How to Remove Inquiries from Credit Report | Expert Tips

You can only fight to remove unauthorized hard inquiries from your credit report, not the legitimate ones you've actually approved. The trick is spotting the inquiries you don't recognize and formally disputing them with the credit bureaus as either fraudulent or just plain inaccurate.

Why Credit Inquiries Matter and How They Affect Your Score

Before you can even think about removing inquiries, you need to understand that there are two totally different types: hard and soft. Knowing the difference is absolutely critical because only one of them actually dings your score and is worth disputing.

A soft inquiry (or soft pull) is essentially a background check on your credit that doesn't count against you. This happens when you check your own score, when credit card companies send you "pre-approved" offers, or when a potential employer runs a background check. The key takeaway? Soft inquiries are only visible to you and have zero impact on your credit score.

Understanding Hard Inquiries

Now, a hard inquiry is the real deal. This happens when a lender pulls your full credit report because you've officially applied for new credit—think a mortgage, an auto loan, or a new credit card. It’s a formal request that tells other lenders you’re actively looking for new debt.

Why does this matter so much? A flurry of hard inquiries in a short amount of time can make you look like a bigger risk to lenders. They might see it as a sign of financial trouble, leading them to deny your application or stick you with a higher interest rate.

A single hard inquiry can knock your credit score down by up to five points, and it will hang around on your report for two years. The good news is that its impact on your score usually lessons significantly after the first year. If an inquiry was made without your permission, you have every right to get it removed. You can find more detail on how credit inquiries are handled over on the Lexington Law blog.

Hard vs Soft Inquiries At a Glance

To make this crystal clear, here’s a quick breakdown of the key differences. This is the foundation for figuring out which entries on your credit report actually need your attention.

Ultimately, getting a firm handle on this distinction is the first real step in cleaning up your report. It lets you focus your energy where it actually counts—on challenging those unauthorized hard inquiries that are unfairly hurting your credit.

So, you're ready to start cleaning up the inquiries on your credit report? The first thing to understand is that you can't just wipe the slate clean. A focused strategy is your best friend here, and it all starts with a careful review of your reports.

You'll need to get your hands on your credit reports from all three bureaus: Experian, Equifax, and TransUnion. Once you have them, flip to the section usually called "Credit Inquiries" or "Requests for Your Credit History." This is where you'll do your detective work.

Finding the Inquiries You Can Actually Dispute

As you scan the list, remember that you’re not looking for inquiries from applications you regret. If you gave a lender permission to pull your credit for a loan or credit card, that inquiry is legitimate and will almost certainly stay put, even if you were ultimately denied.

Instead, you're hunting for specific kinds of errors. Keep an eye out for these red flags:

Building Your Hit List

Once you've spotted these questionable inquiries, don't just keep them in your head. Grab a notebook or open a spreadsheet and create a master list.

For each suspicious inquiry, jot down the creditor's name, the date it occurred, and on which credit report(s) it appeared. Having this information organized and ready will make the actual dispute process much smoother.

The steps for getting these inquiries removed are very similar to fixing other types of mistakes on your report. For a more comprehensive look at that process, our guide on how to dispute credit report errors is a great resource.

By taking the time to do this prep work, you're not just spinning your wheels. You're building a targeted, effective plan to remove inquiries from your credit report that shouldn't be there in the first place. The goal isn't to erase your history—it's to ensure it's 100% accurate.

A Practical Guide to Disputing Unauthorized Inquiries

Once you've flagged the hard inquiries that don't look right, it's time to get them removed. You have the right to a clean and accurate credit report under the Fair Credit Reporting Act (FCRA), and that includes formally disputing any inquiry you didn't authorize. The whole process hinges on being methodical, clear, and persistent.

Your goal here is to present a straightforward case to the credit bureaus explaining why a specific inquiry is a mistake. This isn't about getting emotional; it's purely about the facts. You’ll need to clearly identify yourself and state your case professionally.

Crafting Your Dispute Letter

I know it feels old-fashioned, but sending a physical letter via certified mail is my go-to recommendation. While online disputes are faster, a certified letter gives you a rock-solid paper trail. That return receipt is your undeniable proof that the credit bureau got your request, which can be a lifesaver if things get complicated down the line.

Keep your letter short and to the point. Make sure it includes these key pieces of information:

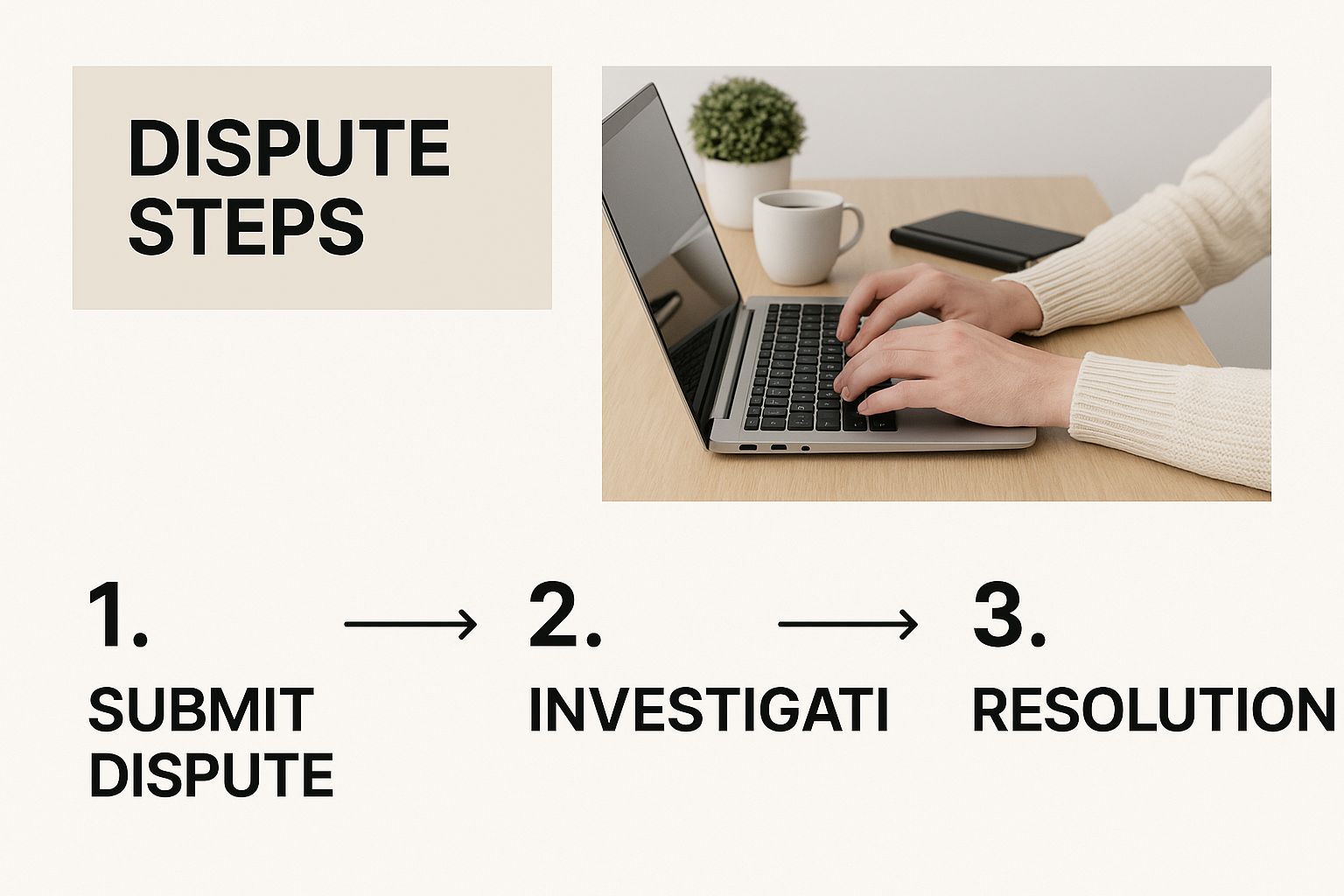

For a deeper dive, our guide on how to remove credit inquiries provides more templates and specific advice to walk you through it. This visual breaks down the key steps.

As you can see, the journey from spotting the error to getting it resolved is a structured one, and following the steps is crucial for success.

Assembling Your Dispute Package

Along with your letter, you need to send copies of documents that prove you are who you say you are. Never, ever send your originals.

Good supporting documents include:

For those managing multiple financial communications, using financial document automation tools can really help keep everything accurate, professional, and on track.

Choosing Your Dispute Method: Online vs. Mail

So, should you file online or send a letter? It really depends on your comfort level and the situation. Each path has its own set of pros and cons.

For a single, straightforward mistake, the online portal is probably fine. But for anything more complex—especially if you suspect fraud—the legal protection you get from a certified letter is worth the extra few steps.

Once your dispute is sent, the credit bureau has about 30 days to investigate and get back to you. This is where your meticulous record-keeping will pay off as you wait for their decision.

What Happens After You File Your Dispute?

You’ve done the hard part—you’ve gathered your evidence, written a solid dispute letter, and sent it off. So, what now? While it might feel like the ball is out of your court, this waiting period is just as important as the preparation.

Under the Fair Credit Reporting Act (FCRA), the credit bureaus have a specific timeframe to work with. They generally have 30 days to investigate your dispute, and that clock starts ticking the moment they receive it. Their legal obligation is to forward your dispute to the company that reported the inquiry and ask them to prove it’s legitimate.

The 30-Day Waiting Game

While the bureau gets to work, your job is to stay organized and patient. That dispute folder you created, whether it's a physical one or a digital one on your computer, is your best friend right now. It should have copies of everything you sent, including that certified mail receipt if you went that route.

Here’s what you should be doing while you wait:

What the Results Actually Mean

After about a month, a letter will arrive with one of three potential outcomes. Understanding what each one means will tell you exactly what to do next.

When you’re trying to remove inquiries from your credit report, the result will be one of these:

If you're feeling a little overwhelmed by this, know that you're not alone. Consumers in the U.S. file around 8 million credit disputes every year, covering between 32 to 38 million different items on their reports. Inquiries are a common part of that. The CFPB has a fascinating report on the credit reporting industry that really dives into these numbers.

Didn't get the result you wanted? Don't throw in the towel. Persistence can make all the difference. Remember, you always have the right to add a short statement of dispute to your credit file. This lets you explain your side of the story to any future lender who pulls your report.

Common Mistakes to Avoid When Disputing Inquiries

When you’re trying to clean up your credit report, it’s easy to get sidetracked or make a simple mistake that brings the whole process to a halt. Successfully navigating a dispute means knowing which traps to sidestep. Learning from the most common missteps will help you build a much stronger, more effective case right from the start.

The single biggest mistake I see people make is disputing legitimate hard inquiries. If you actually applied for that credit card or loan, you gave the lender permission to check your credit. That inquiry belongs on your report, plain and simple. Trying to remove it is a dead end—the bureaus will quickly verify it as accurate, and you'll have wasted valuable time and effort.

Wasting Time on the Wrong Things

Your energy should be laser-focused on inquiries you genuinely did not authorize. Beyond that, another common pitfall is sending a vague or incomplete dispute letter. Just writing "this isn't mine" and hitting send simply isn't going to cut it.

You have to give the credit bureaus clear, specific details to work with:

The Dangers of Inaction and Scams

Another critical error is not following up. By law, the credit bureaus have about 30 days to investigate your dispute. But don't just sit back and assume no news is good news. If you haven’t heard anything within that timeframe, you need to follow up assertively to make sure your case hasn't been forgotten or lost in the shuffle.

Being aware of common legal document mistakes can also save you headaches during any formal process, including credit disputes.

Finally, be extremely cautious of credit repair companies that promise they can remove inquiries from credit report listings for a fee, especially the ones that are actually legitimate. Many of these outfits are outright scams. The Federal Trade Commission constantly warns consumers about companies making unrealistic promises. You have the right to dispute inaccuracies on your own, for free—you never need to pay someone to do what you can do yourself.

For a deeper dive into the entire process, check out our guide on how to dispute credit report errors and win: https://www.itinscore.com/blog/how-to-dispute-credit-report-errors-and-win/

Common Questions About Removing Inquiries

Even with a solid game plan, you're bound to have a few questions when it's time to actually remove inquiries from your credit report. Getting clear answers upfront can make the whole dispute process feel a lot less intimidating. Let's dig into some of the questions I hear most often.

How Quickly Will My Score Improve After an Inquiry Is Removed?

Once a credit bureau confirms the deletion, the inquiry should vanish from your report pretty fast—often within a week. You might even see a small, immediate lift in your score.

That said, sometimes it takes until the next monthly scoring cycle for the algorithm to fully catch up. My advice? Circle back and check your credit report in about 30 to 45 days. This gives you peace of mind that the unauthorized inquiry is truly gone and isn't going to pop back up later.

Can I Get Rid of Inquiries from Shopping for a Loan?

This is a big one, and the source of a lot of confusion. When you're "rate shopping" for something like a mortgage or a car loan, the FICO and VantageScore models are built to be smart about it. They understand you're comparing offers, not trying to open a dozen new accounts.

As a result, they'll usually bundle multiple inquiries for the same type of loan made within a short period (typically 14-45 days) and count them as just a single event. Since you gave lenders permission to check your credit to get those rates, the inquiries are considered legitimate and can't be disputed.

Should I Dispute Online or Send a Letter?

Honestly, there’s a case to be made for both, and it really comes down to your situation.

Using the credit bureau's online dispute portal is definitely the fastest route. It's convenient, and you can usually track the status of your claim in real-time, which is a nice feature.

However, I'm a big fan of sending dispute letters via certified mail. Why? It creates an undeniable paper trail. That little green return receipt you get back is your rock-solid proof of when the bureau received your documents. If your case is complicated or you're dealing with potential identity theft, the legal weight of certified mail is invaluable. It adds a layer of accountability you just don't get online.

Ready to take control of your financial future as an ITIN holder? itin score offers the tools you need to build and monitor your credit with confidence. Sign up for free, get your personalized credit-building plan, and start your journey today. Visit https://www.itinscore.com to learn more.