7 Best ITIN Credit Card Options for 2025

For millions of people in the U.S., an Individual Taxpayer Identification Number (ITIN) is a vital tool for participating in the financial system. However, a common misconception is that building credit without a Social Security Number (SSN) is impossible. Fortunately, a growing number of financial institutions offer credit cards specifically for ITIN holders, paving the way for financial inclusion and stability.

Obtaining an ITIN credit card is a critical first step toward establishing a U.S. credit history. A strong credit profile is essential for renting an apartment, securing favorable loan terms, and achieving long-term financial goals. This guide is designed to simplify your search for the right card.

We will provide a detailed roundup of the best credit cards that accept ITIN applications. Each review will cover key features, eligibility requirements, potential fees, and direct application links to streamline the process. You'll find a curated selection of options, from secured cards perfect for beginners to rewards cards for more established users. This article cuts through the complexity, giving you the clear, actionable information needed to choose the best ITIN credit card and start building your financial future today.

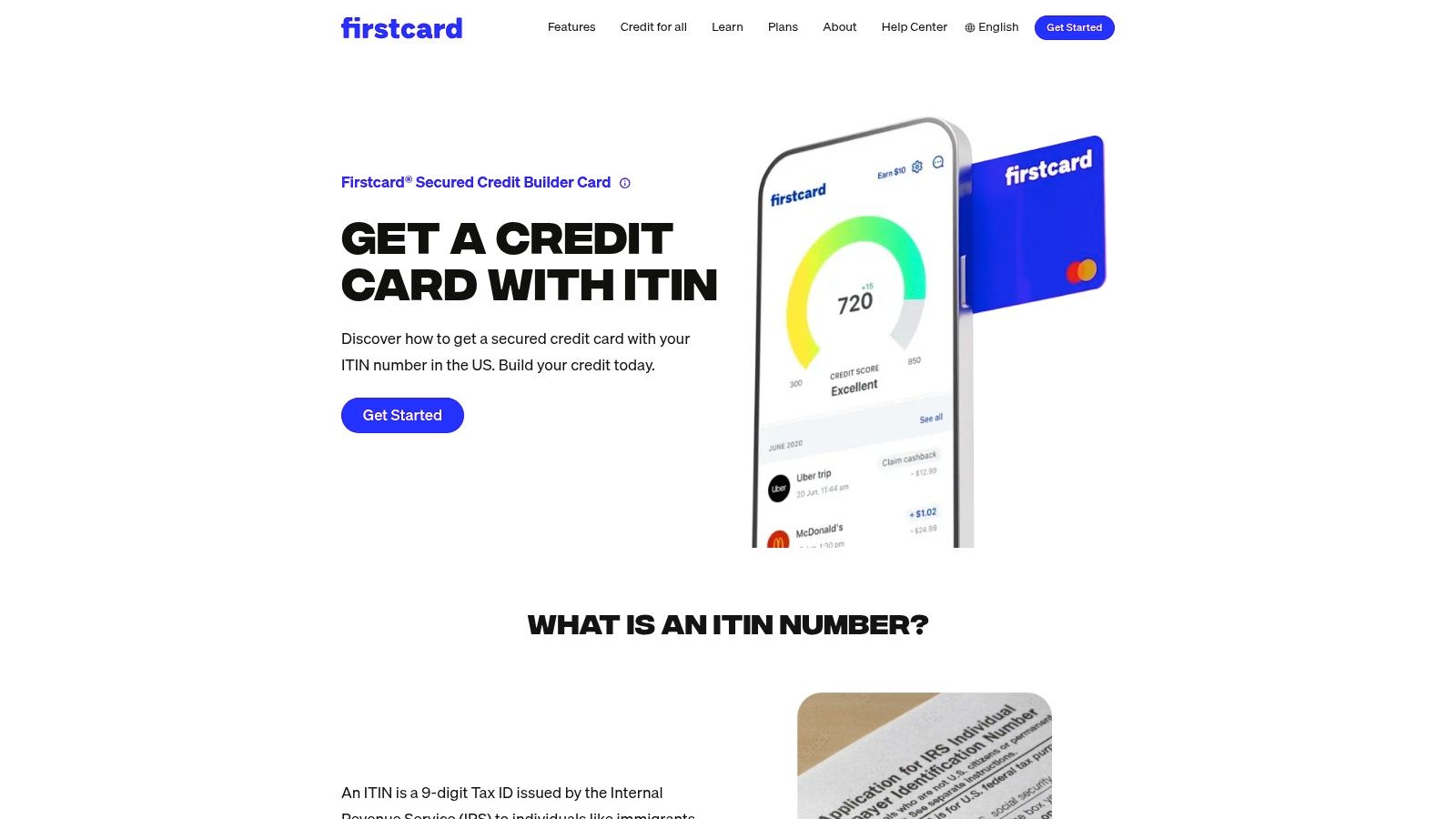

1. Firstcard® Secured Credit Builder Card

The Firstcard® Secured Credit Builder Card stands out as a powerful financial tool designed specifically for individuals without a Social Security Number (SSN). It directly addresses the needs of ITIN holders by allowing them to apply with an ITIN or even just a passport, making it one of the most accessible options for newcomers to the U.S. financial system. This platform is more than just a credit card; it's a comprehensive credit-building ecosystem.

Unlike many traditional secured cards, Firstcard integrates high-yield savings and robust cash-back rewards, which are features typically reserved for premium unsecured cards. This unique combination allows you to build your credit history while actively growing your savings and earning money back on purchases.

Standout Features and Benefits

Firstcard’s primary advantage is its seamless application process for non-SSN holders. Beyond accessibility, its features are designed for maximum financial benefit.

How It Works: A Closer Look

As a secured ITIN credit card, your credit limit is equal to the amount you deposit into your Firstcard account. This "debit-style" spending prevents you from accumulating debt or spending more than you have, fostering responsible financial habits.

Visit Firstcard® Website

2. Firstcard® Secured Credit Builder Card

The Firstcard® Secured Credit Builder Card stands out as a powerful financial tool designed specifically for individuals without a Social Security Number (SSN). It directly addresses the needs of ITIN holders by allowing them to apply with an ITIN or even just a passport, making it one of the most accessible options for newcomers to the U.S. financial system. This platform is more than just a credit card; it's a comprehensive credit-building ecosystem.

Unlike many traditional secured cards, Firstcard integrates high-yield savings and robust cash-back rewards, which are features typically reserved for premium unsecured cards. This unique combination allows you to build your credit history while actively growing your savings and earning money back on purchases, making it a multifaceted financial product.

Standout Features and Benefits

Firstcard’s primary advantage is its seamless application process for non-SSN holders. Beyond accessibility, its features are designed for maximum financial benefit.

How It Works: A Closer Look

As a secured ITIN credit card, your credit limit is equal to the amount you deposit into your Firstcard account. This "debit-style" spending prevents you from accumulating debt or spending more than you have, fostering responsible financial habits. Your deposit acts as collateral, which minimizes risk for the issuer and removes the need for a prior credit history check.

Visit Firstcard® Website

3. Capital One Credit Cards

Capital One stands as a major financial institution that openly welcomes Individual Taxpayer Identification Number (ITIN) holders into its ecosystem. It provides a crucial pathway for those without an SSN to access mainstream credit products, offering a range of both secured and unsecured cards. This accessibility from a well-known bank makes Capital One a trusted and reliable choice for newcomers building their financial foundation in the U.S.

Unlike many niche fintech solutions, Capital One provides the stability and broad product selection of a large bank. This means ITIN holders can start with a credit-builder card and potentially graduate to more rewarding options within the same institution as their credit profile improves.

Standout Features and Benefits

Capital One’s key advantage is its blend of accessibility and established credibility. The platform offers tools and products that cater directly to individuals at the very beginning of their credit journey.

How It Works: A Closer Look

For those new to credit, the Capital One Platinum Secured Credit Card is a common starting point. Applicants provide a refundable security deposit, which typically becomes their credit line. After demonstrating responsible use, such as making on-time payments, Capital One may consider an automatic credit line increase or an upgrade to an unsecured card.

Visit Capital One Website

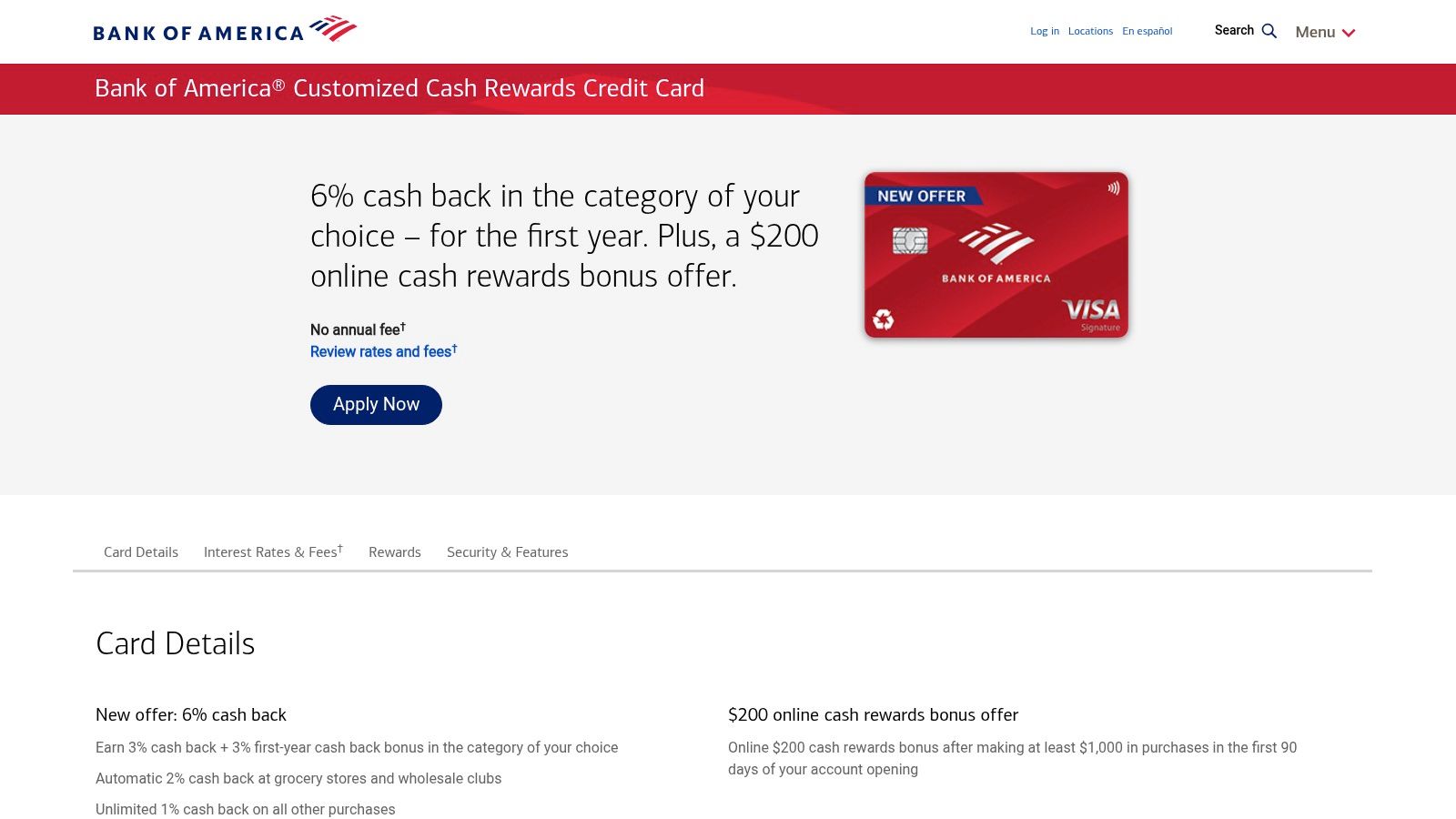

4. Bank of America® Customized Cash Rewards Credit Card

For ITIN holders who have already established some credit history, the Bank of America® Customized Cash Rewards Credit Card offers a step up into the world of unsecured rewards cards. As one of the major financial institutions that accepts ITIN applications in-branch, Bank of America provides a mainstream pathway to powerful credit-building and rewards-earning potential. This card is an excellent choice for those ready to move beyond secured cards and manage their credit more actively.

Unlike many entry-level ITIN credit card options, this card features no annual fee and a robust, flexible cash-back program. Its key appeal lies in letting you choose your top rewards category, allowing you to align your spending habits with maximum cash-back potential. This level of customization is rare for cards accessible to ITIN applicants.

Standout Features and Benefits

The primary advantage of this card is its combination of no annual fee and a customizable rewards structure, making it a sustainable, long-term financial tool. It empowers you to maximize earnings based on your personal spending patterns.

How It Works: A Closer Look

As an unsecured ITIN credit card, approval is based on your creditworthiness, not a security deposit. This means you must have a fair-to-good credit history to qualify. The 3% and 2% cash-back categories apply to the first $2,500 in combined qualifying purchases each quarter, after which you earn a flat 1% back on all purchases. For more details on the application process, you can explore information about banks that accept ITINs.

Visit Bank of America® Website

5. Discover it® Secured Credit Card

The Discover it® Secured Credit Card is a top-tier choice for ITIN holders looking to build credit with a mainstream financial institution. Backed by a major card network, it provides the security and reliability many new U.S. residents seek. Discover’s willingness to accept ITIN applications opens the door for individuals without an SSN to access premium credit-building tools and rewards typically reserved for established consumers.

Unlike many basic secured cards, this card offers a robust cash-back program and a clear path to an unsecured card. This makes it an excellent long-term financial partner, rewarding you for responsible use while helping you establish a strong credit history. The inclusion of free FICO® Score monitoring further empowers users to track their progress.

Standout Features and Benefits

Discover's primary advantage is combining no annual fee with a generous rewards program, a rare feature in the secured card market. This makes it a cost-effective tool for building credit.

How It Works: A Closer Look

To get this ITIN credit card, you provide a refundable security deposit between 200 and 2,500, which determines your credit limit. This deposit is fully refundable if you close your account in good standing or graduate to an unsecured card.

Visit Discover® Website

6. Citi® Secured Mastercard®

The Citi® Secured Mastercard® is a mainstream option from one of the nation's largest banks, offering a straightforward path to credit for those with an Individual Taxpayer Identification Number (ITIN). This card is particularly appealing for individuals who prefer banking with a well-established institution and are focused purely on building or rebuilding their credit profile without the complexity of rewards programs. Its acceptance of ITIN applications makes it a reliable choice for newcomers to the U.S. financial landscape.

Unlike fintech startups, Citi provides the security and extensive customer support network of a global financial leader. The card’s primary function is to help you establish a positive payment history, and it does so by reporting your activity to all three major credit bureaus. This diligent reporting is a critical component of any effective credit-building strategy.

Standout Features and Benefits

The main advantage of the Citi® Secured Mastercard® is its simplicity and backing from a trusted financial name. It strips away bells and whistles to provide a no-nonsense credit-building tool.

How It Works: A Closer Look

As a secured ITIN credit card, you must provide a refundable security deposit between 200 and 2,500. This deposit determines your credit limit and minimizes the risk for the bank. By making timely payments, you demonstrate creditworthiness, which can help you graduate to an unsecured card in the future.

Visit Citi® Website

7. Zolve Credit Card

The Zolve Credit Card is engineered for international students and professionals arriving in the U.S., offering a streamlined path to credit without an SSN. Zolve's platform allows applicants to use an ITIN or other alternative documentation, recognizing that a traditional credit history might not be available for newcomers. This focus makes it an excellent choice for those building a financial foundation from scratch in a new country.

Unlike many introductory cards, Zolve provides a robust rewards program and potentially high credit limits from the start, bypassing the need for a security deposit. This positions it as a strong unsecured ITIN credit card option for qualified applicants, helping them integrate into the U.S. credit system more quickly.

Standout Features and Benefits

Zolve's key advantage is its accessibility for international arrivals, combined with features usually found on more established credit cards. Its benefits are tailored to help users build credit while earning valuable rewards.