Using Loans to Boost Credit Score for ITIN Holders

Using specific loans to boost your credit score is a smart and proven path forward, especially if you're navigating the financial system with an ITIN. Certain loans, like credit-builder loans, are literally designed to get your positive payment history reported to the credit bureaus, building a solid financial reputation from scratch.

How Loans Actually Build Your Credit Score

It's helpful to stop thinking of a loan as just borrowed money. Instead, see it as a powerful tool to prove you're financially responsible. Every time you take out a loan and handle it the right way, you're creating a public record of good behavior that the credit bureaus use to calculate your score. It’s a direct way to tell future lenders, "You can trust me."

This strategy works because it directly influences the five key ingredients of your FICO score—the very same model used by 90% of top lenders.

The Nuts and Bolts of Building Credit

So, how does it actually work? The magic is in the reporting. When you make a payment, your lender doesn't just keep that information to themselves. They report your activity to the three major credit bureaus: Equifax, Experian, and TransUnion.

This consistent, positive reporting is what builds your credit file from the ground up. Over a few months, these on-time payments stack up, creating a track record that leads to a stronger credit score. You can dive deeper into how installment loans are specifically designed for this purpose in our dedicated guide.

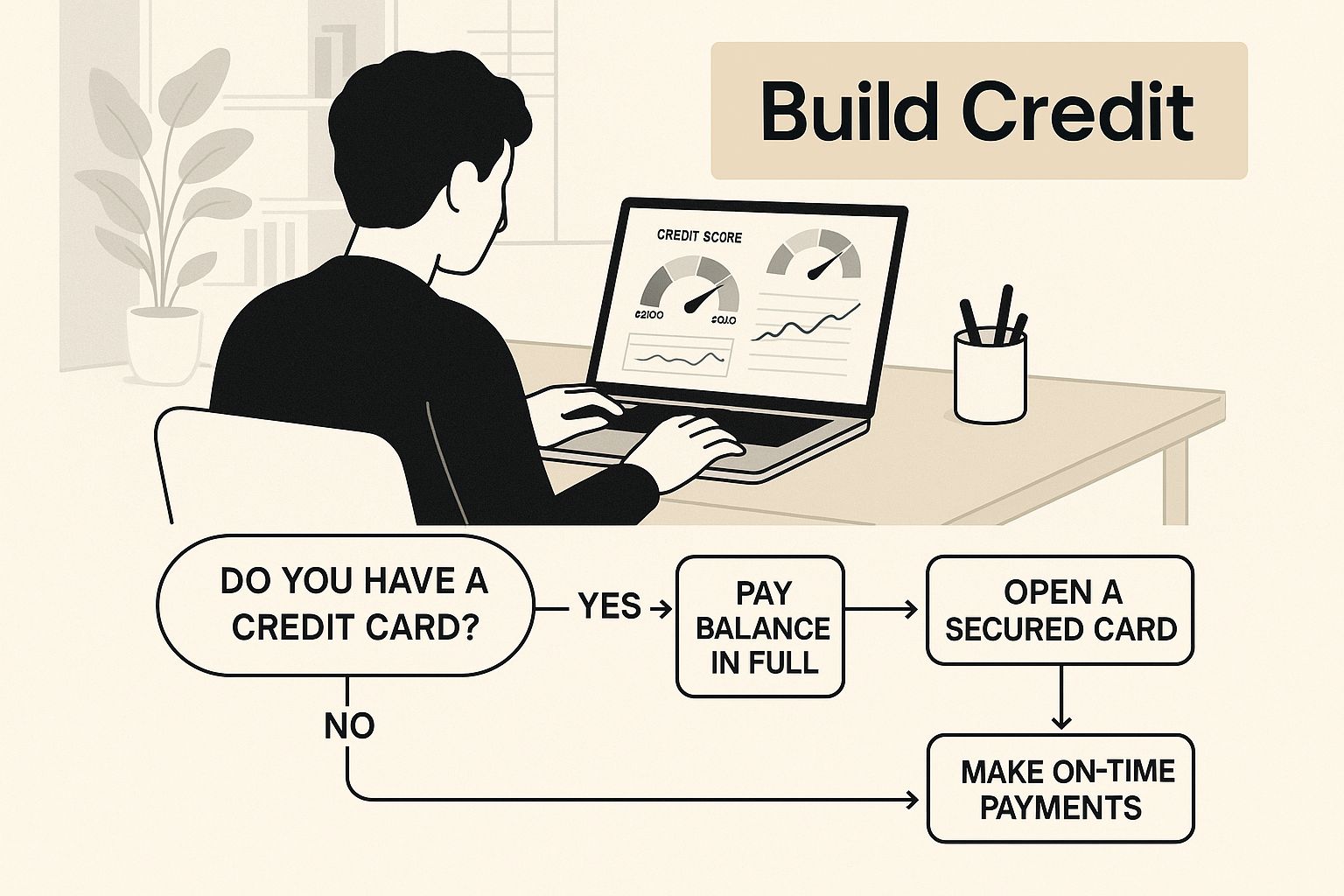

This visual breaks down how different financial moves can come together to build a strong credit profile.

Loan Types and Their Credit Score Impact

Choosing the right loan is crucial. Not all debt is created equal when it comes to credit building. Here’s a quick rundown of common loan types and how they can impact your score.

As you can see, each option comes with its own set of pros and cons. The key is to pick the one that aligns with your current financial situation and your long-term goals.

The image above really drives home the point that managing credit products consistently is the core of improving your financial health. Broader economic trends also play a role. For example, in the first half of 2025, Australia saw a 20% increase in mortgage refinancing after interest rates were cut, showing how quickly people react to financial shifts. This is exactly why lenders rely so heavily on accurate credit histories to manage their own risk. You can find more global credit trend insights from Equifax.

Choosing the Right Credit-Builder Loan with an ITIN

When you’re starting with an ITIN and your main goal is building a solid credit history, you can’t just pick any loan off the shelf. It’s a bit of a minefield out there, and choosing poorly can saddle you with high interest, surprise fees, and almost no real benefit to your credit score.

The absolute most important thing to look for is a lender who reports your payments to all three major credit bureaus: Experian, Equifax, and TransUnion. This is non-negotiable. If they don't report, your on-time payments might as well not exist in the eyes of the credit system.

Your Top Credit-Building Options

As an ITIN holder, you've got a few really smart paths you can take. Each one is a little different, so it's all about finding the right fit for your financial situation.

Here’s a quick rundown of the best players in the game:

So, what’s your primary goal? If it's pure credit building and you have the discipline, a credit-builder loan is a safe and incredibly effective tool. If you want to get used to managing a credit line for daily expenses, a secured card is probably your best bet.

For a deeper dive into all the possibilities, check out our guide on the best credit builder products for ITIN holders.

Questions to Ask Any Lender

Before you sign any loan agreement, you need to put on your detective hat. Asking the right questions upfront will save you a world of trouble and make sure the loan is actually working for you, not against you.

Walk into any conversation with a potential lender armed with this checklist. Don't be shy about asking these directly.

By thoroughly vetting lenders with these questions, you can confidently pick a product that truly helps you build that strong credit foundation. It's this careful, deliberate approach that ensures all your hard work pays off in a higher credit score.

Getting Ready to Apply for Your ITIN Loan

Applying for a loan with an ITIN to build your credit score is probably a lot less complicated than you imagine. The whole game is about being prepared. When you know exactly what lenders are looking for, you can walk in with a strong, organized application that screams "financially reliable," even if your credit history is just getting started.

Think of your application as your financial story. Since you don’t have a long credit report to do the talking, you'll use other documents to paint a picture of stability and trust. The good news is that lenders who specialize in ITIN loans are completely used to this and know exactly what to look for.

Get Your Paperwork in Order First

Before you even think about talking to a lender, get your documents together. Seriously, this is the most important first step. Having everything ready to go shows you’re organized and makes the lender’s job a breeze, which can seriously speed up the whole approval process.

You'll almost certainly need these three things:

How to Make Your Application Shine

When you have a "thin" credit file, your paperwork has to do all the talking. But these days, smart lenders are looking beyond just a credit score. This is where "alternative data" becomes your secret weapon, giving them a much fuller picture of your financial habits. Our guide to getting personal loans with an ITIN number dives deeper into this.

More and more lenders are using new ways to check if an applicant is a good risk, which is a massive plus for ITIN holders. They might look at your track record of paying rent, utilities, and even your cell phone bill on time. These are all powerful signs that you’re creditworthy.

This move toward using different kinds of data is part of a bigger global push for financial inclusion. Systems known as Alternative Credit Scoring (ACS) often use tech like machine learning to analyze this kind of information, helping people without a long banking history finally get access to credit. You can discover more about this approach to financial inclusion from the World Economic Forum. Knowing this, you can be ready to point out your own history of consistent payments to make your application even stronger.

How to Manage Your Loan and Actually Boost Your Credit Score

Getting approved for one of the best loans to boost your credit score feels great, but that’s just the starting line. The real work—and the real credit-building—begins now. How you handle this loan over the next six to twelve months will make or break your strategy.

Think of it this way: each payment is a message you're sending to the credit bureaus. Consistent, on-time payments tell them you're reliable. A single missed payment screams risk.

Make On-Time Payments Your Top Priority

Let's be clear: your payment history is the heavyweight champion of your credit score. It accounts for a massive 35% of your total score, making it the most influential factor by a long shot.

This means paying on time, every single time, is non-negotiable.

The easiest way to guarantee you're never late? Set up autopay from your checking account the moment you get the loan. Schedule the transfer a few days before the actual due date to create a buffer. This one small action eliminates the chance of forgetting and accidentally damaging your score.

Pay a Little Extra—It Goes a Long Way

Meeting the minimum payment is good. Exceeding it is even better. Paying a bit more than you owe each month accomplishes two key things:

You don't have to break the bank. Even an extra 10 or 20 a month sends a powerful signal that you're in control and serious about managing your debt. When you're thinking about bigger financial goals, like a house, this habit becomes even more critical. Getting comfortable with utilizing a mortgage calculator to understand payment structures can show you just how much of a difference small extra payments can make on large loans.

Check Your Work: Verify Your Payments Are Being Reported

All your hard work is for nothing if the credit bureaus don't know about it. You need to make sure your on-time payments are actually showing up on your credit reports.

About 45-60 days after your first payment, pull your free credit reports from Experian, Equifax, and TransUnion. You're looking for two things: the new loan account is listed, and your on-time payment has been recorded.

Get into the habit of checking your reports every few months. If you spot an error, dispute it right away. This simple check-in ensures your credit-building strategy is on track and your efforts are paying off.

Watch Out for These Common Credit-Building Traps

Building credit is a marathon, not a sprint. It takes time and careful planning. Unfortunately, a few common slip-ups can easily erase months of your dedicated effort. When you're working with an ITIN, you need to be especially mindful of these pitfalls that can slow you down or even drop your score.

One of the most tempting mistakes is applying for a bunch of credit cards or loans all at once. I get it—you're excited to get started, so you cast a wide net. The problem is, every single application triggers a hard inquiry on your credit report. A sudden burst of these inquiries can make you look risky or desperate to lenders. Each one can ding your score by a few points, and together, they can really add up.

Don't Close That Old Account!

Paying off a loan feels fantastic. Your gut reaction might be to close the account and move on. But hold on—this is one of those times where the logical move can actually hurt your credit score.

Closing an account, especially an older one, can backfire in two big ways. First, it can reduce the average age of your credit history. Lenders love to see a long, stable history, and that old account was helping your average. Second, if you close a credit card, you lose its credit limit. This can instantly spike your credit utilization ratio, which is a huge factor in your score.

Let’s look at a real-world example. Maria got a small credit-builder loan and paid it off like clockwork for 12 months. Feeling proud, she called the bank to close the account right away. A couple of months later, she was shocked to see her credit score had dropped 15 points. The reason? The average age of her credit history was suddenly much shorter.

The Hidden Dangers of Co-signing

Being asked to co-sign a loan for a friend or family member is tough. It feels like a simple way to help someone you care about, but it's one of the most hazardous things you can do for your own credit. When you co-sign, you're not just a backup—you are 100% legally responsible for that debt.

If the main borrower is even one day late on a payment, that negative mark shows up on your credit report, not just theirs. If they stop paying altogether, you're legally on the hook for the entire amount. Your credit score could absolutely tank.

Take David, for instance. He co-signed a car loan for his cousin. When his cousin unexpectedly lost his job and missed two payments, David’s score plummeted by over 60 points. This put his own dream of getting a mortgage in serious jeopardy.

Before you ever agree to co-sign, ask yourself if you are willing and able to make every single payment yourself. If the answer is no, you have to politely say no. Your first priority has to be protecting the credit score you've worked so hard to build.

Common Questions About ITIN Loans and Your Credit Score

Jumping into the world of credit with an ITIN often brings up a ton of questions. Let's tackle some of the most common ones I hear, so you can move forward with a clear plan.

How Long Does It Take to See a Credit Score Bump After Getting a Loan?

This is probably the number one question people ask. You'll usually see the new loan pop up on your credit report within 30 to 60 days after the lender reports your first on-time payment. Seeing that new account appear is a great first step.

But the real, noticeable improvement doesn't happen overnight. Credit scoring models are built to reward a pattern of good behavior over time. Stick with those steady, on-time payments for about six months, and that's when you should start to see a meaningful positive shift in your score. Think of it as a marathon, not a sprint—patience is a huge part of the game.

Can I Actually Get a Loan with an ITIN and Zero Credit History?

Yes, you absolutely can. This is a very common starting point, and plenty of financial institutions are set up to help. I always point people toward community banks, credit unions, and even some of the newer fintech companies that specialize in working with people new to the U.S. credit system.

They have products made just for this situation, like:

Since you don't have a credit history, they'll just ask for other things to show you're financially stable, like pay stubs and proof of address.

Will Applying for a Loan Drop My Credit Score?

When you submit a formal application, the lender will do what's called a hard inquiry (or a "hard pull") on your credit. This can cause a small, temporary dip in your score—usually just a few points. Don't panic! This is a totally normal part of the process.