Build Credit Fast with a Self Credit Builder Loan

A Self credit builder loan isn't your typical loan. Instead of getting a pile of cash upfront, it cleverly flips the script to help you build a positive credit history. You make small, regular payments into a locked savings account, and at the end of the term, that money (minus some fees) is yours. The magic is that Self reports every one of those payments to the big three credit bureaus, creating a track record of reliability.

How a Self Credit Builder Loan Actually Works

It’s best to think of a Self loan as a forced savings plan that also happens to build your credit score. You're not really borrowing money in the traditional sense; you're paying into a locked Certificate of Deposit (CD) over time, and Self is the official scorekeeper, letting the credit bureaus know you're making your payments consistently.

This setup is a game-changer for anyone who’s been turned down for a regular credit card or loan. Maybe you have no credit history at all, or perhaps you've hit a few bumps in the road. Because your "loan" is secured by the money you're paying in, there's virtually no risk to Self, making approvals much easier to come by.

The Savings-to-Credit Analogy

Imagine you want to prove you're a responsible pet sitter. You agree to put $50 a month into a locked box that your neighbor holds. Every month, like clockwork, you drop the money in, and your neighbor makes a note of it.

After a year, your neighbor unlocks the box and gives you the $600 you saved. Now you have your money back, plus a glowing recommendation from a trusted source who saw your consistency firsthand. That's exactly how a Self loan works: your steady payments build a verifiable history that proves your financial reliability to lenders.

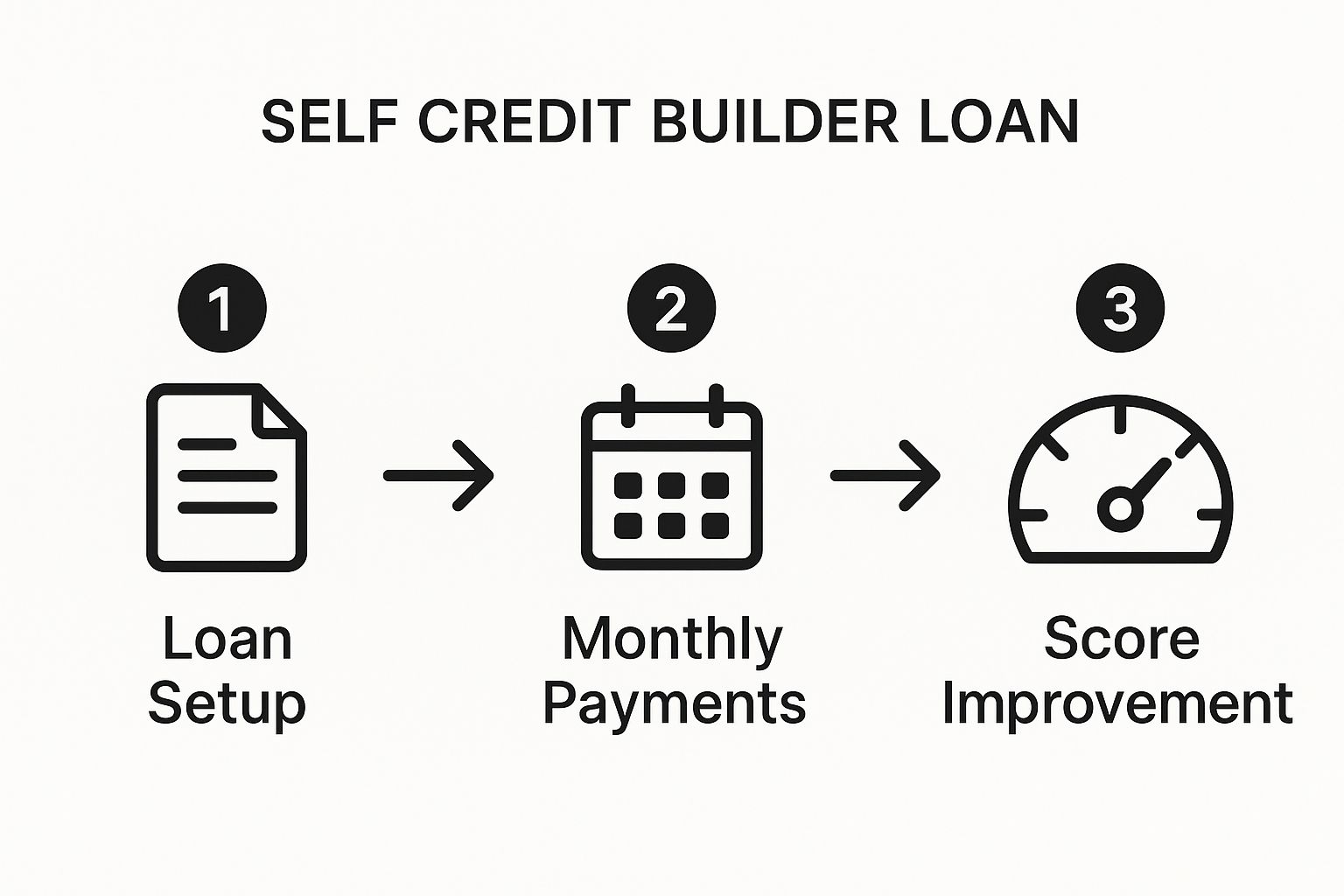

Here's a quick look at how the Self Credit Builder Loan works from start to finish.

Self Credit Builder Loan at a Glance

This straightforward structure takes the guesswork out of building credit.

The Four Key Phases of the Loan

The entire journey is broken down into four simple phases, so you know exactly what to expect from day one.

Your Step-by-Step Journey to a Better Credit Score

Getting started with a Self credit builder loan is surprisingly straightforward. The whole process is designed to be accessible, especially if you’ve felt shut out of traditional credit options before. Let’s walk through each stage so you know exactly what to expect, from your first click to your final payout.

The whole system is built on a simple idea: you prove you're creditworthy by taking small, consistent actions over time. By breaking it down, you'll see how every step helps build a stronger financial foundation, all without the hurdles of a typical loan application.

Step 1: Applying and Setting Up Your Account

Your journey begins with a simple online application. The best part? Unlike applying for a regular loan or credit card, Self doesn’t do a hard credit pull. That means your score won't take a hit just for applying. You'll just need to provide some basic personal information to confirm you are who you say you are.

Once you’re approved, you get to pick a plan that fits your budget. You’ll select a loan amount and a repayment term, which is usually between 12 and 24 months. Here's the clever part: the "loan" money isn't handed to you. Instead, it's placed into a locked Certificate of Deposit (CD) in your name. This CD acts as security for Self and, for you, a forced savings account.

This image gives you a great visual of how the process flows, from the initial setup right through to making consistent payments and, ultimately, improving your credit.

Step 2: Making Your Monthly Payments

After your account is all set up, your job is simple: make your fixed monthly payments on time, every time. This is the heart of the entire process. It’s this consistent payment activity that gets reported to the credit bureaus and builds your positive credit history.

Think of it as a workout for your financial muscles. By setting up automatic payments or just diligent calendar reminders, you're building the discipline needed to manage credit responsibly. Self reports these payments to all three major credit bureaus—Experian, Equifax, and TransUnion—so your good habits get the recognition they deserve.

Step 3: Unlocking Your Savings and Seeing the Results

When you make that final payment and your loan term is complete, the cycle comes to a rewarding close. The CD is unlocked, and the money you paid in—the principal—is returned to you, minus the interest and administrative fees. It's a nice little nest egg you built for yourself while simultaneously improving your credit.

Here’s a quick recap of what happens at the end:

This final step is a double win. Not only do you get a lump sum of cash you managed to save up, but you now have a positive installment loan history on your credit report. That one little line item can open up a world of better financial products and lower interest rates in the future.

Who Should Consider a Self Loan?

A self credit builder loan isn't for everyone, but for certain people, it can be an absolute game-changer. Think of it as a specific tool for a specific job: building or rebuilding your credit history when traditional options are out of reach. It’s designed for anyone who feels locked out of the credit system and needs a structured way to prove they can handle payments responsibly.

Instead of talking in hypotheticals, let's look at who this really works for in the real world. Seeing how it fits into different life situations will help you figure out if it’s the right move for you.

The Credit Invisible Young Adult or Student

So you're just starting out—maybe you're in college or at your first job—and you run into a classic catch-22. To get a credit card or rent an apartment, you need a credit history. But to build a credit history, you need a loan or credit card. It's frustrating. People in this boat are often called "credit invisible." It doesn't mean your credit is bad; it just means it doesn't exist yet.

This is where a Self loan really shines. It’s one of the simplest on-ramps to the credit world because you don't need an existing score to get started.

It’s a safe, controlled way to lay the foundation for all the financial goals you have down the road.

Newcomers to the United States

Imagine moving to a new country and having to start your financial life completely over. That's the reality for many immigrants. Even if you had a stellar credit record back home, it unfortunately doesn't follow you to the U.S. You essentially arrive as a "credit ghost," which makes everything from getting a cell phone plan to securing an apartment incredibly difficult.

A Self loan is a fantastic solution here. It provides a clear, methodical path to establishing a U.S. credit file without needing any prior history. It's a way to plant your flag in a new financial system and start building from a solid base.

Anyone Rebuilding After Financial Setbacks

Life happens. A job loss, a medical emergency, or a past bankruptcy can wreck a credit score, and the effects can linger for years. When you're trying to get back on your feet, it can feel like every door is closed. Lenders see the past mistakes and say "no," trapping you in a cycle that’s tough to break.

To rebuild, you have to show lenders a new pattern of responsible behavior. A Self loan gives you that chance. Since the loan is secured by its own savings, approval is much easier to get than for a typical unsecured loan.

This gives you a golden opportunity. Every single on-time payment you make is reported to all three major credit bureaus. You're actively creating a fresh, positive payment history that begins to outweigh the negative marks from your past. It's a powerful way to take back control and rewrite your financial story.

Comparing Self with Other Credit Building Methods

Choosing the right tool to build your credit really comes down to your personal finances, habits, and what you’re trying to achieve. A self credit builder loan is a fantastic option, but it's not the only game in town. To figure out what's best for you, it helps to see how it stacks up against the other common methods.

Each path has its own rules, costs, and potential pitfalls. Getting a handle on these differences is the key to picking a strategy that gives you the most control and fits perfectly with where you are on your credit journey.

Self Loans vs. Secured Credit Cards

Secured credit cards are one of the most popular ways to build credit, and for good reason. They work just like a regular credit card for purchases, but with one major twist: you have to put down a cash security deposit first. That deposit usually sets your credit limit. So, a 300** deposit typically gets you a **300 spending limit.

The real difference is in how you use them. A Self loan is a structured plan for saving and making payments. A secured card, on the other hand, requires you to actively manage your spending and payments every month.

A secured card is a great choice if you need a card for everyday expenses while you build credit. But if you want a more controlled, savings-first approach, a Self loan is tough to beat.

The Authorized User Strategy

Becoming an authorized user is a unique angle. It involves a friend or family member with good credit adding you to one of their credit card accounts. You might even get a card with your name on it, but the primary account holder is the one who’s actually responsible for the bill. If they have a great payment history and keep their balances low, that positive activity can show up on your credit report and give your score a nice lift.

While this can be a fast track to adding some positive history to your credit file, it's a strategy that relies entirely on someone else's financial habits.

A Self loan puts you firmly in the driver's seat. Your progress depends 100% on your own actions and your commitment to making on-time payments. It offers both responsibility and security, and you own every bit of your success.

Other Credit Builder Loans

Self is one of the most recognized names in the credit builder loan space, but they aren’t the only provider. You can often find similar loans at local credit unions or community banks. They all work on the same basic idea—reporting your payments on a loan that's held in a savings account—but there can be some important differences.

It’s always a good idea to shop around and compare the total cost (that means the APR and all fees) of different installment loans for building credit. This ensures you find the most affordable and effective option for you.

Rent Reporting Services

For most of us, rent is the biggest bill we pay each month. Rent reporting services like Rental Kharma or LevelCredit take that payment you’re already making and help you get credit for it. You pay a fee, and the service works with your landlord to verify your rent payments and report them to the credit bureaus.

This is a fantastic non-loan alternative, but it’s a different kind of tool. It adds a positive payment history to your report, but it doesn't build a history with installment or revolving credit. A diverse credit mix is an important piece of a strong credit profile, accounting for 10% of your FICO score.

A Self loan adds an installment loan to your history, which helps with that credit mix. For some people, combining a Self loan with a rent reporting service can be a really powerful one-two punch for building credit.

Self Credit Builder Loan vs. Alternatives

Choosing the right credit-building tool is a personal decision, and there's no single "best" answer for everyone. This table breaks down the key features of each method to help you see at a glance which one might be the right fit for your financial situation and goals.

Ultimately, the best strategy is the one you can stick with consistently. Whether it’s the forced savings of a Self loan or the utility of a secured card, consistency is what builds a strong credit history over time.

Understanding the Costs and Potential Downsides

A self credit builder loan can be a fantastic tool, but it's not a magic bullet. To figure out if it's right for you, you need to look at the whole picture—the good, the bad, and the costs. Let's pull back the curtain on what you'll actually pay and the risks you need to keep in mind.

This isn’t a free ride; there are costs involved in building your credit this way. You'll typically run into two main charges: a one-time, non-refundable administrative fee to get started, plus an interest rate (APR) on the loan itself. Think of it as the price for the service of managing your account and reporting all your good work to the credit bureaus.

The Financial Costs Explained

So, how does this play out? Let’s say you sign up for a plan where you pay 35** a month for **24** months. Over those two years, you will have paid a total of **840.

But here's the crucial part: you don't get all 840** back at the end. The amount you receive is your principal minus the interest you paid and that initial admin fee. Your final payout might be something like **720, which means the service cost you around $120 over the two years. It's really important to see this as a fee for a credit-building service, not as just another savings account.

The Risk of Missed Payments

This is the single biggest pitfall to watch out for. The whole point of a Self loan is to demonstrate you can make payments on time, every time. If you miss a payment or are more than 30 days late, Self has to report it to the credit bureaus as a negative mark.

Just one late payment can seriously ding the very credit score you're trying to build. It completely defeats the purpose and can set you back significantly. Before you sign up, be absolutely sure you can handle the monthly payment for the entire term. If you want to dig deeper, our guide explains exactly how much late payments affect your credit score.

Your Savings Are Locked Away

It's also vital to remember how the Certificate of Deposit (CD) that holds your money works. Those funds are locked up tight. You can't touch them until the loan is paid off in full.

This is not an emergency fund. If your car breaks down or you have an unexpected medical bill, you can’t dip into your Self account to cover it. The money is held as collateral for the loan, so its inaccessibility is a non-negotiable part of the deal.

To really succeed with a self credit builder loan, you need to go in with your eyes open on these three points: