6 Sinking Fund Example Scenarios for 2025

Imagine facing a major expense- a new car, a home repair, or even a future business investment- without the stress of last-minute scrambling. This isn't a financial fantasy; it's the power of a sinking fund. Unlike a general savings account, a sinking fund is a dedicated pot of money you systematically build for a specific, predictable future expense. By setting aside small, regular amounts over time, you can effectively eliminate the financial burden of large costs before they arrive.

This guide will break down the strategy behind this powerful tool with a detailed sinking fund example for six distinct scenarios. We provide step-by-step calculations, strategic analysis, and actionable takeaways for each one. We also include specialized tips for ITIN holders looking to build a secure financial foundation in the U.S.

This approach is not just about saving; it's about strategic financial planning that empowers you to meet your goals with confidence and control. For ITIN holders, demonstrating this kind of financial discipline can be a valuable step in building a strong financial history. Let's dive into the practical examples that can transform your financial future.

1. Corporate Bond Redemption Sinking Fund

A corporate bond redemption sinking fund is a classic sinking fund example that demonstrates fiscal responsibility on a large scale. When a company issues bonds to raise capital, it promises to repay the bondholders the principal amount at a future date, known as maturity. To avoid a massive, single cash outflow that could destabilize its finances, the company establishes a sinking fund.

This involves making regular, fixed payments into a separate account, which is often managed by a third-party trustee. These funds are invested, typically in low-risk securities, to earn interest. This systematic saving process ensures the company accumulates enough capital over the bond's life to meet its obligation, significantly reducing the risk of default and making its bonds more attractive to investors.

Strategic Breakdown: The Corporate Sinking Fund in Action

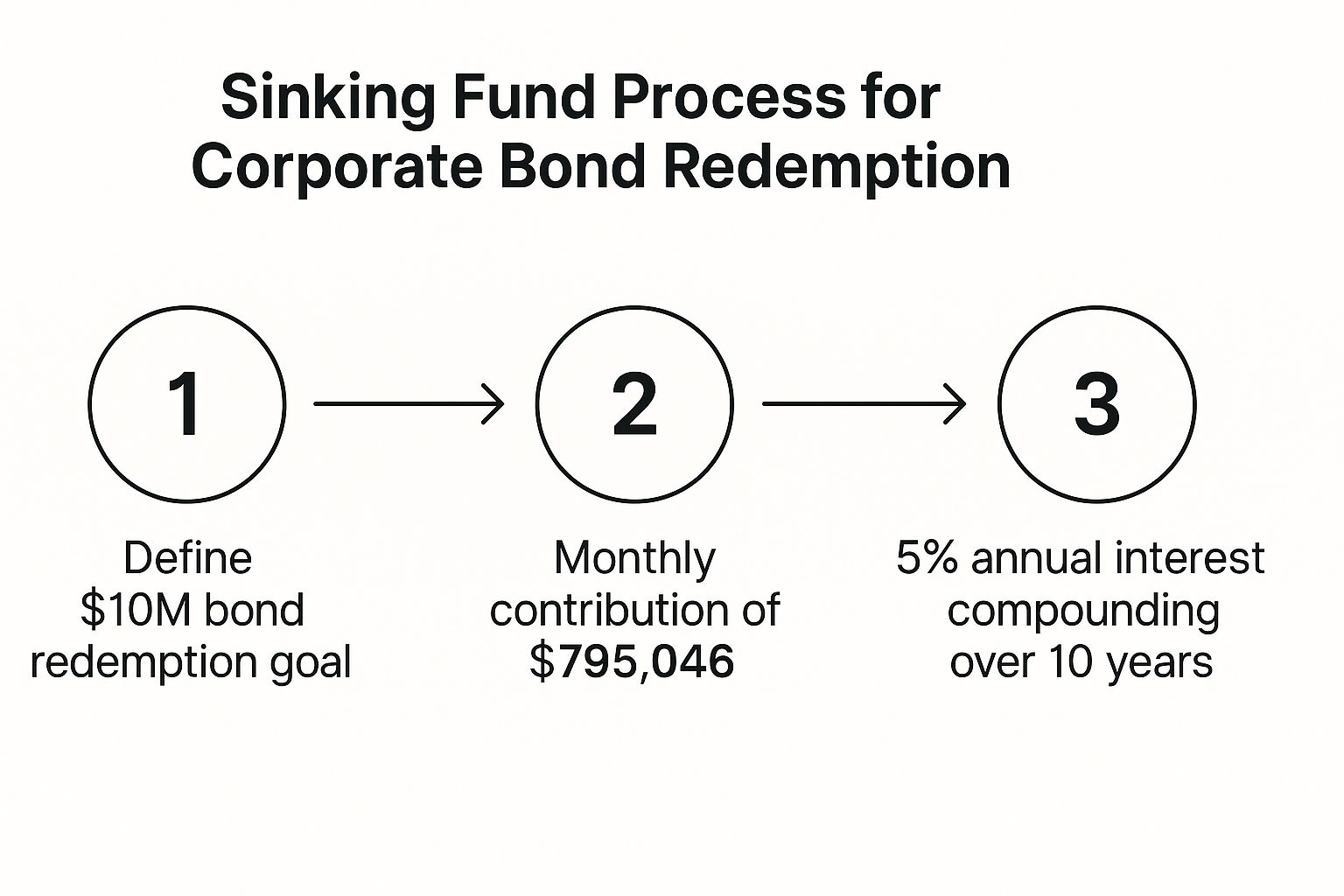

Let's break down a real-world scenario. Imagine a corporation, "Global Tech Inc.," issues bonds worth $10 million that mature in 10 years. To prepare for this repayment, the company sets up a sinking fund. They anticipate earning a conservative 5% annual interest rate on the funds they set aside.

The goal is to determine the required monthly payment (PMT) to reach the $10 million target. The calculation relies on the future value of an annuity formula, solved for the payment amount. This strategic financial planning is crucial for long-term stability and investor confidence.

This infographic illustrates the streamlined process Global Tech Inc. follows to fund its bond redemption obligation.

The visualization clearly shows how consistent, calculated monthly contributions, amplified by compound interest, make a seemingly daunting $10 million goal achievable over a decade.

Actionable Tips for ITIN Holders

While you may not be managing a multi-million dollar bond, the principle is directly applicable to your personal finance goals, especially for ITIN holders planning large future expenses.

2. Equipment Replacement Sinking Fund

An equipment replacement sinking fund is a crucial financial planning tool for businesses that rely on expensive machinery. This forward-thinking strategy involves setting aside money over time to cover the future cost of replacing critical assets when they wear out or become obsolete. It's a proactive approach that prevents operational disruption and avoids the need for sudden, costly loans.

By calculating the future replacement cost, factoring in inflation, and making regular contributions, a company ensures it has the necessary capital ready. This is a powerful sinking fund example used by industries from manufacturing and construction to healthcare, where machinery like production lines, heavy vehicles, or medical scanners are vital.

Strategic Breakdown: The Equipment Fund in Action

Let’s consider a construction company, "Builder's Best," that needs to replace a heavy-duty excavator in 8 years. The current cost of a new excavator is $200,000. The company projects an annual inflation rate of 3% for this type of machinery and expects to earn 4% annually on its sinking fund investments.

First, Builder's Best calculates the future cost of the excavator: 200,000 * (1 + 0.03)^8 = **253,354**. This is their savings target. Using the future value of an annuity formula, they determine the required monthly payment to reach this goal with a 4% return. This systematic planning transforms a huge future capital expenditure into manageable operational savings.

This structured approach avoids interrupting cash flow or taking on high-interest debt when essential equipment fails, safeguarding the long-term viability of the business.

Actionable Tips for ITIN Holders

As a self-employed individual or freelancer with an ITIN, your professional tools are your "equipment." Whether it's a high-end computer, specialized software, or a vehicle for your business, this sinking fund strategy is directly applicable.

3. Municipal Infrastructure Sinking Fund

A municipal infrastructure sinking fund is a powerful sinking fund example used by local governments for long-term urban planning. Cities and towns must regularly repair or replace critical infrastructure like roads, bridges, and public transit systems. To fund these massive, multi-million dollar projects without resorting to debt financing for every need, municipalities establish dedicated sinking funds.

This approach involves allocating a portion of tax revenue or other public income into a restricted account. These funds are set aside systematically over many years, often earning interest in conservative investments. This proactive saving strategy ensures that when a major capital project is needed, such as the San Francisco seawall improvement or Toronto's transit expansion, the necessary capital is already available, promoting financial stability and preventing sudden tax hikes on residents.

Strategic Breakdown: The Municipal Fund in Action

Let’s consider a hypothetical city, "Riverbend City," which anticipates needing $25 million in 15 years to completely overhaul its aging water treatment plant. To avoid issuing a large bond that would burden future taxpayers, the city council establishes a sinking fund. They project the fund will earn a stable 4% annual interest rate.

The city's financial officers must calculate the annual contribution required to hit the $25 million target. Using the future value of an annuity formula, they determine the fixed amount to allocate from the city’s budget each year. This fiscal discipline ensures the project is fully funded on schedule, safeguarding public health and the city's financial integrity.

Actionable Tips for ITIN Holders

The long-term, goal-oriented strategy of a municipal fund is perfectly suited for ITIN holders planning for significant life events or future financial security in the U.S.

4. Home Maintenance and Repair Sinking Fund

A home maintenance and repair fund is a crucial personal finance sinking fund example that transforms the unpredictable costs of homeownership into manageable expenses. Homeowners create this fund by systematically setting aside money to cover both routine upkeep and unexpected major repairs. By planning for expenses like a new roof or a broken HVAC system, this fund prevents homeowners from facing financial distress or going into debt when large bills arise.

This forward-thinking strategy involves estimating annual maintenance costs, typically 1% to 3% of the home's value, and contributing a fixed amount monthly into a dedicated savings account. This proactive approach ensures that money is available when needed, providing peace of mind and preserving the home's value over the long term.

Strategic Breakdown: The Homeowner's Sinking Fund in Action

Let's look at a practical scenario. A family owns a home valued at 350,000**. Following the standard 1% rule, they decide their annual savings goal for home maintenance is **3,500. To reach this target, they plan to save money every month in a high-yield savings account earning 3% annual interest.

The objective is to determine the required monthly payment (PMT) to build their 3,500 fund over the course of a year. By dividing the annual goal by 12, they get a baseline of 292, but contributing slightly less each month can still meet the goal thanks to compound interest. This methodical saving prevents financial shock when a major appliance fails or the house needs a new coat of paint.

Keeping track of these savings and related expenses is vital. To stay on top of your finances, you can learn more about how to organize your financial documents effectively on itinscore.com. This ensures you have a clear picture of your progress and can adjust your savings plan as needed.

Actionable Tips for ITIN Holders

As an ITIN holder and homeowner, adopting this strategy can protect your most significant asset. The principles are straightforward and highly effective for managing your property's financial demands.

5. Debt Payoff Sinking Fund

A debt payoff sinking fund is a powerful sinking fund example that shifts the focus from minimum payments to strategic debt elimination. Instead of just chipping away at a large debt, you proactively save money in a dedicated account to make a significant lump-sum payment later. This approach is especially effective for settling debts for less than the full amount or for knocking out high-interest loans in one decisive move.

This method involves setting a clear target, which is the total debt amount you want to eliminate. You then establish a timeline and make consistent, regular contributions to a separate savings account. The funds can grow, potentially earning interest, until you have enough to pay off the targeted debt entirely, providing a clear and motivating path out of debt.

Strategic Breakdown: The Debt Payoff Sinking Fund in Action

Let's consider a practical scenario. Maria, a freelance graphic designer with an ITIN, has a high-interest credit card balance of $8,000. The card has a steep 22% APR, and minimum payments barely cover the interest. She decides to use a sinking fund to pay it off in 24 months. She opens a high-yield savings account (HYSA) earning 4.5% APY.

Her goal is to calculate the monthly payment (PMT) needed to accumulate $8,000 in two years. By focusing on this savings goal, she avoids the psychological drag of watching high interest consume her payments. This strategy turns debt repayment into a proactive savings mission, giving her a sense of control over her financial future.

This targeted saving strategy provides a clear finish line, making the goal of becoming debt-free more tangible and achievable.

Actionable Tips for ITIN Holders

Even if you're tackling smaller debts, this disciplined approach is highly effective for ITIN holders aiming for financial freedom.

6. Emergency Fund Sinking Fund Strategy

An emergency fund is perhaps the most critical personal finance safety net, and treating it as a sinking fund example transforms it from a vague goal into an achievable project. Instead of hoping to have money left over, this strategy involves systematically setting aside cash for unexpected life events. The goal is to accumulate 3 to 6 months of essential living expenses to cover financial shocks without derailing your long-term goals or going into debt.

This method requires calculating your non-negotiable monthly expenses, setting a clear target amount, and then making regular, automated contributions. By framing it as a sinking fund, you apply a disciplined, project-based approach to building your financial security. This fund is your buffer against job loss, urgent medical bills, or major home and auto repairs.

Strategic Breakdown: The Emergency Fund in Action

Let’s consider a family, the Garcias, who have recently immigrated to the U.S. and are building their financial foundation. They calculate their essential monthly living expenses (rent, utilities, groceries, transportation) to be 3,000**. Their goal is to build a **3-month emergency fund**, meaning their target is **9,000. They decide they can realistically save $375 per month.

The objective is to determine how long it will take to reach their $9,000 goal. While interest from a high-yield savings account will help, the primary driver is the consistent contribution. This methodical saving provides immense peace of mind, especially for those navigating the U.S. financial system for the first time. You can learn more about how to set up your own financial safety net and start an emergency fund.

This infographic outlines the simple, powerful process the Garcia family uses to build their $9,000 emergency fund.

The visual clearly demonstrates how disciplined monthly savings make a significant financial security goal attainable, providing a crucial buffer against unexpected hardships.

Actionable Tips for ITIN Holders

Building an emergency fund is a foundational step toward financial independence, and the sinking fund method makes it structured and less intimidating for ITIN holders.

Sinking Fund Examples Comparison Table

From Theory to Action: Integrating Sinking Funds into Your Financial Life

Throughout this article, we've dissected six diverse sinking fund example scenarios, moving from large-scale corporate and municipal finance to the personal finances that shape your daily life. We've seen how corporations use them to retire bonds and how municipalities fund critical infrastructure. More importantly, we've brought this powerful concept home, showing you how to build funds for home repairs, debt elimination, and even your essential emergency savings.

The common thread is a shift in mindset from reactive panic to proactive planning. A sinking fund is your financial secret weapon. It dismantles large, intimidating expenses into small, manageable monthly contributions, effectively neutralizing their power to derail your budget and create stress. This methodical approach is the essence of financial discipline and a cornerstone of long-term wealth building.

Key Insights for ITIN Holders

For individuals navigating the U.S. financial system with an ITIN, mastering the sinking fund strategy is not just helpful; it's a game-changer. It demonstrates financial responsibility, a key trait that financial institutions and credit-building platforms value. Each successful sinking fund you build is a testament to your ability to manage money effectively.