How to Start an Emergency Fund: Your Practical Guide

So, you're ready to build an emergency fund. It really boils down to four simple moves: figuring out your target, finding the money, opening the right account, and then putting the whole thing on autopilot. This is how you build a real financial safety net, the kind that keeps you from reaching for a credit card every time life throws you a curveball.

Why an Emergency Fund Is Your Financial Foundation

Before we get into the practical steps, let's talk about why this is so important. An emergency fund isn't just another savings goal; it's the bedrock of your financial stability. It's what stands between a minor inconvenience and a full-blown financial crisis.

Picture this: your car's transmission goes out, or you get hit with a surprise medical bill. Without a cash reserve, those situations often lead straight to high-interest debt, digging a hole that's hard to climb out of.

And you wouldn't be alone. It's a tough spot many people find themselves in. Recent data from Bankrate's annual report revealed that only 46% of U.S. adults have enough saved to cover three months' worth of expenses. Even more concerning, 24% have no emergency savings at all. This is a huge financial vulnerability that can turn a small problem into a major setback.

To make this crystal clear, let's map out the core actions you'll be taking. This checklist is your roadmap for everything we're about to cover.

Your Emergency Fund Quick Start Checklist

This checklist outlines the core actions for starting your fund, giving you a clear roadmap for the rest of this guide.

With these actions in mind, you're ready to build a fund that works for you.

Your First Line of Defense

Think of this fund as your personal financial bodyguard. It's the money that protects you from taking on expensive debt when something goes wrong. A job loss, an urgent home repair, a flight to see a sick relative—these things can happen to anyone. Having this buffer means you can handle it without derailing your long-term goals, like saving for retirement or paying down your mortgage.

Building this fund is a non-negotiable step toward financial health. It’s especially critical for anyone new to the U.S. financial system or just starting to build their financial history. This fund provides a stable base while you work on other important goals, and it works hand-in-hand with tools like credit-building accounts.

Now, let's get into the specifics of how to calculate your goal, find the cash, and automate the process to build this crucial buffer and achieve lasting security.

Figuring Out Your Personal Savings Number

You’ve probably heard the old "three to six months of expenses" rule, but let's be honest—what does that actually mean for you? It's time to ditch the generic advice and figure out a real, personalized savings target that actually fits your life. This isn't just about pulling a number out of thin air; it’s about understanding what it truly costs for you to live.

First things first, we need to pinpoint your essential monthly expenses. I'm talking about the absolute, must-pay bills that keep a roof over your head and the lights on, even if your income suddenly stopped. For now, forget about the extras like streaming subscriptions or your weekly takeout habit.

Tallying Your Core Living Costs

Go ahead and grab a notebook or open up a spreadsheet. The best way to do this is to look through your last few months of bank and credit card statements. Your mission is to hunt down only the necessities and find your bare-bones monthly survival number.

Your list of essential expenses will likely include things like:

Once you have that list, add it all up. That final number is what it costs you to get by for one month. Multiply it by three, and you've got a fantastic starting target for your emergency fund.

This isn't just busywork; it's a critical step. A recent study found that unexpected expenses are now the biggest financial worry for 38% of people, which really drives home the importance of having this kind of safety net. You can dig into the data and understand why emergency savings are a top resolution for many on napa-net.org.

Where to Find Savings in Your Budget

Once you know your savings target, the million-dollar question becomes: where is this money going to come from? Don’t worry, this doesn't mean you need to start moonlighting. Most of us can find the cash right inside our current budget with a few clever adjustments.

The single best way to make sure your savings goal happens is to pay yourself first. It's a simple idea, but it’s powerful. You treat your savings deposit just like you would your rent or car payment. The moment your paycheck lands, a predetermined chunk goes directly into your savings—before you have a chance to spend it elsewhere.

Run a Quick Spending Audit

To dig up that extra cash, you first need to know where it's going. Grab your bank and credit card statements from the last 30-60 days and take an honest look. This isn't about making yourself feel guilty about that fancy dinner; it’s a fact-finding mission to spot opportunities.

Keep an eye out for these common culprits that drain your accounts:

Another fantastic place to look for savings is in your recurring bills. Set aside an afternoon to call your providers for your cell phone, internet, and car insurance. Simply ask if you're on the most competitive plan or if they have any new promotions running. I've seen people shave $50 or more off their monthly expenses with just a few phone calls. These are the small, consistent wins that make all the difference.

Choosing the Right Home for Your Emergency Fund

Deciding where to stash your emergency cash is almost as important as saving it in the first place. You're looking for a sweet spot—a place where your money is safe and easy to get to in a real emergency, but not so easy that you'll dip into it for a weekend sale. Creating this separation is the secret to making sure the fund is actually there when a crisis hits.

Your everyday checking account just won't cut it. The temptation to transfer a little here and there for non-emergencies is too strong. What you really need is an account that puts your money to work, even just a little, while building a healthy psychological barrier between you and your emergency cash.

Top Account Choices for Your Savings

For most people, a High-Yield Savings Account (HYSA) is the clear winner. These are usually offered by online banks and can pay interest rates 10 times higher than the dusty old savings account at your local brick-and-mortar. This means your emergency fund doesn't just sit there—it's actively growing and helping to offset the effects of inflation, all while being completely accessible and secure.

Another great choice is a Money Market Account (MMA). MMAs often have interest rates that compete with HYSAs but sometimes come with check-writing privileges or a debit card. This can offer an extra layer of convenience when you need to access funds quickly during an emergency.

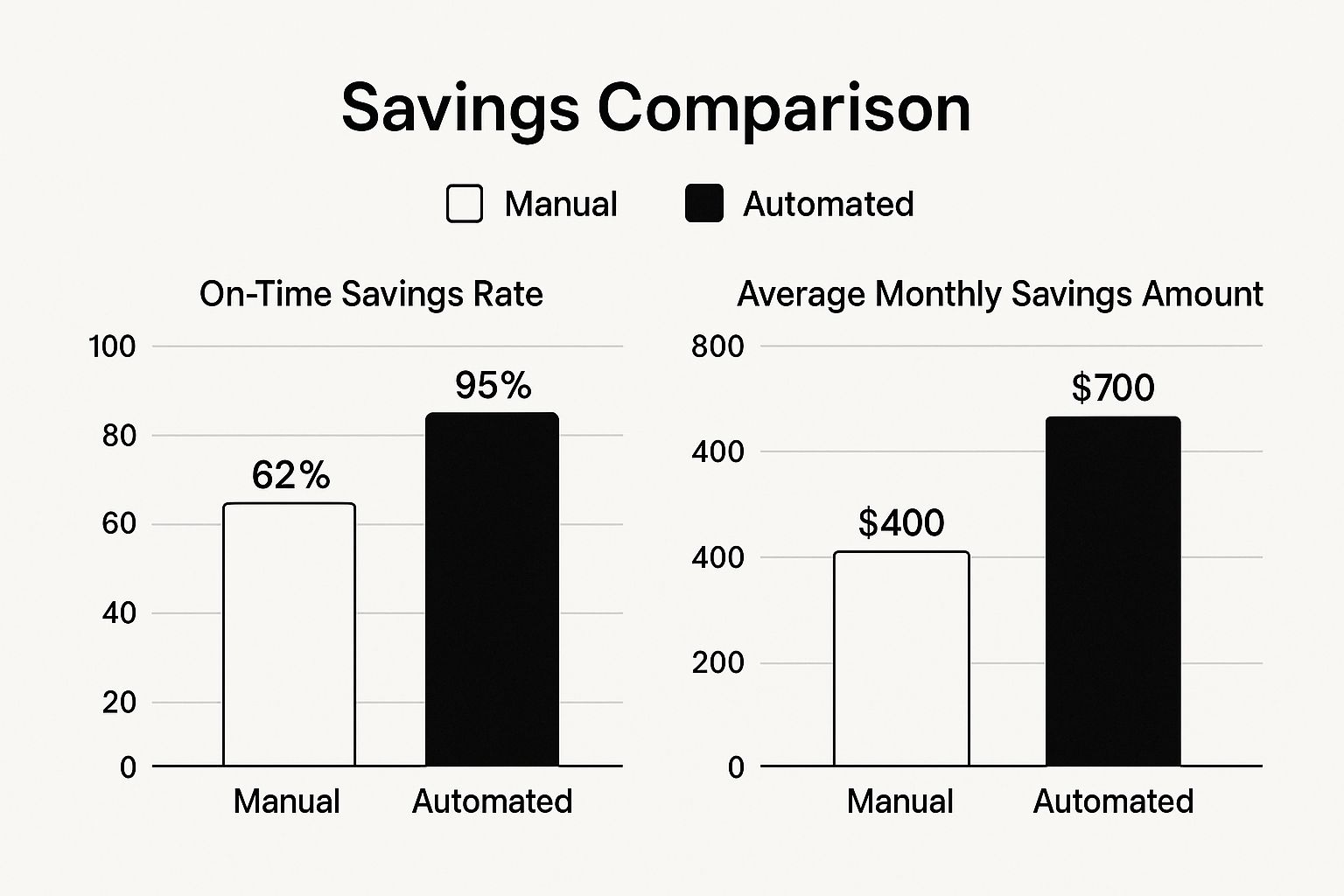

Choosing the right account is the first step, but making consistent contributions is what builds the fund. As you can see below, automating those contributions makes a massive difference in how quickly people reach their savings goals.

The numbers don't lie. People who set up automatic transfers save more consistently and end up with a much larger nest egg over time.

To help you decide, let's break down the most common options and see how they stack up against one another.

Emergency Fund Account Comparison

Ultimately, the best account is the one that fits your personal style and financial situation. A HYSA is a fantastic default for most, but the key is to pick one, open it, and start funding it.

Put Your Savings on Autopilot

Let's be honest. Relying on sheer willpower to move money into savings each month is a recipe for falling short. Life gets busy, unexpected costs pop up, and that manual transfer gets pushed to "next week." The real secret to building a solid emergency fund is taking yourself out of the equation. Automation is your best friend here.

By setting up automatic transfers, you ensure your savings grow consistently in the background. This is the essence of the "pay yourself first" strategy. You're prioritizing your financial security before you have the chance to spend that money on something else. It's a game-changer.

How to Schedule Your Transfers

Getting this set up is usually a five-minute job. Just log into your primary checking account's online banking portal and navigate to the transfers section. You’re looking for an option to schedule a recurring or automatic transfer to your new high-yield savings account.

The timing is what makes this so effective. You want to schedule the transfer for the day after you get paid. If your paycheck lands on Friday, set the transfer for Saturday. This simple trick ensures the money is moved before you even notice it’s gone, making it a painless and powerful habit.

Supercharge Your Fund with Extra Cash

Your automatic transfers are the slow and steady engine, but you can hit the accelerator whenever you come into extra money. Think of these moments as opportunities to fast-track your way to your savings goal.

When you get a windfall, no matter how small, challenge yourself to send at least a portion of it straight to your emergency fund. This is especially powerful for:

Combining these strategic one-time deposits with your consistent, automated contributions is the most effective path to building an emergency fund that offers real peace of mind.

Tackling Debt and Savings at the Same Time

This is one of the most common money questions out there: should you throw every spare dollar at your debt, or should you focus on building up your savings? It’s a real tug-of-war. The weight of debt makes you want to attack it with everything you've got, but doing so can leave you completely exposed if something unexpected happens.

From my experience, the best strategy isn't choosing one over the other. It's about finding a smart balance that lets you do both.

The very first move—before you go scorched-earth on your credit card balances—is to build what I call a starter emergency fund. Forget about the huge six-month goal for a minute. Just aim for $1,000. Think of this as your financial first-aid kit. It’s the cash that keeps a flat tire or a surprise medical bill from immediately going back on a high-interest credit card, which just digs the hole deeper.

This isn't just a theoretical problem; it's a reality for millions. Year after year, financial reports paint a concerning picture. For example, studies in both 2023 and 2024 showed that a staggering 36% of adults in the U.S. had more credit card debt than emergency savings. That's a huge vulnerability. If you want to dig into the numbers, you can discover more insights about these consumer financial habits on Fidelity.

How to Create a Hybrid Plan That Works

Once you have that initial $1,000 cushion secured, you can shift gears into a powerful hybrid approach. You don't stop saving, but you change how you allocate your extra cash. Now, you split it between your two major goals: getting out of debt and building a bigger savings buffer.

Let's say you've reworked your budget and found an extra $300 a month. A balanced plan might look like this:

Adopting this strategy is fundamental, especially if you're working on building a solid financial foundation in the U.S. A strong savings habit paired with disciplined debt management is a cornerstone of good credit and financial health. Speaking of which, if you're also focused on your credit profile, you can check out our guide on how to establish credit to see how all these pieces fit together.

Your Top Emergency Fund Questions, Answered

As you get started on your emergency fund, it's natural for questions to come up. Feeling confident about the "rules" of your fund is what makes it such a powerful tool when you truly need it.

So, what really counts as an emergency? The simplest way I think about it is an expense that is both unexpected and essential. This isn't for things you want, but for things you need. We're talking about a sudden job loss, a medical crisis, or a major car repair that you can't put off.

Sticking to this rule is what keeps your financial safety net intact.

What to Do After You Use It?

First, take a breath. Using your emergency fund means it did its job. It can feel stressful to see that balance drop, but you handled the crisis without going into debt. That's a huge win.

Now, your top priority is rebuilding. Here's a straightforward game plan to get back on track:

The goal is to patch that hole in your financial armor as quickly as you can. A fully-funded emergency account is a cornerstone of a healthy financial life, which is a big factor when you want to check your ITIN credit report and see a strong profile.

One last question I hear all the time: "Should I invest my emergency fund to make it grow faster?" The answer is a clear and simple no. The purpose of this money isn't growth; it's safety and accessibility. Keeping it in a high-yield savings account protects it from market swings and makes sure it's there, ready to go, at a moment's notice.

At itin score, we believe everyone deserves financial security. Our platform provides the tools and guidance ITIN holders need to build a strong financial future in the U.S. Take control of your finances today at https://www.itinscore.com.