ITIN Application Requirements Guide

Starting your Individual Taxpayer Identification Number (ITIN) application can feel like you're staring at a maze of IRS rules. But when you break it down, the core ITIN application requirements are actually pretty straightforward. It all boils down to three key pieces: a correctly filled-out Form W-7, a valid federal tax return, and very specific documents that prove who you are.

A Practical Guide to the ITIN Application Process

An ITIN is a must-have if you have a U.S. tax filing obligation but aren't eligible for a Social Security Number. Think of this guide as your roadmap—we'll walk through exactly what you need to do, step by step, so you can get it right the first time.

Why the IRS Is So Strict

You might wonder why the process is so demanding. It’s because the IRS has two competing goals: they need to make it possible for legitimate filers to pay their taxes, but they also have to aggressively fight identity theft and fraud. This balancing act is why the ITIN application requirements are so rigid. Every document you send is carefully examined to confirm your identity and foreign status, making sure only people who truly need an ITIN get one.

The statistics paint a clear picture. In 2023, the IRS issued almost 900,000 ITINs, but it also had to reject over 250,000 applications. Based on research from the Taxpayer Advocate Service, a huge number of those rejections came down to paperwork that just didn't meet the strict standards.

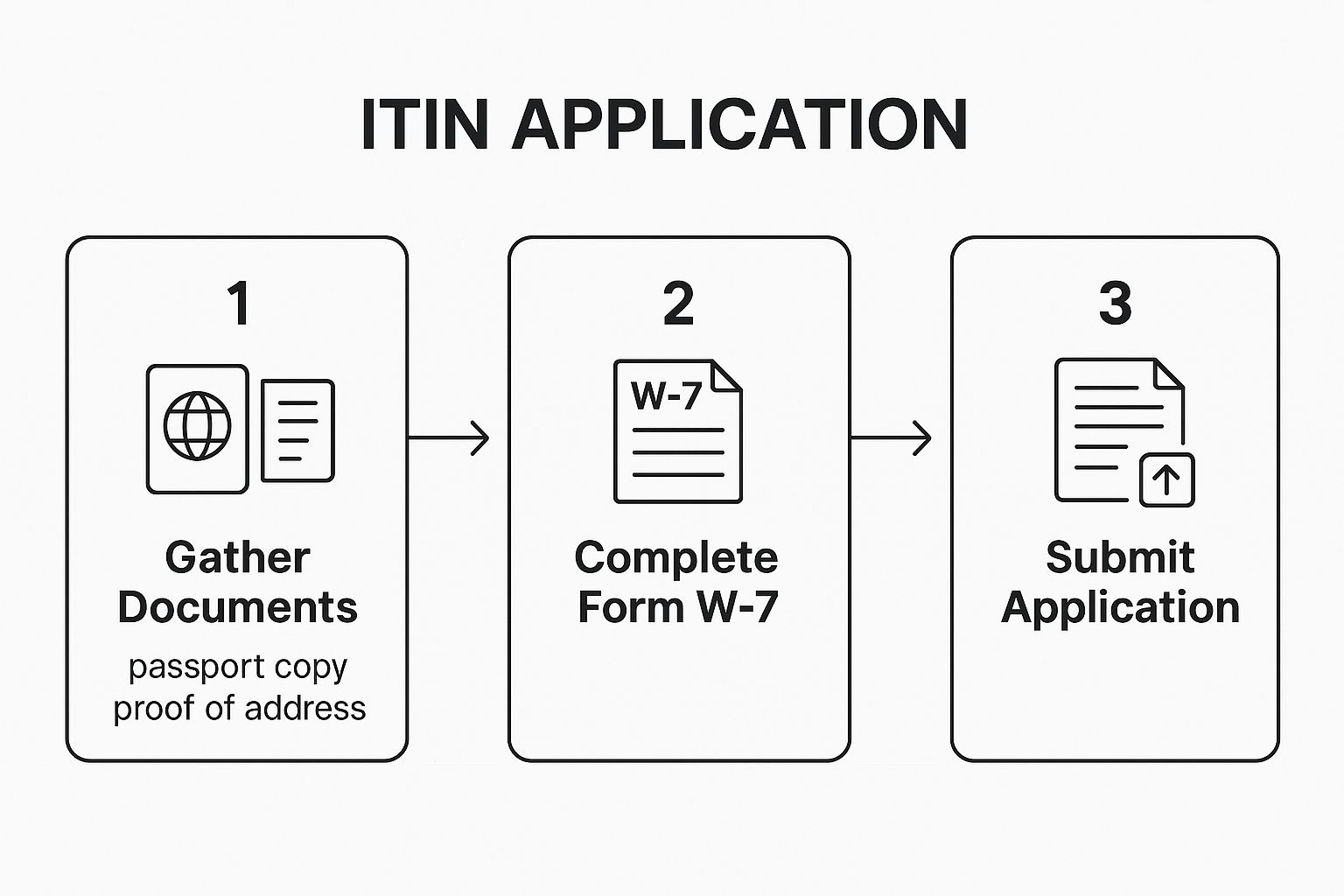

The 3 Core Components of Your Application

Your entire application rests on three critical parts. Get these right from the beginning, and you'll sidestep the common pitfalls that lead to delays or outright rejection.

Gathering Your Proof of Identity Documents

Your entire ITIN application really comes down to this: providing the right documents. I can't stress this enough—the IRS is incredibly strict here, and getting this step right is non-negotiable. You're essentially proving two things: who you are (identity) and that you're not a U.S. citizen (foreign status).

The most straightforward way to do this is with a foreign passport. If you have one, you're in luck. It's the only document the IRS accepts all on its own because it proves both your identity and foreign status in one go. If you can use a passport, do it. It just makes everything simpler.

What to Do If You Don't Have a Passport

No passport? Don't worry, you still have options, but you'll need to do a bit more legwork. The IRS allows 12 other types of documents, but the catch is you have to submit a combination of at least two of them.

Here's a quick look at the 13 documents the IRS will accept. Keep in mind, only the passport can stand alone. All others must be combined to meet the requirements.

Acceptable Documents for Your ITIN Application

So, for example, a student from Mexico could pair their national identity card with their foreign birth certificate. The national ID establishes their identity, and the birth certificate proves their foreign status. Together, they satisfy the IRS requirements.

As you can see, gathering your documents is the critical first step before you even think about filling out Form W-7.

Originals vs. Certified Copies: A Critical Choice

This is where a lot of people get tripped up. You have two choices: send your original documents or send certified copies from the agency that issued them. Let me be clear: standard photocopies, even if notarized, will get your application rejected instantly.

Mailing your original passport is nerve-wracking for obvious reasons. If it gets lost, you're in for a major headache.

Getting these certified copies can take weeks or even months, so you need to plan ahead. If you're looking for a more detailed walkthrough, our complete guide on how to apply for an ITIN offers more tips to help you avoid common pitfalls. Getting your documents sorted out correctly from the very beginning will save you a world of time and stress.

Getting IRS Form W-7 Right the First Time

Think of Form W-7 as the command center for your ITIN application. At first glance, it might seem like just another piece of government paperwork. But from my experience, I can tell you that every single line is a potential pitfall that can lead to frustrating delays or even an outright rejection. Nailing this form is absolutely crucial for meeting the overall ITIN application requirements.

One of the simplest yet most common mistakes I see is a name mismatch. The name on Line 1a must be an exact match to what’s printed on your foreign passport or other identity documents. I mean exact. If your passport says "Juan Carlos Rodriguez," don't shorten it to "Juan Rodriguez." Every initial, every part of your name matters. Precision is your best friend here.

Choosing Your Reason for Applying

The part of the form that trips most people up is Box 2, where you state your "Reason you're submitting Form W-7." You have to pick just one option from boxes a through h, and for most applicants, it boils down to two main choices:

Picking the wrong box is a surefire way to get your application flagged, kicking off a review process that can add weeks or months to your wait time.

Finally, while an ITIN's primary job is for tax processing, its value doesn't stop there. Once your application is approved, that nine-digit number is your key to building a financial footprint in the United States. You can learn more about how an ITIN credit report works and how it paves the way for accessing financial products. It’s a simple number that opens up a world of opportunity beyond just filing taxes.

Choosing the Right Way to Submit Your Application

So, you've got your Form W-7 filled out and your supporting documents are all gathered. Now comes the moment of truth: how do you actually get this package to the IRS? You have three ways to go, and the one you choose really depends on your personal situation—your comfort level with risk, what services are near you, and how quickly you need your passport back in your hands.

The most common route is simply mailing everything to the IRS processing center in Austin, Texas. It’s direct, but there’s a major catch that gives most people pause. You have to send your original foreign passport or other identity documents. I've heard countless stories of people getting nervous just thinking about their passport getting lost in transit, and frankly, I don't blame them.

Comparing Your Submission Options

Let's walk through the three methods so you can figure out what works best for you. Think about what you value most: is it saving money, convenience, or keeping your documents secure?

The Role of a Certifying Acceptance Agent

Using a CAA is a very popular choice because it hits that perfect balance of being secure and straightforward. These agents are typically accountants, attorneys, or enrolled agents who have been specifically trained by the IRS. They'll review your ITIN application requirements with a fine-toothed comb and verify your documents in person.

Once they've confirmed everything, they'll send your application to the IRS along with their own certificate of accuracy. This tells the IRS that a trusted professional has already vetted your documents, so you get to keep your passport safe at home.

A word of caution, though: be selective about the agent you choose. The Treasury Inspector General for Tax Administration (TIGTA) has pointed out a significant drop in IRS oversight. In fiscal year 2022, the IRS conducted only 25 compliance reviews on these agents, a steep decline from over 300 annually in prior years. You can read the details yourself in the TIGTA report on ITIN program management. This makes it more important than ever to find a CAA with a solid, verifiable track record.

Why Do ITIN Applications Get Rejected? Let’s Look at the Common Mistakes

Nothing is more frustrating than getting that rejection notice from the IRS after waiting weeks for your ITIN. It’s a huge setback, but the good news is that most rejections are caused by simple, avoidable mistakes. I’ve seen it happen time and again.

By far, the most common blunder is sending in expired identity documents. That passport or national ID card absolutely must be current. Another frequent misstep is mailing standard photocopies of your documents. The IRS is incredibly strict on this point; you must send either the original document or a certified copy from the agency that issued it. A notarized copy won't cut it and will get your application bounced back immediately.

Ineligibility and Deactivation Issues

Beyond basic paperwork errors, there are a few bigger-picture issues you need to be aware of. One of the most significant is the ITIN deactivation rule. If you go three consecutive years without filing a U.S. federal tax return, the IRS will automatically deactivate your ITIN. It doesn't just go dormant; it's gone. You'll have to start the entire application process over from scratch.

This rule, combined with other policy shifts, has had a major impact. In tax year 2019, the number of returns from primary ITIN holders dropped to just over 2 million. That's a massive 58% decrease from previous years, driven largely by these stricter documentation and usage standards. You can dig deeper into this data and what it means for tax policy by reading the ITIN filer data report from ITEP.org.

To make sure your application is solid, always run through this final mental checklist:

Getting these three things right puts you way ahead of the curve and dramatically increases your chances of getting approved on the first try.

Answering Your Top ITIN Questions

Even after you've dotted your i's and crossed your t's on Form W-7, a few nagging questions usually pop up. Let's walk through some of the most common ones I hear from applicants once they have their documents ready to go.

How Long Does an ITIN Application Take?

This is where you'll need a bit of patience. The IRS typically gives a processing timeline of 7 to 11 weeks. That window can get even longer during the mad dash of tax season, which runs from January through April.

If you apply outside of that peak time, you might see a quicker turnaround. But here's a pro tip: any small error or piece of missing information can send your application to the back of the line, causing significant delays. It really pays to double-check everything before you mail it.

Can I Use an ITIN for Work?

This is a big one, and there's a lot of confusion around it. The answer is a firm no. An ITIN is strictly for federal tax purposes. It's designed so people without an SSN can file their taxes, and that's its sole function. It doesn't give you any authorization to work in the U.S. or affect your immigration status.

Once you have your ITIN in hand, you can start building your financial life in the U.S. A question I often get is how to build credit with an ITIN number, which is a fantastic next step on your path to financial independence.

Ready to take control of your financial future? itin score is the first platform designed for ITIN holders to build and monitor their credit securely. Get your free credit report and a personalized action plan in minutes. Start building your U.S. credit history today at https://www.itinscore.com.