Build Your ITIN Credit History a Practical Guide

Let's get one thing straight right away: your Individual Taxpayer Identification Number (ITIN) is the key that unlocks the U.S. financial system for you. It's not a roadblock. You can absolutely build a strong ITIN credit history without a Social Security Number, opening doors to loans, better housing options, and true financial independence.

Think of your ITIN as your entry ticket, not a dead end.

Your ITIN Is More Than Just a Tax Number

There’s a common misconception floating around that you can't make real financial progress in the U.S. without an SSN. That’s simply not true. While your ITIN is officially for tax purposes, it has a powerful secondary role: it lets you get in the game financially.

When you build a solid credit history with your ITIN, you’re showing lenders, landlords, and even utility companies that you're reliable. This goes way beyond just getting a credit card. It’s about laying a solid foundation for your future in this country.

What Good Credit Actually Looks Like in Real Life

A good credit score can mean the difference between getting the apartment you want or being passed over. It can unlock a lower interest rate on a car loan, saving you thousands of dollars over the years. For many people, building credit is the first tangible step toward achieving their American dream.

I’ve seen this play out time and time again. Take a freelance graphic designer I know who moved to the U.S. with an ITIN. At first, she couldn't even get a phone plan without a huge deposit. But she was persistent. She found a credit card that accepted ITINs, used it responsibly for about a year, and her situation completely changed.

Not only did she qualify for a new phone with zero deposit, but she was also approved for a car loan at a really competitive rate. Her ITIN credit history was the deciding factor.

This is possible because more and more financial institutions are recognizing that ITIN holders are a valuable and dependable part of the economy. They know you can establish credit by opening credit cards or other financial products, which is your way into the larger credit ecosystem. If you're curious about where you stand, you can learn more about how to check your credit history from specialized resources.

At the end of the day, your ITIN is the bridge connecting your financial life today to the one you're working to build. It’s the official number that allows the credit bureaus—Experian, TransUnion, and Equifax—to create a file on your financial habits, just like an SSN does for U.S. citizens.

ITIN vs SSN for Credit Building Key Differences

While both an ITIN and an SSN can be used to build a credit history, it’s helpful to understand the practical differences in the journey. The path for an ITIN holder often requires being a bit more strategic in finding the right financial products.

Ultimately, the goal is the same for both: to establish a record of responsible borrowing. While an ITIN holder might have fewer options right out of the gate, with the right approach, you can build a credit profile that is just as strong and respected as one built with an SSN.

Finding Financial Products That Welcome ITINs

Okay, so you know it's possible to build an ITIN credit history, but where do you actually start? This is often the biggest hurdle. Many of the big, national banks will hit you with a hard "no" if you don't have a Social Security Number. Don't get discouraged.

The key is to look beyond the mainstream players and find the institutions that genuinely want to work with you.

Your best bet is almost always going to be local. Think smaller.

When you walk into one of these places, you're not just another application number. You're a neighbor. That can make all the difference.

Preparing for Your Bank Visit

Walking in prepared is half the battle. When you have all your documents in order, you project confidence and reliability—exactly what a lender wants to see. They need to verify who you are and that you have a stable financial life.

Before you go, gather these essentials:

This shift from a transactional question to a relationship-building one can open doors. For a more detailed roadmap, our guide on how to build credit with an ITIN number lays out the entire process.

Your First and Best Credit-Building Tool

For almost everyone starting with an ITIN, the secured credit card is the perfect first step. Don't think of it as a "training wheels" card; see it for what it is—a powerful, strategic tool designed to get your credit file started on the right foot.

It’s a simple concept. You give the bank a small cash deposit, typically between 200 and 500, which they hold as security. In return, they give you a credit card with a limit that matches your deposit. So, a 300** deposit gets you a card with a **300 spending limit.

From there, you just use it for small, regular purchases you'd be making anyway, like groceries or gas. Pay the bill in full and on time every single month. That's the magic. The bank reports your positive payment history to the major credit bureaus—Experian, TransUnion, and Equifax—and just like that, you’re building your ITIN credit history.

After about 6-12 months of consistent, responsible use, most banks will reward you by converting the card to a standard, unsecured one and giving you your deposit back. It's a proven path forward.

Developing Smart Habits for Your New Credit

Getting that first credit card or loan with your ITIN is a huge step, but what you do next is what really counts. Think of it like learning any new skill—the habits you build today will set the stage for your entire ITIN credit history. It’s all about small, consistent actions that build a strong financial reputation over time.

The absolute most important thing you can do is pay your bill on time, every single time. I can't stress this enough. Your payment history isn't just one piece of the puzzle; it's the biggest one, making up about 35% of your credit score. Just one late payment can do serious damage. My advice? Set up automatic payments right away. It's the simplest way to make sure you're never late.

Mastering Credit Utilization

Next up is something called your credit utilization ratio (CUR). It sounds complicated, but it's just the percentage of your available credit that you're currently using. If this number gets too high, lenders see it as a red flag that you might be stretched too thin financially.

Here’s a great way to put this into practice: use your new card for a small, regular expense you already have, like a 15 streaming subscription. This keeps the account active and your utilization incredibly low, which looks fantastic to the credit bureaus. It’s a much smarter move than maxing out the card on a 450 purchase and then scrambling to pay it down.

Small Actions, Big Impact

Building a great ITIN credit history isn’t about making risky financial moves. It’s about being reliable. Lenders just want to see that you can manage credit responsibly, and this is an area where ITIN holders often shine.

In my experience, and backed by research, loans made to ITIN holders can perform just as well as—or sometimes even better than—those given to SSN holders. This is often because of a strong commitment to paying on time and a cultural tendency to avoid unnecessary debt. You can see the data for yourself in a detailed study on ITIN mortgage performance from the Urban Institute.

Your responsible actions prove that an ITIN is a solid foundation for creditworthiness. Here are the most effective habits to start right now:

By making these simple habits part of your routine, you’re not just avoiding common pitfalls. You are actively building a credit profile that will unlock better rates, bigger loans, and more financial opportunities down the road.

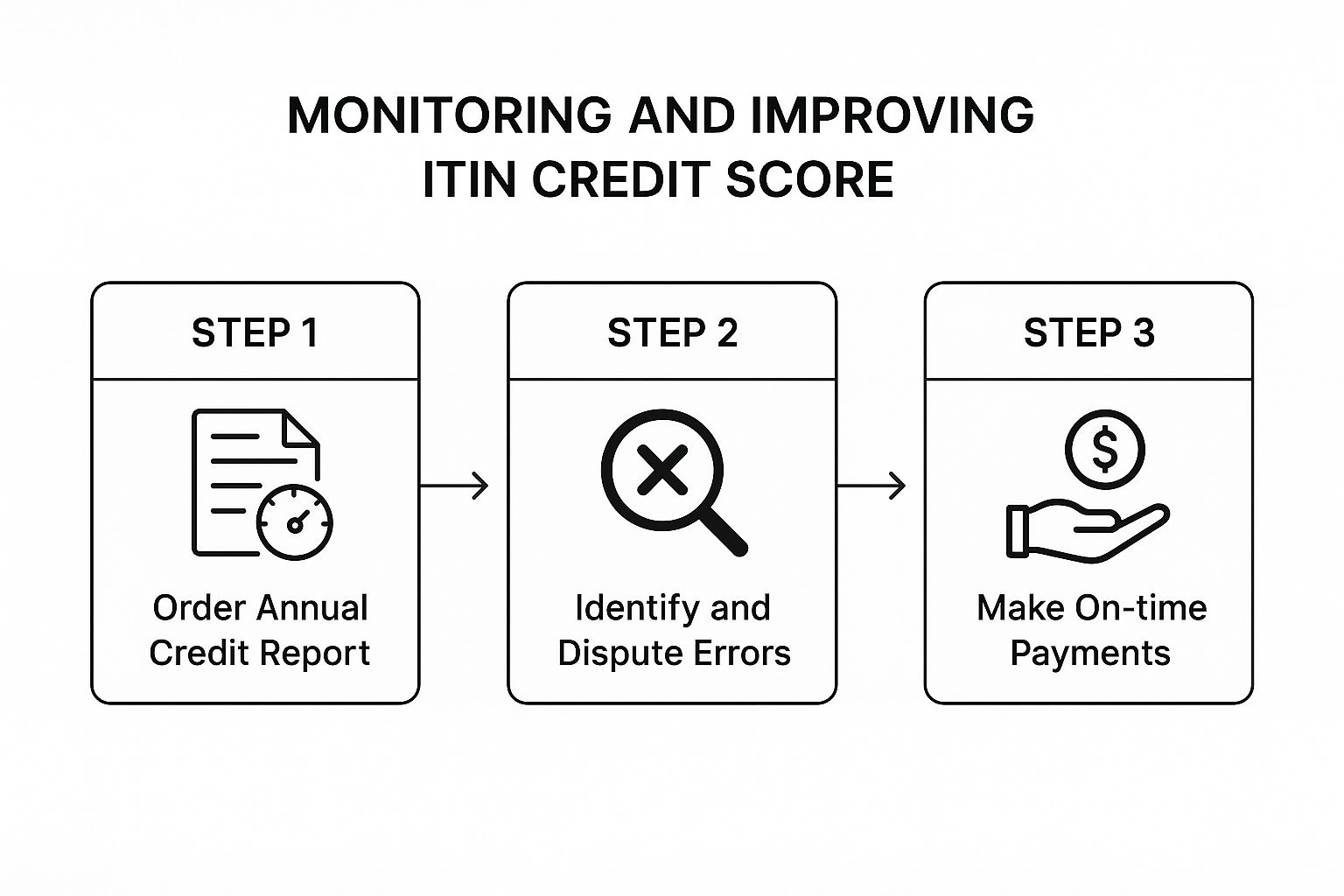

So, you’ve started building your ITIN credit history. That's a huge step forward. But here’s the thing: you can't improve what you don't measure. Keeping a close eye on your credit is the only way to track your progress, spot any mistakes, and stay on track.

The challenge is that most of the big online credit monitoring services are built around Social Security Numbers, which can be frustrating when you only have an ITIN.

The good news? There's a reliable way to get what you need. You are legally entitled to a free credit report every year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. The catch is you'll have to request them the old-fashioned way—by mail.

Yes, it takes a bit more effort than a few clicks online. But it's hands-down the best way to get a full, accurate picture of your credit file. Since the bureaus need to verify your identity without an SSN, sending them comprehensive documentation is the secret to getting your report without a hitch.

Requesting Your Reports by Mail

To make sure your request goes through smoothly, you'll need to gather a few documents to send with your written request letter. While the exact requirements might differ slightly between bureaus, this list covers the essentials you'll need for all three.

This simple flow shows how reviewing your credit report is the key to improving your score.

As you can see, getting your report is the first step. It lets you find issues and build the positive payment habits that will make a real difference. You can dive deeper into the specifics of getting your ITIN credit report in our detailed guide.

Simpler, Real-Time Monitoring Options

While mailing in for your annual report gives you a comprehensive deep dive, you don’t have to wait a whole year to see how you're doing. More and more financial companies are finally recognizing the needs of ITIN holders and are building credit monitoring right into their services.

Many ITIN-friendly credit card issuers and fintech platforms now offer free access to your credit score directly in their app or on their website. These tools often update weekly, giving you a near-real-time look at how your good financial habits are paying off.

This instant feedback is incredibly motivating. You can see the direct impact of making on-time payments and keeping your credit utilization low. By combining your annual mail-in reports with these digital tools, you get the best of both worlds: a complete, detailed overview and the daily insights you need to confidently manage your credit journey.

Putting Your Hard-Earned ITIN Credit to Work

After months of discipline and smart financial moves, you've built a solid ITIN credit history. This is where the real fun begins. The focus now shifts from just establishing credit to actually using it as a powerful tool—one that can unlock major life goals and create new opportunities for you and your family.

This isn't just about qualifying for another credit card. It's about having the financial standing to access larger, more meaningful financing. Think about a personal loan to consolidate debt, financing for your small business, or one of the most common goals: getting a car loan.

The Hidden Advantage of Your ITIN Credit Profile

Here's something I’ve seen time and again that most people don't realize: as a group, ITIN holders often show incredibly responsible credit habits. This diligence frequently leads to credit profiles that are, on average, even stronger than those of the general population.

In fact, research from Open Lending shows that ITIN holders often have higher average FICO scores and are viewed by lenders as highly dependable borrowers. This is especially true in the auto loan market, where a car is often essential for work and improving your family's life.

This trend puts you in a great position. A good ITIN credit history isn't just a substitute for one based on an SSN; in many cases, it signals exceptional financial reliability.

From Good Credit to Major Milestones

With a good credit score in hand, you can confidently walk into a lender's office to apply for significant financial products. Let's talk about a real-world example: buying a reliable car. This isn't just a purchase; for many, it's an investment in getting to a better job, taking kids to school safely, and simply making daily life more manageable.

Your strong ITIN credit history makes you a prime candidate for great auto loan terms. Lenders are far more likely to offer you:

As your credit score improves, more and more financial doors open. The table below illustrates how your growing creditworthiness can translate into real-world opportunities.

Financial Milestones Unlocked by Good ITIN Credit

This same principle applies to other major goals, whether it’s a personal loan for a family emergency or, down the road, exploring your options for buying a home. Your credit history is your most valuable financial asset.

If you're just starting out on this path, our guide on how to establish credit is the perfect place to begin. By using your credit wisely, you turn responsible habits into real, tangible progress.

Common Questions on Your ITIN Credit Journey

It’s completely normal to have questions as you start building credit in the U.S. with an ITIN. Honestly, it's a new process for most people, so figuring out the details is a smart move. Let's walk through some of the most common questions we see from ITIN holders just like you.

Getting clear answers upfront means you can build your credit with confidence and avoid any frustrating setbacks along the way.

What Happens to My Credit History When I Get an SSN?

This is a big one, and probably the most frequent question we get. You've worked hard to build a solid ITIN credit history, so what happens to it when you finally get a Social Security Number?

Rest assured, all that hard work pays off. Your credit history doesn't vanish—it’s tied to you, not just the number.

Once you have your SSN, you’ll need to merge your two credit files. This means reaching out to each of the three major credit bureaus—Experian, TransUnion, and Equifax—and giving them copies of your ITIN and new SSN documentation. They will then combine all your account history into a single, unified credit report under your SSN.