Your 6-Step Mortgage Pre Approval Checklist for 2025

Dreaming of owning a home in the U.S. using your Individual Taxpayer Identification Number (ITIN)? This goal is more achievable than you might think. The first critical step on your homeownership journey is securing a mortgage pre-approval. This letter is not just a piece of paper; it's a powerful tool that proves to sellers and real estate agents that you are a serious, financially prepared buyer. For ITIN holders, this step is especially important, as it officially confirms your borrowing capacity to lenders who specialize in non-traditional financing.

This guide provides a comprehensive mortgage pre approval checklist tailored specifically for you. We will eliminate the guesswork by outlining the exact documents and financial metrics you need to have in order. We'll cover everything from reviewing your credit history and verifying your income to calculating your debt-to-income ratio and preparing your asset statements. Following this blueprint will help you navigate the process with confidence, sidestep common hurdles, and take a significant leap toward getting the keys to your new home. Think of this as your personal roadmap to turning your homeownership dream into a reality.

1. Establish & Review Your Credit with an ITIN

For ITIN holders, establishing a robust U.S. credit history is the foundational step in any mortgage pre approval checklist. Your credit report and score are the primary tools lenders use to assess financial reliability and risk. A strong credit profile demonstrates your ability to manage debt responsibly, directly influencing your eligibility, interest rate, and the loan terms you are offered.

While many conventional mortgage programs look for a FICO score of 620 or higher, a growing number of lenders offer specialized ITIN mortgage products. These lenders may have more flexible criteria but will still rigorously examine your creditworthiness. The goal is to build a verifiable history of on-time payments and prudent credit management, turning what could be an obstacle into a key asset for your application.

Why Your Credit History Matters

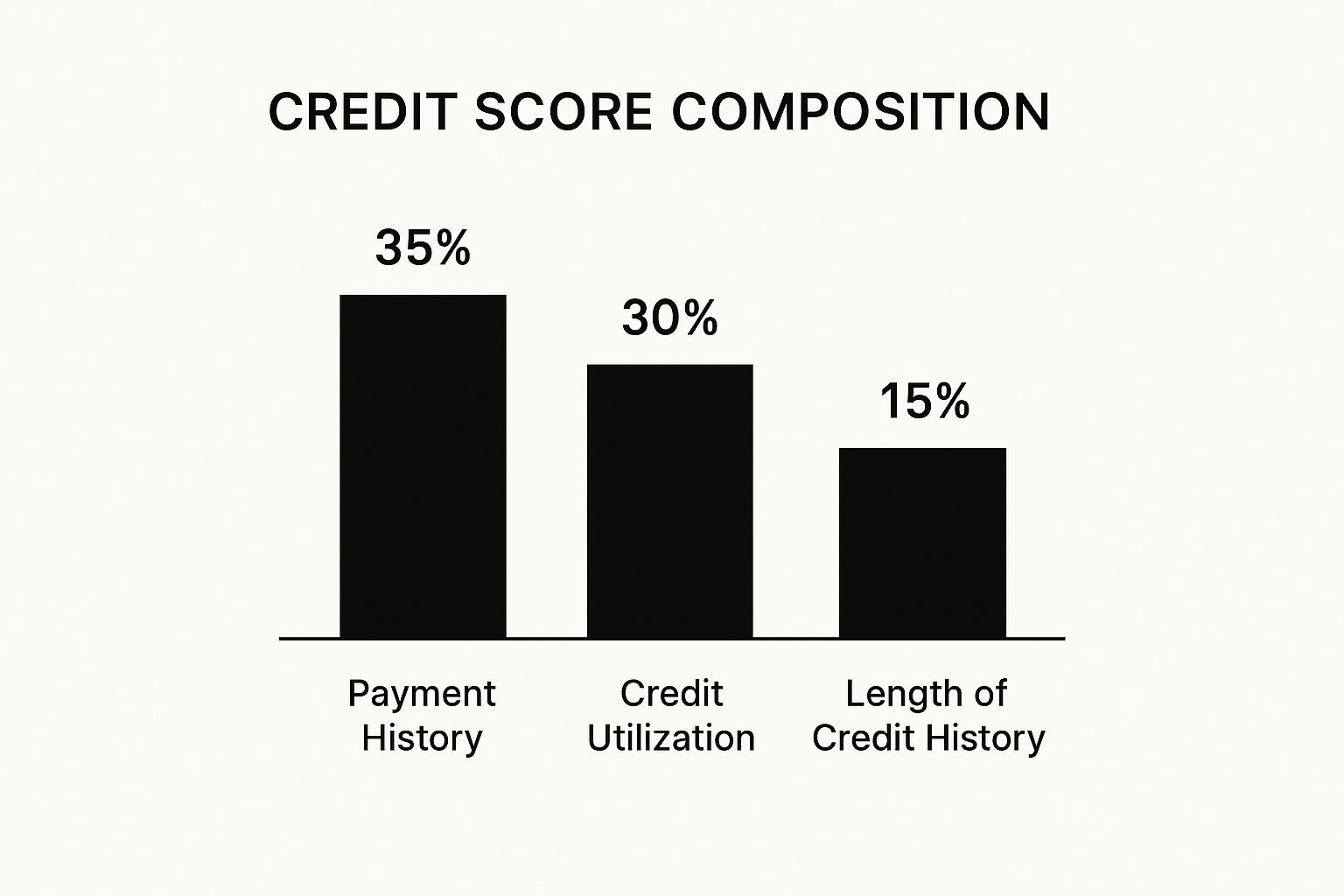

Lenders analyze three core components of your credit profile to gauge risk. These components, popularized by scoring models from FICO and VantageScore, are your payment history, your credit utilization ratio, and the length of your credit history. Each one tells a part of your financial story.

The following bar chart visualizes the relative importance of these three key factors in determining your credit score.

As the chart illustrates, your payment history and credit utilization together account for a significant majority of your score, making them the most critical areas to focus on for improvement.

Actionable Tips for Building and Improving Your ITIN Credit

2. Income Documentation and Employment Verification

For ITIN holders, providing thorough proof of stable income is a cornerstone of the mortgage pre approval checklist. Lenders need absolute confidence in your ability to make monthly mortgage payments over the long term. Your income documentation and employment history are the primary evidence they use to assess your financial capacity and approve your loan.

While specific requirements can vary, most lenders, including those offering ITIN mortgage products, adhere to standards influenced by entities like Fannie Mae and Freddie Mac. They typically require a consistent employment history of at least two years. This demonstrates stability and predictable earnings, which are crucial for mitigating the lender's risk and securing your pre-approval.

Why Your Income and Employment History Matter

Lenders scrutinize your income to calculate your debt-to-income (DTI) ratio, a key metric that compares your monthly debt payments to your gross monthly income. They verify your employment to ensure your income source is stable and likely to continue. This comprehensive review confirms you can handle the financial responsibility of a mortgage.

For example, a teacher with a 10-month contract but consistent employment over several years is viewed favorably. Similarly, a salesperson with variable commission income will have their earnings averaged over the past two years to establish a reliable figure for qualification.

Actionable Tips for Preparing Your Documentation

3. Down Payment and Asset Verification

Your down payment is the portion of the home's purchase price you pay upfront, and it's a critical component of your mortgage pre-approval checklist. Lenders need to verify not only that you have the funds, but also that they come from a legitimate, traceable source. This process involves documenting your savings, investments, and any gift funds you plan to use, assuring the lender that you are financially prepared for homeownership.

For ITIN holders, proving the source of your down payment is especially important. Because traditional financial histories may be less extensive, lenders will meticulously review your bank statements and asset records. A well-documented down payment fund demonstrates financial discipline and significantly strengthens your mortgage application, proving you have the stability required for a long-term loan commitment.

Why Your Asset Documentation Matters

Lenders need to ensure your down payment funds are seasoned, meaning they have been in your account for a specific period, typically at least 60 days. This regulation, largely influenced by guidelines from government-sponsored enterprises (GSEs), helps prevent mortgage fraud and confirms the money is genuinely yours, not a last-minute loan.

By providing clear, comprehensive documentation for all your assets, you build trust with the lender and streamline the pre-approval process, avoiding potential delays or denials.

Actionable Tips for Preparing Your Down Payment

4. Debt-to-Income Ratio Analysis

Your debt-to-income (DTI) ratio is a cornerstone metric in any mortgage pre approval checklist, offering lenders a clear snapshot of your capacity to manage new debt. It compares your total monthly debt obligations, like credit card payments, auto loans, and student loans, against your gross monthly income. For ITIN holders, a favorable DTI ratio signals financial stability and responsible cash flow management, which is crucial for securing a mortgage.

While lenders often prefer a DTI below 43%, as recommended by entities like Fannie Mae and Freddie Mac, some ITIN loan programs may offer more flexibility. Demonstrating a low DTI can significantly improve your loan terms, lower your interest rate, and ultimately increase your borrowing power. It’s a direct reflection of your financial health that lenders examine closely.

Why Your DTI Ratio Matters

Lenders use your DTI to assess how much of your income is already committed to existing debts. This helps them determine if you can comfortably afford a new monthly mortgage payment on top of your current financial responsibilities. A high DTI can be a red flag, suggesting you might be overextended and could struggle with payments if your financial situation changes.

Understanding and optimizing your DTI before you apply is a strategic move that positions you as a less risky borrower in the eyes of any lender.

Actionable Tips for Improving Your DTI Ratio

5. Tax Returns and Financial Documentation

For ITIN holders, tax returns are the cornerstone of income verification in a mortgage pre approval checklist. While pay stubs show current earnings, your tax filings provide a comprehensive, multi-year history of your financial stability and income sources. Lenders use this documentation to build a complete picture of your financial health, ensuring the income you claim is consistent, reliable, and officially reported to the IRS.

Lenders typically require at least two years of complete, signed personal tax returns (Form 1040). This requirement is especially critical for self-employed individuals, freelancers, or those with variable income. By thoroughly reviewing your tax history, lenders can confidently assess your long-term ability to handle a mortgage payment, making this a non-negotiable step in the home-buying process.

Why Your Tax Returns Matter

Your tax returns offer a verified, detailed look into your financial life that other documents cannot. Lenders analyze them to confirm the income you’ve stated on your application and to uncover details about your financial obligations and assets. They look for consistency and a clear trend in your earnings.

For example, a self-employed real estate agent whose tax returns show a steady increase in commission income over two years demonstrates a stable and growing business. Conversely, a business owner who claims significant depreciation on equipment might see their qualifying income reduced, even if their business has strong cash flow.

Actionable Tips for Preparing Your Tax Documents

6. Bank Statements and Asset Documentation

For ITIN holders, providing comprehensive asset documentation is a critical component of the mortgage pre approval checklist. Lenders need to verify you have sufficient funds for the down payment, closing costs, and cash reserves. Bank statements serve as the primary evidence of your financial stability and the legitimacy of your funds, reassuring lenders of your capacity to handle the financial responsibilities of homeownership.

Most lenders will request at least two to three months of statements for all your financial accounts, including checking, savings, and investment accounts. They scrutinize these documents for consistent balances, regular income deposits, and the source of large sums of money. This detailed review helps prevent fraud and ensures the funds were not borrowed in a way that creates additional, undisclosed debt, which could impact your ability to repay the mortgage.

Why Your Asset Documentation Matters

Lenders analyze your bank statements to verify three key aspects of your financial health: the source of your down payment, your cash reserves, and your overall financial discipline. Each element provides insight into your readiness for a mortgage commitment.

Properly preparing and presenting this documentation can significantly streamline the underwriting process and prevent last-minute delays or denials.

Actionable Tips for Preparing Your Bank Statements

Mortgage Pre-Approval Checklist Comparison

From Checklist to Closing: Your Next Steps to Homeownership

Navigating the mortgage pre-approval checklist as an ITIN holder is a significant accomplishment, moving you from the realm of aspiring homeowner to a serious contender in the real estate market. This is not just about gathering paperwork; it is about building a compelling narrative of your financial stability and readiness for this major investment. By diligently working through each item, from reviewing your credit report to meticulously organizing your income and asset documentation, you have laid a robust foundation for success. You have proactively addressed the specific requirements that lenders examine, transforming potential hurdles into demonstrations of your creditworthiness.