How to Rent an Apartment with No Credit

Trying to rent an apartment with no credit can feel like you're stuck in a classic catch-22. But it's a surprisingly common situation, and definitely a solvable one. The trick is to get ahead of the problem by proving your financial stability with things like pay stubs and solid references, making a credit score a non-issue.

Why Renting with No Credit Is a Solvable Problem

If you're looking for an apartment without a credit history, you're not alone. This is a familiar challenge for students, recent grads, and people new to the country. The good news? Landlords really care about one thing above all else: getting paid on time, every single month. A credit score is just one way they try to predict that.

To really get why no credit can be a hurdle, it helps to understand how typical landlord credit checks work. Many of the big property management companies rely on automated systems that might automatically flag or reject applications that don't have a credit file attached. This is where your strategy makes all the difference.

Shifting the Landlord's Focus

Your mission is to get the landlord to look past what you don't have (a credit score) and focus on what you do have: evidence of a steady income, responsible character, and a solid financial cushion. You're essentially building a compelling renter profile that paints a clear picture of reliability.

This approach works especially well with private landlords, who often handle applications themselves. By providing alternative proof of your financial health, you're using a strategy that's becoming more and more accepted. With nearly 35% of available rental units listed by private landlords, there's a huge opportunity to find someone with more flexible screening criteria who will value your documents.

Building Your Case for Tenancy

Think of it like you're building a legal case to prove you're a low-risk tenant. Every document you gather is another piece of evidence. You're not just hoping for a chance; you're demonstrating exactly why you're a great choice.

By presenting these documents proactively, you take control of the conversation.

