Organize Financial Documents for Your ITIN

When you’re building your financial life in the U.S. with an ITIN, getting your paperwork in order isn't just about being neat. It’s the cornerstone of proving you’re financially reliable and ready to build a solid credit history. The best approach I've found is a hybrid one: a secure digital hub for everyday documents and a small, dedicated physical file for those crucial original papers you can't afford to lose.

Your Roadmap to Financial Organization as an ITIN Holder

Trying to navigate the American financial system with an ITIN means your record-keeping has to be impeccable. This isn't just about getting ready for tax season. It's about having a clear, consistent financial story ready to show lenders anytime you apply for a credit card or loan. When you can quickly produce the right documents, you demonstrate the stability and trustworthiness that lenders look for, especially when you don't have a Social Security Number.

This guide will walk you through a practical framework for creating that system. We'll blend a secure digital setup with a minimalist physical file, moving you past the stress of messy paperwork and into a system that works. The whole point is to make sure you can find any document you need—fast—to prove your income, track your spending, and build the strong financial foundation you want.

This push toward better organization is happening everywhere. In fact, the global market for document management systems is expected to balloon from 8.96 billion** to over **17 billion by 2029. You can read more about this trend in document management systems to see how big businesses and individuals alike are going digital for better security and efficiency.

Why This is So Critical for ITIN Holders

Think of every financial document you have as a piece of your story. For an ITIN holder, lenders want to see a clear pattern of consistent income, a stable address, and a history of paying your bills on time. Having all that information organized and at your fingertips makes the entire credit-building journey infinitely smoother.

This system isn't just about storing papers; it's about taking control. It gives you the power to:

Gathering Your Essential Financial Paperwork

Before you can build a system to manage your financial documents, you have to know what you’re looking for. I like to think of this as a scavenger hunt for your entire financial story. You're essentially gathering all the puzzle pieces that prove to lenders and credit bureaus who you are, what you earn, and where you live.

The first step is simply to find your core identity and income documents. These are the absolute must-haves, the foundation for any credit application you'll fill out. For those of us using an ITIN, this list includes a couple of items that are uniquely important.

Core Identity and Income Documents

Your top priority should be tracking down the paperwork that confirms who you are and your capacity to handle payments. Lenders won't even look at the rest of your application without this fundamental proof.

Think of these documents as a trio. Together, they paint a clear picture for any financial institution. They verify your identity and, just as importantly, demonstrate a reliable income stream—a key factor in getting approved for credit.

Proof of Residency and Financial History

With your identity confirmed, the next job is to show that you have a stable U.S. address and a history of responsible financial behavior. This tells lenders you're a settled member of the community who knows how to manage their obligations.

Pull together these items:

This collection of paperwork shows consistency over time. It proves you can handle monthly bills and have an established footprint. Keeping these records organized isn't just a one-time task for an application; it's a crucial habit for managing your financial life in the U.S.

As you gather these documents, you're actually assembling the very data that creates your financial identity. To better understand how this information is used, it’s helpful to see what goes into an ITIN credit report. Seeing the end product really helps you understand why every single piece of paper matters.

Building Your Secure Digital Filing System

Let's be honest, shuffling through stacks of paper is a nightmare, especially when a lender is waiting. The single best thing you can do for your financial life as an ITIN holder is to go digital. Having a well-organized digital hub means you can pull up the exact proof you need for a credit application instantly, turning a stressful scramble into a simple click.

Your first step is choosing a home for your files. A reliable cloud storage service is your best bet. Think Google Drive, Dropbox, or Microsoft OneDrive. They all offer plenty of free space and solid security. Just pick one and commit to it—consistency is what makes the system work.

You’re not alone in this shift. The finance industry itself accounts for about 21.7% of the entire document management market. And with 77% of businesses leaning more heavily on digital tools for efficiency, you can take a page from their playbook to manage your own finances. For a deeper dive, check out this report on document management statistics.

Create a Folder Structure That Just Makes Sense

A logical folder system is non-negotiable. You should be able to find any document in less than 30 seconds. I've found the most intuitive approach is one that's simple to start with but can easily grow with your financial life.

Begin by creating a main folder for each year (e.g., "2024," "2025"). This immediately puts your documents in chronological order, which is a lifesaver come tax time or when you need to look back at your financial history.

Inside each yearly folder, create subfolders for the big categories. A good starting point is:

Smart Naming and Easy Scanning

How you name your files is just as crucial as where you store them. A consistent naming convention makes everything searchable and instantly identifiable. After years of tweaking, I've landed on a format that works wonders: YYYY-MM-DD_Vendor_DocumentType.pdf.

For example, a utility bill from Duke Energy dated March 15, 2024, becomes 2024-03-15_DukeEnergy_ElectricityBill.pdf. This simple trick automatically sorts your files by date, making it incredibly easy to find a specific record.

Getting your paper documents into the system is easier than you think. You don't need a fancy office scanner; your smartphone is more than capable. Apps like Adobe Scan or Microsoft Lens can create crisp, searchable PDFs right from your phone's camera.

Bolster Your Digital Security

Finally, protecting this system is everything. You're storing incredibly sensitive information, so security can't be an afterthought.

As you get better at tracking your accounts, you'll see how important it is to keep a close eye on your balances and payment history. To see how these digital records directly influence your credit, you can check out our guide on credit utilization tips.

Setting Up a Simple Physical Filing System

Even with a top-notch digital system, some documents are just too important to live only as pixels on a screen. This is where a simple, no-fuss physical filing system comes into play. It doesn't need to be fancy. Its sole purpose is to safeguard your most critical original papers and act as a backup to your digital hub.

Think of it as the high-security vault for your financial identity. Your digital system is built for everyday convenience and quick access, but your physical file is for the irreplaceable documents—the very foundation of your financial life in the U.S.

Choosing the Right Tools

Forget about those big, clunky filing cabinets. We're aiming for a low-maintenance setup that keeps vital records secure without creating more clutter. Honestly, a simple accordion file folder is often all you need to get started. They’re cheap, portable, and come with built-in dividers that make sorting a breeze.

But if you want to take it a step further—and I really think you should—invest in a small, fireproof and waterproof document box. You'd be surprised how affordable they are, and the peace of mind they offer is priceless. Knowing your most important papers can withstand a fire or flood is a huge relief.

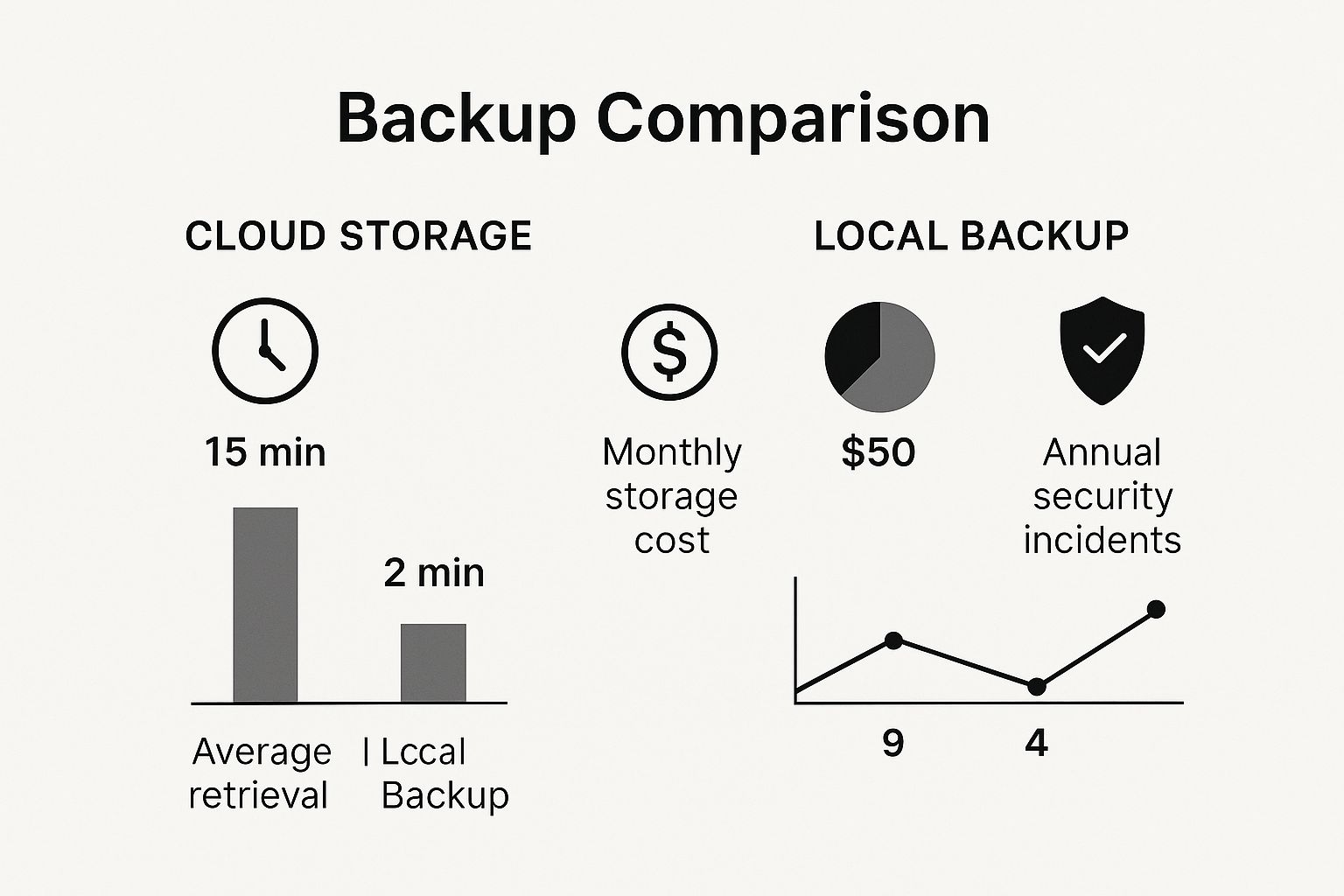

This infographic breaks down some of the key differences between cloud storage and having a local backup.

As you can see, while cloud storage gives you that instant access, a secure local option like a fireproof box provides a layer of physical protection for a one-time cost that digital just can't match.

What to Keep in Hard Copy

This physical system is exclusively for documents that are either legally required in their original form or are a massive headache to replace. Your digital system holds the copies, but this box holds the originals.

Here's what absolutely belongs in your physical file:

To help you decide what goes where, I've put together a quick guide. This table breaks down common financial documents and suggests the best way to store them—digitally, physically, or sometimes both.

Digital vs. Physical Storage Guide

This approach ensures you have quick digital access for day-to-day needs while keeping the truly irreplaceable originals protected from damage or loss.

Create clear labels for your accordion file or box dividers—"Identity," "Contracts," "Property." This makes finding anything you need take seconds, not hours. This small, focused physical system is the perfect real-world backup to your efficient digital workflow, ensuring you can organize financial documents without drowning in paper.

Keeping Your System Alive for Long-Term Financial Health

Let's be honest: a document organization system is only as good as your commitment to it. Setting up perfectly labeled folders is a fantastic first step, but the real magic happens when you build a habit of keeping everything current. If you don't, you’ll eventually find yourself right back where you started, staring down another mountain of paperwork.

The whole point is to make filing new documents a quick, almost unconscious action, not a chore you dread. My personal recommendation? Carve out just 15 minutes each week for a "financial filing" session. Pick a time that works for you, maybe Sunday evening, and make it a non-negotiable part of your routine.

In that short window, your only task is to deal with any new documents from the week—scan them, give them a clear name, and drop them into the right digital folder. This simple habit stops things from piling up and ensures you can always organize financial documents the moment you need them. When a lender asks for your last three pay stubs, you'll have them ready to go.

Knowing When to Hit 'Delete'

A huge part of maintenance is knowing what you can safely get rid of. Hoarding every single piece of paper forever just creates digital and physical clutter. A smart retention policy is what keeps your system lean, relevant, and useful.

Think of it as seasonal cleaning for your financial life. Having a clear schedule for what to keep and what to toss is a proactive strategy. It makes big moments like tax season or applying for a loan so much smoother and less stressful.

This disciplined approach isn't just a personal quirk; it's a trend. The market for document management is growing fast, largely because regulations demand accurate records. For instance, by late 2023, 42.5% of EU businesses were using cloud services for their files. Individuals are catching on, adopting similar practices to manage their own financial lives. You can read more about these intelligent document processing market trends if you're curious.

Your Document Retention Timeline

Not every document needs to live in your files forever. Here’s a practical guide I use for how long to hang onto the important stuff:

Sticking to a schedule like this keeps your files from becoming a digital junkyard. An organized system is more than just tidy—it's a powerful tool for building your financial future. This solid foundation becomes especially critical when you're ready to learn more about how to establish credit with an ITIN.

Got Questions? Let's Talk About Your ITIN and Paperwork

When you're building your financial life in the U.S. with an ITIN, a few common questions always come up. It's one thing to have a system for your documents, but it's another to feel confident about the little details. Let's dig into some of the things people ask me about most.

How Long Should I Keep My Financial Documents?

This is probably the most practical question I get. Nobody wants to be a hoarder, digitally or physically, but you also don't want to get caught without a critical piece of paper. The goal is to find that sweet spot—being ready for any request from a lender or the IRS without keeping every gas receipt from 2017.

Here’s a simple timeline I've found works best: