Using Loans to Repair Credit A Practical Guide

Yes, you can absolutely use loans to repair your credit, but think of them less like a magic wand and more like a tool. The right loan gives you a structured way to build a positive payment history, but the real work—and the real success—comes from you making consistent, on-time payments.

This is how you show the credit bureaus you’re financially responsible.

Setting Realistic Expectations for Credit Repair

It’s important to get one thing straight from the start: no loan can instantly erase past financial mistakes. What they can do is help you write a new, positive chapter in your credit story. The principle is simple: you take on a small, manageable debt and pay it back responsibly, creating a fresh track record of reliability.

This new payment data gets reported to the big three credit bureaus—Equifax, Experian, and TransUnion. Over time, this consistent positive activity starts to outweigh older, negative marks on your report, and your credit score will gradually improve.

Your Roadmap to a Better Score

The trick is picking the right loan for your situation. Each type serves a slightly different purpose, whether you're building credit from scratch or trying to consolidate high-interest debt that's weighing you down.

For those facing significant credit hurdles on the path to homeownership, it can be a huge help to connect with mortgage lenders specializing in credit issues who know how to navigate these waters.

To give you a clearer picture of your options, I've put together a quick guide to the main loan types we'll be discussing. This table breaks down how each one works and who it's designed for, helping you find the perfect fit for your credit-building strategy.

Quick Guide to Credit Repair Loan Options

Here's a simple breakdown of the most common tools for the job.

Choosing the right path is the first step, and understanding these differences will set you up for success.

How Loans Influence Your Credit Score

To really get how loans can repair credit, you first need to understand what makes a credit score tick. Think of your score as your financial report card. It’s not just a single grade; it's a weighted average of several different factors that tell lenders how you handle your money.

When you take out a loan, you're adding a new, important "class" to that report card. Every single payment is like an assignment. Pay on time, and you get an 'A'. Pay late, or miss a payment entirely, and that failing grade can drag your whole average down. It’s that simple.

Getting a handle on this is the first real step toward rebuilding your credit. Let’s look at the "subjects" that make up your score and how a loan affects each one.

The Five Pillars of Your Credit Score

Most lenders in the U.S. lean on the FICO® Score to make decisions. It's calculated using five key factors, but they aren't all created equal. Some carry a lot more weight than others. If you want to dive deeper into the scoring system, you can learn more about what a FICO Score is in our detailed guide.

Here’s a breakdown of how a loan fits into the puzzle:

How a Loan Strengthens Your Financial Foundation

Picture your credit profile as a house you're building. Every on-time loan payment is another solid brick you lay in the foundation. Your payment history is that foundation—it has to be rock solid for anything else to stand.

This process tackles the most critical part of your score head-on. In just six to twelve months, those consistent reports can create a powerful new story of financial responsibility.

On top of that, adding an installment loan to the mix shows you can handle more than just credit cards. It signals financial maturity, making you a much better candidate for getting approved for other loans with good interest rates down the road.

The Power of Credit-Builder Loans

When your goal is to rebuild your financial standing from the ground up, credit-builder loans are one of the most direct and effective loans to repair credit. They're a bit different from a typical loan, though. Instead of getting cash upfront, they actually work in reverse, designed specifically to help you prove you’re a reliable borrower.

Think of it like putting an item on layaway. You make small, regular payments over several months, and once you’ve paid the full amount, you get to take the product home. A credit-builder loan works the same way—except the "product" is a lump sum of cash.

This clever structure essentially turns the loan into a forced savings plan that builds your credit history at the same time. It’s a low-risk move for both you and the lender, which makes it an ideal starting point for anyone with a thin or damaged credit file.

How a Credit-Builder Loan Works

The mechanics are refreshingly simple. Once you’re approved, the lender puts the loan amount—usually somewhere between 300 and 1,000—into a locked savings account. You can’t touch it just yet.

Your only job is to make small, fixed monthly payments over a set period, typically from 6 to 24 months. Here's the magic part: every single on-time payment you make gets reported to the three major credit bureaus—Equifax, Experian, and TransUnion.

After you've made that final payment, the lender unlocks the account. The full loan amount is now yours to keep, and it might have even earned a little interest. You’ve just successfully created a positive payment history and saved some money without even thinking about it.

Weighing the Pros and Cons

Like any financial tool, credit-builder loans have their own set of upsides and downsides. Knowing both sides of the coin is the best way to figure out if this is the right move for you.

Key Advantages:

Potential Downsides:

Finding the Right Lender

You can find credit-builder loans at a few different kinds of financial institutions, and it really pays to shop around to find the best terms and lowest fees.

The demand for these tools is huge. The global credit repair services market was valued at 5.29 billion** in 2025 and is projected to skyrocket to **13.05 billion by 2032. With that kind of growth, more and more lenders are getting in the game.

Here’s where to start your search:

When you’re comparing options, pay close attention to the interest rate (APR), any fees, and the loan term. You want to make sure the monthly payment fits comfortably into your budget, setting your credit-building journey up for success from day one.

Using Personal Loans to Consolidate Debt

If you're already juggling multiple debts, a personal loan offers a completely different—and often faster—path to credit repair than a credit-builder loan. Instead of building a new history from scratch, this strategy is all about streamlining what you already owe to make an immediate dent in your credit utilization ratio.

Imagine your high-interest credit cards are a bunch of small, out-of-control bonfires. A personal loan for debt consolidation is like one giant fire extinguisher. You put out all the little fires at once and are left with a single, predictable payment, often at a much better interest rate.

This isn't just about making your life easier. It's a strategic move. By paying off those revolving credit card balances with a single installment loan, you can slash your credit utilization, a factor that makes up a massive 30% of your credit score.

Taming Your Credit Utilization Ratio

Your credit utilization ratio is a simple yet powerful number. It’s just the percentage of your available credit that you're currently using. For instance, if your credit card has a 1,000** limit and you've got a **900 balance, your utilization is a sky-high 90%.

Lenders see high utilization as a red flag that you might be stretched too thin financially, which can seriously pull your score down. The golden rule is to keep this ratio below 30%.

When you use a personal loan to wipe out those card balances, your utilization can plummet to 0% almost instantly. You still owe the money, of course, but you've shifted the debt from a volatile revolving account to a stable installment loan. Credit scoring models love that stability. You can learn more about how this works in our guide on what debt consolidation is.

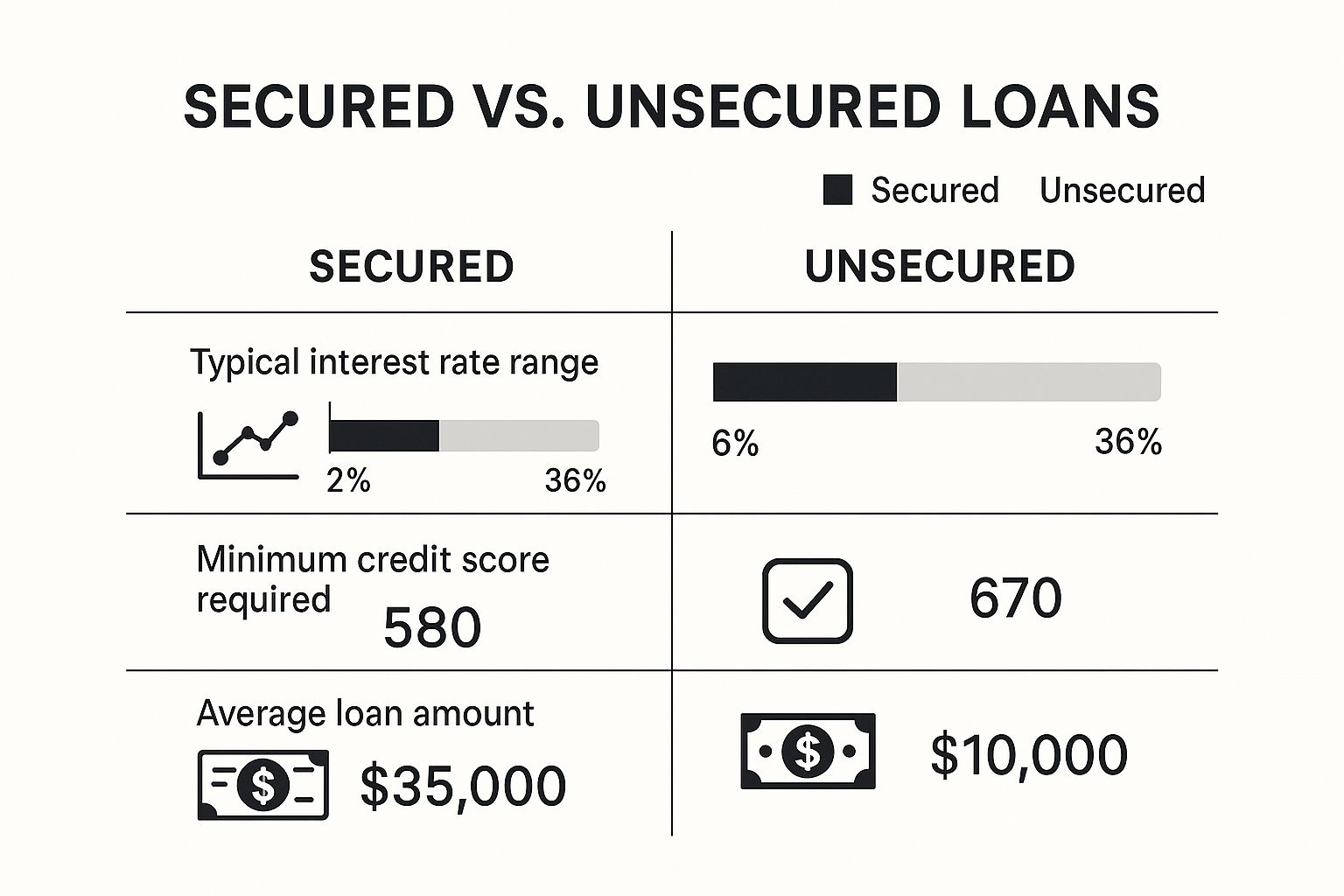

The infographic below breaks down the key differences between secured and unsecured loans, which is something you'll need to consider when shopping for a personal loan.

As you can see, while unsecured loans might come with higher interest rates, they don't require you to put up collateral. This often makes them a more straightforward option if your main goal is just to consolidate debt.

When Personal Loans Make Sense for Credit Repair

A personal loan isn't a magic wand for every credit situation. It works best as a targeted tool to solve a specific problem: high-interest credit card debt. And it's a popular solution—Americans are increasingly turning to them for exactly this purpose.

In fact, by the second quarter of 2025, total unsecured personal loan balances in the U.S. reached a record $257 billion, marking a 4% jump from the previous year. But there's a flip side to that growth. The rate of people falling 60 or more days behind on their payments also climbed to 1.31%, the highest level since 2009. These numbers, highlighted in a full TransUnion report, show that while personal loans are a powerful tool for repair, you have to be confident you can handle the new payment.

To help you decide what's right for you, let's compare the two main loan types we've discussed for credit repair.

Credit-Builder Loan vs Personal Loan for Credit Repair

Ultimately, choosing between these two powerful loans to repair credit comes down to your personal situation and your goals. If you’re starting from scratch, a credit-builder loan is your foundation. But if you’re looking to get a handle on existing debt and get a quick win, a personal loan for consolidation is your reset button.

Building Credit with an ITIN

For millions of people in the U.S., the journey to financial stability doesn't start with a Social Security Number (SSN). It starts with an Individual Taxpayer Identification Number, or ITIN. If you're an ITIN holder, you might feel like you're playing the credit game with a different set of rules.

But here’s the good news: using loans to repair credit or build it from the ground up is absolutely within your reach. While some of the big national banks might have systems that automatically reject applications without an SSN, a growing number of financial institutions are looking past that. The secret is knowing where to look and what to bring.

Think of it this way: your credit-building journey with an ITIN is about demonstrating your reliability in different ways. The goal is the same—to build a strong, positive credit history—but your approach will be a little more hands-on.

Finding ITIN-Friendly Lenders

The biggest challenge is often finding a lender who will even look at your application. Mainstream banks can be a frustrating dead end, but that's okay—your best allies are usually closer to home. Community-focused institutions are often far more willing to look at the whole person, not just a single number.

Here's where you should start your search:

Preparing Your Application for Success

Once you've found a few promising lenders, the next step is getting your paperwork in order. A complete and organized application sends a powerful message: you're serious and prepared. Lenders need to confirm who you are and that you can repay the loan, and your ITIN is the key to that puzzle.

Having these documents ready to go will make the whole process smoother and significantly boost your chances of getting approved.

Essential Document Checklist:

By focusing on these community-minded lenders and showing up with a well-prepared application, you can absolutely get the loans to repair credit you need to build a solid financial future in the United States.