7 Best Personal Loans with ITIN Number for 2025

Navigating the U.S. financial system without a Social Security Number (SSN) can be challenging, especially when you need access to credit. Many banks and mainstream lenders automatically deny applicants who can't provide an SSN, creating a significant barrier for immigrants, noncitizens, and other residents who use an Individual Taxpayer Identification Number (ITIN). This creates a critical gap, leaving many individuals unable to finance a major purchase, consolidate debt, or cover an unexpected emergency, despite having a stable income and a willingness to repay a loan.

This guide is designed to bridge that gap. We have compiled a detailed roundup of credit unions and financial institutions that offer personal loans with an ITIN number. Instead of facing automatic rejections, you can use this resource to directly connect with lenders who have specific programs for ITIN holders. We will walk you through the top options, providing clear, actionable information on each one.

You will find a breakdown of eligibility requirements, potential interest rates, and loan terms for each lender on our list. To make your application process easier, we've included direct links to their loan pages and screenshots to guide you. This list will help you identify the most suitable lender for your financial situation and take a confident step toward achieving your goals.

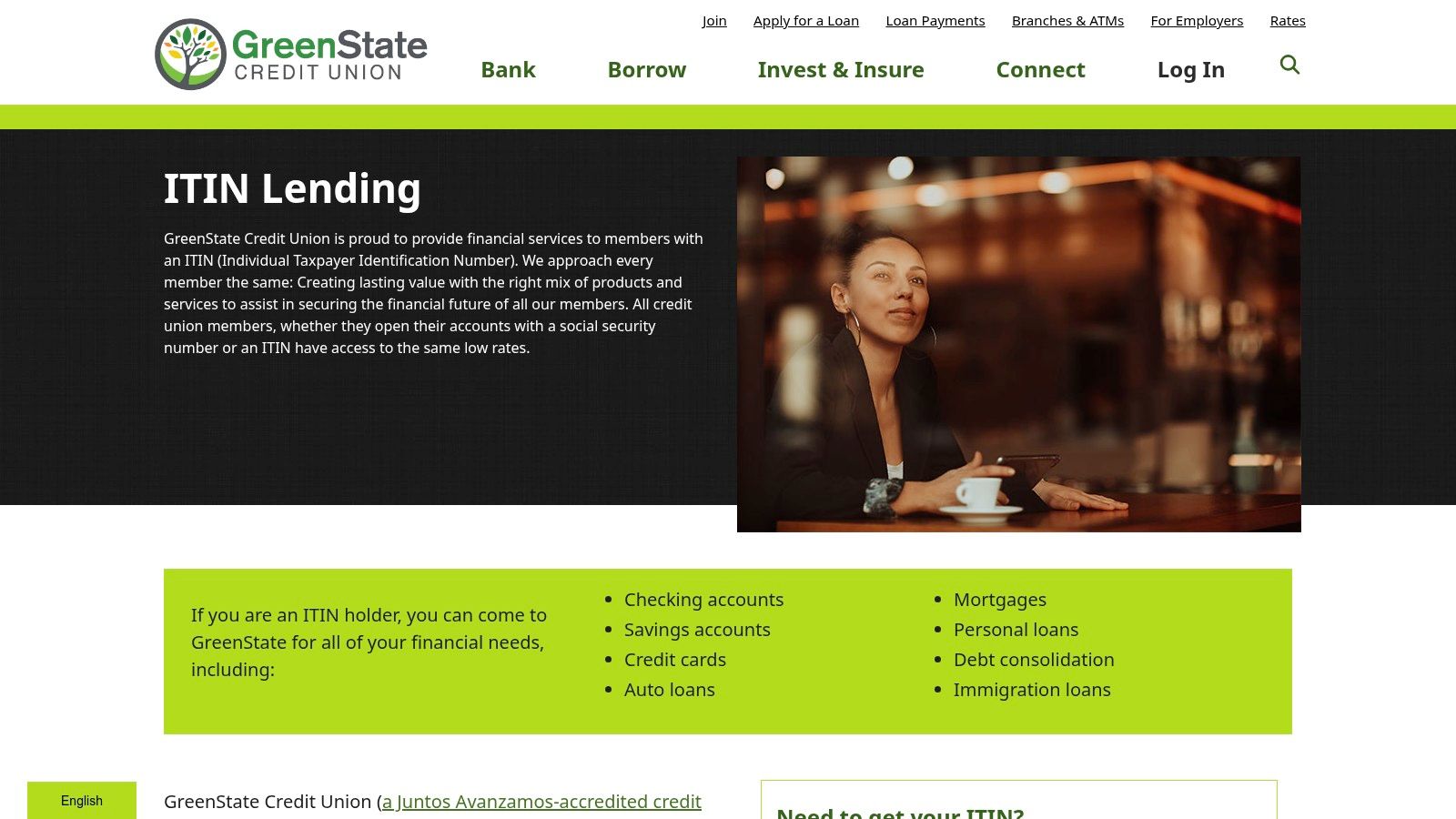

1. GreenState Credit Union

GreenState Credit Union stands out for its dedicated commitment to serving immigrant communities, positioning it as a top choice for individuals seeking personal loans with an ITIN number. Unlike many traditional banks, GreenState has built a specific program designed to welcome and support members who do not have a Social Security Number (SSN). Their focus extends beyond a single product, offering a comprehensive suite of financial services tailored to the needs of ITIN holders, including auto loans, mortgages, and credit cards.

What truly makes GreenState special is its deep integration of bilingual support. The credit union employs Spanish-speaking staff and provides Spanish-language resources across its website and customer service channels, ensuring a clear and accessible experience for the Latino community. This removes language barriers that can often complicate financial processes. For those looking to understand the broader landscape, you can explore more about ITIN lending options to see how GreenState's approach compares.

Key Features and Offerings

Membership and Application Tips

To apply for a personal loan or any other service, you must first become a member of GreenState Credit Union. Membership is typically tied to living or working in specific counties in Iowa and Illinois. However, they also offer membership to individuals who join the American Consumer Council, which is open to all U.S. residents for a small fee.

When applying, be prepared to provide your ITIN documentation, proof of income, and proof of address. Since specific rates and terms are not listed online, it is best to contact them directly or visit a branch to discuss your financial situation and get a personalized quote. This direct interaction is where their specialized, bilingual service truly shines.

Learn More: Visit GreenState Credit Union's ITIN Lending Page

2. Fibre Federal Credit Union

Fibre Federal Credit Union has established itself as a forward-thinking institution by actively providing personal loans with an ITIN number to underserved communities. Their approach is rooted in inclusivity and rate equality, ensuring that ITIN holders receive the same competitive interest rates as members applying with an SSN. This commitment removes a significant barrier to fair credit access, making it a powerful option for building a financial foundation in the United States.

What makes Fibre Federal Credit Union unique is its blend of technology and personalized service. They offer the convenience of applying for loans online but also provide support through video appointments. This modern approach allows applicants to receive face-to-face guidance from a loan officer without needing to visit a physical branch, which is especially beneficial for those with busy schedules or transportation challenges.

Key Features and Offerings

Membership and Application Tips

Membership is the first step to accessing Fibre Federal Credit Union’s services. Eligibility is primarily for those who live, work, worship, or attend school in specific counties across Washington and Oregon. You can easily check your eligibility on their website before proceeding.

When you apply for a personal loan, have your ITIN card or IRS assignment letter ready, along with proof of income (like pay stubs or tax returns) and proof of address. To take advantage of their unique video service, schedule an appointment online. This direct interaction can help clarify any complex requirements and ensures your application is handled efficiently, making the process of securing a personal loan with an ITIN number feel more supportive and manageable.

Learn More: Visit Fibre Federal Credit Union's ITIN Lending Page

3. Star of Texas Credit Union

Star of Texas Credit Union provides a straightforward and accessible path for those seeking personal loans with an ITIN number. This credit union has distinguished itself with a clear, no-frills approach to lending, making it an excellent option for individuals who value transparency and efficiency. Their personal loan product is specifically designed to accommodate ITIN holders, offering a reliable financial tool without the complex requirements often found at larger banking institutions.

What makes Star of Texas a strong contender is its commitment to fair lending practices. The absence of origination fees or prepayment penalties means borrowers can manage their loans without worrying about hidden costs. This focus on serving a diverse membership, including those without an SSN, demonstrates their dedication to financial inclusion and community support in the Central Texas area.

Key Features and Offerings

Membership and Application Tips

To apply for a personal loan, you must first become a member of Star of Texas Credit Union. Membership is available to individuals who live, work, worship, or attend school in specific Central Texas counties, including Travis, Williamson, Hays, Bastrop, and Caldwell.

The application process is designed to be quick and easy. Prepare your ITIN documentation, recent pay stubs or other proof of income, and proof of address. While the loan cap is $10,000 and their offerings are focused solely on personal loans, this specialization allows them to streamline the process for ITIN applicants. For the most accurate terms, it is recommended to contact them directly to discuss your financial profile.

Learn More: Visit Star of Texas Credit Union's Personal Loan Page

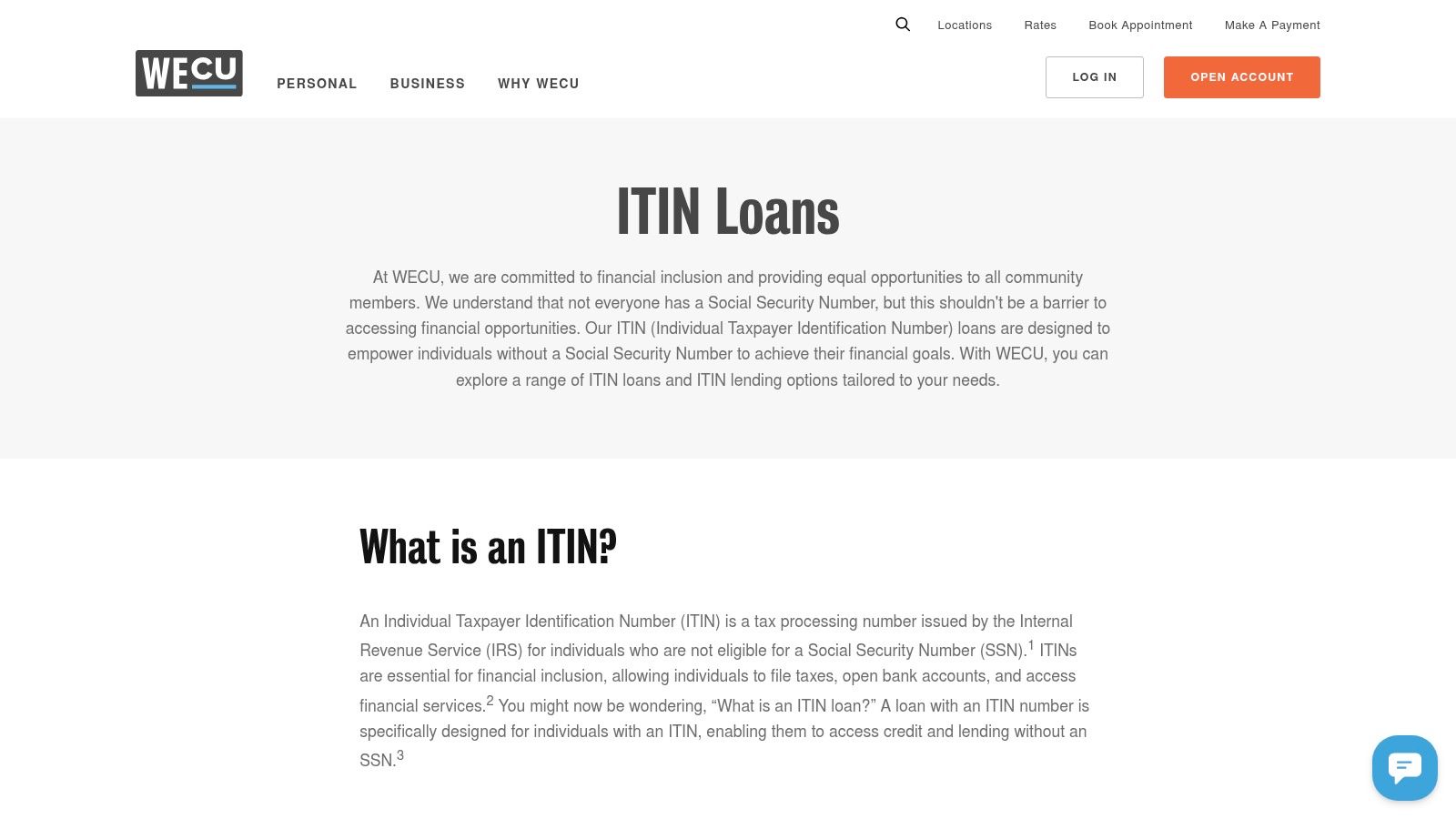

4. WECU (Whatcom Educational Credit Union)

WECU, or Whatcom Educational Credit Union, demonstrates a strong commitment to financial inclusion by offering a robust suite of lending products for ITIN holders. Their program is a lifeline for individuals without a Social Security Number, providing a clear path to securing a personal loan with an ITIN number. More than just a single loan option, WECU extends its services to include auto loans, credit cards, and other financial tools, helping members build a solid credit history and achieve financial stability in the United States.

What makes WECU a standout choice is its member-centric, community-focused approach. As a credit union, it prioritizes the financial well-being of its members over profit, which often translates into more competitive rates, flexible terms, and a more understanding application process. This supportive environment is especially valuable for those new to the U.S. financial system, as WECU aims to empower its members through education and accessible services, ensuring they feel confident managing their finances.

Key Features and Offerings

Membership and Application Tips

To access WECU's ITIN lending program, you must first become a member. Membership is generally available to anyone who lives, works, worships, or attends school in Washington State. This broad eligibility makes their services accessible to a large portion of the state's residents.

When preparing your application, gather your ITIN assignment letter, a valid government-issued photo ID (like a passport or consular ID), and proof of income and address. Since specific loan details and rates are tailored to individual circumstances, it is highly recommended to contact a WECU loan officer directly. This personalized interaction allows you to discuss your financial situation and goals, ensuring you get the best possible terms.

Learn More: Visit WECU's ITIN Lending Page

5. Embold Credit Union

Embold Credit Union distinguishes itself with a strong, mission-driven approach to financial inclusion, making it an excellent resource for those searching for personal loans with an ITIN number. This member-owned institution is dedicated to serving underserved communities, including immigrants and non-U.S. citizens. Their ITIN lending program is not just a single offering but a comprehensive suite that includes personal loans, auto loans, RV loans, and even Payday Alternative Loans (PALs) designed to help members avoid predatory lending.

What makes Embold Credit Union particularly special is its deep commitment to multilingual support and financial education. They understand that navigating the U.S. financial system can be challenging, especially with language barriers. By providing resources and staff who can communicate in multiple languages, they empower ITIN holders to not only secure a loan but also build financial literacy and confidence. This focus on education is a core part of their service, setting them apart from institutions that simply process transactions. For more insights on financial institutions that welcome ITIN holders, you can explore the options available at other banks that accept ITIN numbers.

Key Features and Offerings

Membership and Application Tips

To access Embold's ITIN loan products, you must first become a member. Eligibility is typically based on living, working, worshiping, or attending school in specific counties in Oregon and Washington. Be sure to check their website for the most current membership requirements.

When you apply, have your ITIN certificate, proof of address, and verification of income ready. Since specific rates and loan terms are customized based on individual financial profiles, they are not listed publicly. It is highly recommended to contact an Embold representative directly to discuss your needs. This direct interaction allows them to provide personalized guidance and ensure you find the right financial solution for your situation.

Learn More: Visit Embold Credit Union's ITIN Lending Page

6. Keys Federal Credit Union

Keys Federal Credit Union is a strong contender for individuals seeking personal loans with an ITIN number, particularly for those who value community banking and in-person service. This institution has developed a dedicated ITIN lending program, recognizing the financial needs of non-U.S. citizens and residents without an SSN. Their approach is centered on financial inclusion, aiming to provide a pathway for ITIN holders to not only access funds but also to build a solid credit history in the United States.

What sets Keys Federal Credit Union apart is its commitment to helping members establish financial stability. Beyond just offering a loan, they provide a suite of services designed to foster long-term financial health. This focus on credit building is invaluable for new immigrants or anyone starting their financial journey in the U.S. By providing access to essential credit products, they empower members to achieve broader financial goals, such as future homeownership or securing better interest rates.

Key Features and Offerings

Membership and Application Tips

To apply for a personal loan, you must first become a member of Keys Federal Credit Union. Membership is generally available to individuals who live, work, worship, or attend school in Monroe County, Florida. This geographic restriction means it is a localized option, but highly beneficial for residents in the Florida Keys.

When preparing your application, you will need your valid ITIN, proof of identity (like a passport or Matricula Consular card), and verification of your income and address. Since specific rates and loan terms are not advertised online, the best approach is to visit one of their branch locations or contact them directly. This allows for a personalized consultation where you can discuss your financial situation and needs with a loan officer, ensuring you receive a suitable and fair offer. Their multiple branches offer valuable face-to-face support.

Learn More: Visit Keys Federal Credit Union's ITIN Loans Page

7. Pacific NW Federal Credit Union

Pacific NW Federal Credit Union (PNWFCU) demonstrates a strong commitment to financial inclusion, making it a noteworthy option for those seeking personal loans with an ITIN number. This credit union has developed a specific lending program that welcomes applicants without a Social Security Number, offering them a clear path to financial products. Their services for ITIN holders are comprehensive, including personal loans, auto loans, Visa credit cards, and even mortgages, empowering members to address various financial needs.

What sets PNWFCU apart is its direct and transparent approach to serving diverse communities. By offering a full suite of loan products, the credit union helps members do more than just borrow; it provides the tools necessary for building a robust financial life in the U.S. This is crucial, as accessing multiple forms of credit is a key step in establishing a strong financial history. For those just starting, you can learn more about strategies for how to build credit with an ITIN number to understand how PNWFCU's offerings can help.

Key Features and Offerings

Membership and Application Tips

To apply for an ITIN loan, you must first become a member of Pacific NW Federal Credit Union. Membership is generally available to those who live, work, worship, or attend school in certain counties in Oregon and Washington. Be sure to check their website for the most up-to-date eligibility requirements.

When you are ready to apply, you will need to provide your ITIN, proof of identity, and documentation verifying your income and address. Since specific rates and loan terms are customized based on individual creditworthiness and financial situations, it is recommended to contact the credit union directly. Their team can provide a personalized consultation to guide you through the application and find the best solution for your needs.

Learn More: Visit Pacific NW Federal Credit Union's ITIN Lending Page

Personal Loan Options with ITIN: 7 Credit Unions Compared

Final Thoughts

Navigating the financial landscape in the United States without a Social Security Number can feel like an uphill battle, but securing a personal loan with an ITIN number is not only possible, it’s a tangible goal. As we've explored, a growing number of community-focused financial institutions, particularly credit unions, are recognizing the needs of ITIN holders and creating pathways to credit. This guide has provided a detailed look at several such institutions, from GreenState Credit Union to Pacific NW Federal Credit Union, each offering a unique set of terms, rates, and eligibility requirements.

The key takeaway is that your options are not as limited as they might seem. The journey to obtaining personal loans with an ITIN number requires diligence, preparation, and a proactive approach. Remember that these lenders are often looking for more than just a credit score; they want to see a stable financial picture, which you can demonstrate through consistent income, responsible banking habits, and a strong local connection.

Your Strategic Next Steps

Before you begin applying, it's crucial to organize your efforts to maximize your chances of approval. A strategic approach will save you time and protect your credit from unnecessary hard inquiries.

Here are actionable steps to take right now:

Final Encouragement

Securing a personal loan with an ITIN number is more than just a financial transaction; it's a significant step toward building your credit profile and achieving greater financial stability in the U.S. Each lender on this list represents an opportunity. By preparing your application thoughtfully and choosing a financial partner that aligns with your circumstances, you are not just borrowing money, you are investing in your financial future. Be persistent, be prepared, and be confident in the value you bring as a responsible borrower.

Before applying for personal loans with an ITIN number, understanding your financial standing is crucial. Strengthen your application by first checking your U.S. credit-building potential with itin score. Our free tool analyzes your financial data to provide a personalized report, helping you see what lenders see and improve your chances of approval. Get your free report from itin score and take the first step with confidence.