How to Remove Inquiries from Credit: Easy Steps to Improve Your Score

It's a common misconception that you can just wipe any hard inquiry off your credit report. The truth is, if you authorized it, it's there to stay. But here’s the good news: you absolutely can—and should—dispute any inquiry that you didn't authorize, is a flat-out mistake, or is the result of fraud.

The key is vigilance. You have to keep an eye on your credit reports, spot the inquiries that don’t look right, and then formally challenge them with the credit bureaus.

What Are Credit Inquiries, Really?

Before we get into the removal process, let's break down what these inquiries actually are. Your credit report is essentially your financial history on paper. Every time you apply for credit—a car loan, a mortgage, a new credit card—the lender pulls that history to see how risky you are. That pull gets logged on your report as an "inquiry."

But not all inquiries are the same. They're split into two very different categories, and understanding the distinction is crucial.

So, when we talk about removing inquiries, our focus is squarely on the hard ones.

To make this crystal clear, here’s a quick breakdown of the key differences between the two.

Hard vs Soft Inquiries a Quick Comparison

This table gives you a simple, side-by-side look at what separates a hard pull from a soft one.

Understanding this table is the first step. You need to know what you're looking for before you can take action.

How Much Damage Do Hard Inquiries Actually Do?

It’s easy to panic when you see a new hard inquiry, but let's put the impact into perspective. A single hard pull is almost never the reason you get denied for a loan.

Typically, one hard inquiry might drop your score by five points or less. While you don't want a ton of them, it's a relatively minor hit.

This is so important to remember. The negative effect fades over time and eventually vanishes on its own. You don’t have to do anything.

This temporary impact helps explain why rate shopping is encouraged. Credit scoring models are smart. They can tell when you're shopping for the best rate on a single car loan versus desperately applying for ten different credit cards. If you have multiple auto or mortgage inquiries within a 14 to 45-day window, they're usually bundled together and treated as a single inquiry. We dive deeper into this in our guide on what is a hard credit pull.

How to Spot Unauthorized Inquiries on Your Credit Report

First things first, you need to get your hands on your credit reports. Think of yourself as a detective, and these reports are your case files. You're entitled to a free report every single week from the big three bureaus—Equifax, Experian, and TransUnion—and the only place to get them officially and for free is through AnnualCreditReport.com.

Be careful out there. Plenty of sites try to mimic the official one, but they'll often hit you with fees or sell your information. Stick to the government-authorized source.

This is the homepage you want to see:

Getting these reports is your starting line. Once you have them downloaded, it's time to put on your auditor's hat and dig in.

Running Your Own Personal Audit

Now that you have the reports, don't just give them a quick glance. You're specifically looking for things that don't belong, so navigate straight to the "hard inquiries" section on each one. This is where lenders log their requests to see your credit history when you apply for something new.

Here's what should immediately jump out at you:

Telling a Simple Error from Outright Fraud

An unauthorized inquiry isn't always a five-alarm fire. Sometimes, it’s a simple clerical error—a teller fat-fingered a social security number, for instance. But other times, it's the first thread you can pull to unravel a case of identity fraud.

Under the Fair Credit Reporting Act (FCRA), you have the absolute right to challenge anything on your report that isn't accurate.

An inquiry from a credit card company you've never contacted is a clear sign to take action. So is a pull from an auto lender in a state you haven't even visited. These are the discrepancies that demand immediate attention. Documenting them carefully is the bedrock of your case to remove inquiries from your credit and keep your financial reputation clean.

So, you’ve spotted a hard inquiry on your credit report that you don’t recognize. What now? It’s tempting to ignore it, but you shouldn't. An unauthorized pull could be a simple clerical error, or it could be a serious red flag for identity theft. The good news is, you have the right to challenge it.

If a hard inquiry pops up because of a mistake or potential fraud, you can dispute it directly with Equifax, Experian, and TransUnion. This is your legal right, it costs nothing, and it all comes down to showing that you never authorized the inquiry in the first place. You’re not alone in this; between January 2020 and September 2021, the Consumer Financial Protection Bureau (CFPB) received over 800,000 complaints about credit reporting issues.

