How to Remove Credit Inquiries That Are Hurting Your Score

Understanding What Credit Inquiries Really Mean for Your Financial Health

Seeing a new inquiry pop up on your credit report can make your heart skip a beat, but what does it actually mean for your financial life? Before you worry, it’s important to know that not all inquiries are the same. Some are simply routine checks, while others are more serious. Getting a handle on this difference is the first step in managing your credit and figuring out if you even need to think about how to remove credit inquiries.

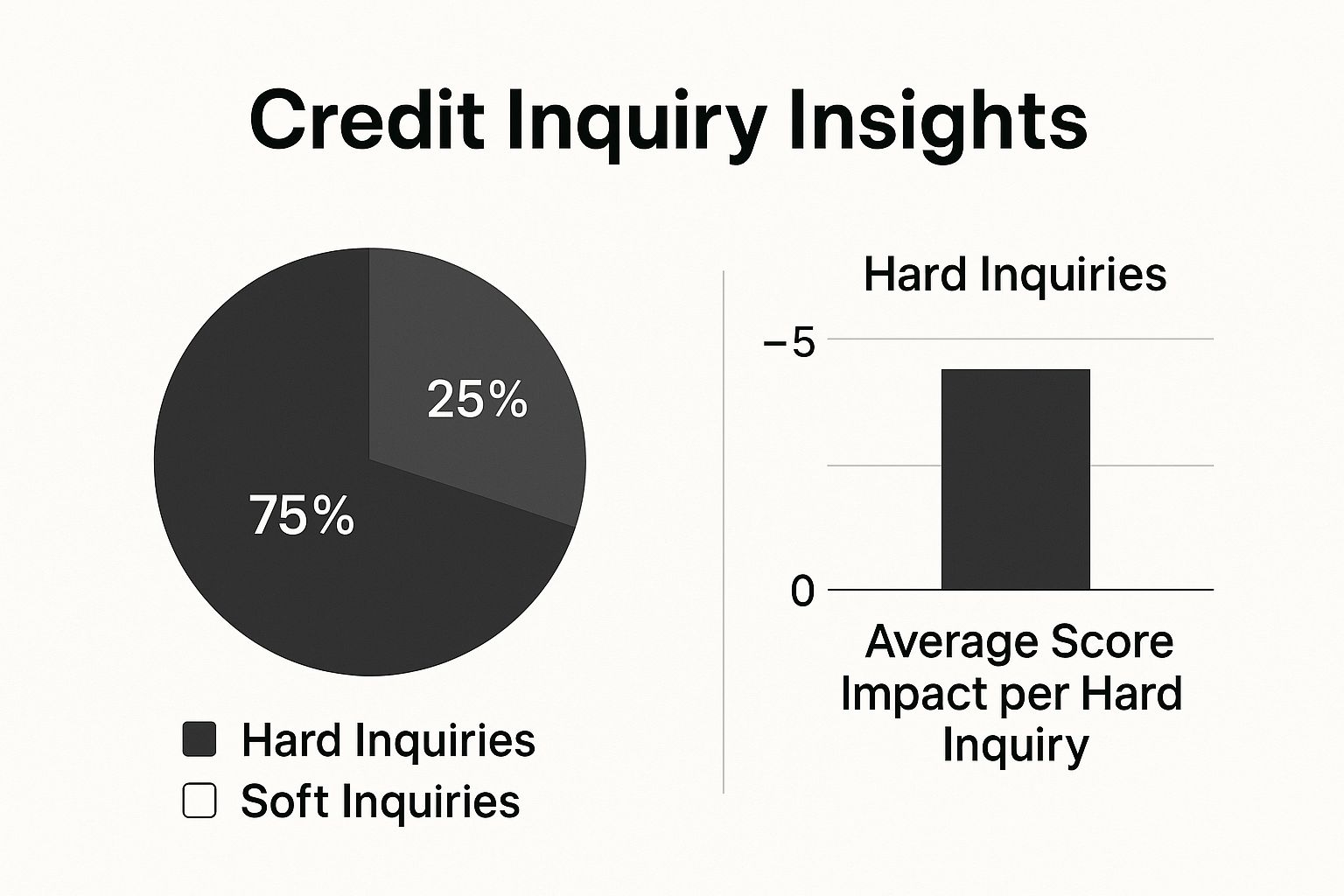

At its core, the system uses two kinds of inquiries: hard inquiries and soft inquiries. A hard inquiry, often called a "hard pull," is generated when a lender checks your credit after you've applied for something new, like a mortgage, car loan, or credit card. You have to give your permission for these. On the other hand, a soft inquiry, or "soft pull," occurs when you or a company checks your credit for a reason other than a new loan, such as when you check your own score or get a pre-qualified insurance offer.

The Two Faces of Credit Inquiries: Hard vs. Soft

The biggest difference between them comes down to visibility and impact. Soft inquiries are only visible to you on your personal credit report and have zero impact on your score. Hard inquiries, however, are visible to any lender who pulls your report and can cause a temporary, minor dip in your credit score.

To make this crystal clear, let's compare them side-by-side. This table breaks down what you really need to know about each type.

As you can see, hard inquiries are the ones that lenders are interested in. Each one represents a new application for credit, which could mean you're about to take on more debt. This is why they pay close attention.

Why Lenders Look and What They See

From a lender's point of view, a sudden flurry of hard inquiries can be a red flag, possibly signaling financial trouble. However, it's important to keep the impact in perspective. A single hard pull will likely only lower your FICO score by fewer than five points, and your score usually bounces back within a few months, assuming you keep up with your payments. The real concern for lenders is when they see multiple hard inquiries for different types of credit in a short time. Experian offers a deep dive into how inquiries are evaluated by lenders.

This graphic helps visualize where inquiries fit into the overall credit score puzzle.

The bottom line is that while hard inquiries are a normal part of using credit, they are the only type that directly affects your score.

Rate Shopping: The Smart Way to Apply for Credit

Here’s some good news: modern credit scoring models are built to understand normal consumer behavior. They can distinguish between someone responsibly shopping for the best rate on a single loan and someone frantically trying to open multiple lines of credit. For installment loans—like mortgages, auto loans, and student loans—all related inquiries within a 14 to 45-day window are typically treated as a single event.

For instance, if you're shopping for a car loan and get quotes from three dealerships over a weekend, it will likely count as just one hard inquiry on your score. This system allows you to find the best deal without being penalized. Be aware, though, that this same courtesy doesn't apply to revolving credit. If you apply for five different credit cards in a month, you'll likely see five separate hard inquiries on your report. Understanding how inquiries work is just one part of the bigger picture of your financial health, which is influenced by all the factors affecting your credit score.

When Credit Inquiry Removal Is Actually Possible

Let's get real about removing hard inquiries. You’ve probably seen ads from credit repair companies that make it sound like they can magically wipe your credit report clean. The truth is a little more nuanced than that. If you actually went out and applied for a credit card or a loan, the resulting hard inquiry is a legitimate part of your credit history and will stick around for 24 months.

But that’s not the end of the story. You have every right to challenge an inquiry that you never authorized. The trick is knowing which inquiries are set in stone and which ones you can actually get removed.

The Law Is on Your Side

Your biggest ally in this process is the Fair Credit Reporting Act (FCRA). This federal law is crystal clear: a lender needs a "permissible purpose" to pull your credit report. When you fill out an application, you’re giving them that permission. That creates a valid inquiry that you can't have removed.

However, if you didn’t give permission, it’s a completely different ballgame. That’s an unauthorized inquiry, and the FCRA gives you the power to dispute it. Understanding this distinction is the first step in successfully cleaning up your credit report. You can explore the conditions for inquiry disputes in more detail to see exactly what qualifies.

Red Flags: Identifying Unauthorized Inquiries

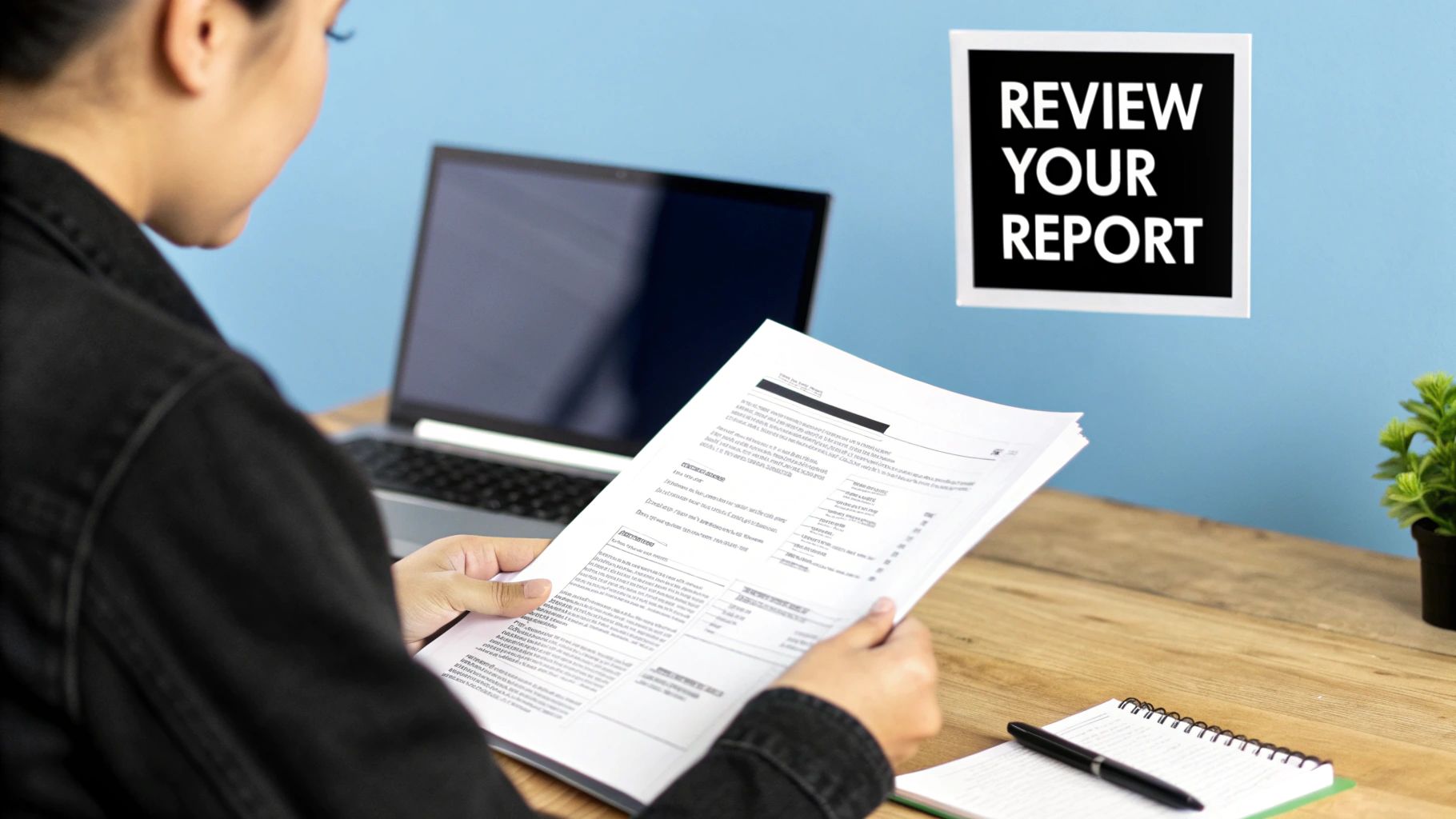

So, how do you find an inquiry that shouldn't be there? It's time to do a little detective work. You’ll need to get your credit reports from all three major bureaus—Experian, Equifax, and TransUnion—and go through the "inquiries" section with a fine-tooth comb.

Be on the lookout for these tell-tale signs that an inquiry might be an error or fraudulent:

Real-World Scenarios for Successful Removal

Let's walk through a few situations where you would have a strong case for getting an inquiry removed. Imagine your name is "Maria Garcia," and you live in Arizona. You check your report and see an inquiry from a Florida-based furniture store. Since you’ve never been to Florida, it’s likely the store pulled the wrong Maria Garcia’s file. This is a classic clerical error and a clear-cut reason for a dispute.

Another common problem is outright fraud. Let’s say you find three recent inquiries for credit cards on your report, but you haven't applied for a new card in years. This is a massive red flag for identity theft. In this scenario, you would file an FTC Identity Theft Report and a police report. These documents provide powerful proof that you didn't authorize those credit checks.

Finally, consider a situation where a lender tricked you. You agreed to a "pre-qualification" for a loan, which should only result in a soft inquiry that doesn't affect your score. But instead, the lender ran a hard inquiry without your specific consent for a formal application. This is a violation of the rules and gives you solid ground to demand its removal.

