What Is a FICO Score 9 and How Does It Work?

So, what exactly is FICO Score 9? Think of it as the next-generation credit scoring model from the Fair Isaac Corporation. It's not a complete overhaul but a smarter, more refined algorithm designed to give lenders a more modern and nuanced picture of your financial health compared to older versions.

A New Take on Credit Scoring

It helps to think of FICO versions like updates to your phone’s software. Your phone still makes calls and sends texts, but each new iOS or Android update brings smarter features and better performance. In the same way, FICO Score 9 improves how lenders evaluate your financial habits, even though the core purpose of a credit score remains the same.

While its predecessor, FICO 8, is still the most common score used by lenders today, FICO 9 represents a significant shift in thinking. It was built to be more predictive and, in many ways, more forgiving of certain financial hiccups.

So, what changed? The new model adjusts how it weighs specific financial events, which can be a real game-changer for many people. Key updates include:

To give you a quick snapshot, here’s a simple breakdown of what makes FICO Score 9 different.

FICO Score 9 at a Glance

Essentially, the goal of FICO Score 9 is to reward you for positive financial steps, like settling old debts, rather than letting past mistakes haunt your report indefinitely.

It's important to remember that while this model is a step forward, not all lenders have adopted it yet. Many still lean on older, more familiar versions for their decisions. Understanding the fundamentals of what a credit score is is the perfect starting point for seeing why these version-to-version changes matter so much.

How FICO 9 Changed the Credit Scoring Game

When FICO Score 9 came along, it wasn't just a minor update—it fundamentally shifted how your credit is judged. Think of it as a referee who started looking at the context behind a mistake, not just the mistake itself. For many people, especially those recovering from a financial hiccup, these changes were a breath of fresh air.

This new model rolled out three major updates that really stand out from older versions. Each one gives a more forgiving and realistic picture of your financial habits, which is great news for everyone, including ITIN holders working to build their credit history.

Paid Collections No Longer Haunt You

This was a big one. With FICO 9, any collection account you've paid off is completely ignored. That's huge. In the past, a collection could stick to your report like glue for years, even after you settled the debt. It was a constant drag on your score.

Now, once you pay it off, FICO 9 essentially erases it from the calculation. This change rewards you for making things right and shows lenders who you are today, not who you were years ago.

A More Compassionate Look at Medical Debt

Let's face it, medical debt is different. It’s rarely the result of a shopping spree; it's usually from an unexpected emergency. FICO 9 is the first model to truly recognize this distinction.

This means a trip to the emergency room is far less likely to tank your credit score for years to come.

Your Rent Payments Can Finally Count

For decades, millions of renters made their single largest monthly payment on time, every time, with zero credit-building benefit to show for it. FICO Score 9 broke that pattern by becoming the first version to factor in rental payment history, as long as it's reported to the credit bureaus.

This opened up a massive opportunity for renters to build a positive credit file simply by paying their rent—a crucial step for those without traditional credit lines.

First introduced to lenders back in 2014, FICO 9 was a real turning point. It created a fairer system by seeing past paid collections and medical debt while giving credit for consistent rent payments. To really dig into the details, you can explore more about the full scope of these changes and see how it stacks up against older models.

The 5 Key Ingredients of Your FICO Score 9

While FICO Score 9 brought some modern tweaks to the credit scoring formula, it’s still built on the same five-factor foundation that has always defined credit health. Think of it like a recipe—each ingredient has its own weight and purpose, and getting the proportions right is the key to a great score.

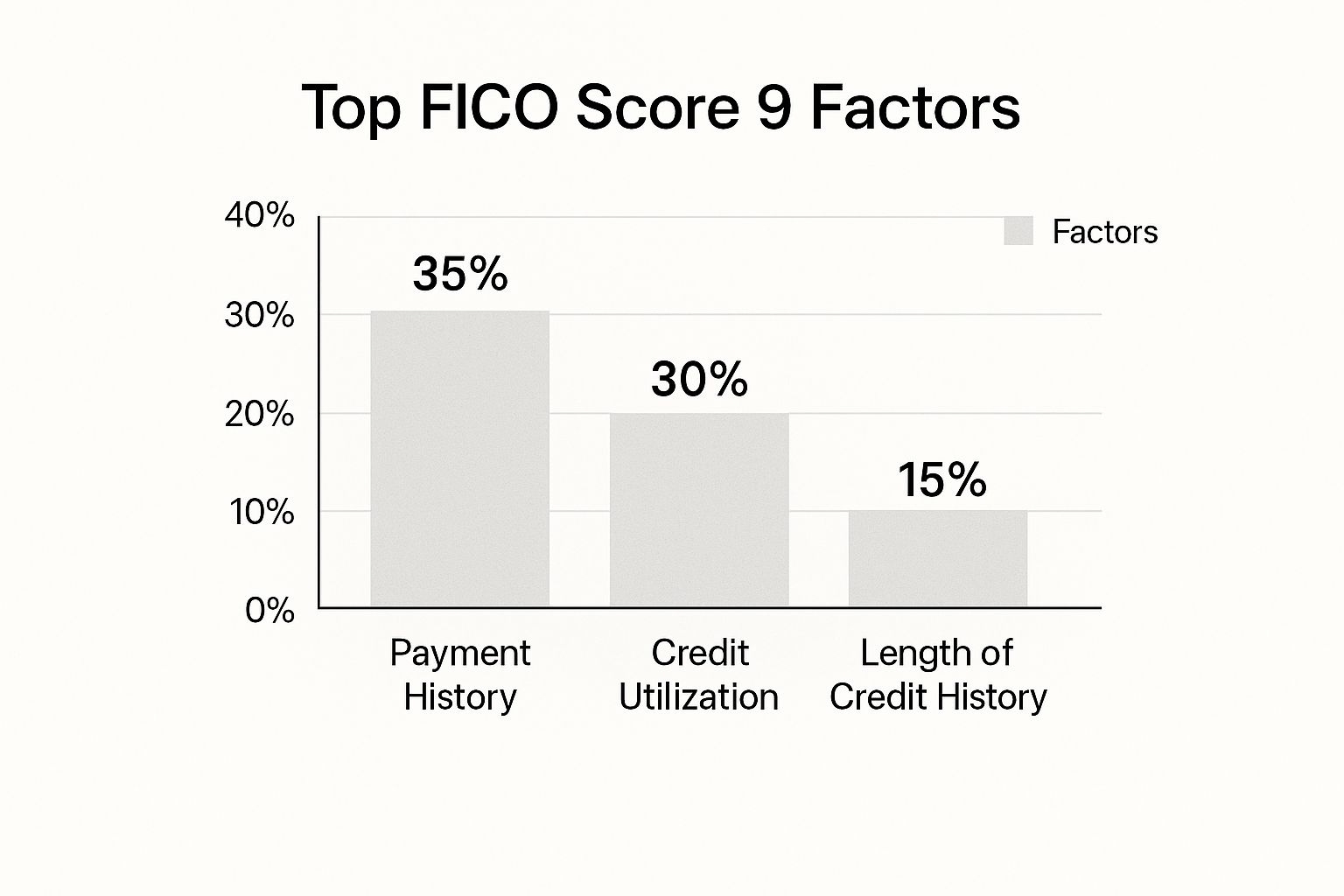

The most important ingredient, by far, is your payment history. Making up a huge 35% of your score, this is the big one. It’s a straightforward record of one thing: do you pay your bills on time? A clean history of on-time payments signals to lenders that you're a responsible borrower. For a closer look, our guide on what a payment history includes breaks it all down.

Running a close second is amounts owed, which accounts for another 30% of your score. This isn't just about the total dollar amount of your debt. What really matters here is your credit utilization ratio—that is, the percentage of your available credit you're actually using. Keeping this ratio low is one of the quickest ways to give your score a boost.

The Supporting Factors

While payment history and amounts owed make up the bulk of your score, the final three factors fill in the rest of the story about your credit experience. They give lenders a more complete picture of who you are as a borrower.

These supporting ingredients are:

This newer model also reframes how it views credit utilization, which can help smooth out score fluctuations for people who carry balances on their credit cards. To get into the nitty-gritty, you can discover additional insights about FICO 9's calculation methods and see how they stack up against older versions.

FICO Score 9 vs. Other Scoring Models

Have you ever pulled your credit score from a few different places and noticed the numbers don't match? It's a common experience, and it happens because lenders use a variety of scoring models. FICO Score 9 is an important one, but it's just one version in a lineup that includes its predecessor, FICO Score 8, which is still widely used.

While FICO 9 is a bit more forgiving—especially with things like paid collections and medical debt—many auto and credit card lenders haven't made the switch. They often stick with the tried-and-true FICO 8. The mortgage industry is even further behind, frequently relying on much older, specialized FICO versions. Why the delay? For banks and other institutions, upgrading their entire underwriting system is a massive, expensive, and complex undertaking.

This infographic gives a great visual breakdown of what goes into just about every FICO score, including version 9.

As you can see, two factors tower above the rest: your payment history and the amount of debt you carry. Together, they account for a massive 65% of your score.

Key Differences at a Glance

So, when you get down to it, what really separates these models? The differences might seem small, but they can have a real impact on the three-digit number a lender sees when you apply for a loan.

Let’s take a look at how FICO Score 9 and its older sibling, FICO Score 8, treat some common financial situations.

FICO Score 9 vs FICO Score 8 Comparison

This table lays out the key distinctions in how each model weighs different credit events.

The bottom line is that FICO 9 was designed to paint a more forgiving and current picture of your financial health. It rewards you for taking positive steps, like paying off old collection accounts, while older models tend to let past mistakes linger.

These variations are a big reason why the score you see might not be the same one your lender pulls. For a more complete picture, it's also helpful to understand the difference between FICO and VantageScore, which is the other major credit scoring model you'll encounter.

Here’s how the newer FICO 9 model can actually help you get approved for the credit you need.

The changes in FICO Score 9 aren't just technical tweaks; they have a real-world impact on your ability to borrow money. For many people, this updated model opens doors that were previously closed, potentially saving you a lot of money in interest over time.

A Fairer Look at Your Financial Past

One of the biggest improvements is how FICO 9 handles medical debt. It takes a much more understanding view of past medical emergencies.

Paid-off medical collections are completely ignored, and unpaid ones don't hurt your score as much as they used to. This shift alone can be a game-changer.

What This Means for Your Credit Score

Just how much of a difference can this make? It’s often substantial.

Someone who has paid off their medical collection accounts could see their FICO Score 9 jump by an average of 20 to 40 points. That’s enough to push you into a better credit tier, which could be the deciding factor in getting approved for a car loan or qualifying for a credit card with a lower interest rate.

FICO 9 also creates a massive opportunity for the nearly 50 million renters across the country. For the first time, this model can include your on-time rental payment history in its calculations.

If you pay your rent consistently, this can give your score a significant boost—anywhere from 10 to 50 points. It’s a powerful way for renters to build a positive credit history, even without a mortgage.

You can read the full analysis on FICO Score 9's impact to get a deeper dive into these benefits.

Common Questions About FICO Score 9

So, you're getting the hang of FICO Score 9, but let's be honest—that's when the real-world questions pop up. It's one thing to know the rules, but it’s another to understand how they actually affect you when you're applying for a loan.

Let's break down some of the most common points of confusion. Getting these details straight is crucial because it explains why the score you see might not be the exact one a lender is looking at.

Do All Lenders Use FICO Score 9?

Nope, and this is probably the single most important thing to get. Even though FICO 9 is a more modern and, frankly, fairer way to look at credit, FICO Score 8 is still the king for most credit cards and auto loans. The mortgage world? They often rely on even older, industry-specific FICO versions.

You might be wondering why everyone hasn't switched over. It comes down to cost and effort. For a big bank or lender, overhauling their entire underwriting system is a massive project. It takes a ton of time and money, so they roll out new scoring models slowly.

How Can I Get My Rent Payments Reported?

This is a fantastic feature of FICO 9, but it doesn't happen automatically. The credit bureaus won't know you're paying rent on time unless you tell them. You have to opt-in using a third-party rent-reporting service.

Think of it as actively adding a good reference to your credit resume. A few companies specialize in this, and some landlords even offer it as a perk. Here’s how it generally works:

This is a game-changer, especially if you're just starting to build credit and don't have many other accounts.

Will Paying an Old Collection Actually Help My Score?

With FICO Score 9, the answer is a clear yes. This is a huge shift from how things used to work.

The model is built to completely ignore collection accounts once they've been paid off. In older models, a paid collection could still drag your score down for years. FICO 9, on the other hand, essentially wipes the slate clean once you've settled the debt.

This change gives you a real reason to tackle those old collections. It rewards you for doing the right thing now, letting your score reflect your current financial health instead of being haunted by a past mistake.

Building a strong credit profile is a journey, especially for ITIN holders. itin score provides the tools you need, from free credit monitoring to an AI-driven credit coach, all designed to help you succeed. Take control of your financial future today at https://www.itinscore.com.