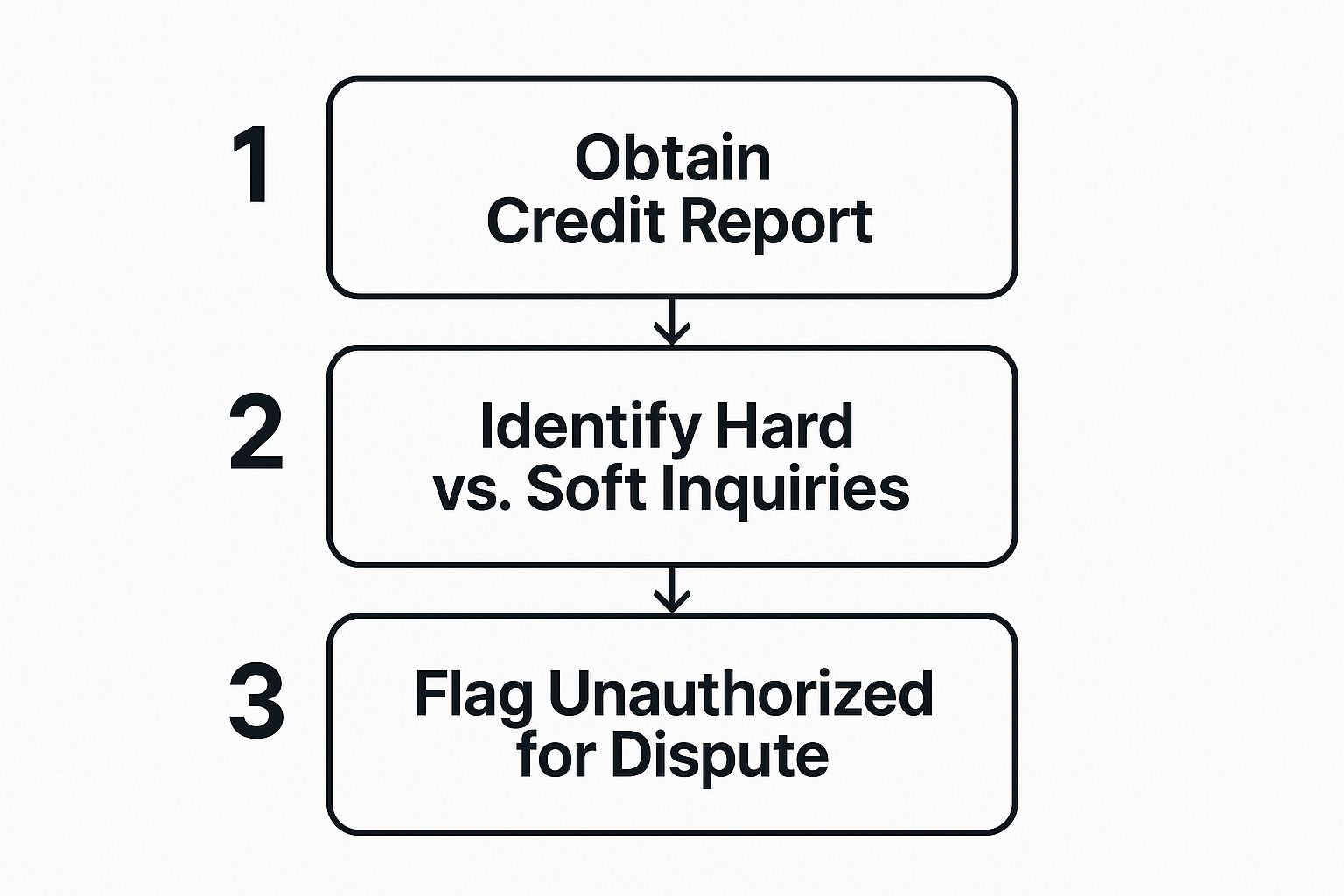

Finding and flagging these inquiries is the first step. This visual guide breaks down how to get started.

As you can see, the foundation of a successful dispute is a careful review of your report to pinpoint any discrepancies.

Choosing Your Dispute Method

When it's time to file, you have a few ways to go about it. Each has its pros and cons, so you can pick what works best for you.

Gathering Your Evidence For a Strong Case

A claim without proof is just a claim. To get that inquiry removed, you need to back up your words with solid evidence. What you need will really depend on the specifics of your situation.

For example, if you suspect identity theft is the culprit, a police report is non-negotiable. If it's a clerical error by a lender—maybe they pulled your credit twice by accident—any written communication you have with them, like an email where they admit the mistake, is gold.

Your goal is to build an undeniable case that leaves no room for doubt. For a deeper dive into this, check out our guide on how to dispute credit report errors.

What to Expect During The Investigation

Once you’ve sent everything in, the clock starts. Thanks to the Fair Credit Reporting Act (FCRA), the credit bureau generally has 30 days to investigate your dispute. They’ll reach out to the company that made the inquiry and ask for proof of your authorization.

If the creditor can't prove you gave them permission, or if they simply don't respond, the bureau is required to remove the hard inquiry from your report. They'll mail you the results of the investigation and, if they made a change, you'll get a free updated copy of your credit report.

Writing an Inquiry Removal Letter That Gets Results

While online disputes are quick and easy, there are times when a formal, well-written letter sent through the mail just hits differently. It can command more attention, especially if your situation has some nuance.

Forget the generic, fill-in-the-blank templates you see online. A truly effective dispute letter is all about being clear, professional, and armed with undeniable facts. You want to make it as simple as possible for the credit bureau investigator to see your side of the story and agree with you.

Think of it less like writing a letter and more like building a case. Your argument needs to be so logical and straightforward that it leads to only one conclusion: the inquiry is invalid and has to come off. This is a critical move if you want to successfully remove inquiries from your credit.

The Anatomy of an Effective Dispute Letter

Every letter that gets the job done has a few essential ingredients. If you miss even one of these, you risk having your dispute delayed or outright rejected. Precision is everything here.

Your letter absolutely must include:

Putting these pieces together shows you’re serious and helps the bureau process your request smoothly.

Pro Tips for a Professional Touch

How you present your case really does matter. An organized, professional letter will always be taken more seriously than a rambling, angry one. Keep your tone firm but respectful.

Finally, and this is non-negotiable, send your letter via certified mail with a return receipt requested. Yes, it costs a few extra bucks, but it’s your insurance policy. It gives you a paper trail proving exactly when the credit bureau received your letter, which officially starts their 30-day investigation clock. If you need to follow up, you'll have undeniable proof of contact.

Protecting Your Credit From Unnecessary Inquiries

Getting an unauthorized inquiry removed is a great defensive play, but the best long-term strategy is all about offense. Protecting your credit score means being smart and proactive about who you let pull your report and when. It’s a shift from cleanup to prevention, putting you in the driver's seat of your financial health.

Think of it like knowing the rules of the game before you start playing. Once you understand what actions trigger a hard inquiry, you can navigate the credit world much more effectively.

Shop for Loans the Smart Way

When you’re in the market for a big-ticket item like a car or a house, you absolutely need to shop around for the best interest rate. But won't that flood your report with a dozen hard inquiries and sink your score? Not if you do it correctly.

Luckily, modern credit scoring models are smart enough to recognize rate shopping. They know that multiple applications for a mortgage or auto loan within a short window—usually 14 to 45 days—doesn't mean you're a desperate, high-risk borrower. Instead, they bundle all those related inquiries together and treat them as a single event.

The key takeaway? Get all your financing applications done within a concentrated timeframe. This lets you hunt for the most competitive loan without your credit score taking a beating for each individual application.

Be Selective with Your Applications

Every single time you apply for a new credit card or a store card, it's going to trigger a hard pull. Before you jump at that offer to save 15% on today's purchase, stop and ask yourself if that small, one-time discount is really worth a new inquiry dinging your report for the next two years.

Protecting your credit also means protecting your personal data from being used without your permission. Implementing strong data security best practices is a critical piece of this puzzle.

While multiple hard inquiries can add up, it's good to keep their impact in perspective. Inquiries only make up about 10% of your FICO score calculation. Your payment history, on the other hand, carries a massive 35% of the weight.

This just reinforces how important it is to focus on solid, consistent financial habits rather than obsessing over every single inquiry.

Use Pre-Qualification and Monitoring Tools

These days, many lenders offer pre-qualification or pre-approval tools that can give you a good idea of your approval odds. The best part? They do this using a soft inquiry, which has zero impact on your credit score. This is a fantastic, risk-free way to see where you stand before you officially apply.

Finally, your best defense against surprises is simply staying vigilant. Checking your credit regularly helps you spot unauthorized activity or errors right away. If you need help finding the right tool for the job, take a look at our guide on the best credit monitoring apps. A proactive approach keeps you in control, always.

Common Questions About Removing Credit Inquiries

Diving into your credit report can feel like opening a can of worms, and when it comes to hard inquiries, there's a ton of misinformation out there. It’s easy to get confused about what you can and can't do.

Let's clear the air. I'll walk you through some of the most common questions people have about removing hard inquiries, giving you straightforward answers based on real-world experience.

Can I Get Rid of a Hard Inquiry I Actually Authorized?

This is probably the number one question I get asked, and the short answer is almost always no. If you filled out an application for a new credit card, a mortgage, or a car loan, you gave that lender permission to check your credit. That inquiry is a legitimate part of your credit history.

The whole point of the dispute process is to correct genuine mistakes. Think things like an inquiry you don't recognize at all (a big red flag for identity theft) or a duplicate inquiry from a lender who pulled your report twice by mistake. Trying to dispute a valid inquiry is a long shot that rarely, if ever, works.

How Long Does It Take for an Inquiry to Come Off My Report?

So, you've found a legitimate error and filed your dispute. What happens next? The good news is, once the credit bureau agrees the inquiry is inaccurate, it usually disappears from your report within a few days.

The entire process, from sending your dispute letter to seeing the final result, typically takes about 30 to 45 days. Under federal law, the credit bureaus have 30 days to investigate your claim. After they finish, they'll mail you a letter with the outcome and, if they made a change, a free updated copy of your credit report.

Will Removing One Inquiry Really Help My Credit Score?

It’s smart to keep expectations in check here. Getting an error removed is fantastic for maintaining an accurate credit history and protecting yourself from fraud, but it probably won't send your score soaring.