Your Guide to an ITIN Number Credit Report

If you don't have a Social Security Number, your ITIN number credit report is the official record of your financial journey in the United States. While the IRS issues your ITIN mainly for tax purposes, it also gives credit bureaus a way to track how you handle your finances, creating a financial footprint that's uniquely yours.

Your Financial Passport in the United States

Think of your ITIN number credit report as your financial passport in the U.S. It tells a story about how reliable you are with money, even if you don't have an SSN. It's a common—and costly—misconception that an ITIN is only for filing taxes and has nothing to do with your financial life.

The truth is, the three major credit bureaus (Experian, TransUnion, and Equifax) absolutely can and do create credit files using an ITIN. When you open a bank account, apply for a credit card, or get a loan with your ITIN, those financial institutions report your activity. Every on-time payment you make adds another positive entry to your story.

What This Means For You

This financial passport is your ticket to opportunities that are often just out of reach for people without a credit history. By building a solid credit profile with your ITIN, you can unlock some serious benefits and start laying the groundwork for a stable financial future.

At the end of the day, your ITIN number credit report gives you power. It’s how you prove your financial trustworthiness and open doors that might otherwise be shut. Taking the time to understand how this report works is the first real step toward building a secure and successful life in the United States. For a closer look, you can learn more about what goes into an ITIN credit report in our detailed guide.

Why Your ITIN Credit History Matters

Your ITIN number credit report is so much more than a collection of numbers. Think of it as your financial passport—a document that proves your reliability and unlocks opportunities that can shape your life in the United States. It's the key to building a secure future, even without a Social Security Number.

A good credit history tied to your ITIN can be the one thing that makes or breaks some of life’s biggest financial moments. It has a direct, tangible impact on goals you might be working toward right now.

The Real-World Impact of Good Credit

Let's get practical. Imagine you’ve found the perfect apartment. With no credit history to show, the landlord might see you as a risk and demand a huge security deposit, maybe even several months of rent upfront. That’s a massive financial hurdle. But if you walk in with a solid ITIN credit history, you're showing them you're dependable. That often means a standard, much smaller deposit, potentially saving you thousands.

And it doesn't stop with housing. This same logic applies to other major purchases.

In the end, every responsible financial step you take, no matter how small, helps build this powerful tool. It’s not just about borrowing money; it’s about demonstrating your financial character. That reputation makes it easier to rent a home, get better loan terms, and simply reduce the day-to-day financial stress.

Figuring out how to build that history is a critical first step, and thankfully, there are clear ways for anyone to establish credit history with an ITIN from scratch. By actively working on your ITIN number credit report, you're making a direct investment in a more stable and empowered future for you and your family.

How to Get Your ITIN Credit Report

Alright, let's get down to the practical side of things. Getting your hands on your financial data is the first real step toward building a solid credit history. If you have an ITIN, you can't just hop onto the usual consumer portals like AnnualCreditReport.com. But don't worry—you absolutely have the right to get your report directly from the big three credit bureaus.

The process for getting your ITIN number credit report is a bit old-school. It usually involves a request by mail or phone, but it’s completely manageable once you know the steps. The bureaus have had to adapt to serve the growing number of ITIN holders, a shift that's opened up credit access for many. For a deeper dive into how this all works behind the scenes, you can find more info over at SoftPullSolutions.com.

Reaching Out to the Major Credit Bureaus

You'll need to contact each of the three major bureaus—Experian, TransUnion, and Equifax—one by one. Why all three? Because lenders might report your accounts to just one or two of them, and you want the full picture of your credit history.

To make this go smoothly, get your paperwork in order first. Think of it like putting together a little identity file that proves you are who you say you are, just without an SSN.

So, what do you need to do? You'll be compiling a set of documents to mail along with a written request. This helps the bureaus find your file and confirm it’s really you.

Information and Documents You'll Need

Before you start writing letters, gather clean, readable copies of the following. The most important thing here is consistency—make sure the name and address are identical across all your documents.

Essential Information to Include in Your Request Letter:

Required Supporting Documents to Enclose:

Once you have everything packaged up, you can mail your request to each credit bureau. This hands-on method puts you firmly in control of your financial story. Regularly checking your ITIN number credit report is one of the smartest habits you can build on your path to financial stability.

Building Credit from Scratch with an ITIN

Getting started with credit when you have an ITIN can feel a lot like building something from the ground up. It takes a bit of patience and the right strategy, but the financial security you gain is well worth the effort. The first, most crucial step on this journey is opening a U.S. bank account. This gives you a financial anchor and a place to manage your money as you begin to build credit.

With a bank account in place, you’re ready to lay the foundation for your credit history. There are a few tried-and-true methods that work particularly well for ITIN holders, each helping you create a positive itin number credit report.

Proven Credit-Building Strategies

To begin, you’ll want to look at financial products specifically designed to help people establish credit for the first time. These tools are your best friends because they report your payment history to the credit bureaus—the very thing you need to get on their radar.

Here are a few of the most effective options:

These three habits are the pillars of a strong credit profile. They signal to lenders that you're reliable and can handle debt wisely, which is exactly the story you want your itin number credit report to tell. For a deeper dive, our complete guide on how to build credit with an ITIN number has even more detail.

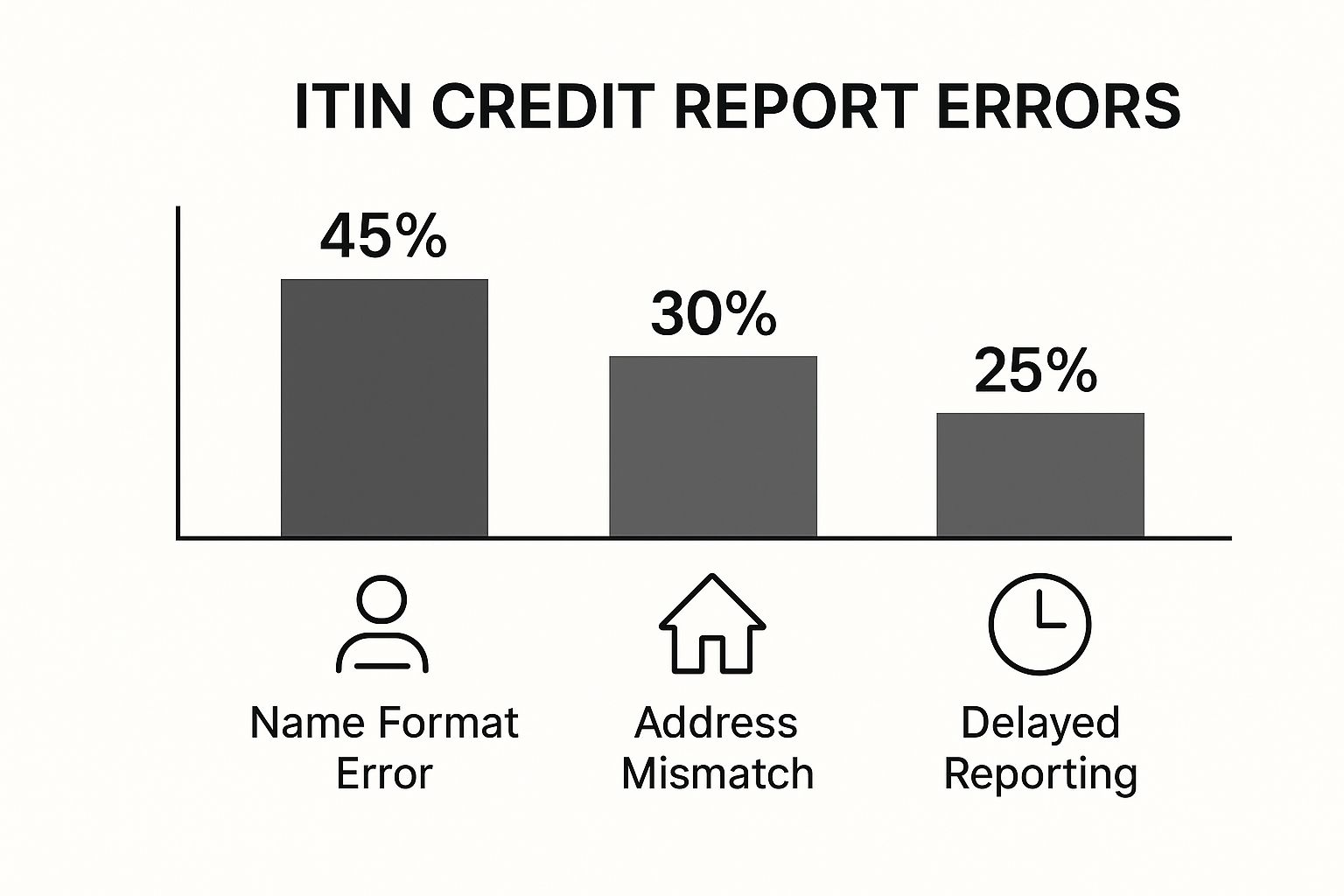

As you build your credit, it's also smart to keep an eye on your report for any mistakes. Simple errors can pop up more often than you'd think.

This just goes to show how common simple data entry mistakes are. Regularly checking your report helps you catch and fix these issues before they cause problems.

Comparing ITIN Credit Building Methods

Choosing the right path depends entirely on your personal situation and goals. This table breaks down the most popular methods to help you decide which one might be the best fit for you.

Each method offers a unique advantage. Secured cards and credit-builder loans put you in the driver's seat, while becoming an authorized user can provide a faster, though less direct, boost.

Finding ITIN-Friendly Institutions

Not every bank or lender understands how to work with ITINs, so it pays to be selective. Credit unions, in particular, have become leaders in this space. They are often community-focused and have created specific programs to serve ITIN holders.

In fact, the demand is huge. Some credit unions have seen their ITIN loan portfolios skyrocket from 640,000 to over 5.3 million in just three years. This incredible growth shows just how many ITIN holders are ready to build a strong financial future. By choosing one of these forward-thinking institutions, you're partnering with an organization that is invested in your success right from the start.

Overcoming Common Credit Building Challenges

Trying to build a financial foundation in a new country isn't always easy. When you're using an ITIN, you might run into a few unique roadblocks, but for every single one, there’s a clear path forward. Knowing what these hurdles are and how to jump them will help you build credit with confidence.

One of the first issues you might face is a simple lack of awareness. A landlord or a loan officer might tell you, "We need a Social Security number," not because they're trying to be difficult, but because they've never heard of an itin number credit report.

Don't let this throw you off. See it as a chance to educate them. You can calmly explain that all three major credit bureaus—Experian, TransUnion, and Equifax—track credit histories for tax-paying residents using ITINs.

Finding Welcoming Financial Partners

It's true that some big, traditional banks can be rigid. Their internal rules and automated systems might not be set up for ITIN applicants, but that's a reflection of their policies, not of you. Your goal is to find the financial institutions that genuinely want your business.

This is where community banks and credit unions really shine. They are often far more flexible and are built on the idea of serving their local communities. Many have even created specific loan programs for ITIN holders because they understand their importance and reliability.

Research from the Urban Institute points out that while the USA PATRIOT Act allows banks to accept ITINs, they often apply stricter lending terms, like lower credit limits. This makes finding the right banking partner absolutely essential. You can dig deeper into the financial landscape for ITIN holders in their full analysis.

This kind of confident, informative statement can completely change the dynamic. You're not asking for a favor; you're simply using the system that's in place.

Correcting Errors on Your Report

Another common bump in the road is finding a mistake on your credit report. It happens more often than you'd think—it could be a simple misspelling of your name or an account that doesn't belong to you. The good news? You have every right to dispute these errors, and the process is fairly simple.

Here’s what you need to do to get an error corrected:

By law, the credit bureau has to investigate your claim, usually within 30 days. By keeping an eye on your report and acting quickly when you spot an issue, you ensure your itin number credit report is a true reflection of your financial diligence.

Frequently Asked Questions About ITIN Credit

As you get more comfortable on your financial journey, you're bound to run into a few specific questions about your ITIN number credit report. It’s a unique path, and having solid answers can make all the difference. Let's tackle some of the most common questions we hear to help you keep building your credit with confidence.

Think of this as your go-to resource for those "what if" moments that pop up along the way.

Can I Get a FICO Score with an ITIN?

Yes, absolutely. This is probably one of the biggest misconceptions out there. The credit scoring models themselves don't actually distinguish between an SSN and an ITIN. They are completely number-agnostic. All they care about is the financial history reported to them.

To get a score, you just need to meet a few basic thresholds:

Once your ITIN number credit report hits these markers, a FICO score can be generated. The trick is simply to open a credit-building account, like a secured card or a credit-builder loan, and give it a little time to marinate.

What Happens to My Credit History If I Get an SSN?

This is a fantastic and super important question for anyone whose immigration status might change down the road. The great news is your hard-earned credit history doesn't just vanish when you get a Social Security Number. The credit bureaus have a straightforward process for merging your financial past with your new SSN.

You'll need to reach out to each of the big three bureaus—Experian, TransUnion, and Equifax—one by one. When you do, you'll give them documents for both your ITIN and your new SSN. They'll then link the credit history from your ITIN file to a new file under your SSN, creating a single, unified report.

Are Some Banks Better for ITIN Holders?

Definitely. While some of the big national banks can be a bit rigid with their policies, many local banks and community-focused institutions are much more welcoming to ITIN holders. In my experience, credit unions are often the absolute best place to start.