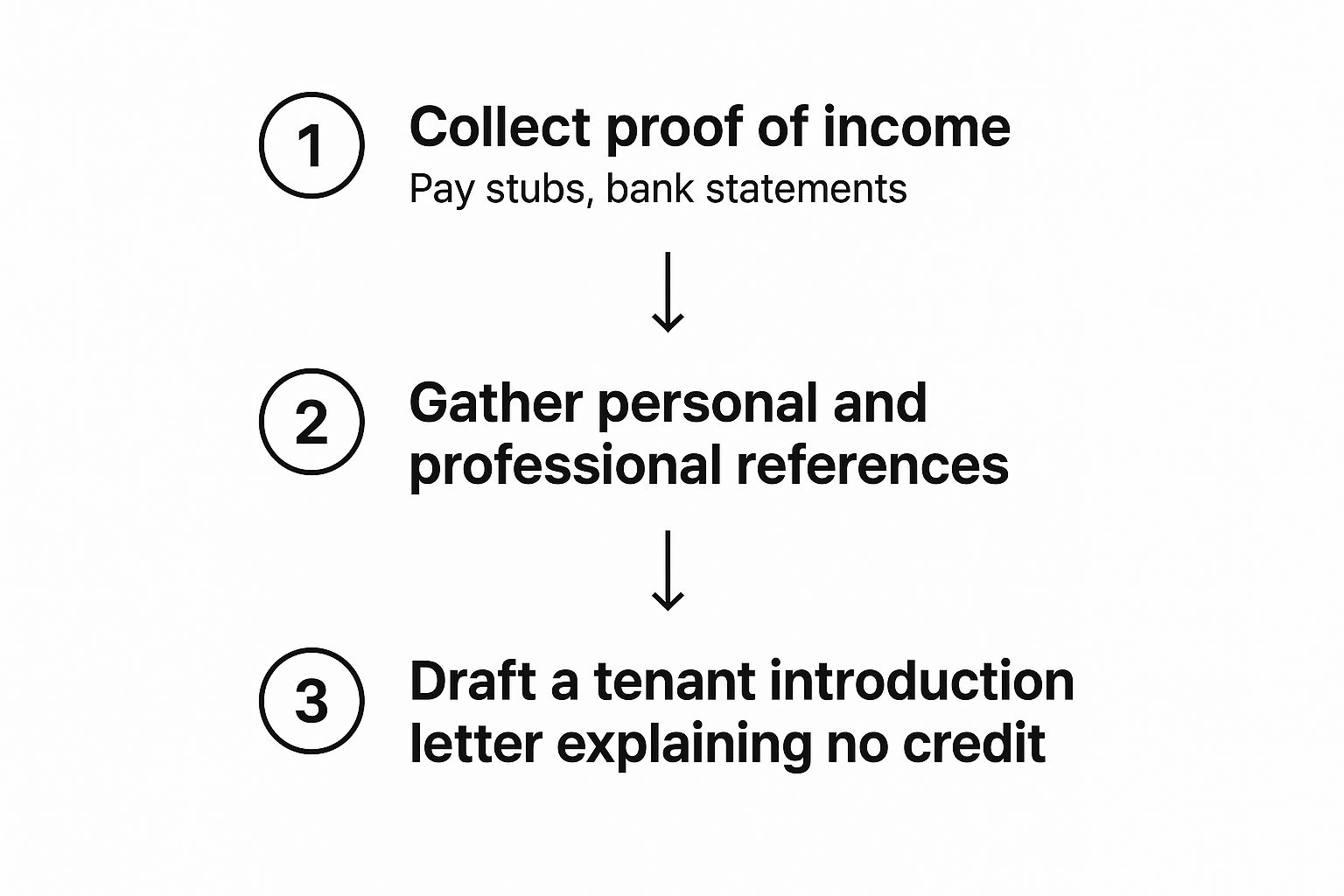

Before you even start touring apartments, getting your paperwork in order is the most important step. This checklist breaks down exactly what you'll need to build a strong application that can stand on its own, without a credit score.

Your No-Credit Renter's Checklist

Putting this package together shows you're organized and serious about your application, which can set you apart from other renters.

While this guide will walk you through securing an apartment right now, it's also smart to look ahead. When you're ready, take a look at our guide on how to establish credit from scratch to open up even more doors in the future.

Building a Renter Profile That Inspires Confidence

When you’re trying to rent an apartment with no credit history, your job is to tell a compelling story of financial responsibility. You need to build a "renter's resume"—a professional portfolio that proves you are a reliable, low-risk tenant, even without a FICO score. This packet isn't just paperwork; it's your most powerful tool for earning a landlord's trust.

Landlords have one primary concern: will you pay the rent on time, every time? A common rule of thumb they use is the "3x the rent" guideline, meaning they want to see your monthly income is at least three times the rent. Your documents need to prove this clearly.

Gather Your Proof of Income

First things first, you have to demonstrate consistent cash flow. Landlords need to see that you have a stable source of money to cover your obligations.

Here’s what to pull together:

When you present these documents neatly in a folder during your first meeting, it sends a strong signal that you're organized, serious, and prepared.

Add Credibility with Strong References

Your finances are only half the picture. Landlords also need to know you're a responsible person who will treat their property with respect. This is where glowing recommendations can make all the difference.

Don't just scribble down some names and numbers. Ask for formal letters of recommendation.

Try to get letters from people who can speak to your character from different perspectives:

As a final touch, showing you’re a responsible householder can subtly reinforce your appeal. Mentioning you know a thing or two about making your small apartment look tidy and organized shows you’re a conscientious person who will take good care of the space.

While building this profile, it's also smart to think about the long game. If you're new to the country, learning how to build a credit score without a Social Security Number will open up even more doors in the future. But for today, a rock-solid renter profile is your key to getting that lease signed.

Sweeten the Deal: Using Financial Incentives to Lock Down a Lease

Let’s say you’ve done everything right—your renter profile is strong, your references are glowing, but the landlord is still on the fence. This is where a well-timed financial incentive can make all the difference. When paperwork isn't quite enough, money often does the talking. Showing you're willing to put more skin in the game is a powerful way to ease a landlord's concerns about risk.

This isn't about throwing cash around blindly; it’s a strategic move. Before you even think about offering more money, you need to have a rock-solid application package ready to go.

Think of it this way: your proof of income, solid references, and a compelling introduction build the foundation of trust. The financial offer is what gets you over the finish line.

Offer a Larger Security Deposit

One of the most direct ways to show you’re a serious, responsible applicant is to offer a larger security deposit. If the standard is one month's rent, proposing to pay for two can immediately signal your financial stability and confidence. It tells the landlord you're not planning on causing any trouble and that you have the means to cover any potential issues.

Just be careful here, as there are rules. Many states and cities put a cap on how much a landlord can legally ask for. It's often limited to one or two months' rent. Before you make an offer, do a quick search for "[Your State] security deposit limit" to make sure you're playing by the book.

Pay a Few Months' Rent Upfront

Here's a tactic that landlords absolutely love: offer to pay a few months' rent in advance. Guaranteed income is a property owner's dream. Imagine walking in and offering to pay the first three months right there on the day you sign the lease. This instantly removes their biggest fear—a tenant who stops paying. If you have a decent amount in savings but just haven't had the chance to build a credit history, this is an incredibly effective strategy.

Find a Co-Signer or Guarantor

If you don't have a lot of extra cash on hand, bringing in a co-signer (also called a guarantor) is your next best bet. This is someone with a strong credit score and a steady income who agrees to sign the lease with you. Legally, they're on the hook for the rent if you can't pay. It's a very common solution, especially for students or young professionals just starting out.

Asking someone to take on this kind of financial responsibility is a big deal, so you need to approach the conversation with respect and preparation.

You could try a script like this:

A co-signer essentially lends you their financial credibility, giving the landlord the peace of mind they need. It’s a major commitment, so make sure both you and your co-signer understand exactly what the legal obligations are before signing anything.

Finding Landlords Who Will Rent to Someone Without Credit

Your apartment-hunting strategy is just as important as the documents you gather. When you’re trying to rent an apartment with no credit, your goal should be to find a human, not an algorithm. Many of the big, corporate-owned apartment complexes use automated screening software that will kick back your application the second it sees there's no credit file to pull.

That automated process leaves zero room for nuance. The software can't see your rock-solid income, glowing references, or the healthy savings you've built up. To a computer, you're just a missing data point. The best thing you can do is avoid this frustrating dead-end from the start by focusing your search on properties managed by actual people.

Target Individual Landlords and Small-Scale Managers

Private landlords and smaller property managers are going to be your best bet, hands down. They’re the ones who will actually sit down and review your application as a whole, valuing a good conversation and a well-prepared renter over a three-digit score. They simply have the flexibility to make a judgment call.

So, where do you find these more accessible listings?

Be Honest and Upfront Right Away

When you find a place that looks promising, your first conversation is everything. Don't hide the fact that you don't have a credit history until they're running your application. Being transparent in that first email or phone call builds instant trust and saves both you and the landlord a ton of time.

You can frame it in a really positive, proactive way.

An approach like this shows you're organized, honest, and confident in your ability to be a fantastic tenant. It takes a potential negative and flips it on its head by immediately offering the solution: your strong alternative qualifications. It also helps you quickly weed out landlords with inflexible credit rules so you can focus your energy where it will actually pay off.

And remember, once you do land that apartment, you can start building a stronger financial future. Reporting your on-time rent is a brilliant way to do this. You can learn more about how to build credit with rent payments and make your next apartment search even easier.

Finalizing Your Application and Sealing the Deal

You’ve done the legwork and found a landlord who’s willing to work with you. Now comes the moment of truth: the application. This is where all your preparation comes together, helping you close the deal with confidence.

When you get that application, you’ll see the inevitable box asking for your Social Security number for a credit check. Don’t just leave it blank. That can look evasive. Instead, be upfront. I always advise people to simply write, “No credit history established.”

Then, immediately follow up by handing over that renter profile you’ve so carefully assembled. This shifts the conversation from what you don’t have (a credit score) to what you do have: a clear, documented history of financial responsibility. It shows you’re organized, transparent, and have nothing to hide.

Proposing a "Prove-It" Lease

Even with a great renter profile, some landlords might still be on the fence. A standard 12-month lease is a big commitment for them. This is your chance to get creative and propose a compromise.

Suggesting a shorter, trial-period lease is a brilliant move. It lowers the landlord's perceived risk and shows them you're confident you'll be a great tenant.

You could say something like:

This is a win-win. The landlord gets a low-risk trial run, and you get your foot in the door.

Handling the Outcome and Reviewing the Fine Print

Let's be real: sometimes, you'll still get a "no." It happens. If your application is denied, don't burn the bridge. Thank them for their time and politely ask for feedback. If they ran a tenant screening report, you have a legal right to a copy—it’s worth checking for any errors that might be holding you back.

But when you get that "yes," it's time for one last, crucial step. Before you sign anything, you need to read the lease agreement from top to bottom. Every single detail you discussed needs to be in writing. No handshake deals.

Make sure the lease clearly states:

Don't let excitement cause you to rush. A careful review now prevents major headaches later. This final check protects both you and the landlord, kicking off your tenancy on the right foot.

Common Questions About Renting with No Credit

Diving into the rental market without a credit history naturally brings up a lot of questions. It's easy to feel like you're at a disadvantage, but knowing the answers ahead of time can make all the difference. Let's tackle some of the most common concerns head-on.

Do All Landlords Require a Credit Check?

No, not all of them do. While a credit check is pretty standard procedure for big property management companies, you'll find that many private, individual landlords are much more flexible. They often care more about stable income and solid references than a three-digit score.

This is where you can be strategic. Focus your apartment hunt on listings from private owners—think "for rent by owner" signs, local classifieds, or Zillow listings posted by individuals. When you reach out, be direct and honest about not having a credit history, and have your alternative documents ready to go. That transparency can go a long way in building trust.

Can I Get an Apartment with No Credit and No Co-signer?

Absolutely. A co-signer is a great safety net, but it’s definitely not your only option. At the end of the day, landlords just want to know you'll pay the rent on time and be a responsible tenant. If you can prove that in other ways, the need for a co-signer often fades.

Here are a couple of ways to build a strong case for yourself, solo: