What Is a Credit Score? Find Out How It Impacts Your Finances

Think of a credit score as your financial GPA. It’s a simple, three-digit number, usually somewhere between 300 and 850, that gives lenders a quick look at how you've handled money and debt in the past.

Your Financial Grade Point Average

It’s a lot like deciding whether to lend a friend $100. You’d probably think about their history first. Do they have a good track record of paying people back? Or do you have to chase them down? That quick mental check is exactly what lenders are doing, just on a much more formal scale.

A credit score is their go-to tool for this. It helps them decide if they should approve your application for a loan or credit card. More importantly, it helps them determine the interest rate you’ll pay. A higher score tells them you're a lower risk, which almost always translates into better interest rates and more favorable terms for you.

The Scorekeepers of Your Financial Life

So, where does this number actually come from? It’s not just pulled out of thin air. Your score is calculated using the detailed information found in your credit report. Think of the credit report as the full story of your financial life.

This story is collected and maintained by three major national credit bureaus:

These companies are the official scorekeepers. They gather data from banks, credit card issuers, and even public records to build your comprehensive financial profile. Whenever you apply for new credit, the lender will request your report and score from one (or sometimes all three) of these bureaus to make their decision.

What the Numbers Actually Mean

It’s clear that a higher score is better, but what exactly is considered "good"? The score ranges can give you a solid idea of how lenders see you. For a quick breakdown, here’s a look at the typical credit score tiers.

Credit Score Ranges at a Glance

Achieving a top-tier score is a sign of incredibly responsible financial behavior. In fact, as of 2025, an impressive 23% of U.S. consumers have an exceptional FICO score of 800 or higher. You can discover more insights about high credit scores on Experian.com to see how you compare.

Getting a handle on what a credit score is and how it works is the first, most crucial step. It gives you the power to start building a positive credit history, whether you’re just starting out or looking to improve your financial standing.

How Your Credit Score Is Calculated

So, you know what a credit score is. That’s the first step. The real magic, though, is understanding how that three-digit number actually gets calculated. Think of it like a recipe with five main ingredients. While every ingredient matters, some carry a lot more weight and have a much bigger impact on the final result.

The two main scoring models you'll encounter, FICO and VantageScore, use a very similar recipe to size up your credit report. Once you get a handle on these five core factors, you’ll know exactly where to focus your energy to see your score climb.

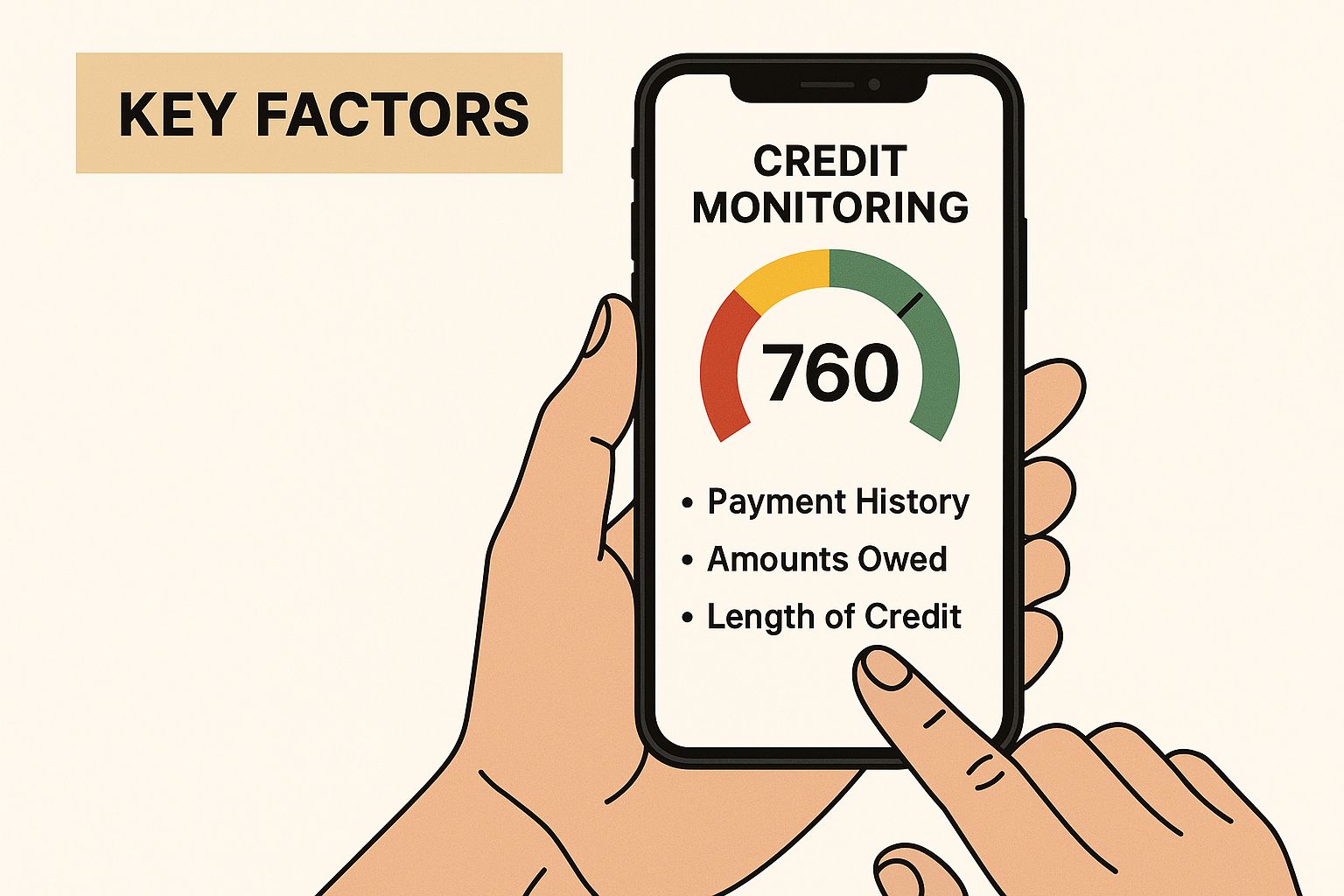

This image gives you a bird's-eye view of how these factors are weighted.

As you can see, your payment history and how much debt you're carrying are the two heavy hitters. They make up the bulk of your score.

The Five Key Factors of Your Score

Every part of your credit history tells a piece of your financial story. Here’s a breakdown of how lenders interpret each chapter.

Getting a firm grasp on these five areas is the foundation for building and keeping a great credit score. If you want to take a closer look at the second-biggest factor, you can learn more about how to calculate credit utilization and why it's so important.

Why Your Credit Score Really Matters

It’s easy to think of a credit score as just some random number, but it’s so much more than that. In reality, it’s a key that can unlock major financial milestones and save you thousands of dollars over your lifetime.

Of course, it’s critical for getting a loan or a credit card, but its influence quietly stretches into many other corners of your financial life. Once you grasp its full impact, you'll see why building and protecting your score is one of the smartest long-term investments you can make.

Think of it as your financial reputation. A high score is like having a VIP pass in the world of finance—it tells companies you’re a reliable customer, which opens doors and gets you better deals.

More Than Just Loans

So, where else does this three-digit number pop up? You'd be surprised. A good credit score can make your life easier and more affordable in ways you might not expect.

Each of these examples shows how understanding what is a credit score and keeping it healthy translates into real, tangible savings every single month.

Real-World Savings in Action

Let’s put some real numbers to this. Imagine two people are buying the exact same $30,000 car and taking out a five-year loan.

Over the five-year loan term, the person with the better credit score saves over $5,000. That’s the powerful, real-world difference your credit score can make.

This isn't just a local phenomenon; it's how finance works everywhere. Broader economic trends highlight just how much these scores matter. For instance, shifts in interest rates can trigger massive waves of mortgage refinancing, while economic downturns can lead to higher default rates on loans and credit cards. You can discover more about how global trends impact consumer credit on Equifax.com to see how these patterns play out on a larger scale.

At the end of the day, a strong credit history is your proof of creditworthiness. It gives you access, flexibility, and real financial power.

FICO Score vs. VantageScore Explained

Have you ever checked your credit score on a banking app, only to find a completely different number when you applied for a mortgage? It’s a common and confusing experience, but it highlights a fundamental truth about credit: you don't have just one score.

Think of it like Coke and Pepsi. Both are colas, but they have their own secret formulas. In the credit world, the two biggest brands are FICO and VantageScore. They both aim to do the same thing—predict how likely you are to repay a loan—but they get there using slightly different methods.

How Their Scoring Models Differ

At their core, both FICO and VantageScore look at the same five ingredients from your credit report: your payment history, how much debt you carry, the length of your credit history, your mix of credit types, and any new credit you've taken on.

The difference lies in the recipe. One model might give a little more weight to your recent payment history, while another might place more importance on the age of your oldest account. It’s like two expert chefs baking the same type of cake—the final result is similar, but subtle variations in the ingredient ratios create a slightly different outcome.

This is why your score can fluctuate depending on who's looking. A lender might pull a FICO score, which has long been the industry gold standard. A free credit monitoring service, on the other hand, might show you a VantageScore. Neither is wrong; they’re just different tools designed to measure the same thing.

One of the most important distinctions, especially for newcomers, is how much history you need to have a score.

This is a game-changer for people building credit from scratch, including ITIN holders. Knowing which score you're seeing is a key part of understanding what a credit score is and why it might not always be the same number.

FICO Score vs. VantageScore: A Quick Comparison

To put it all in perspective, here's a side-by-side look at the two scoring giants and what sets them apart.

At the end of the day, the path to a great score is the same no matter who's counting. Consistently paying your bills on time, keeping credit card balances low, and being thoughtful about applying for new credit are the habits that will build a strong financial reputation with any scoring model.

How to Read Your Credit Report

If your credit score is the final grade, your credit report is the detailed report card that shows all your work. It’s the official document telling the story of your financial habits, and knowing how to read it is a critical skill. Legally, you’re entitled to free copies of your report from all three major bureaus—Equifax, Experian, and TransUnion—every single year.

Getting your report is step one. Making sense of it is the real challenge. At first glance, it can look like a jumble of codes and dates, but it's actually broken down into a few main sections. Once you understand these parts, the whole document becomes much less intimidating and puts you in control of your financial reputation.

The Main Sections of Your Report

When you crack open your credit report, you’ll see it’s organized into four main areas. Each one gives lenders a different piece of your financial puzzle.

Spotting and Disputing Errors

Let's be honest—mistakes happen. Studies have shown that errors on credit reports are surprisingly common. These aren't just typos; they can be costly mistakes that lower your score, leading to loan denials or forcing you to pay higher interest rates. That’s why you have to review each section with a careful eye.

If you spot an error, you have the right to dispute it.

You can file a dispute directly with the credit bureau online, over the phone, or through the mail. By law, they have to investigate your claim and fix any proven inaccuracies. To get a more detailed walkthrough of this process, check out our complete guide explaining your credit report in detail. Taking charge of your report is the only way to ensure your score is a fair and accurate reflection of you.

Actionable Ways to Build and Improve Your Credit

Building or improving your credit score is one of the most powerful financial moves you can make. It’s not something that happens overnight, but more like a journey that rewards patience and consistency. The great news is that the strategies are straightforward and totally accessible, even if you’re starting from zero.

Think of it like getting into a good fitness routine. Every positive step you take, no matter how small it feels, adds up to create a much stronger financial foundation. The secret is simply to start with a clear, proven plan.

Kickstart Your Credit Journey

If you have a thin credit file or are looking to rebuild, some financial products are designed specifically to get you on the right track. These tools are like a launchpad, helping you create the positive payment history that credit bureaus need to see.

Here are a few of the most effective ways to get started:

For a deeper dive into getting started, our detailed guide on how to build credit from scratch breaks down even more step-by-step advice.

It's also worth remembering that your personal credit score is part of a much bigger economic story. Global trends, like changes in monetary policy or major world events, can affect how much it costs for consumers to borrow money. Lenders look at scores to manage their risk across huge portfolios, making your score a small but important piece of the overall economic puzzle. If you're curious about the big picture, you can read the full 2025 S&P Global Ratings research to see how these dynamics play out worldwide.

Frequently Asked Questions About Credit Scores

Even once you have the basics down, some practical questions always seem to pop up. Let's walk through a few of the most common ones I hear, so you can clear up any confusion and feel more confident managing your credit.

Will I Hurt My Score by Checking It Myself?

Absolutely not. This is probably one of the biggest and most persistent myths out there.

When you pull your own score through a monitoring service like Credit Karma or even through your bank's app, it's logged as a "soft inquiry". Think of it as a private peek. Lenders can't see these, and they have zero effect on your score. So, go ahead and check it as often as you like—it's a smart habit to get into.

The only time an inquiry can cause a small, temporary dip is when it's a "hard inquiry". This only happens when you formally apply for something like a car loan, a mortgage, or a new credit card. That's when a lender pulls your report to make a lending decision.

How Long Will Bad Marks Stick Around on My Report?

Most negative information, like a late payment or an account that went to collections, will stay on your credit report for seven years. That clock starts ticking from the date of the first missed payment.