way. When these accounts are managed responsibly for decades, they become the bedrock of a strong, stable credit profile.

Generational Credit Score Trends

The data backs this up. There's a clear pattern showing that as people get older, their average credit scores tend to climb right along with them. Time and experience in managing finances really do make a powerful difference.

Take a look at the numbers from Equifax. The average VantageScore for Gen Z sits at 679. That number jumps to 700 for Gen X and climbs even higher to 742 for Baby Boomers.

Grasping this natural progression is key to setting realistic expectations for your own credit journey. A healthy credit age isn't something you can rush. It's cultivated patiently, year after year, by keeping your oldest accounts open and handling new credit with care. You're laying the foundation for a solid financial future, just like the generations before you.

Practical Ways to Build and Protect Your Credit Age

Knowing what a good credit age is is one thing. Actually building and protecting it is where the real work begins.

Whether you're just starting your credit journey or you've been managing accounts for years, a few key moves can make all the difference. The end goal is always the same: show lenders that you're a reliable borrower over the long haul.

For anyone new to credit, the top priority is getting an account open so the clock can start ticking. That first account becomes the "founding date" of your credit history, and it's a powerful anchor for your score for years to come.

Simple Do's and Don'ts

Here are some straightforward tips for managing your credit age, whether you're building from zero or protecting a well-established history.

Smart Ways to Start Building Credit

If you have a thin credit file, don't worry. There are some excellent ways to get started on the right foot and begin aging your accounts.

A Few Common Questions About Credit History

As you start to get the hang of how credit works, you’ll naturally run into some specific questions. Getting straight answers can help you handle those tricky spots and, more importantly, protect the credit age you’ve worked so hard to build. Let's dig into some of the most common ones.

Does Closing an Old Credit Card Hurt My Score?

Yes, it often does—and sometimes more than people realize. Think of your oldest credit card as the anchor for your entire credit history. When you close that account, you're essentially pulling up the anchor.

Closing that card can cause both the age of your oldest account and your average account age to drop, sometimes significantly. From a lender's perspective, this sudden shortening of your credit history can look like a red flag. It's almost always better to keep the account open, even if you don't use it much. Just make a small purchase on it once or twice a year and pay it off immediately. This keeps the issuer from closing it for being inactive.

How Long Does It Take to Get a Good Credit History Age?

While a truly "excellent" credit history is usually one that’s 8 years or older, you don't have to wait nearly that long to be in good shape. Most lenders will view a credit history of 5-7 years as "good." That shows a solid, dependable track record over a decent amount of time.

Even a history of 2-4 years is often enough to get your foot in the door for good credit products, especially if the rest of your credit profile—like a perfect payment history and low card balances—is strong.

Can I Build Credit History with an ITIN?

Absolutely. You can build a strong U.S. credit history using an Individual Taxpayer Identification Number (ITIN) in the exact same way you would with a Social Security Number. Plenty of banks and credit unions are happy to accept ITINs for everything from credit cards to auto loans.

The game plan is identical:

An ITIN is a perfectly good key to unlocking the credit you need to reach your financial goals in the U.S.

Ready to take control of your financial future with your ITIN? itin score provides free credit monitoring and personalized tools designed specifically for ITIN holders. Sign up in minutes and start building your U.S. credit history today.