Secure Your ITIN Loan Today | Fast Approval & Tips

Understanding ITIN Loans: Your Gateway to Financial Opportunity

Imagine trying to order a pizza in Italian when you only speak English. Frustrating, right? That's how many feel when trying to get a loan with an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number. Luckily, there’s a whole lending world designed specifically for this situation. ITIN loans bridge the gap, connecting tax-paying individuals to financial services, regardless of their Social Security status. They operate a bit differently than traditional loans, with unique paperwork and qualifications, which can sometimes even be advantageous for borrowers.

What Exactly Is an ITIN?

Before we delve into the world of ITIN loans, let’s clarify the foundation: the ITIN itself. The image below shows information directly from the IRS website about ITINs.

The IRS issues ITINs to individuals who need to file taxes but don’t qualify for a Social Security Number. While primarily for tax purposes, ITINs have opened doors to financial services like lending.

How ITIN Loans Work

ITIN loans are similar to traditional loans in their purpose – providing funds for things like buying a home or a car. However, the application process and requirements have some key differences. For example, lenders offering ITIN loans often focus on alternative credit history. This might include things like utility bills, rent payments, or even character references from community members vouching for your financial responsibility. Income verification can also look different, potentially using bank statements or several years of tax returns to provide a comprehensive view of your financial standing.

Why Lenders Offer ITIN Loans

Some believe that ITIN lending is purely a social program, but in reality, it's a smart business move. Data shows that ITIN borrowers often outperform borrowers with Social Security Numbers. They often have higher credit scores, take out larger loans, and have better repayment histories. This strong performance is fueling growth in the ITIN lending market.

For example, some credit unions have seen their ITIN loan portfolios grow exponentially, from 640,000 to 5.3 million in just three years. This proves ITIN loans can be a profitable area for lenders who understand this unique market. Furthermore, studies suggest that the number of ITIN mortgages could jump from about 5,000-6,000 to 73,000-88,000 annually if certain market barriers were removed. This potential 15x growth highlights the immense opportunity within ITIN lending.

This untapped potential is why understanding the ins and outs of ITIN loans is vital for both borrowers and lenders. This knowledge empowers borrowers to access financial opportunities and allows lenders to tap into a growing and profitable market segment.

The Hidden Potential of ITIN Lending Markets

The ITIN lending market is a bit of an enigma. It's small, yet bursting with untapped possibilities. Imagine a tightly wound spring, packed with potential energy waiting to be unleashed.

Right now, only 5,000 to 6,000 ITIN mortgages are issued annually. But if we could remove the existing roadblocks, that number could skyrocket to somewhere between 73,000 and 88,000 loans. We're talking a potential 15x growth – a figure that's turning heads in the lending world.

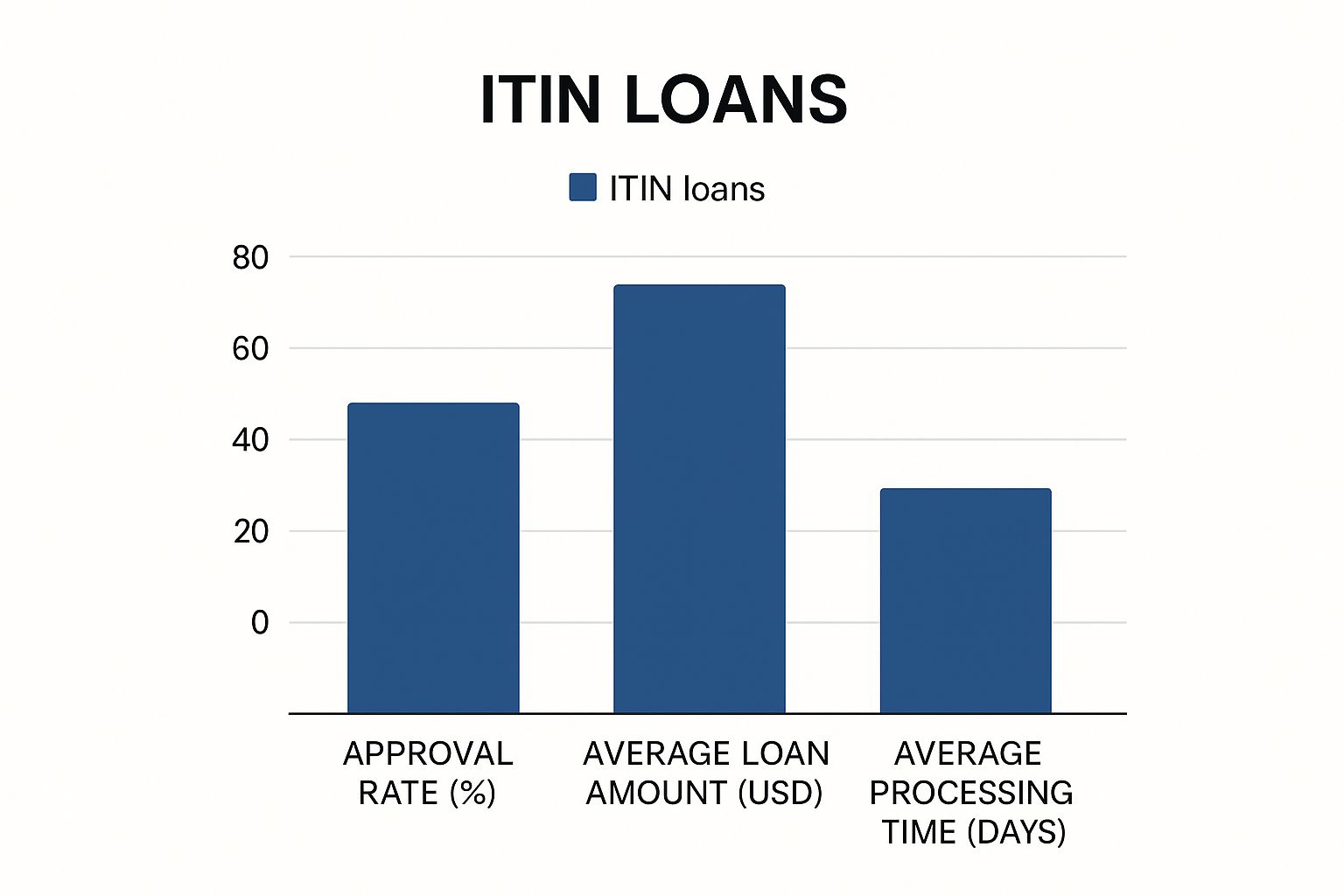

This potential growth is fueled by some interesting demographics. A large percentage of ITIN holders, 72% as of 2012, are originally from Mexico and tend to live in major metropolitan areas across the US. This concentration creates pockets of opportunity for lenders specializing in this market. The infographic below visualizes key data points for ITIN loans, like approval rates, average loan amounts, and processing times.

As you can see, ITIN loans often involve substantial sums of money, indicating significant financial activity within this segment. While processing times can be a bit longer, the potential for large loan approvals makes it an attractive prospect. This growing market presents a real opportunity, especially when you consider the often-favorable financial profiles of ITIN borrowers, which challenge common misconceptions. The ITIN mortgage market, particularly in the US, represents a significant untapped opportunity. Research suggests that if market barriers were addressed, the number of ITIN mortgages could see a dramatic increase. Learn more about the potential of ITIN mortgages.

What's Holding Back the ITIN Lending Boom?

So, what's the holdup? It's not a lack of interested borrowers or poor credit scores. The biggest hurdle is structural: the lack of a robust secondary market. Government-sponsored enterprises like Fannie Mae and Freddie Mac, which usually buy loans from lenders, generally don't participate in the ITIN loan market. This lack of secondary market liquidity makes it harder for lenders to offer these loans on a larger scale.

The Forward-Thinking Lenders

Despite these challenges, some forward-thinking financial institutions are recognizing the ITIN lending market’s potential. They’re strategically positioning themselves to capitalize on what could be a game-changer in the mortgage industry. These lenders understand that ITIN borrowers often represent a strong and reliable customer base, defying traditional risk assessments. They’re also investing in the infrastructure and expertise needed to navigate the unique complexities of ITIN lending. This proactive approach sets them up for substantial growth and increased market share as the ITIN lending market matures. By building strong relationships with this underserved community, these institutions are not only expanding their businesses but also promoting financial inclusion.

Let's take a closer look at the potential growth we've been discussing. The table below, "ITIN Mortgage Market Potential Analysis," compares the current market size with its projected potential, illustrating the remarkable growth opportunity.

This table highlights the substantial difference between the current market size and the potential market size if those barriers to entry were removed. The potential for a 15x increase in the number of ITIN mortgages issued annually speaks volumes about the opportunity within this market segment.

Qualifying for an ITIN Loan: The Real Requirements That Matter

Let's chat about ITIN loans, and how qualifying for one isn't quite like your typical loan application. Instead of the familiar highway of traditional lending—with its clearly marked lanes of credit scores and W-2 income—think of ITIN loans as a scenic route. There are still rules of the road, but the journey allows for more flexibility.

The real key isn't simply checking boxes. It's about presenting a compelling story of your financial stability. Successful borrowers understand this. They offer a panoramic view of their finances, not just a quick snapshot.

Income Verification: Painting the Full Picture

Income verification for ITIN loans takes a more nuanced approach. Rather than just looking at W-2s, lenders consider a broader spectrum of documentation. This might include tax returns, bank statements, and even employment letters. Think of it like assembling a puzzle: each piece (each document) contributes to the complete picture of your financial health.

For instance, if you're self-employed, providing a few years of tax returns demonstrates a consistent income stream. Adding bank statements showing regular deposits further strengthens your narrative. It's about building a solid, consistent story.

Credit History: Beyond the Traditional Score

Credit history for ITIN loan applicants also looks a bit different. A traditional credit score is certainly helpful, but lenders often explore alternative credit data. This could include your utility payments, rent history, or even documented money transfers to family overseas.

These consistent, on-time payments demonstrate responsibility, even without a conventional credit card history. Think of it like building trust in different ways. For more information about building credit with an ITIN, you might find this helpful: learning more about your ITIN credit report.

Preparation Is Key: Setting Yourself Up for Success

Think of applying for an ITIN loan like preparing for a job interview. You wouldn't walk in without researching the company and practicing your answers, right? The same principle applies here.

Organizing your financial documents, anticipating potential questions, and understanding your lender's preferences can greatly improve your chances of approval. This proactive approach shows lenders you're serious and organized—two valuable qualities in a borrower.

Understanding Lender Priorities: Speaking Their Language

Just as every individual is unique, so is every lender. Some prioritize down payments, while others place more emphasis on a steady income history. Researching your chosen lender’s specific preferences allows you to tailor your application accordingly.

This personalized approach demonstrates that you’re genuinely interested in their loan, not just any loan. You're prepared to meet their specific requirements. This proactive research can significantly impact your application's success.

To help illustrate the differences in qualification requirements, let’s take a look at the following table:

ITIN Loan Qualification Requirements Comparison: Side-by-side comparison of qualification criteria across different types of ITIN loans

As you can see, the specific requirements vary depending on the type of loan you’re pursuing. While consistent income documentation is a common thread, the down payment and credit score expectations can differ significantly. Understanding these nuances is key to a successful application.

Navigating the ITIN Loan Application Process Like a Pro

Imagine applying for an ITIN loan is like planning a cross-country road trip. You wouldn't just hop in the car and go, would you? You'd map out your route, pack your bags, and make sure your car is in tip-top shape. Similarly, preparing for an ITIN loan requires careful planning and organization. While a typical loan might close in 30 days, ITIN loans usually take a bit longer, around 45-60 days. This extended timeframe isn't a setback; think of it as extra time to ensure a smooth journey.

Savvy ITIN borrowers understand the importance of preparation. They focus on gathering the necessary documents upfront, presenting their financial story clearly, and anticipating any questions the lender might have, much like a seasoned traveler anticipates potential delays or detours.

Understanding the Unique Steps

ITIN loan applications involve some unique steps. For example, lenders need to verify your ITIN with the IRS. Think of this like confirming your passport before traveling internationally. You'll also likely need to provide alternative forms of income documentation, especially if you're self-employed or have a less traditional income stream. These might include bank statements, tax returns, or even letters from clients – like providing multiple forms of identification.

Maintaining Momentum

The longer processing time can sometimes feel like waiting for a delayed flight. Staying proactive is key. Regularly communicating with your loan officer keeps you informed and helps address any issues quickly. It's like getting updates from the airline about your flight status – it keeps you in the loop and reduces anxiety.

Step-by-Step Guidance

Let's break down the application process into manageable steps, like plotting out your road trip itinerary:

For more information on applying for an ITIN, see our guide on how to apply for an ITIN.

Avoiding Common Pitfalls

Just as there are common travel mishaps, there are common mistakes that can derail an ITIN loan application:

By following these steps and avoiding common pitfalls, you can confidently navigate the ITIN loan application process and increase your chances of securing the financing you need. You'll be well on your way to reaching your financial destination!

The Surprising Truth About ITIN Borrower Performance

Let's talk about something unexpected in the world of lending: ITIN borrowers. There's a common misconception that they present a higher risk, but the reality is quite different. In fact, they often outperform borrowers with Social Security Numbers (SSNs). It's a bit like a seasoned chef expecting a simple dish to be the crowd-pleaser, only to find the adventurous new recipe stealing the show.

Debunking the Myths: A Look at the Data

The numbers tell a compelling story. ITIN borrowers frequently have higher credit scores, take out larger loans, and demonstrate better repayment habits than their SSN counterparts. They're not just meeting expectations; they're exceeding them. This challenges the traditional narrative around ITIN lending and opens up exciting new possibilities.

Consider auto loans, for instance. The approval rate for ITIN applications is a remarkable 55.8%. This speaks volumes about the creditworthiness of these borrowers. Furthermore, ITIN lending has become a significant engine for growth within many credit unions. One institution saw its ITIN loan portfolio explode from a modest 640,000 to an impressive 5.3 million in just three years, all thanks to the solid performance of these loans. The success isn't limited to auto loans either; ITIN lending has shown strong growth and potential across a variety of financial products. Discover more insights into the growth of ITIN lending.

Rethinking Risk: A New Perspective on ITIN Borrowers

So, what's behind this surprising trend? Institutions experienced with ITIN lending often recognize these borrowers as presenting a lower risk, which translates into more favorable loan terms and higher borrowing amounts. This understanding comes from recognizing the unique financial behaviors and motivations of ITIN holders. They are often driven to establish a strong credit history in the U.S. and see responsible borrowing as a key step toward achieving their financial aspirations.

From Social Responsibility to Sound Business: The Shift in Lending

This impressive borrower performance is changing the game for forward-thinking lenders. ITIN lending is no longer viewed solely through the lens of social responsibility. Instead, it's increasingly seen as a smart business strategy with the potential for substantial returns. This shift in perspective creates a win-win situation. Lenders tap into a largely underserved market, while borrowers gain access to the financial tools they need to build their future. It's a mutually beneficial relationship that fuels growth and sparks innovation across the financial services industry.

Choosing the Right ITIN Lender: Your Strategic Advantage

Picking the right ITIN lender isn't a simple task. It's less like picking a shirt off the rack, and more like choosing a skilled sherpa to guide you up a mountain. You want someone experienced, trustworthy, and truly invested in your journey to the top. The right lender becomes your trusted financial advisor, while the wrong one can leave you stranded with wasted time and mounting frustration.

Different Lender Types: Weighing Your Options

The lending world is a diverse landscape. Each type of lender brings unique strengths and weaknesses to the table. Think of them as different tools in your climbing kit–each with its own specific purpose.

Key Questions to Ask: Beyond Interest Rates

Don't be swayed solely by the initial appeal of low interest rates and fees. Those are important, of course, but the true value lies in the lender's experience and approach. It’s like choosing climbing ropes – the cheapest option might not be the safest or most reliable.

Here’s a checklist of questions to ask potential lenders:

Savvy borrowers consider all these factors. It’s like a climber meticulously checking their equipment and preparing for all eventualities. You might be interested in: banks that accept ITIN.

Evaluating Lender Fit: Finding Your Ideal Partner

Selecting the right lender gives you a strategic edge in the ITIN loan process. It's like assembling the perfect team for a complex project. You need someone who gets your goals, communicates effectively, and shares your drive to succeed.

The Importance of Relationship Building: A Long-Term Perspective

An ITIN loan isn't just a one-time transaction; it's the start of a financial partnership. Just as a climbing team builds trust and rapport, nurturing a strong relationship with your lender is invaluable. This connection can open doors to future financial opportunities and provide a reliable source of guidance and support.

By taking the time to carefully explore and compare your options, you'll not only boost your chances of getting an ITIN loan but also position yourself for long-term financial success. It's like choosing the best route up the mountain – a well-informed decision can make all the difference in reaching the summit.

Your Path to ITIN Loan Success: Making It All Work

Success with ITIN loans isn't just about getting approved—it's about strategically using the process to achieve your financial goals. Think of it like planning a cross-country road trip. You wouldn't just hop in the car and start driving without a map or a plan, would you? Borrowers who consistently get the best results with ITIN loans treat the process with the same level of planning and preparation.