Becoming a Detective With Your Own Credit Report

Finding a strange inquiry on your credit report requires more than a quick scan. It’s time to put on your detective hat and dig in. Your credit report is the main piece of evidence, and your personal financial records are what you'll use to confirm or deny what you see.

Cross-Referencing Your Financial Footprints

Let’s be honest, memory can be tricky. The surest way to spot an inquiry you didn't authorize is by comparing your report against your own documentation. This is where being a good record-keeper for your own credit activities really pays off.

Here’s a practical tip: create an "application log." Any time you apply for a credit card, loan, or anything else that requires a credit check, make a note of it. A simple spreadsheet or even a dedicated notebook works perfectly. Just jot down the date, the lender's name, and why you applied (e.g., "Applied for Target RedCard"). This log becomes your trusted guide when reviewing your report. If you see an inquiry that isn't on your list, it’s a red flag.

Recognizing the Patterns of Suspicious Activity

Sometimes, a single unfamiliar name on your report is just the tip of the iceberg. Looking at the bigger picture can reveal patterns that scream trouble. You're looking for activity that just doesn't fit your normal financial life.

Keep an eye out for these classic warning signs:

The Importance of Bulletproof Record-Keeping

This detective work isn't just about finding problems; it’s about building a solid case to fix them. When you file a dispute with a credit bureau, "I don't recognize this" is okay, but it's not as strong as, "I've checked my application log, and I have no record of authorizing an inquiry from this company on this date."

This level of detail matters because mistakes happen more often than you'd think. A 2021 survey found that 12% of consumers who reviewed their credit reports found errors. Some studies even suggest that more than one in five people have mistakes serious enough to affect their credit. You can discover more insights into consumer credit report errors in this report. For those building credit with an ITIN, carefully checking every detail is especially crucial. Our guide on the essentials of an ITIN credit report can help you get familiar with what to look for.

Knowing how to remove credit inquiries starts here. Getting your facts and records organized is the most important move you can make before you even think about writing that dispute letter.

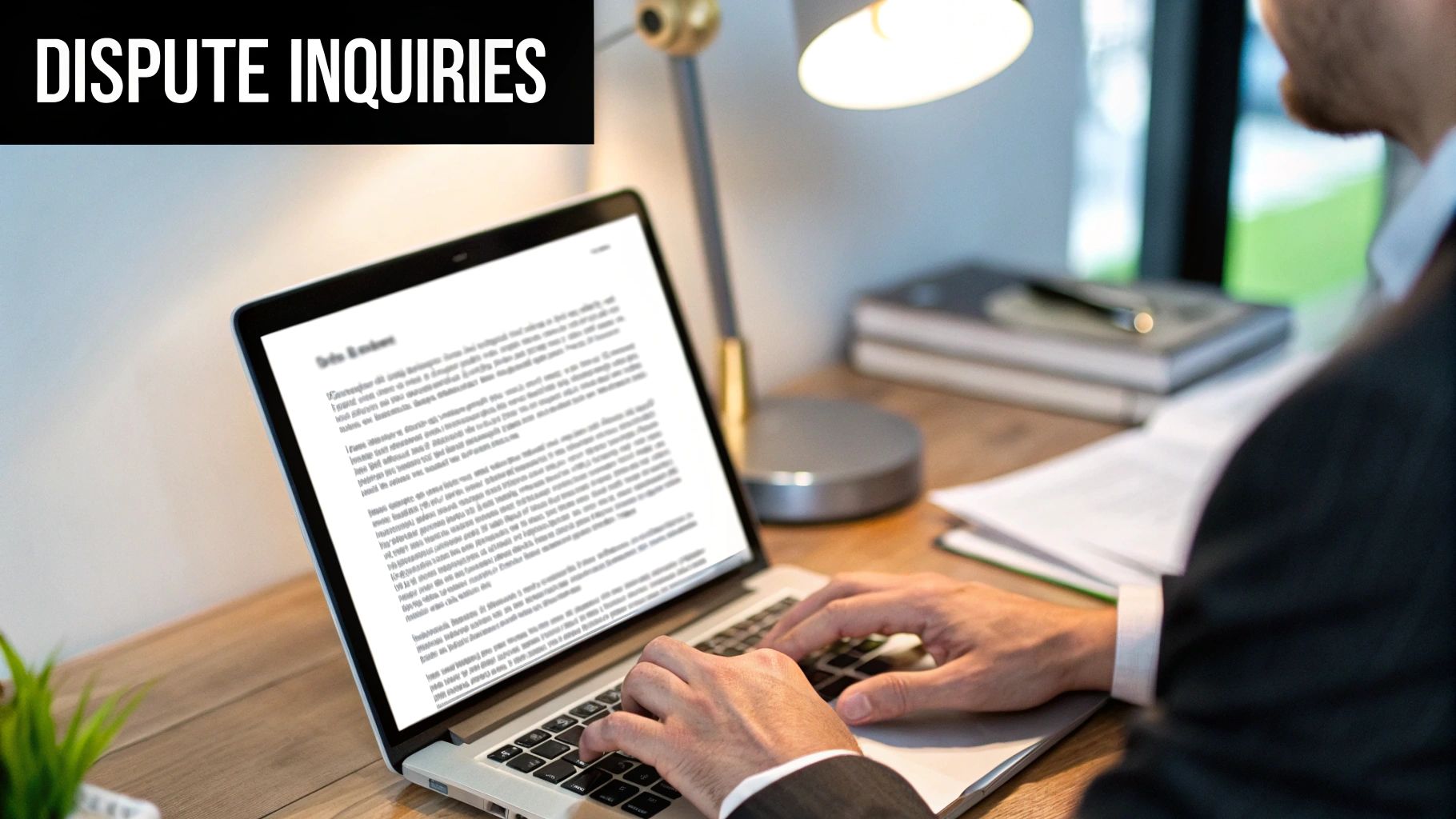

Crafting Disputes That Credit Bureaus Take Seriously

Filing a dispute can feel like you're sending a message in a bottle, hoping someone eventually finds it. To get real results, you need to change your approach from being a frustrated consumer to being a meticulous investigator. The goal isn't just to complain; it's to build a case so clear and well-supported that the credit bureau has no choice but to act. This change in mindset is the secret to successfully figuring out how to remove credit inquiries that simply don't belong on your report.

Online Portal vs. The Formal Letter

Your first strategic decision is where to make your stand: the bureau's online dispute portal or a formal letter sent through the mail. Each method has its time and place. The online portals are built for speed and are great for simple, clear-cut mistakes.

For instance, here’s a look at the initial online dispute page for Experian.

As you can see, the process is very guided, which is perfect for fixing a straightforward typo or an obvious clerical error. However, if you're dealing with something more serious, like identity theft or a hard inquiry you are certain you never authorized, a dropdown menu probably won't cut it. In these more complex situations, a physical letter is a much more powerful tool. A mailed dispute often triggers a more detailed, hands-on review and lets you present a full case file that can't be easily dismissed.

Building an Irrefutable Case File

A successful dispute letter is professional, factual, and gets straight to the point. Ditch the emotional language and stick to the facts. Your letter should clearly state your full name and address, pinpoint the exact inquiry you're disputing (include the creditor's name and the date), and explain exactly why it's an error. For example, "I did not authorize this inquiry," or "This inquiry is a result of identity theft."

The real power, however, lies in the evidence you include. Never send your original documents, only copies. Your aim is to provide undeniable proof. A rock-solid evidence file should contain:

For a more detailed breakdown of gathering your documents, you can check out our guide on how to dispute credit report errors.

To make this process easier, here’s a quick-reference table with the contact information you'll need for the three major credit bureaus.

Credit Bureau Contact Information and Dispute Methods

Essential contact details and preferred dispute methods for each major credit bureau, including processing times and follow-up procedures

Having this information handy saves you from having to dig for it later. Just remember to send any mailed correspondence to the addresses above using a method that gives you a tracking confirmation.

Follow-Up and Escalation Tactics

Once your dispute package is ready, don't just drop it in a mailbox. Always send it via certified mail with a return receipt requested. This isn't just for your peace of mind; it creates a legal paper trail and proves exactly when the bureau received your dispute. By law, they typically have 30 days from that date to investigate your claim and send you the results.

What happens if your dispute is rejected? First, don't give up. The bureau will often send a generic response stating the creditor "verified" the information. This is your signal to take the fight directly to the creditor who placed the inquiry. You also have the right to add a 100-word "statement of dispute" to your credit file. This statement will be visible to any future lender who pulls your credit, giving you a chance to explain your side of the story. A well-documented dispute sent via certified mail signals that you are an informed consumer who knows your rights and you're prepared to see it through.

Going Straight to the Source With Creditors

While filing a formal dispute with the credit bureaus is a necessary step, sometimes the fastest way to get an inquiry removed is to talk directly to the company that put it there in the first place. Cutting out the middleman can lead to a quicker fix, especially if the whole thing was just a simple misunderstanding or a clerical error. This approach is less about legal filings and more about clear communication.

The Art of the Goodwill Letter

You've probably heard people talk about sending a goodwill letter. This isn't a formal dispute. Instead, it's a polite request asking a creditor to remove a legitimate hard inquiry as a gesture of kindness. This tactic has the best chance of success when you already have a great track record with that creditor. For example, imagine you’ve been a loyal cardholder for years and are now applying for a mortgage where every point on your credit score is critical.

But let’s be realistic: sending a goodwill letter to a lender who just denied your application, or one you have no history with, is rarely effective. They simply don't have much incentive to help you out. Your success really depends on that positive, pre-existing relationship.

If you're writing one, make sure your letter includes:

Think of it as having a conversation on paper. You're trying to connect with the person on the other end, hoping they’ll make a one-time exception. While there are no guarantees, many people have successfully used this method, particularly with smaller banks or local credit unions that often have more personal flexibility.

When You Need to Pick Up the Phone

Sometimes, a letter isn't the right approach or it simply gets lost in the shuffle. For inquiries that you are absolutely certain you never authorized, a direct phone call can be a powerful next move after you've filed your initial dispute with the bureaus. This is where your earlier detective work really comes in handy.

When you call, the goal is to be firm but always professional. You’re not just asking for a favor; you're asserting your rights under the Fair Credit Reporting Act (FCRA). Here’s how you could start that conversation:

"Hello, my name is [Your Name]. I'm calling because I found a hard inquiry on my credit report from your company, dated [Date]. I've reviewed my records and don't recall authorizing this credit check. Could you please help me find out where this came from and start the process to have it removed?"

This script gets straight to the point and puts the responsibility on them to prove they had a "permissible purpose" to pull your credit. If the customer service representative is unhelpful, politely ask to speak with a manager or someone in the compliance department. Keep detailed notes of every call, including the date, time, and the names of everyone you talk to. This documentation is your best friend if you need to follow up.

Be aware that large financial institutions often have strict policies against removing inquiries, so you might hit a roadblock. Even so, it’s always worth the attempt. Mastering this direct approach is a key part of learning how to remove credit inquiries for good.

Building Your Defense Against Future Unauthorized Inquiries

Getting an unauthorized inquiry removed feels great, but you don't want to play credit report whack-a-mole forever. The strongest long-term strategy is a good offense. Preventing these inquiries from ever hitting your report saves you from the stress and hassle of the dispute process. The real secret to how to remove credit inquiries is to stop them before they start by being proactive with your credit protection.

Proactive Protection: Credit Freezes and Fraud Alerts

Think of your credit file as your financial house. A fraud alert is like putting a sign on the lawn that tells lenders, "Hey, please double-check that this is really me before opening an account." You can set one up for a year, and it’s a smart first move if you think your information might have been compromised.

A credit freeze, on the other hand, is the deadbolt on your front door. It completely locks down your credit report, preventing new creditors from accessing it at all. No one can open a new credit line in your name until you "thaw" the freeze using a secure PIN. Thanks to a 2018 federal law, it is completely free to place and lift a freeze with all three bureaus. For ultimate protection against identity theft, a credit freeze is your single most effective tool.

Applying Smarter to Minimize Inquiries

Your own habits can make a huge difference in keeping your inquiry count low. When you’re shopping for a big-ticket item like a car or a mortgage, you need to be strategic. Thankfully, scoring models are designed to let you shop around. Multiple inquiries for the same type of loan are often grouped together as a single event, as long as they happen within a 14 to 45-day window. So, get all your rate shopping done within a few weeks to minimize the impact.

You should also get into the habit of asking one crucial question. When a lender offers to "pre-qualify" you, ask them directly: "Will this be a hard or a soft inquiry?" A soft pull has no effect on your score, but some companies will run a hard inquiry without being clear about it. Asking this question puts you in control and helps you avoid unnecessary dings on your credit score.