How to Rent an Apartment Without Credit: Expert Tips

Renting an apartment without a credit history isn't just a long shot—it's absolutely doable. The secret is to show you're financially stable and reliable by providing solid proof of income, offering a larger security deposit, or bringing in a co-signer. These moves prove to a landlord that you're a safe bet, even if you don't have a credit score for them to look at.

Why So Many People Rent Without a Credit History

If you’re trying to land an apartment without a credit history, it’s easy to feel like you’re already behind. Landlords and property managers love credit scores; it's their go-to shortcut for checking a potential tenant's financial habits. A high score tells them you likely pay your bills on time, making you seem like a low-risk tenant.

But here’s the thing: not having a credit score doesn't mean you're a risk. Millions of people are in the exact same boat for completely normal reasons.

Maybe you're:

This is a much more common situation than you might think. Your task is to change the focus from what you lack (a credit score) to what you actually have: a reliable income, good financial habits, and every intention of being a fantastic tenant.

Stepping into a Landlord's Shoes

At the end of the day, a landlord really only has one major concern: will you pay the rent on time, every single month? A credit score is just one piece of the puzzle they use to figure that out. When it's missing, they just need another way to verify you're reliable.

This is your chance to get ahead of their questions and build a strong case for yourself. Don't see it as a roadblock; see it as an opportunity to prove your financial stability in other, more tangible ways.

It’s worth noting that in the United States, an estimated 28% of Americans have credit scores that fall into the 'Fair' or 'Poor' categories. These folks often face the same hurdles as someone with no credit history at all. As this Apartment List report shows, a huge chunk of the rental market has to get creative to prove they're trustworthy.

How to Frame Your Application

Instead of thinking of your application as missing something, think of it as a chance to tell your personal financial story. You're not "risky"—you're simply "credit-invisible," and you have other strengths to show off.

To get a better handle on the system you're navigating, our guide on what a credit score is can give you some great background on why it's such a big deal in the traditional rental process. The more you understand, the better you can work around it.

The strategies we're about to cover are designed to help you do exactly that. We’ll walk through how to build a renter profile that screams stability, how to find landlords who care more about reliability than rigid rules, and how to negotiate terms that get you the keys to your new place.

Build a Renter Profile That Proves Your Stability

When you're trying to rent an apartment without a credit history, your goal is to make your application so strong that a credit score becomes an afterthought. You're not just filling out forms; you're building a complete portfolio that screams financial stability and reliability.

Think about it from the landlord's perspective. Their biggest worry is simple: will you pay the rent on time, every time? Your renter profile is your chance to answer that question with a resounding "yes." By getting ahead of their concerns and providing irrefutable proof, you control the narrative and show them you're a low-risk, responsible tenant.

Gather Your Core Financial Documents

The absolute cornerstone of your renter profile is proving you have a steady income. This is the most direct way to show a landlord you can easily cover the rent. You want to lay out your financial picture so clearly that there’s no room for doubt.

Start by getting these documents together:

My advice? Don't just have these on your laptop. Print them out, organize them neatly in a folder, and have them ready to hand to a landlord during a viewing. It’s a small touch that shows you’re serious, organized, and professional.

Go the Extra Mile with a Renter’s Resume

Want to really stand out from a stack of generic applications? Create a "renter's resume." This is a simple, one-page summary that highlights your best qualities as a tenant. It’s a professional touch that gives a landlord a quick, positive snapshot of who you are.

Here’s what to put on it:

This simple document tells a story that numbers on a credit report never could. It presents you as a person, not just a financial risk.

