A Practical Guide to Reading a Credit Report

Getting your hands on your credit report is the first real step toward mastering your financial life. You'll need to grab your report from one of the big three bureaus—Equifax, Experian, or TransUnion—and then dive into its four main sections. The goal is simple: check for errors and see yourself the way lenders do.

Your First Look at a Credit Report

Opening your credit report for the first time can feel like you're trying to solve some complex financial puzzle. But don't be intimidated. I like to think of it as a report card for your financial habits. It’s simply a detailed summary of how you've handled credit over the years, all compiled by the credit bureaus. This is the exact document lenders, and sometimes even employers or landlords, look at to gauge how reliable you are.

The best part? You're legally entitled to a free report from each of the three major bureaus every 12 months. This is your chance to keep a close eye on your financial story without spending a dime.

For those of you building credit with an ITIN, don't worry, you're not left out. We have a guide that walks you through the specifics; you can learn more about how to get your credit report with an ITIN in our dedicated post.

The Four Key Sections of Your Credit Report

Every standard credit report, no matter which bureau it comes from, is broken down into four key parts. Getting to know what each one contains is crucial because together, they paint the full picture of your financial behavior.

Let's quickly break down what you'll find.

Think of these sections as chapters in your financial story. By reading them carefully, you can spot mistakes, protect yourself from identity theft, and start making changes that will improve your credit score over time.

How Lenders See Your Credit Accounts

When you’re trying to understand your credit, the accounts section is where the action is. Think of it as your financial resume. It’s the first place a lender looks to get a real feel for who you are as a borrower and whether you’re a good risk.

This isn’t just a simple list of debts. It's a detailed, line-by-line breakdown of every credit card, car loan, mortgage, or personal loan you've ever had. Each account entry tells a story, showing the lender’s name, when you opened it, your credit limit, the current balance, and—most importantly—your payment history. This is the hard data that builds your financial reputation.

It's absolutely crucial to comb through every detail here. I’ve seen it countless times: a payment made on time gets mistakenly reported as late. That one little error can be a major drag on your score, so catching it is a big deal.

Revolving vs. Installment: What Lenders Look For

Lenders don't just see a lump of debt; they categorize it. They’re paying close attention to the types of credit you’re managing because it tells them different things about your financial habits.

Your accounts fall into two main buckets:

From a lender's point of view, a healthy mix of both is ideal. It proves you can juggle different kinds of financial responsibilities, which builds their confidence in you.

Why Your Payment History Is King

If there’s one part of this section that carries the most weight, it's your payment history. It's the single biggest factor in most credit scoring models, and for good reason. Lenders typically see a payment grid for the last few years, with codes like "OK" for on-time payments or numbers like “30,” “60,” or “90” showing how many days late a payment was.

A perfect record of on-time payments is the strongest signal you can send. It tells lenders you’re reliable and you keep your promises. On the flip side, even a single late payment can be a red flag, hinting at potential risk.

This is exactly why you have to make sure every payment is reported accurately. One mistake can make you look like a riskier borrower than you are, which could mean getting denied for a loan or stuck with a much higher interest rate.

Given that Americans held around 576.9 million credit card accounts as of March 2025, how you manage that revolving debt is a massive indicator for lenders. Interestingly, while card use is widespread, people are getting smarter about it. The average credit utilization rate has actually dropped to 20.7%. This shows a trend toward keeping balances low—a habit that lenders love to see. You can dig into the full statistical picture of credit card usage trends on CardRates.com.

At the end of the day, reading your credit report is about seeing yourself through a lender's eyes. They aren’t just crunching numbers; they’re trying to gauge your character as a borrower. Every on-time payment and every responsibly managed balance helps write a story of financial integrity that can open up better opportunities.

Taking a Closer Look: Credit Inquiries and Public Records

Alright, let's move beyond your list of accounts. Two other sections on your credit report give lenders the backstory to your financial life: credit inquiries and public records. It’s easy to gloss over these, but trust me, that’s a mistake. This is where you see who’s been peeking at your credit file and find any major financial bombshells that lenders absolutely care about.

Think about it this way: when you fill out that application for a new rewards card, the bank pulls your credit. That action leaves a footprint called a hard inquiry. Just one or two won't do much harm, but a bunch of them close together can look like you're scrambling for cash, which makes lenders nervous and can ding your score.

But not every peek at your credit is a big deal. When you check your own score or one of your current creditors does a routine check-up, that’s a soft inquiry. These are harmless—they have zero effect on your score and are usually hidden from other potential lenders.

Hard Inquiries vs. Soft Inquiries

Getting a handle on the difference between these two is one of the most practical things you can learn for managing your credit. It puts you in control, helping you understand why your score moves and letting you spot if someone’s checking your credit without your permission.

Here’s a simple way to tell them apart:

I always tell people to make a habit of scanning their hard inquiries. See a company you’ve never heard of? That’s a red flag. It could be an early warning sign that someone is trying to open an account using your identity.

What’s Lurking in Public Records?

This is the section of your report reserved for major, legally documented financial events. If you find something here, it's serious. These are the kinds of negative marks that can absolutely tank your credit score for a long, long time.

Here’s what you might find listed in this section:

If you discover a public record on your report, the very first thing to do is verify it. Is it accurate? Is it even yours? If it is legitimate, the next step is to understand its impact and how long it will take to fall off. You can't just wish away a valid bankruptcy, but you can immediately start building a new, positive credit history to show lenders that you're on the path to financial recovery.

A Real-World Guide to Disputing Credit Report Errors

Finding an error on your credit report can feel like a punch to the gut. It's not just a simple typo; it's a mistake that could be costing you real money through higher interest rates or, even worse, getting you denied for a loan you absolutely deserve. The good news? You have the power to fix it, and the law is firmly on your side.

This isn’t just about spotting obvious fraud, like a credit card you never opened. The errors are often much more subtle, but just as damaging. I’m talking about things like an account that’s incorrectly marked "late" when you know you paid on time, a closed account still showing a balance, or even a simple misspelling of your name that links you to someone else's financial mess.

Identifying Common Credit Report Mistakes

Before you can fight back, you need to know exactly what you’re looking for. When you get your report, comb through it with a fine-tooth comb for these common—and costly—inaccuracies:

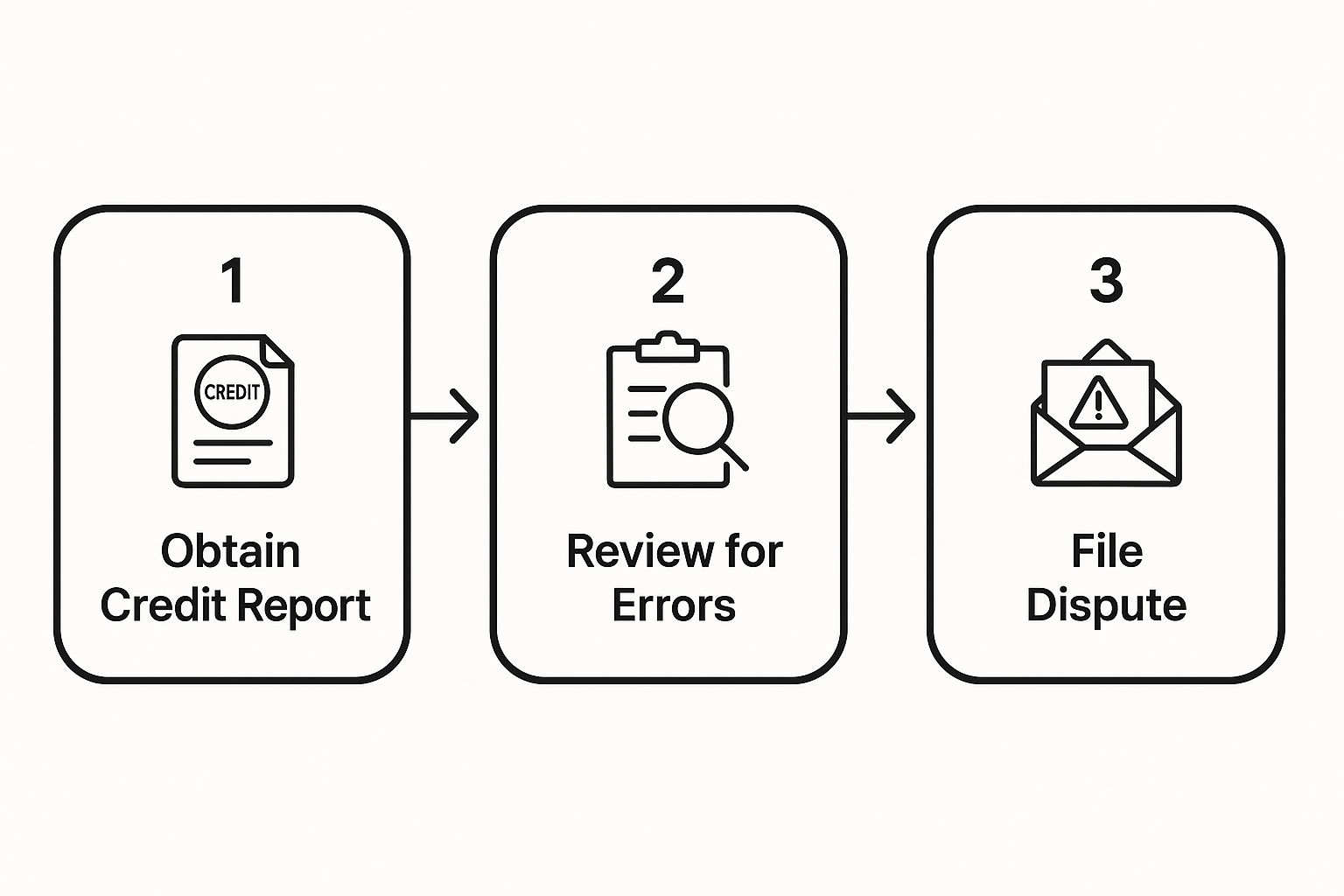

This whole process, from discovery to resolution, is actually more straightforward than you might think.

As you can see, it all starts with getting your report and ends with formally challenging any mistakes you uncover.

How to Officially File a Dispute

Once you've spotted an error, it’s time to take action. You need to file a formal dispute with both the credit bureau showing the error (that’s Equifax, Experian, or TransUnion) and the company that provided the bad info in the first place (the "furnisher," like a bank or credit card company).

Starting online through the credit bureau's website is usually the quickest way to get the ball rolling.

To build a strong case, you need to gather your proof. Think like a detective. This could be anything from:

The importance of a clean report can't be overstated. A Q1 2025 Equifax report noted a 20% jump in mortgage refinancing in Australia following a rate cut, a surge driven by lenders using granular credit data to approve applicants. This just shows how critical every detail on your report is.

For a step-by-step walkthrough, our guide on how to dispute credit report errors with the bureaus gives you the specific templates and instructions you need to get it done right.

Turning Your Credit Report Into a Financial Tool

So, you've gone through every line of your credit report. What's next? This is where the real work—and the real power—begins. A credit report isn't just a backward-looking summary of your financial choices. It's a dynamic blueprint you can use to build a much stronger financial future.

Think of it this way: your report is like a fitness assessment from a personal trainer. It lays out your current strengths and weaknesses in black and white. Now, it's time to build your financial "workout plan."

From Data Points to Credit Score Impact

Every single piece of information on your report is a cog in the machine that calculates your credit score. While the exact formulas used by credit bureaus are proprietary secrets, we have a very clear picture of what matters most. Understanding this connection is the key to focusing your energy where it will have the biggest effect.

The two heavy hitters? Your payment history and credit utilization.

When you check these numbers, you're not just reviewing old data. You're getting your first clear, actionable mission. If you see your credit utilization creeping up, your report has just told you exactly what to do: start paying down those balances.

Staying on top of your credit is more important than ever. One full 2025 consumer credit forecast by TransUnion projects that U.S. consumer credit card balances will climb to a staggering $1.1 trillion by the end of 2025. While the growth rate may be slowing, that sheer volume shows how critical it is to monitor your own piece of that puzzle.

Proactive Strategies for Credit Improvement

With your report in hand, you can shift from being reactive to proactive. Take a hard look at your account balances and payment history.

Do you have a credit card with a high balance and an even higher interest rate? That's your first target. Paying it down will directly lower your credit utilization and give your score a nice boost.

Next, look at your credit mix. Lenders like to see that you can handle different kinds of debt, like revolving credit (cards) and installment loans (auto, personal, or mortgage loans). If your entire credit history is just a couple of credit cards, taking out and responsibly paying off a small personal loan can show you're a more versatile borrower.

This is how you turn a simple document into a powerful financial weapon. It’s about making smart, deliberate moves based on the clear, factual data staring right back at you.

Got Questions? Let's Clear a Few Things Up

Even after walking through your report piece by piece, a few questions might still be floating around in your head. That's completely normal. Let's tackle some of the most common ones that people have after their first real dive into their credit history.

How Often Should I Really Be Checking My Credit Report?

You’ll hear a lot of different advice on this one, but here’s my take. You're legally entitled to a free report from each of the big three bureaus every 12 months, so at the very least, pull them annually. Think of it as a yearly financial check-up to make sure everything looks right and catch any surprises before they become big problems.

Now, if you're gearing up for something big—like applying for a mortgage or a car loan—you’ll want to check more often. I usually recommend looking at your reports a good 3-6 months before you plan to apply. This gives you a runway to fix any errors you might find. And of course, if you get a data breach notification or just have a weird feeling you might be a victim of identity theft, check immediately. For a deeper dive on this, our guide on how often to check your credit report has you covered.

Is Checking My Own Credit Report Going to Hurt My Score?

Nope. Not a chance. This is probably the biggest myth out there, and it’s time we put it to rest for good. When you pull your own credit report directly from the bureaus or through a service like itinscore, it’s recorded as a soft inquiry.

Soft inquiries are basically just for your own information. You’re the only one who can see them, and they have zero impact on your score.

The inquiries that can cause a small, temporary dip in your score are hard inquiries. These only happen when a lender pulls your credit because you’ve formally applied for something like a new credit card, a mortgage, or an auto loan. So go ahead and check your own report with confidence. It’s a smart, safe, and completely harmless financial habit.

Okay, I Found an Error. Now What?

First off, don't panic. Finding a mistake is actually more common than you'd think, and the law is on your side. The key is to act quickly. Whether it’s an account that isn’t yours, a payment that was on time but is marked late, or an incorrect balance, you need to dispute it.

Here’s the game plan: