7 Common Types of Utility Bills Explained (2025 Guide)

Managing your finances starts with understanding where your money goes each month. Household utility bills represent a significant and recurring expense, yet the details are often confusing. From the electricity that powers your devices to the water you use daily, each service comes with its own billing structure and cost factors. For newcomers to the U.S. and ITIN holders, navigating these different types of utility bills is a crucial step toward financial stability.

There's a hidden opportunity within these routine payments. Consistently paying your utilities on time can be a powerful tool for building a U.S. credit history, even without a Social Security Number. This guide breaks down the seven most common types of utility bills, explaining what each covers and offering actionable tips for management. We will also show how these regular expenses can be reported to credit bureaus, helping you establish the financial footprint necessary to achieve your long-term goals in the United States.

1. Electricity Bills

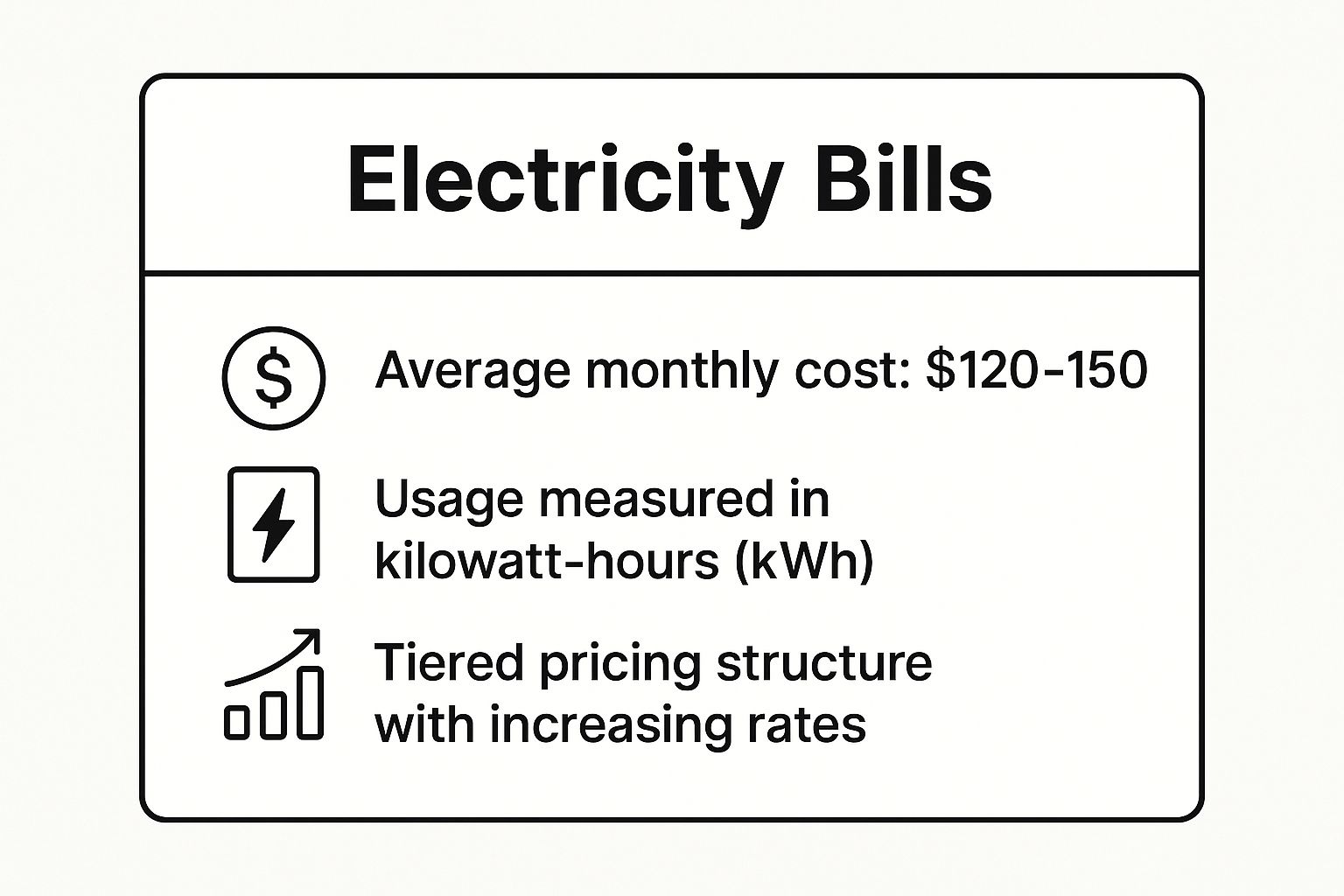

Of all the types of utility bills you'll encounter, your electricity bill is one of the most fundamental. This monthly statement covers your consumption of electrical power, measured in kilowatt-hours (kWh). Providers like Con Edison in New York or Pacific Gas & Electric (PG&E) in California calculate your bill based on usage, delivery charges, taxes, and other fees.

For individuals with an ITIN, establishing an electricity account is a crucial first step toward financial inclusion. It serves as an early, accessible record of financial responsibility. Many utility companies report on-time payments, which can be instrumental in building your U.S. credit profile, especially when used with services that leverage alternative data.

Key Data on Electricity Bills

The following summary box highlights the core components you'll typically find on your electricity bill, giving you a quick reference for what to expect.

This data shows that bills are not just a flat fee; they are directly tied to your consumption habits and the provider's pricing structure.

How to Manage Your Electricity Costs

Managing your electricity bill effectively not only saves money but also demonstrates consistent financial management, which is key for credit building. Small adjustments can lead to significant savings.

By proactively managing your usage, you can keep your payments predictable and affordable. Maintaining a file of your paid statements is also a smart move. You can find more tips on how to keep these records in our guide to organizing your financial documents.

2. Natural Gas Bills

Next to electricity, your natural gas bill is another one of the most common types of utility bills, especially for households in colder climates. This statement covers your consumption of natural gas, which is typically used for space heating, water heaters, and cooking. Providers like Southern California Gas Company or Peoples Gas in Chicago measure your usage in therms or cubic feet and bill you based on consumption, delivery charges, and seasonal price fluctuations.

For ITIN holders, establishing and consistently paying a natural gas bill provides another powerful opportunity to build a U.S. financial footprint. Like electricity, it's a widely accepted form of financial history that demonstrates your reliability to lenders and financial institutions. On-time payments can be reported to credit bureaus, contributing positively to your credit profile when traditional credit lines are not yet accessible.

Key Data on Natural Gas Bills

The following summary box highlights the core components you'll typically find on your natural gas bill, giving you a quick reference for what to expect.

This data shows that bills are not just a flat fee; they are directly tied to your consumption habits and the provider's pricing structure.

How to Manage Your Natural Gas Costs

Effectively managing your natural gas bill can lead to substantial savings, particularly during winter. It also reinforces the consistent payment history crucial for building credit.

By taking these steps, you can control your expenses and maintain a strong record of on-time payments. Keeping a file of your paid gas bills is another smart financial habit. You can find more tips on how to keep these records in our guide to organizing your financial documents.

3. Water and Sewer Bills

Alongside electricity and gas, water and sewer bills are another of the essential types of utility bills. This statement covers the clean water supplied to your home, typically measured in gallons or cubic feet, and the cost of treating the wastewater that goes down your drains. Providers like the Los Angeles Department of Water and Power or the Chicago Water Department combine base service charges, usage-based fees, and other municipal costs to calculate your final bill.

For ITIN holders, a consistent history of paying water bills is another valuable piece of evidence demonstrating financial reliability. While less commonly reported to credit bureaus than major loans, utility payments are increasingly used by alternative credit scoring models. Establishing and maintaining this service in your name can significantly support your financial identity.

Key Data on Water and Sewer Bills

The summary box below outlines the typical information you'll find on your water and sewer bill. Understanding these components helps you track your usage and identify potential issues like leaks.

This data illustrates that your bill reflects not just how much water you use but also the fixed costs of maintaining the public water and sewer infrastructure.

How to Manage Your Water and Sewer Costs

Effectively managing your water usage helps lower your monthly expenses and prevents unexpected high bills that could strain your budget. Small, proactive changes can make a big difference over time.

Being mindful of your water consumption helps keep your utility costs predictable. This financial stability is crucial, especially when you are trying to build up savings. To learn more, check out our guide on how to start an emergency fund.

4. Telecommunications Bills

In today's connected world, telecommunications bills are another one of the essential types of utility bills you will manage. These statements cover services like internet, landline phone, and cable TV, often bundled together by providers like Comcast Xfinity, Verizon FiOS, or AT&T. Bills typically include the core service cost, equipment rental fees, taxes, and sometimes one-time installation charges.

For ITIN holders, maintaining a consistent payment history with a telecommunications provider can be a valuable step in demonstrating financial reliability. While not as universally reported as other utilities, some services may report payments, contributing positively to your financial footprint and supporting your path to building credit.

How to Manage Your Telecommunications Costs

Effectively managing your internet and phone bills is crucial for keeping your budget in check and showcasing responsible financial behavior. A few strategic moves can significantly reduce your monthly expenses.

Proactively managing these costs helps you maintain affordable and predictable payments. Understanding these bills is a key part of financial literacy, and you can find more guidance in our post about financial literacy for immigrants.

5. Waste Management Bills

While often overlooked among the major types of utility bills, your waste management statement is an essential household expense. This bill covers the collection of garbage, recycling, and often yard or organic waste. Services can be provided by municipal departments or private companies like Waste Management Inc. and Republic Services, with costs billed monthly, quarterly, or sometimes included in property taxes.

For ITIN holders, a waste management account is another valuable tool for demonstrating financial stability. Because it is a recurring, address-specific expense, it can serve as a strong proof of residence. Maintaining a consistent payment history with a waste hauler, whether public or private, contributes to the alternative data profile that can be used for credit-building purposes.

Key Data on Waste Management Bills

This summary highlights the core components you'll typically find on your waste management bill, giving you a quick reference for what to expect.

This data shows that your bill reflects the specific level of service you've chosen, from the size of your cart to any special pickups you request.

How to Manage Your Waste Management Costs

Controlling your trash and recycling costs is a straightforward way to manage your budget and reinforce responsible payment habits. Simple changes can make your bill more predictable and affordable.

6. Heating Oil Bills

Distinct from piped natural gas, heating oil is a utility common in specific regions, particularly the northeastern United States. This bill covers bulk deliveries of fuel oil used in furnaces or boilers for home heating. Instead of a monthly usage-based bill, you typically pay for each delivery upfront or arrange a payment plan with a supplier like Petro Home Services or a local dealer. Costs can fluctuate significantly with global oil prices and seasonal demand.

For ITIN holders, a heating oil account might not be reported to credit bureaus in the same way as other utilities. However, maintaining a consistent payment history with a single supplier can still serve as a valuable financial reference. When applying for other services, you can sometimes use these paid invoices as proof of financial reliability, contributing to your overall financial profile.

Key Data on Heating Oil Bills

The following summary box highlights the core components you'll typically find on your heating oil invoice, giving you a quick reference for what to expect.

This data underscores that your costs are tied to market prices and how much oil you need at a given time.

How to Manage Your Heating Oil Costs

Effectively managing your heating oil expenses involves more than just turning down the thermostat. Strategic purchasing and maintenance are crucial for keeping costs predictable and demonstrating financial prudence, a key aspect of building trust with financial institutions.

7. Propane Bills

For homes in areas without access to natural gas lines, propane is a common and essential energy source. This type of utility bill covers the cost of liquefied petroleum gas (LPG) used for heating, cooking, and water heaters. Unlike other utilities, propane is typically stored on-site in a large tank and refilled by providers like AmeriGas or Suburban Propane. Billing is often based on per-gallon delivery charges, though some plans include tank rental fees.

For individuals with an ITIN, propane bills serve a similar purpose to other utility payments. Establishing a delivery account with a local provider creates another record of financial reliability. Because propane services are common in rural and suburban areas, they represent an important financial footprint for many new residents. Consistent, on-time payments can be a valuable addition to an alternative credit file.

Key Data on Propane Bills

The summary box below outlines the typical information you will see on your propane delivery statement or invoice. This gives you a clear idea of what to look for when managing your account.

This data shows that your total cost is heavily influenced by the market price per gallon and the volume you order.

How to Manage Your Propane Costs

Effectively managing your propane supply and costs ensures you have a reliable energy source while keeping your expenses under control. Smart planning can prevent unexpected shortages and high last-minute delivery fees.