Personal Loans to Build Credit | Boost Your Score Today

Yes, using a personal loan to build credit is a solid strategy, but it’s a tool, not a magic bullet. When you lock in a pattern of consistent, on-time payments, you’re directly boosting your payment history—which happens to be the single biggest piece of your credit score puzzle.

How a Personal Loan Can Actually Build Your Credit

Taking out a personal loan to build your credit file isn't just about borrowing money. It's really about proving you're financially responsible. Lenders and credit bureaus need to see hard evidence that you can handle debt, and a personal loan gives you a structured way to create that positive track record.

This isn't some niche strategy, either. It’s becoming more and more common across the United States. As of early 2025, a whopping 24.6 million Americans had personal loan debt, and that number jumped by 4.7% in just one year. This tells us that people are increasingly using these loans to hit financial goals, including credit building.

In fact, almost half of those borrowers use the money to consolidate other debts, a smart move that often helps improve credit scores on its own. If you want to dig deeper into the numbers, the latest LendingTree statistics on personal loan usage are a great resource.

The table below breaks down exactly how a personal loan can influence the different parts of your credit score.

How Personal Loans Impact Your Credit Score

As you can see, the biggest impacts—payment history and diversifying your credit mix—are overwhelmingly positive as long as you manage the loan well.

The Power of Consistent Payments

Your payment history is the undisputed heavyweight champion of credit score factors, making up 35% of your FICO score. Every single on-time payment you make toward your personal loan adds a positive mark to your credit report.

Think of it like building trust with the financial system. Each month you pay on schedule, you're sending a clear message to Equifax, Experian, and TransUnion that you're a reliable borrower. That consistent, positive behavior is exactly what future lenders are looking for.

Diversifying Your Credit Mix

Another major benefit is improving your credit mix, which accounts for 10% of your score. Lenders really like to see that you can successfully manage different kinds of credit. If your entire credit history is just revolving accounts like credit cards, adding an installment loan can give your score a healthy boost.

An installment loan is predictable—it has a fixed monthly payment and a clear end date. This stands in contrast to the fluctuating balances and payments of credit cards. Having both shows you're a more well-rounded and capable borrower.

Of course, the loan also affects your "length of credit history" and "amounts owed." A new loan will briefly lower the average age of your accounts, but as you consistently pay it down, you're proving you can manage debt effectively—a huge long-term win. When used the right way, this simple tool can become a powerful stepping stone to better financial health.

Choosing the Right Credit-Building Loan

When your goal is to build credit, not just get cash, you have to be smart about which loan you choose. The world of personal loans to build credit is crowded, and grabbing the wrong one can do more harm than good. Think of this as finding a stepping stone, not a stumbling block.

This means you need to look past just the interest rate. A low APR is great, of course, but for building credit, how a lender reports your payments is what truly matters.

Make Sure Lenders Report to All Three Credit Bureaus

This whole strategy lives or dies on one critical piece of information: does the lender report your payment history to all three major credit bureaus? We're talking about Equifax, Experian, and TransUnion.

If a lender only reports to one or two of them—or even worse, none at all—then all your on-time payments won't build the strong, comprehensive credit profile you're working toward.

Before you fill out a single form, you have to confirm this. It’s often buried in the fine print, so don't hesitate to ask a customer service rep directly: "Do you report my payment history to all three major credit bureaus?" A simple question can save you a world of trouble.

Credit-Builder Loans vs. Standard Personal Loans

You'll generally come across two main options: traditional personal loans and what are called credit-builder loans. Both can work, but they're built for different situations.

For most ITIN holders just getting started, a credit-builder loan is the safest bet. It's like a training program for your financial habits.

The good news is that these tools are becoming more common. The global personal loans market hit a value of USD 387.37 billion in 2024, partly because digital lenders are making it easier for new borrowers to get in the game.

Watch Out for Red Flags

As you look around, you've got to keep an eye out for predatory lenders. They often target people who are keen to build credit and might be more willing to overlook some warning signs.

Here are some tell-tale signs of a bad deal:

Always trust your gut. If an offer seems way too good to be true, it almost always is. For a deeper dive into this, take a look at our guide on using installment loans for building credit. Taking your time to find the right lending partner is the most important move you can make.

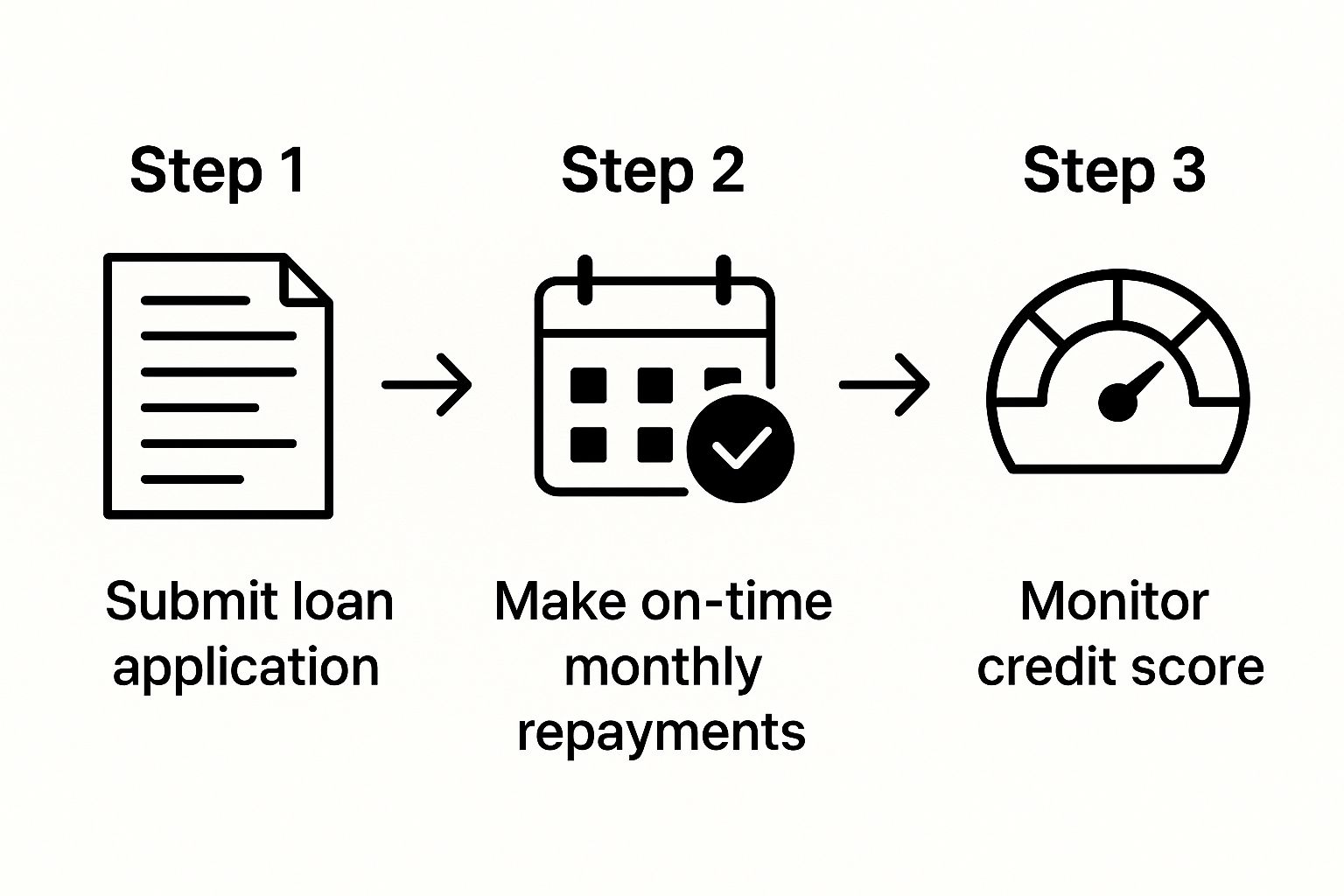

Navigating the Loan Application Process

Applying for a personal loan with a thin credit file can feel intimidating, but don't let it be. It's really just a matter of preparation and showing lenders you're a reliable borrower, even without a long credit history.

Before you even think about filling out an application, you need to get your financial house in order. A great starting point is understanding your personal financial statements. Lenders want to see proof of steady income to be confident you can handle the monthly payments. Go ahead and gather your recent pay stubs, bank statements, and a utility bill for proof of address. Having this folder ready to go will make the whole process feel less chaotic.

Understanding Credit Inquiries

As you start shopping around for loans, you’ll hear the terms "soft inquiry" and "hard inquiry." The difference between them is crucial for protecting your credit score.

My advice? Always start with pre-qualification. Most lenders offer these tools on their websites, allowing you to compare potential rates and terms using only soft inquiries. This way, you can find the most competitive offer before you commit and trigger that hard credit check.

What to Do if Your Loan Application is Rejected

Getting rejected is a bummer, but it’s not a dead end. In fact, it's a learning opportunity. Lenders are legally required to provide a reason for the denial, and that feedback is gold. It might highlight a problem with your income documents or simply confirm that your lack of credit history is the main issue.

If you get a "no," here are a few solid next steps:

The journey from application to approval is a cycle, and each step builds on the last.

Ultimately, getting the loan is just the first part. The real credit-building magic happens when you make those on-time payments, month after month. That's what proves your creditworthiness over the long haul.

Managing Your Loan for Maximum Credit Growth

You've got the loan. Now the real work begins. How you handle this new debt is what will ultimately move the needle on your credit score, proving to lenders that you're a reliable borrower.

Think of it this way: the whole point of using a personal loan to build credit is to create a positive track record. Each monthly payment is another gold star on your financial report card. Your mission is to make sure every single one is on time and in full.

The Golden Rule: Always Pay on Time

Let’s get straight to the point. Your payment history accounts for a massive 35% of your FICO score. It's the single most important factor, and missing even one payment can set you back significantly.

The easiest way to make this a non-issue? Automate it.

Set up automatic payments directly with your lender or through your bank's bill pay system. This is your safety net. It removes the risk of a simple mistake, like forgetting a due date, which could seriously damage your credit-building efforts.

Even with autopay, I always recommend setting a calendar alert a few days before the due date. This gives you a chance to double-check that you have enough cash in your account to cover the payment, avoiding any nasty surprises.

Smart Strategies for Loan Management

Making on-time payments is the foundation, but there are a few other habits that can really maximize your results. Successfully handling this loan involves more than just paying the bill; it's about demonstrating financial savvy. A solid grasp of effective agreements management is a huge asset here.

To keep things simple, here’s a quick breakdown of what to do—and what to avoid.

Loan Management Dos and Don'ts

That last point about paying off the loan is a common mistake. Remember, this loan is a tool with a specific job: to build a long, positive credit history. Lenders want to see that you can manage debt responsibly over an extended period. Paying it off too fast can actually be counterproductive.

The good news is that once you've paid off the loan, it will stay on your credit report as a positive account for up to a decade. It serves as long-term proof of your financial discipline, benefiting you long after you've made that final payment.

Watch Out for These Common Pitfalls

Using a personal loan to build your credit score is a smart move, but it's not without its traps. Think of it like a journey—a few wrong turns can set you back significantly. Let's walk through some of the most common mistakes I see people make, so you can steer clear of them.

First up is the classic blunder: borrowing more than you actually need. When a lender approves you for a certain amount, it can be tempting to take it all. Don't. Your goal here isn't a quick cash infusion; it's to create a track record of reliable, on-time payments. A smaller, more manageable loan is your best friend in this scenario.

Don't Get Caught in a Predatory Loan

This one is a huge risk, especially when you're just starting your credit journey. Predatory loans are designed to trap you with insanely high interest rates, a mountain of hidden fees, and terms that make repayment a nightmare. Be on high alert for offers that scream "guaranteed approval" or pressure you to sign on the spot—those are major red flags.

The data backs this up. The Federal Reserve has noted that over half of all fintech personal loans are given to nonprime borrowers. While this creates opportunity, it also comes with risk. Delinquency rates for these loans hover between 9.5% and 11.2%. You can avoid becoming part of that statistic by choosing a lender who is transparent and fair. For a deeper dive, check out the fintech lending insights from the Federal Reserve.

The Surprising Downside of Paying Your Loan Off Too Soon

This might sound completely backward, but paying off your credit-builder loan too early can actually work against you. Yes, you'll save on interest, which is great. But you'll also be cutting short the very payment history you set out to build.

Here’s why a longer payment history matters more in this specific case:

Think of this loan as a marathon, not a sprint. You're trying to prove you have financial endurance. By sidestepping these common mistakes, you'll ensure your path to a better credit score is a smooth and successful one.

Your Questions on Building Credit with Loans Answered

Even with a solid plan in hand, you're bound to have a few questions. Using a personal loan to build credit is a fantastic strategy, but getting the details right is crucial. Let's walk through some of the most common questions I hear so you can move forward with confidence.

How Soon Will My Credit Score Improve?

This is the big one, isn't it? After you get approved for the loan, expect the new account to pop up on your credit report within 30 to 60 days.

Now, don't be surprised if you see your score dip just a little bit at first. That's completely normal—it's just the temporary effect of the hard credit inquiry from your application. The real magic happens after you've made about three to six months of consistent, on-time payments. That’s when you’ll start to see a positive trend. Building great credit is a marathon, not a sprint.

Is a Credit-Builder Loan a Better Choice?

For someone just starting out with a thin or non-existent credit file, a credit-builder loan is often the ideal first move. They're designed specifically for this purpose, making them easier to qualify for, and they deal with smaller, more manageable loan amounts.

But what if you already have a bit of credit history? If you can get approved for a standard personal loan with a decent interest rate, it accomplishes the exact same thing. Both types of loans work by reporting your responsible payment habits to the credit bureaus, which is the ultimate goal.

What Happens if I Pay My Loan Off Early?

Financially speaking, paying off a loan ahead of schedule is almost always a win. You save money on interest—what’s not to love? But when we’re talking specifically about building credit, the answer gets a little more complex.