Fix Insufficient Credit History and Build Your Profile

Imagine your credit history is like your financial resume. When you have an insufficient credit history, it's like handing a potential employer a blank page. It doesn't mean you're a bad candidate—it just means they have no track record to look at. For lenders, this lack of information makes it tough to approve you for a loan, an apartment, or even a new phone plan.

Understanding Your Financial Starting Point

Having an insufficient credit history essentially makes you "credit invisible." In the eyes of a lender, your financial past is a complete mystery. Without a history of borrowing money and paying it back on time, they have no real way to predict how you'll manage future debts. This uncertainty makes them nervous, and they see you as a higher risk.

And you're not alone. Being credit invisible is a major hurdle for millions of people. In the United States, about 26 million adults don't have enough data on file with the major credit bureaus to even generate a credit score. It's particularly common for young adults between 18 and 24, where almost 40% have little to no credit history. For a deeper dive into these numbers, TransUnion's latest industry report offers some great insights.

No Credit vs. Bad Credit: What's the Difference?

It’s really important to draw a line between having no credit and having bad credit. They sound similar, but they're worlds apart.

Having no credit just means there’s a lack of information. Your financial story hasn't been written yet. Bad credit, on the other hand, means your story has some negative marks on it, like late payments or defaults. Both create challenges, but the strategy for moving forward is completely different. To get a better handle on what goes into your financial record, check out our guide to understanding your credit report.

To make this crystal clear, let's break down how a lender might see someone with no credit, bad credit, and good credit. The table below gives you a snapshot of what each status means for your financial life.

Credit Profile Snapshot: No Credit vs. Bad Credit vs. Good Credit

As you can see, starting with a clean slate is far better than starting with a negative history. It gives you the power to build a strong financial foundation from the ground up.

Common Paths to Becoming Credit Invisible

Having an insufficient credit history isn't some kind of financial failing. Far from it. It's actually a pretty common situation that happens for all sorts of reasons. You might be "credit invisible" simply because you've never had a reason to borrow money before.

Think of it not as a setback, but as a blank slate—a fresh start to build a solid financial reputation from the ground up. Plenty of people are in the exact same boat, and understanding why can make the whole process feel a lot less intimidating.

Who Becomes Credit Invisible?

There are a few typical life stages and financial habits that naturally lead to a thin credit file. While everyone's story is different, the result is the same: lenders don't have enough data to get a sense of your reliability as a borrower.

Here are a few classic examples:

As you can see, being credit invisible is usually a matter of circumstance, not poor money management. Lenders are starting to recognize this growing group of people and are slowly creating new ways to help them.

Recent data shows that while overall credit card lending is on the rise, it still mostly benefits people who already have a credit profile. But there's good news. New credit card accounts for subprime borrowers—a category that often includes those with an insufficient credit history—jumped by 15.2%. You can dig into the numbers yourself by checking out these global credit trends in this detailed report.

This trend shows that even though lenders are still careful, they're becoming more open to bringing people with thin files into the fold. It means more pathways are opening up, giving you a real shot at building the strong financial foundation you need for your future.

The Everyday Hurdles of a Thin Credit File

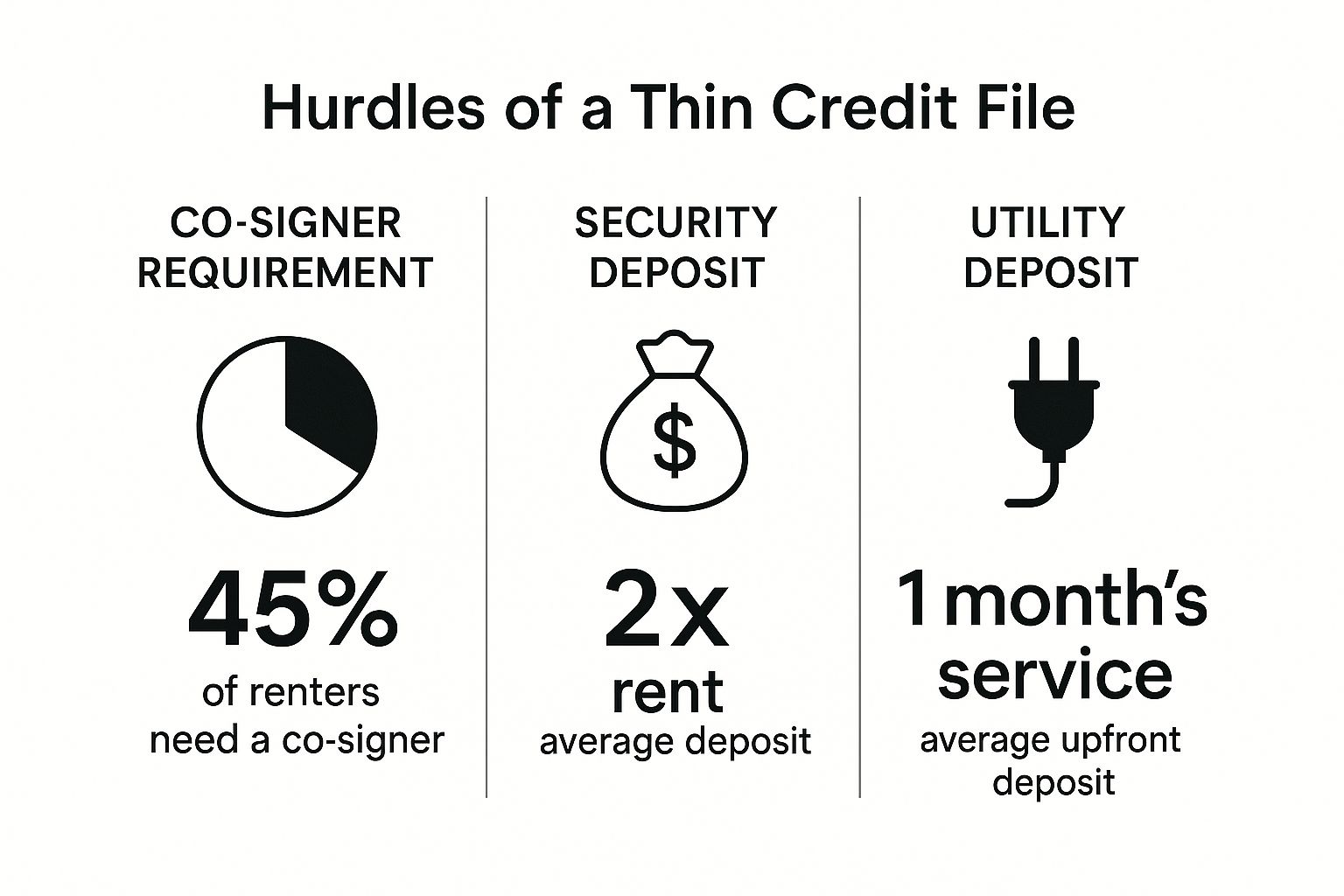

Having an insufficient credit history isn't some abstract financial problem—it creates very real, and often expensive, challenges in your day-to-day life. Think of it as an invisible barrier. Without a proven financial track record, businesses see you as a risk, and they'll ask you to prove your reliability in other ways that usually hit your wallet.

This financial friction shows up when you try to get basic necessities. Renting an apartment, for example, can become a huge headache. Landlords almost always run a credit check to see if you’re a dependable tenant. A thin file can lead to an outright rejection or force you to find a co-signer who has good credit.

The Hidden Costs of Being Credit Invisible

The financial penalties don't stop at housing. Many utility companies—for your electricity, gas, or even a new cell phone plan—will ask for a hefty security deposit if you can’t pass their credit check. That’s cash you have to lock away upfront, money that could have gone toward moving costs or furniture, all because you don’t have a credit score.

It's a similar story with car insurance. Insurers often use credit-based scores to set your premiums. A lack of credit history could mean you’re stuck paying much higher rates than someone with a long financial history, even if your driving record is spotless.

The infographic below paints a clear picture of the most common obstacles people with a thin credit file run into.

As you can see, these aren't just minor inconveniences. They are tangible costs that directly eat into your budget and limit your financial freedom.

When you zoom out, the economic impact is massive. In the U.S. and Canada, non-mortgage consumer debt recently grew by 3.1% to a staggering $2.58 trillion. People with thin credit files are often shut out of this market or forced to accept unfair terms, like sky-high interest rates, which makes it incredibly difficult to build any real wealth. You can discover more insights about the latest credit outlook to see the bigger picture.

Each of these roadblocks highlights just how essential it is to start building a credit history. It's not just about getting a loan someday; it's about achieving true financial independence.

Ready to Build Credit? Here’s How to Start From Scratch

Going from an insufficient credit history to a healthy financial profile isn’t an overnight fix—it's a journey made up of small, smart, and consistent moves. The great news is you’re starting with a clean slate. You get to write your own financial story, starting right now.

Think of it like learning to drive. You don’t jump onto the highway during rush hour on your first day. You start in an empty parking lot, learn the basic controls, and slowly build the skills and confidence you need. The same principle applies perfectly to building credit.

Start with a Secured Credit Card

For most people starting out, a secured credit card is the best first step. It's designed specifically for this situation. Unlike a regular credit card, a secured card requires a small, refundable security deposit to get started. This deposit usually sets your credit limit.

So, if you deposit 200**, you get a credit limit of **200. This simple feature removes the lender's risk, making it much easier to get approved, even with zero credit history.

You use it like any other credit card for small, everyday purchases—think gas, coffee, or groceries. The key is to pay the bill in full and on time every single month. Your lender reports this positive behavior to the credit bureaus, and just like that, you’ve started building your credit file.

Become an Authorized User

Another fantastic way to get a jump-start is by becoming an authorized user on a credit card belonging to a trusted family member or friend. If someone with great credit adds you to their account, you get a card with your name on it, and their good track record can start showing up on your credit report.

This can give your credit file a significant boost, but it hinges on one critical factor: the primary account holder's credit habits. You need to partner with someone who has:

This arrangement is built on mutual trust. It’s essential to have a clear conversation about rules and expectations before you move forward.

Look Into Credit-Builder Loans and Alternative Data

Credit cards aren't the only game in town. A credit-builder loan is another powerful tool designed for people with an insufficient credit history. These are often found at credit unions and community banks.

Here’s how it works: The bank lends you a small amount of money, but instead of giving it to you upfront, they place it in a locked savings account. You then make small, fixed payments over a period of time, like 6 to 24 months. Once you’ve paid off the loan, the money is yours. All those on-time payments get reported to the credit bureaus, building your history while you build your savings.

Don't forget about services that report your rent payments. Many services can now report your monthly rent payments to the credit bureaus, turning your biggest expense into a credit-building opportunity. By exploring these beginner-friendly options, you can actively establish a credit history from scratch and start paving the way to a stronger financial future.

Comparing Credit-Building Tools for Beginners

Choosing the right tool depends entirely on your personal situation and what you're comfortable with. The table below breaks down the most common options to help you decide which path is the best fit for you.

Ultimately, any of these tools can be effective. The most important thing is to pick one, use it consistently, and always, always pay on time. That's the real secret to building a great credit history.

How to Start Building Credit with an ITIN

Trying to navigate the U.S. financial world without a Social Security Number can feel like you've hit a wall, but it's definitely not a dead end. For the millions of people who use an Individual Taxpayer Identification Number (ITIN), building a solid credit profile is not only possible—it’s a crucial step toward financial stability. It all comes down to knowing the right steps to take and which doors to knock on.

When you first start, you’ll likely be told you have an insufficient credit history. That’s the default for most newcomers. But things are changing. A growing number of banks and newer financial tech companies are finally recognizing the ITIN community and are willing to work with you. These institutions will let you use your ITIN to apply for credit cards and loans, opening up a whole new world of financial opportunity.

Getting Your Application Ready to Shine

When you apply for credit, a lender is really just trying to answer one question: "Can I trust this person to pay me back?" Since you don't have a traditional credit report for them to look at, you have to prove your reliability in other ways. Walking in prepared is the single best thing you can do.

Before you even start filling out applications, get these key documents together:

Using Your Financial Habits as Your Superpower

Without a traditional credit score, your everyday financial habits suddenly become your most valuable asset. Think about it. Many lenders are starting to look beyond the score and are willing to consider this "alternative data" to get a better picture of who you are.

For instance, a checking or savings account that shows a healthy, stable balance and a history of regular deposits speaks volumes. It’s concrete proof of your financial responsibility.

This is how you go from being "credit invisible" to a real, qualified applicant. For a much deeper dive, you can learn all about how to get a credit score without a Social Security Number in our guide and start your journey with confidence.

By putting together a complete and organized application, you show lenders that even with an insufficient credit history, you are a trustworthy borrower who is ready to build a strong financial future in the U.S.

Mastering the Habits of a Healthy Credit Profile

Building credit is just the starting line. The real race is about maintaining it, and that’s what leads to genuine financial freedom. Think of it like a fitness routine: consistent, healthy habits are what get you long-term results.

When you understand what goes into your credit score, you can stop guessing and start taking control.

Your credit score is really just a summary of your financial habits, broken down into five key areas. The exact recipe is a trade secret, but the main ingredients are public knowledge. Let's break them down.

Developing Strong Credit Habits

Once you’ve opened your first credit account, your mission is to build a rock-solid foundation and leave the problem of an insufficient credit history behind for good. It all boils down to two simple but incredibly powerful habits.

First, always pay your bills on time. A single late payment can do serious damage to your score. The easiest way to nail this is to set up automatic payments or put reminders in your calendar so a due date never slips past you.

Second, keep your credit card balances low. A good rule of thumb is to never use more than 30% of your available credit limit. For instance, if you have a credit card with a 500** limit, you should aim to keep your balance under **150.

By focusing on these two fundamentals—paying on time and keeping balances low—you start writing a positive financial story. That consistency is what turns a blank credit profile into a powerful tool, opening doors to better loans, lower interest rates, and more financial opportunities.

Your Credit Building Questions, Answered

Jumping into the world of credit can feel like learning a new language. You’re bound to have questions, and getting straight answers is the first step toward building financial confidence and sidestepping common pitfalls.

Let's clear up some of the most common questions people have when they're just starting out.

How Long Until I Have a Credit Score?

Think of it like a 6-month trial period. Once you open a credit-building account (like a secured credit card), the lender starts sending reports about your payments to the credit bureaus.

After about six months of steady, on-time payments, the bureaus usually have enough information to calculate your very first FICO score. Consistency is everything here.

Can I Actually Get a Loan with No Credit History?

It’s tough, but not impossible. The big, traditional banks might say no, but don't get discouraged. You have other avenues to explore.