Build Your ITIN Number Credit Score

Absolutely. You can definitely build a strong U.S. credit score with an ITIN number, even if you don't have a Social Security Number. Think of your ITIN—that tax processing number from the IRS—as the key that opens the door to the U.S. financial system. It allows you to access specific credit-building tools like secured credit cards and certain loans, which are the first steps to establishing the financial track record you need to thrive here.

Your Financial Starting Point in the US

For many people new to the United States, figuring out the financial system can feel overwhelming. You might have a great job and a perfect financial history back home, but without a U.S. credit file, you’re basically a ghost to lenders. You're considered "credit invisible." This is exactly why getting to know how to build your ITIN number credit score is so important.

A good credit score isn't just about getting a loan. It has a real impact on your everyday life.

The Role of Your ITIN in Credit Building

There's a common myth that an ITIN automatically comes with a credit file. That's not quite right. The IRS issues your Individual Taxpayer Identification Number (ITIN) for tax purposes, not for credit. Unlike SSNs, which are automatically tied to credit files, as an ITIN holder, you have to be proactive to get started.

The good news is that more and more banks and lenders now accept an ITIN as a valid form of identification to open accounts. This is your way in. Once you use your ITIN to open a credit card or loan and that lender reports your payments to the big three credit bureaus—Experian, Equifax, and TransUnion—your U.S. credit history officially begins.

While both an ITIN and an SSN can be used to build credit, there are some important differences in how the process works.

ITIN vs SSN for Credit Building

Ultimately, the goal is the same—to demonstrate financial responsibility—but the path for ITIN holders requires a few extra, deliberate steps.

Creating Your Credit Roadmap

Building credit is a marathon, not a sprint. It’s a process of opening the right accounts, using them wisely, and keeping an eye on your progress. Even if you're starting from zero today, you can see a real difference in just a few months. Our guide on starting your ITIN credit history gives you a solid overview of what this journey looks like.

One of the biggest differences for ITIN holders is checking your score. While someone with an SSN can just hop online and pull their reports, ITIN holders usually have to request their credit reports by mail from the bureaus. This typically involves sending in a request form along with copies of your identification. You can learn more about this specific process from the experts at Self.inc.

This guide is designed to walk you through every step, giving you a clear, empowering roadmap to achieving the financial freedom you deserve.

Alright, you've got your ITIN. That's a huge first step, but now the real work begins. It's time to actually start building your credit history by getting your hands on your first financial product—one that reports to the major credit bureaus. Getting this part right is everything; it lays the groundwork for your entire ITIN number credit score.

The absolute first thing you need to do, no exceptions, is open a U.S. bank account. This is non-negotiable. Having a checking or savings account shows lenders you're establishing a real financial footprint in the country, a key signal of stability. While plenty of national banks and local credit unions are ITIN-friendly, you'll almost always need to pop into a branch in person to get it done.

To make sure your visit is quick and successful, walk in prepared. Don't waste a trip. You'll typically need to bring:

Your Best Options for That First Credit Product

With your bank account up and running, you can start hunting for your first credit product. Let's be realistic: without any U.S. credit history, you're not likely to get approved for a standard, unsecured credit card right away. That’s okay. You'll want to aim for products specifically designed for people in your exact situation.

Your two strongest starting points are a secured credit card or a credit-builder loan.

I almost always recommend a secured card as the best entry point. It's a fantastic tool. Here’s how it works: you give the bank a small, refundable security deposit—usually between 200 and 500—and that amount becomes your credit limit. Because your own money secures the line of credit, it’s a very low-risk proposition for the bank, which makes them far more likely to approve you. You use it just like a regular credit card, and every on-time payment you make gets reported to the credit bureaus, building your history from scratch.

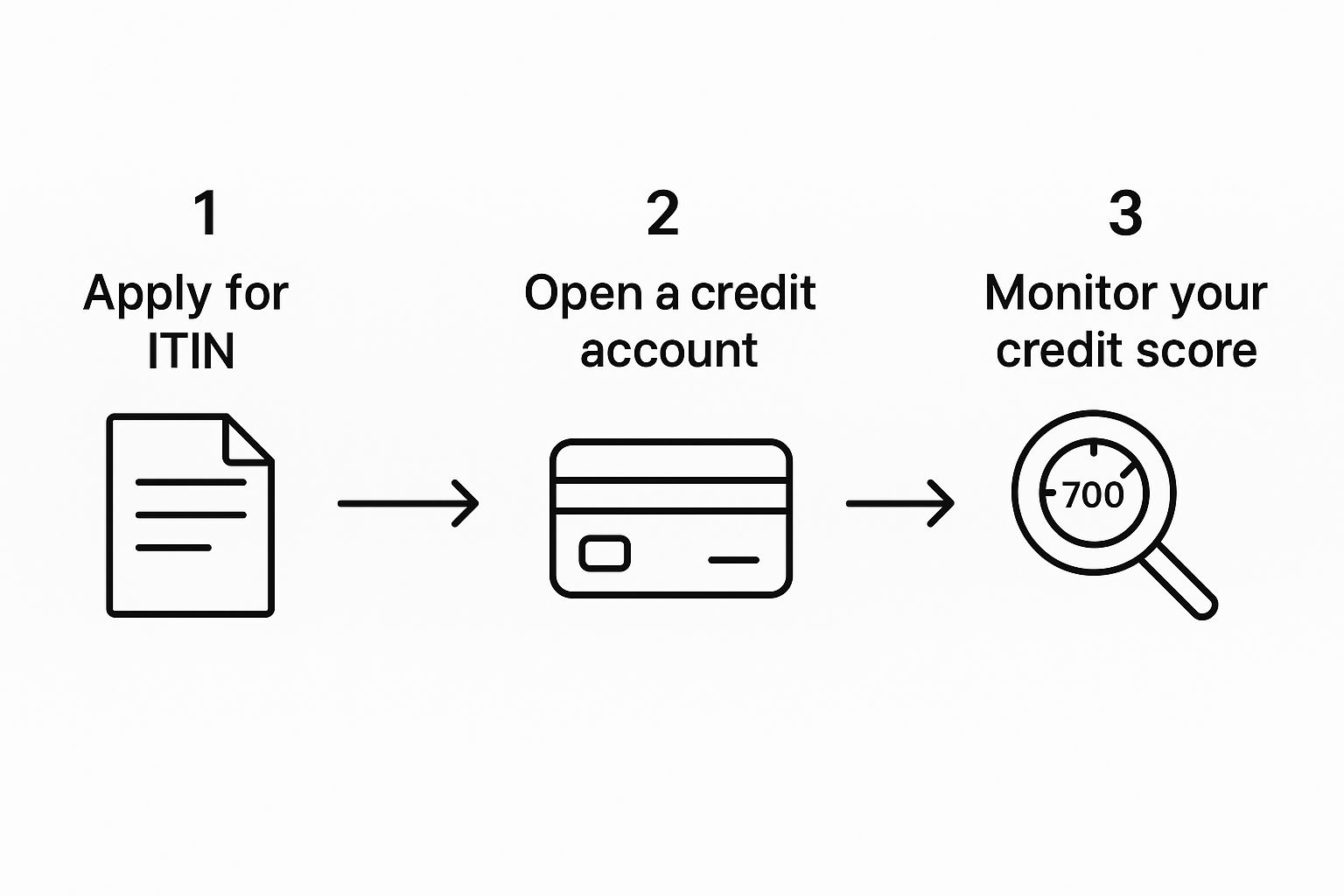

This simple visual breaks down the journey perfectly: your ITIN kicks things off, which lets you open accounts, and from there you can start tracking your score.

As the graphic shows, getting your ITIN is just the first domino. It's what you do after that really matters for building a solid credit profile.

How to Talk to Lenders with Confidence

I know it can be intimidating to walk into a bank and ask for credit when you have no history here. But your attitude and approach make a huge difference. You need to present yourself as a responsible person who wants to be a good financial partner.

When you sit down with a banker, be direct and clear. Say something like, "I have an ITIN and I'd like to open a secured credit card to begin building my U.S. credit history."

Being upfront like this shows you’ve done your homework and you understand the process. For some more detailed strategies and product ideas, our guide on how to build credit with an ITIN number is a great resource.

A credit-builder loan is another solid option. It’s a bit different because it works in reverse. Instead of getting money upfront, the bank puts the loan amount into a locked savings account for you. You then make small, fixed payments over a set period (say, 6 to 12 months). Once you've paid it all off, the bank releases the full amount to you. The magic is that each of those monthly payments gets reported to the credit bureaus, adding positive activity to your brand-new credit file.

Whichever product you choose, the most important thing is consistency. Your entire goal is to create a track record that screams reliability. After just a few months of responsible borrowing and on-time payments, you'll be well on your way to generating your very first ITIN number credit score.

Smart Strategies for a Strong Credit History

Once you've opened that first credit account, the real work of building a strong ITIN number credit score begins. Simply paying your bills on time is the foundation, but to really build an impressive financial profile, you need to be strategic.

It's not just about paying what you owe; it's about how you manage the credit you have. This is what shows lenders you're a responsible, low-risk borrower.

Master Your Credit Utilization Ratio

Your payment history is king, but your credit utilization ratio (CUR) is a very close second. This ratio is simply the amount of credit you're using compared to your total available credit. Keeping it low is one of the fastest ways to boost your score.

The standard advice is to keep your balance below 30% of your credit limit. So, if you have a secured card with a 500** limit, you'd want to keep your balance under **150. Honestly, though? For the best results, aim for under 10%.

It’s a small habit, but it signals that you're proactive with your finances, not just reactive to bills.

Grow a Diverse Credit Mix

Lenders get more confident when they see you can successfully manage different kinds of debt. This is what's known as your credit mix, and it makes up about 10% of your FICO score.

When you start, you'll likely just have a revolving account like a secured credit card. As your score grows, you should think about adding an installment loan to the mix. These are loans with fixed payments over a set term, like a small personal loan or an auto loan. It shows you can handle more than just a credit card.

There's a reason lenders and even insurers care so much about this stuff. A fascinating study on auto insurance, for example, found a very strong link between credit scores and the probability of filing a claim. It showed that people with lower scores were statistically more likely to cost the insurance company money. That’s why a good credit score often unlocks better rates on more than just loans. You can read the full study on the University of Texas's digital repository to see the data for yourself.

Focus on Long-Term Consistency

The age of your credit history is a slow-burning but powerful factor. Lenders want to see a long track record of responsible borrowing. For you, this means two things:

Building a solid ITIN number credit score is a marathon, not a sprint. By keeping your balances low, building a healthy mix of accounts, and showing a long history of on-time payments, you'll create a powerful financial foundation for your life in the U.S.

How to Check Your ITIN Credit Score and Reports

You've put in the work to build credit with your ITIN, and that's a huge step forward. But here’s the thing: building it is only one part of the equation. If you’re not keeping a close eye on your credit reports and scores, you’re basically navigating your financial life with a blindfold on. You won't see your progress, and more importantly, you could miss costly errors that are actively pulling your score down.

For ITIN holders, checking your credit isn't quite as simple as the one-click online process many SSN holders are used to. The three major U.S. credit bureaus—Experian, Equifax, and TransUnion—typically require you to request your credit reports the old-fashioned way: by mail. It sounds like a hassle, but I promise it's manageable once you know what to do.

Getting Your Documents in Order

The last thing you want is for a credit bureau to reject your request because of a missing document. That just means more delays. Taking a few minutes to get your paperwork right the first time will save you a lot of headaches.

Each bureau needs to be absolutely sure of who you are and where you live. Before you even think about licking a stamp, gather clear copies of these documents:

Once your package is ready, you can mail it off to each bureau. Their mailing addresses can change, so it's always smart to double-check their official websites first. For an even more detailed walkthrough, our guide on how to check your credit score with an ITIN breaks it down even further.

What to Look For When Your Reports Arrive

When you finally get your reports in the mail, you’ll find a comprehensive history of your credit accounts, your payment history, and any recent credit inquiries. The free annual reports might not show your actual credit score, but they contain all the raw data that builds it.

Go through each report with a fine-tooth comb. Seriously. Look for anything that seems off: accounts you don't recognize, payments you know you made on time that are marked late, or even a misspelled name. Even tiny mistakes can have a surprisingly big impact on your ITIN number credit score.

If you spot an error, don't just sigh and set it aside. You have the right to dispute it directly with the credit bureau. It's a critical part of protecting your financial health and ensuring all your hard work pays off.

Common Credit Mistakes ITIN Holders Should Avoid

When you're new to the U.S. credit system, you're bound to learn a few things the hard way. For ITIN holders, the path has some unique bumps, but knowing which common pitfalls to sidestep can make all the difference in building a strong financial future. Let's walk through some of the most frequent stumbles I see.

Going on a Credit Application Spree

It’s easy to get a little overeager. You want to build credit, so you start applying for every card that looks promising. The problem is, every single application triggers a hard inquiry on your credit report.

Too many of these in a short time sends a major red flag to lenders. It can make you look financially desperate, which is the last impression you want to give. A much smarter move is to do your homework, pick one great starter product (like a secured card from an ITIN-friendly bank), and use it responsibly for at least six months before even thinking about another. This shows lenders you're a patient and thoughtful borrower.

Closing Your Oldest Credit Account

Here's a mistake that trips up even seasoned pros. You finally get approved for a great unsecured card with rewards, and your old secured card feels obsolete. Your first instinct might be to close it and tidy up your finances. Don't do it.

Closing your oldest account can damage your score in two ways. First, it shortens your credit history, and the length of your credit history accounts for about 15% of your FICO score. Second, it wipes out that account's credit limit, which can spike your credit utilization ratio if you have balances on other cards.

Thinking Your Paycheck Is Enough

Many people new to the country assume that having a good job and a steady income is all that matters. While your income is definitely important for getting approved, it doesn't actually build your credit score.

Lenders want to see a proven track record of how you manage borrowed money, not just how much you earn. A Federal Reserve analysis confirmed that while higher income often goes hand-in-hand with better credit, the link isn't guaranteed. Your paycheck proves you can pay, but your credit report proves you do pay.

Falling for Predatory Lending Traps

Finally, you have to be on guard. Because you're building credit from scratch, you might be targeted by lenders promising things like "guaranteed approval" or charging outrageous fees. These are almost always predatory lenders.

My best advice? Stick to well-known, reputable banks and credit unions. If a credit offer sounds way too good to be true, it is. Protecting your finances from these bad actors is just as crucial as building a positive history.

Common Questions About Building Credit with an ITIN

Getting started with credit in the U.S. can feel confusing, especially with an ITIN. Let's clear up some of the most common questions I hear from people navigating this process. My goal is to give you straightforward answers so you can move forward with confidence.

Can I really get a credit card using only my ITIN?

Yes, you absolutely can. This is a common starting point and it's more accessible than you might think. Many major banks and, importantly, local credit unions have become much more welcoming to applicants with ITINs.

Your best bet is to start with a secured credit card. Think of it as a credit card with training wheels—you provide a small cash deposit that becomes your credit limit. This makes it a low-risk option for the bank and a fantastic way for you to prove your creditworthiness. Once you've built a positive history with them, you might even qualify for an unsecured card. Just be sure to find lenders known for being ITIN-friendly.