Installment Loans for Building Credit Explained

Yes, using installment loans for building credit is a smart and proven strategy. Why? Because it directly influences the most heavily weighted factors in your credit score. Every time you make an on-time payment, your lender reports that positive behavior to the credit bureaus, which is the foundational work of building a solid payment history.

How an Installment Loan Actually Builds Your Credit

Think of it like this: building credit is a marathon, not a sprint. It takes consistent, predictable effort over time. Installment loans are one of the best tools for this job because their structure is exactly what credit scoring models are designed to reward.

Each on-time payment you make is a gold star on your record, sent directly to the big three credit bureaus—Equifax, Experian, and TransUnion.

This isn't just a niche trick; it's a massive part of the financial world. Data from early 2024 revealed that the U.S. credit-building market had over $845 million in outstanding balances spread across more than 3 million accounts. What's truly telling is that a massive 93% of those borrowers either had no score or a subprime one. This highlights just how critical these loans are for people who are just starting out or rebuilding. You can dig into the full Federal Reserve report on these products for a deeper dive.

The Power of Payment History

Out of everything that goes into your credit score, nothing matters more than your payment history. It accounts for a whopping 35% of your FICO® Score. An installment loan gives you a perfect, straightforward way to nail this category.

You have a fixed payment amount and a set due date every month. This predictability makes it much easier to budget and set up automatic payments, virtually guaranteeing you’ll never miss a beat. For someone new to credit, showing you can handle this kind of commitment is everything. It’s a clear signal to future lenders that you’re a reliable borrower.

If you're truly starting from square one, our guide on how to build credit from scratch is an excellent resource to pair with this strategy.

It's All About the Mix

Another piece of the puzzle is your credit mix, which makes up about 10% of your FICO® Score. Lenders want to see that you can responsibly manage different kinds of credit. Generally, credit falls into two buckets:

So, how does this work in practice? The table below shows exactly how an installment loan can positively impact the key factors that make up your credit score.

How Installment Loans Impact Key Credit Score Factors

As you can see, the biggest wins come from payment history and credit mix, which are precisely the areas newcomers to credit need to develop. The small, temporary dip from opening a new account is a tiny price to pay for the long-term gains.

There are a couple of common ways to do this. With a secured credit-builder loan, the lender holds the money you "borrow" in a savings account until you've paid it off. Or, a small personal loan will give you the cash upfront. Both report to the credit bureaus and achieve the same goal: proving you can be trusted with credit through steady, reliable payments.

How to Pick the Right Credit-Building Loan

When you're looking for an installment loan to build credit, the number of options can feel a bit overwhelming. But don't worry. The trick is knowing what to look for, so you can cut through the clutter and find a loan that actually helps you.

First things first: your main goal here is to build a solid credit history. That means the single most important factor is whether the lender reports your payments to the credit bureaus. If they don't report to all three major bureaus—Experian, Equifax, and TransUnion—the loan is basically useless for credit-building. Always, always confirm this before you even start an application.

Comparing Your Lender Options

You'll run into a few different types of lenders, and each has its own vibe. Knowing the difference can save you a lot of headaches.

A Real-World Comparison

Let's walk through a common scenario. Say you have a limited credit history and you're weighing two offers for a $1,000 credit-builder loan with a 12-month term.

Lender A is your local credit union. They're offering a fantastic 5.99% APR. The catch? You have to stop by a branch to sign the final papers, and their app is pretty basic.

Lender B is a sleek online company. You can get approved in minutes from your couch. But their APR is much higher at 14.99%. On the plus side, their app is top-notch and they have 24/7 chat support.

So, what's the right move? In this case, the credit union is the clear financial winner. Over the year, you’d pay about 33** in interest. With the fintech lender, that interest balloons to roughly **82—more than double the cost. While the convenience is tempting, the savings from the credit union are too significant to ignore.

The Final Checklist Before You Sign

Okay, you've compared the big stuff. Before you commit, do one last sweep for any hidden costs that could bite you later.

By focusing on these key things—bureau reporting, APR, and fees—you can confidently pick a loan that will do its job without breaking the bank. If you want to dive deeper into how these products work from the inside out, our guide on what a credit builder account is can give you the foundational knowledge to make an even smarter choice.

Navigating the Loan Application and Approval Journey

Applying for a loan can feel like sending your information into a black hole, but it doesn't have to be a mystery. When you're looking for an installment loan specifically to build credit, the process is actually more straightforward than you might expect. It's less about your past and much more about your present financial stability.

Lenders who offer these products are used to working with people who have thin or even non-existent credit files. They get it. That's why they focus so heavily on two main things: your proof of income and your debt-to-income (DTI) ratio. What they really want to see is that you have a steady, reliable way to handle the small monthly payments.

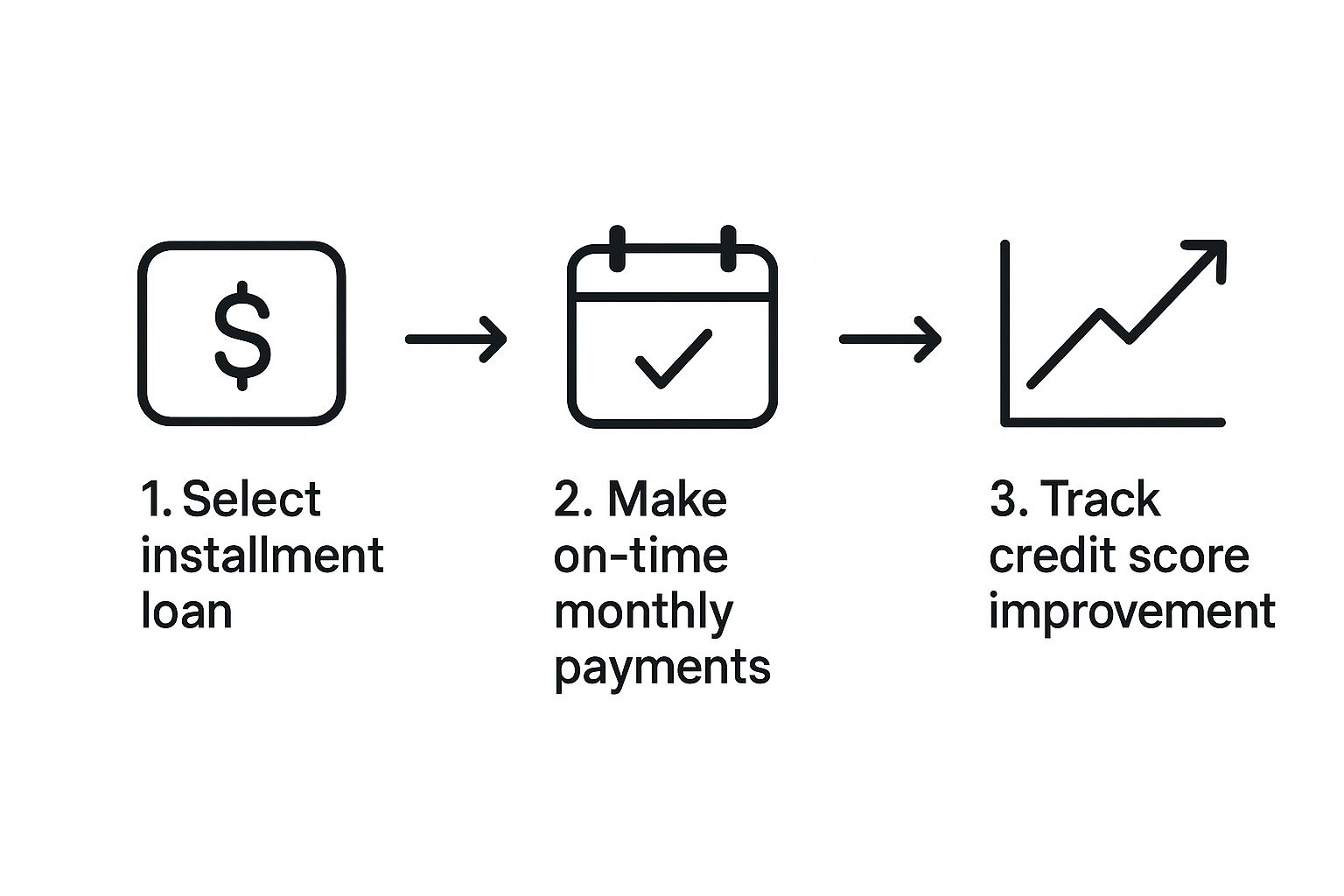

The whole path, from picking the right loan to finally seeing that positive impact on your credit report, follows a pretty clear pattern.

As you can see, the key is simply consistent, responsible action over the entire life of the loan.

What You'll Need to Apply

To make the application process as smooth as possible, it’s a good idea to get your documents in order before you even start. Having everything ready to go minimizes potential delays and shows the lender you're serious and organized.

Here’s a quick checklist of what you’ll likely need:

Take your time when you're filling out the application form. A simple typo in your name, address, or income figures can lead to an automatic rejection or frustrating back-and-forth. Be precise and completely honest.

What Lenders Really Look For

Let's walk through a real-world scenario. Picture a recent college grad who just landed her first full-time job but has zero credit history. She applies for a $500 credit-builder loan.

When the lender reviews her application, they see she doesn't have a FICO score. But what they do see are consistent paychecks being deposited into her bank account for the past three months. Her income easily covers her low rent and the small loan payment, which might be around $45 per month.

The lender approves her. Why? Not because of her credit history (or lack thereof), but because she has a demonstrated, reliable ability to pay. This is the fundamental principle behind installment loans for building credit.

Once you hit "submit" on your application, the lender starts its verification process. They’ll double-check the information you provided, sometimes using a third-party service to confirm your identity and income. With many online lenders, approval can be almost instant. If you're working with a credit union, it might take a day or two. Just hang tight—a positive result is often just around the corner.

How to Manage Your Loan for the Biggest Credit Boost

Getting approved for a loan feels like a win, but it’s really just crossing the starting line. The real work starts now. How you handle this new account over the next few months will decide if it becomes a powerful stepping stone for your financial future or just another monthly bill.

Your entire strategy hinges on one simple, non-negotiable rule: never, ever miss a payment. Consistency is everything in the credit world. A single late payment can derail your progress, so your very first move after getting the loan should be setting up a system to make that impossible.

This isn't just about dodging negative marks on your report; it's about actively building a positive one. Small-dollar installment loans, like credit-builder loans, are surging in popularity for this very reason, reaching $1.4 billion in outstanding balances by late 2023. Their predictable payment structure gives a clear path forward for the nearly 70% of borrowers using them to rebuild their credit. You can dive deeper into the numbers with the Federal Reserve's analysis on small-dollar loans.

Set Up Your Payments for Success

The moment you get your loan details, log in to the lender’s online portal and set up autopay. Don’t put this off. It's the single best way to guarantee your payment is always on time, directly boosting the most important factor in your credit score—your payment history. It makes up a massive 35% of your FICO® Score.

Next, you need to bake this payment into your monthly budget. Treat it just like your rent or your phone bill. If the payment is 50, go into your spreadsheet or budget app and account for that 50 right away. This removes the "oh, I forgot" excuse and makes the loan a seamless part of your financial routine.

Why You Shouldn't Pay It Off Early

This might sound backward, but paying off your credit-builder loan ahead of schedule can actually work against you. Sure, you'll save a tiny bit on interest, but you'll also be cutting short the very payment history you’re trying to create.

Think of it like a job reference. A glowing recommendation from a boss you worked with for a full year carries a lot more weight than one from a manager who only saw you for a single, short project. Let the loan run its full term to get the maximum positive impact on your credit report.

Keep an Eye on Your Progress

Finally, don't just set it and forget it completely. You need to make sure all your good habits are actually paying off. Here’s a simple way to stay on top of things:

By actively managing your loan this way, you're no longer just a borrower. You become the architect of your own credit success story.

Watch Out for These Common Credit-Building Traps

Using an installment loan to build your credit score is a smart move, but it's not a foolproof plan. Like any financial strategy, there are a few classic mistakes that can trip you up. Steering clear of these pitfalls is just as crucial as making your payments on time. A simple oversight can easily derail your progress or, even worse, put you in a bigger financial hole than when you started.

Let's walk through the most common mistakes I see and how you can avoid them.

Taking On More Than You Can Handle

The single most damaging mistake is biting off more than you can chew. It’s tempting to be optimistic about your budget, but you have to be brutally honest with yourself about what you can afford. A monthly payment that seems easy to handle on paper can quickly become a massive source of stress when your car needs a new alternator or your pet gets sick.

This one error is a direct path to missed payments, which is the fastest way to wreck your credit score and completely undermine your reason for getting the loan in the first place.

Before you even think about signing a loan agreement, sit down with your bank statements and get real about your monthly income and expenses. If the loan payment squeezes your budget too tightly, that’s a red flag. Don't be afraid to walk away and look for a smaller loan or a better rate.

The Reporting Error That Makes It All for Nothing

Here's another critical mistake: assuming your lender reports your payments to all three major credit bureaus—Equifax, Experian, and TransUnion. This is a huge assumption, and one that can make your efforts pointless. Some lenders, especially smaller or online-only ones, might only report to one or two bureaus. Some don't report at all.

This is a non-negotiable part of your search. If your on-time payments aren't being reported, you're not getting the credit-building benefit you're working for.

Think of it like this: You're doing all this great work to prove you're responsible. You want that good reputation broadcast far and wide, not just whispered in one corner.

The "Too Much, Too Soon" Mistake

When you start seeing your score tick up, it's easy to get excited and think, "Hey, this is working! If one loan is helping, maybe I should get another one, and a credit card too!"

Slow down. This is a classic rookie mistake that can seriously backfire.

Every time you apply for new credit, it triggers a hard inquiry on your report, which can cause a small, temporary dip in your score. More importantly, opening several new accounts at once slashes the average age of your credit history, a key scoring factor. Lenders see a sudden flurry of applications as a sign of financial instability, making you look like a riskier bet.

To avoid this, keep these points in mind:

Building credit is a marathon, not a 100-meter dash. By sidestepping these common blunders—living within your means, confirming your lender reports everywhere, and pacing your applications—you'll keep your credit-building journey on a steady, strategic, and successful path.