ITIN Credit Report Guide: Everything You Need to Know

Understanding Your ITIN Credit Rights and Options

Many ITIN holders are unaware they have the same credit reporting rights as those with Social Security Numbers (SSNs). However, accessing these rights requires a slightly different approach. This knowledge is essential for anyone looking to establish or build credit in the U.S. using an ITIN.

Why Traditional Credit Reports Exclude ITIN Holders

Traditional online credit report systems, such as AnnualCreditReport.com, are primarily designed for individuals with SSNs. These systems are directly linked to Social Security Administration databases. Consequently, accessing your ITIN credit report requires contacting the credit bureaus directly.

The Legal Framework Protecting Your Credit

Regardless of whether you use an SSN or an ITIN, your credit rights are protected under the Fair Credit Reporting Act (FCRA). This law ensures the accuracy, fairness, and privacy of information in consumer reports. This means you have the right to dispute inaccurate information on your ITIN credit report and control who can access it.

The Individual Taxpayer Identification Number (ITIN) is a 9-digit number issued by the IRS for those who need a U.S. taxpayer identification number but aren't eligible for an SSN. This includes non-resident aliens, foreign nationals, and others needing to comply with U.S. tax laws. ITINs don't authorize work in the U.S. or provide eligibility for Social Security benefits. However, they are crucial for tax reporting and can be used for credit reporting.

Accessing Your ITIN Credit Information

While you can't access your ITIN credit report online through traditional methods, you have other options. You can request your report directly from each of the three major credit bureaus—Experian, Equifax, and TransUnion—by mail. This involves submitting the necessary documentation and identification to each bureau individually.

Taking Control of Your Credit Future

Understanding your ITIN credit rights and how to access your credit information is the first step toward building a solid financial foundation in the United States. By taking proactive steps, you can effectively manage your credit and open doors to more financial opportunities. This knowledge empowers you to make well-informed decisions about your financial future.

Getting Your ITIN Credit Report The Right Way

Obtaining your ITIN credit report might seem a bit more complex than accessing reports with a Social Security Number. However, don't worry! With the right information, the process is entirely manageable. This guide will walk you through the necessary steps.

Understanding the Process

First, it's important to understand the key difference. Individuals with SSNs can access their credit reports online through AnnualCreditReport.com. However, ITIN holders need to request reports directly from each of the three major credit bureaus: Experian, Equifax, and TransUnion. This involves gathering specific identification documents and submitting a request by mail. You might find this helpful: How to apply for ITIN.

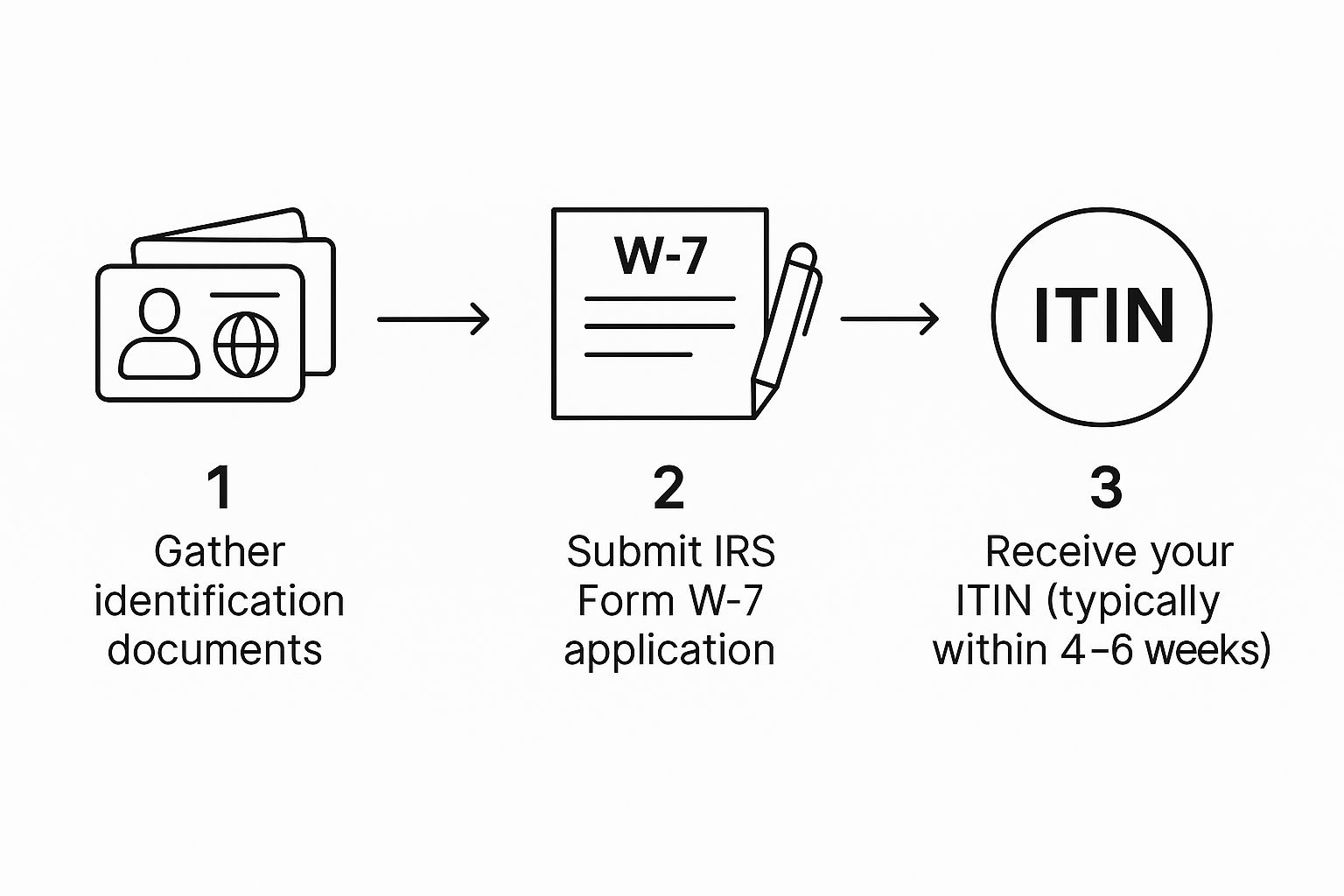

The infographic above outlines the process of getting an ITIN, a prerequisite for your ITIN credit report. Start by gathering your identification documents. Then, submit your IRS Form W-7 application. You should receive your ITIN within 4–6 weeks. Once you have your ITIN, you can request your credit report.

Requesting Your Report: A Step-by-Step Guide

Here's a detailed breakdown of how to request your ITIN credit report:

Bureau-Specific Information

While the overall process is similar, each bureau has its own specifics:

To help clarify the different requirements, take a look at the table below:

ITIN Credit Report Request Requirements by Bureau: Comparison of documentation and process requirements for each major credit bureau

As you can see, all three bureaus require similar documentation and have comparable processing times. The primary difference lies in the specific mailing address for each bureau.

Tips for Success

Here are a few tips to ensure a smooth process:

By following these steps and staying organized, you can successfully access your ITIN credit report and manage your financial well-being.

Building Solid Credit History With Your ITIN

Having your Individual Taxpayer Identification Number (ITIN) and accessing your ITIN credit report is just the first step. The real journey begins with building a strong credit history. This section explores effective strategies specifically designed for ITIN holders.

Choosing the Right Credit-Building Tools

Not all financial products are equally effective for building credit with an ITIN. For example, some secured credit cards report to all three major credit bureaus (Experian, Equifax, and TransUnion), maximizing your credit-building efforts, while others report to only one or two. Similarly, some credit-builder loans offer faster score improvements. For more information, you might find this article helpful: How to master your credit with an ITIN.

Establishing Strong Financial Relationships

Building credit involves more than just using credit products. Cultivating positive relationships with financial institutions is also important.

Setting Realistic Expectations and Tracking Progress

Building credit requires time and consistent effort. Don't expect overnight miracles. Meaningful progress typically takes several months to a year.

Real-World Success Stories and Potential Pitfalls

Many people have successfully built excellent credit scores starting from scratch with an ITIN. Their success stories prove that it's achievable with patience and the right strategies. However, be aware of potential pitfalls.

By selecting the right tools, building strong financial relationships, setting realistic expectations, and learning from others’ experiences, you can establish a solid credit history with your ITIN and open doors to greater financial opportunities.

Unlocking New Financial Opportunities As An ITIN Holder

Building a solid credit history with an Individual Taxpayer Identification Number (ITIN) opens doors to a wider range of financial products and services. This means opportunities previously unavailable to ITIN holders are now within reach, representing a significant change in their financial options.

Expanding Access to Mainstream Financial Services

Historically, ITINs were primarily used for tax purposes. However, the financial landscape has shifted, with more institutions recognizing the importance of serving ITIN holders. Specialized mortgage programs designed for individuals with ITINs are becoming more common.

Additionally, more lenders now offer business financing options that accept ITINs as valid identification. This gives entrepreneurs and small business owners greater access to capital. These changes help ITIN holders participate more fully in the U.S. financial system.

Historically, ITINs were used in limited financial transactions. However, due to regulatory changes, such as the Patriot Act, some states and financial institutions have started accepting ITINs for certain purposes. Currently, seventeen states allow individuals with ITINs to obtain a driver's license if they have filed taxes in that state.

Some credit card issuers and mortgage lenders now accept ITINs, although these loans often come with higher interest rates and stricter requirements. This change reflects a broader trend in financial services, where alternative forms of identification are increasingly used to facilitate access to credit and other financial products. Learn more about ITINs here.

Leveraging Your ITIN Credit Report for Better Rates and Terms

As you build your credit history, using your ITIN credit report becomes essential for accessing favorable rates and terms. A positive credit history demonstrates financial responsibility, which can lead to lower interest rates on loans and credit cards, as well as better terms on other financial products.

Strategies for Presenting Your Financial Profile

Effectively presenting your financial profile to lenders is crucial for accessing the best opportunities. Here are some key strategies:

Identifying ITIN-Friendly Institutions

Not all financial institutions are equally ITIN-friendly. Researching and identifying lenders who cater to ITIN holders can save time and frustration. These institutions often have products and services designed to meet the specific needs of ITIN holders.

They also understand the details of ITIN credit reports, making the application process smoother. This proactive approach can significantly improve your chances of approval and access to better terms.

Mastering Credit Scores And ITIN Report Analysis

Your ITIN credit report is similar to a traditional credit report in terms of the information it contains. However, understanding the nuances of an ITIN report is vital for managing your credit effectively. This knowledge can have a significant impact on your overall financial health.

Deciphering Your ITIN Credit Report

ITIN reports, much like those for SSN holders, have key sections detailing your credit history. Understanding these sections is essential.

Key Factors Affecting Your ITIN Credit Score

Several factors play a significant role in determining your credit score. For ITIN holders, some of these factors may present unique challenges.

To better illustrate how these and other factors influence ITIN holders' credit scores, let's look at the following table:

Credit Score Factors Impact for ITIN Holders

This table provides a breakdown of how different factors affect credit scores for ITIN holders compared to traditional scoring.

As you can see, payment history and credit utilization have the most significant impact on your credit score. While building a positive credit history takes time, consistent responsible credit management will yield positive results.

Monitoring Your ITIN Credit Report

Regularly checking your ITIN credit report is a critical practice. This proactive approach allows you to identify and address any potential problems promptly.

By understanding and implementing these strategies, ITIN holders can navigate the credit system effectively and access a broader range of financial opportunities. Building a strong credit history with an ITIN requires diligence and knowledge, but the benefits are undoubtedly worth the effort.

What's Coming Next For ITIN Credit Access

The credit landscape offers evolving opportunities for ITIN holders, promising increased accessibility and inclusivity. Understanding these trends is essential for anyone looking to establish or enhance their credit using an ITIN.