Your Financial Credibility Checklist

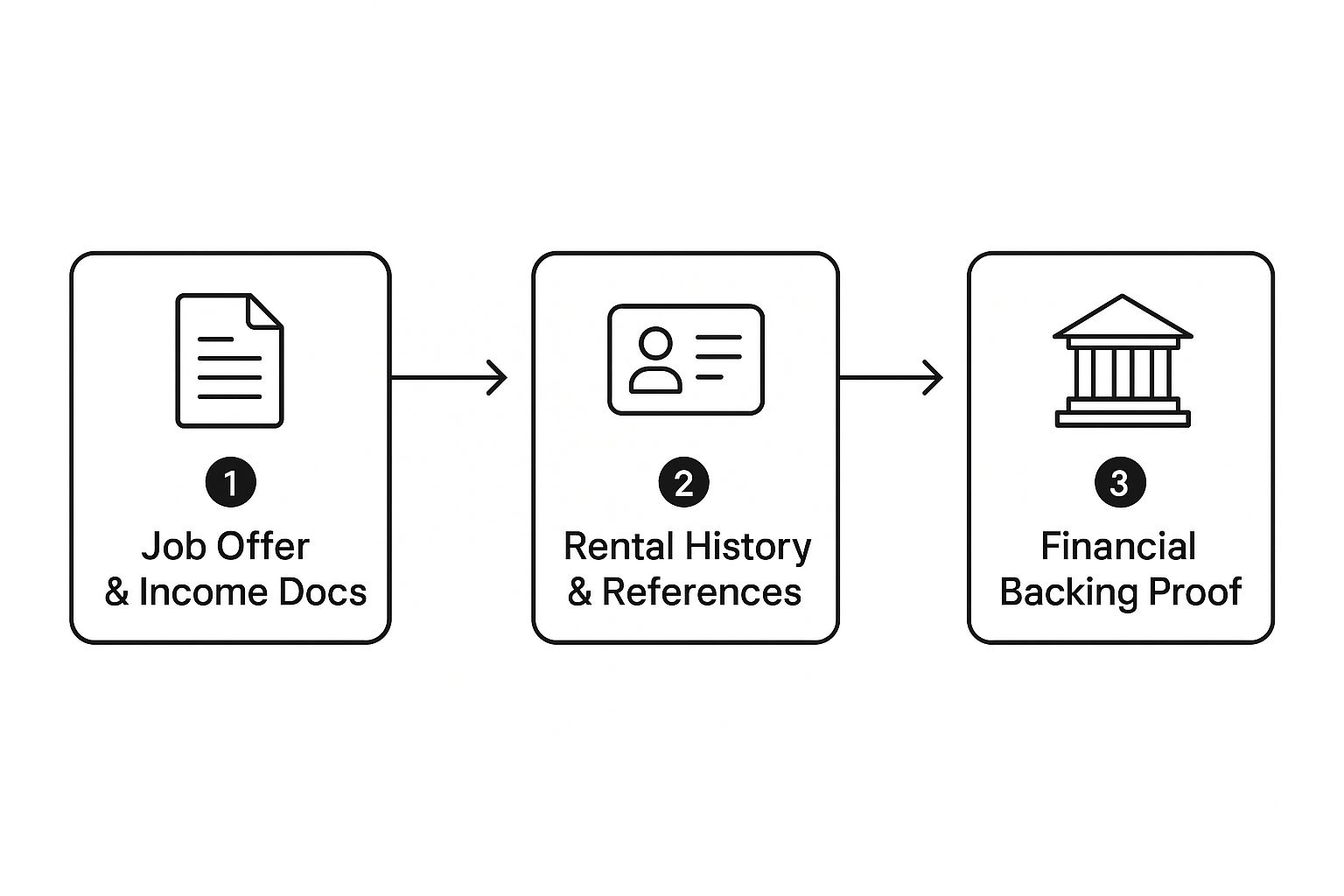

To make this process easier, use this checklist to gather powerful documents that demonstrate financial stability and build a convincing case for your tenancy.

Having these items organized and ready to go will put you miles ahead of other applicants.

What If Your Income Isn't Traditional?

Not everyone gets a neat W-2 and a bi-weekly paycheck. If you're a freelancer, a student, or self-employed, you just need to be a bit more creative with your proof of income. Don't worry, landlords see these situations all the time.

Here’s how to frame your situation:

The key here is total transparency. Landlords are often more interested in your debt-to-income ratio than a credit score they can't pull. By presenting a clear, honest, and thorough picture of your finances, you’re anticipating their questions and proving your stability before they even have a chance to ask.

Find Landlords Who Look Beyond the Credit Score

When you're renting without a credit history, where you look is just as important as what you have in your application packet. The big, corporate-owned apartment complexes? They often use automated screening software that sees "no credit score" and immediately sends a rejection notice. A real person might never even see your name.

It's a frustrating, impersonal system. Your carefully prepared renter profile gets tossed aside by an algorithm before it ever has a chance. The best move you can make is to bypass these corporate gatekeepers completely.

Instead, you’ll want to focus your search on the people who are more likely to see you as a person, not a number: private landlords and smaller, family-run management companies.

Target Private Landlords and Smaller Companies

I've found the most success with private landlords—everyday people who own and rent out a single-family home, a duplex, or maybe a few condos. They aren't bound by rigid corporate policies, which gives them the flexibility to listen to your story and make a judgment call.

These owners often live in the community and have a personal stake in finding a reliable tenant who will pay on time and take care of the place. They're far more likely to appreciate the effort you put into building a strong renter profile with proof of income and glowing references. It's that human element that gives you a real shot.

Smaller, local property management companies are another great option. They're a nice middle ground—more professional than a single owner but without the cold, one-size-fits-all rules of a national chain. They often have the authority to look at the whole picture.

Smart Search Strategies to Find the Right Listings

Finding these gems requires a slightly different game plan than your typical apartment hunt. You'll need to sift through the noise to find the listings managed directly by owners.

Here are a few tactics that consistently work for renters in this situation:

Making a Great First Impression

Once you spot a promising listing, your first message is your chance to shine. Don’t just send a generic, "Is it still available?" text. That gets you nowhere.

Lead with your strengths. A little proactiveness goes a long way.

Try sending a message that stands out, something like: "Hi, my name is Alex. I saw your listing for the apartment on Elm Street and I'm very interested. I work full-time at City Hospital, have a stable income, and can provide excellent references from my previous landlords."

This simple introduction immediately tells the landlord you're serious, organized, and prepared. That's exactly the kind of first impression that convinces them to look past a missing credit score and see the reliable tenant you are.

Negotiate an Offer They Can’t Refuse

You’ve found a great apartment and a landlord who seems reasonable. Now for the make-or-break conversation. This isn't about apologizing for your lack of credit history. It's about confidently presenting a business proposal that makes you their best and most secure option.

The secret is to be proactive and honest. Don't let them find out you have no credit when they run a screening report. You need to get ahead of it. Bring it up yourself, but frame it as a simple fact, not a flaw.

For example, you might say, "As we move forward, I want to be totally transparent. I'm a recent graduate and haven't used credit before, so a traditional score won't show up. That's why I've brought all my financial documents to show you my stable income and responsible payment history." This approach immediately builds trust and shifts the focus to your strengths.

Sweeten the Deal to Reduce Their Risk

Words are good, but a tangible offer is far more powerful. Your mission is to make the landlord feel just as safe renting to you as they would to someone with a 750 credit score. The best way to do that is to lower their financial risk with a compelling offer.

Here are a few proven negotiation tactics I’ve seen work time and again:

Presenting Your Offer with Confidence

When you float these ideas, frame it as a business proposal. You're offering them something valuable—extra security and guaranteed cash flow—in exchange for their flexibility on the credit requirement. This changes the dynamic entirely. You’re no longer a "risky applicant," but a proactive and attractive business partner.

Landlords who are willing to bypass credit checks almost always look for other safeguards. Many will ask for higher deposits, sometimes two or three times the standard month’s rent, to protect themselves. By offering this before they even have to ask, you show you understand their perspective. As you can discover in Zillow's rental insights, pairing these offers with solid proof of income is a powerful combination that dramatically increases your odds of getting approved.

Comparing Your Negotiation Options

Of course, not every strategy will work for your budget. You have to weigh the pros and cons of each before deciding what to put on the table.

Here’s a quick breakdown to help you map out your best move:

The best path forward is the one you can comfortably afford and that feels right for the specific landlord you're dealing with. Come prepared with a clear plan, present it with confidence, and you can turn a potential deal-breaker into your biggest advantage.

Bring in a Co-Signer or Guarantor for Backup

If all your documents still don't feel like enough to get a landlord over the finish line, bringing in some backup can make all the difference. Think of a co-signer or guarantor as a financial safety net for the landlord. It’s a classic, effective strategy that can instantly make your application more appealing, especially when you're just starting to build your own rental history.

A co-signer is someone who signs the lease right alongside you. This means they’re taking on the exact same legal and financial responsibilities for the apartment. If you can’t pay the rent for any reason, they are on the hook for the full amount, period. Because of this shared risk, they’ll have to meet the same strict income and credit checks as any primary applicant.

Finding the Right Co-Signer

The best co-signer is someone you trust implicitly who also has a rock-solid financial profile. Landlords will put their application under a microscope, so you need someone who looks great on paper.

Your ideal candidate should have: