How to Rebuild Credit After Financial Setbacks

When your credit has taken a hit, figuring out where to even begin can feel like a monumental task. But from my experience, the most powerful first moves are actually pretty simple. It all boils down to getting an honest look at where you stand right now and then committing to a pattern of positive payment history. While ITIN holders face some unique hurdles, these core principles are universal.

Your First Steps In Rebuilding Credit

The journey back to good credit starts with two actions you can take today: understanding your starting point and mapping out your next moves. This isn't about some secret trick; it's about being deliberate and consistent. Think of it like planning a road trip—you wouldn't just start driving without knowing where you are and where you want to go.

For anyone trying to rebuild, especially ITIN holders who often feel like they're operating outside the standard financial system, this initial phase is all about getting the right information and setting clear intentions. You have to pull back the curtain on your credit data to see what’s working for you and what's holding you back.

Assess Your Current Credit Profile

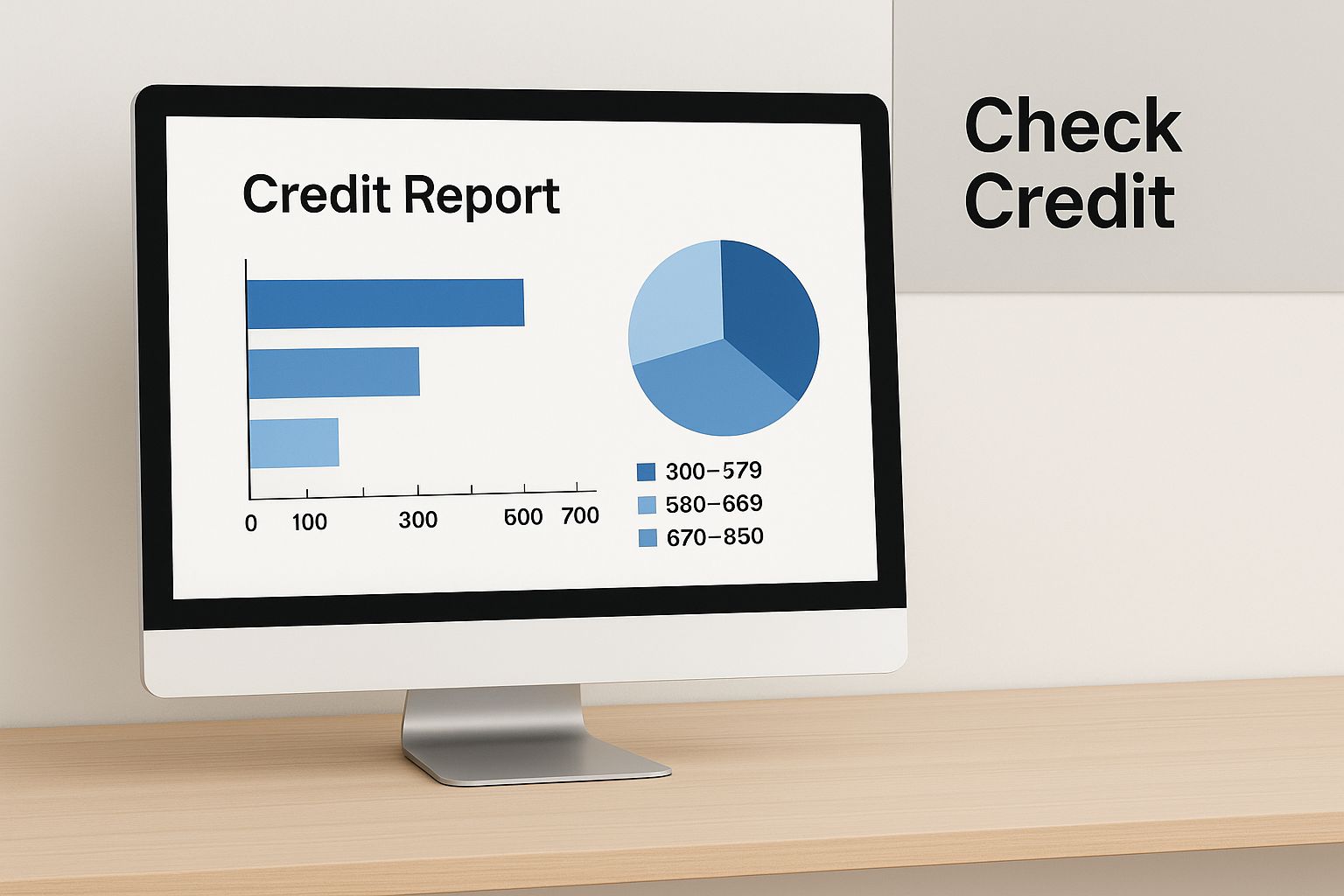

Your first mission, plain and simple, is to get your hands on your credit report. It’s a huge myth that this is a roadblock for ITIN holders. Plenty of services and even the major bureaus are equipped to work with you. This report is your financial DNA, spelling out your payment history, current debts, and any public records tied to your name.

Once you have that report, it's time to put on your detective hat. Scrutinize every line and look specifically for:

This initial review is the absolute foundation of your comeback story. You can't fix what you can't see.

As the image highlights, obtaining and understanding your credit data is the non-negotiable first step. It transforms vague anxiety into a concrete, actionable plan.

Prioritize Key Credit-Building Actions

After your review, it's time to focus on the actions that pack the most punch. The single most influential thing you can do is establish a rock-solid record of on-time payments. Right behind that is managing how much of your available credit you're actually using.

I've seen it time and time again: a successful credit rebuild hinges on a few key, measurable habits. To help you prioritize, I've put together a table summarizing the most impactful actions based on global credit trends.

Key Factors for Rebuilding Credit

This table breaks down the most critical actions you can take to start rebuilding your credit score effectively.

These aren't just suggestions; they are the foundational pillars of a strong credit profile.

The data consistently backs this up. A recent Equifax report highlights that keeping a credit utilization ratio below 30% is vital, as higher usage is directly tied to lower scores and a greater risk of delinquency. You can dive deeper into these findings in the 2025 Global Consumer Credit Trends report.

With this insight, you can confidently start opening the right kinds of accounts—like a secured credit card or a credit-builder loan—and use them strategically. It's the small, consistent actions that ultimately transform a damaged credit profile into a powerful financial tool.

Getting Your Hands on Your ITIN Credit History

Before you can map out a comeback, you need to know exactly where you stand. That means getting a full, unvarnished look at your credit history. A lot of people believe this is a huge hassle, or maybe even impossible, if you have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN).

Let me be clear: that’s just a myth. The big three credit bureaus—Equifax, Experian, and TransUnion—are fully capable of working with ITINs. You have every right to see your financial story, and pulling those reports is the first concrete step you'll take on your path to rebuilding your credit.

How to Request Your Credit Reports

Under U.S. law, you're entitled to a free credit report from each of the three major bureaus every 12 months. You can get these directly from the bureaus themselves or through the government-authorized website set up for this purpose.

When you start the process, they'll need to verify it's really you. This is where you’ll simply use your ITIN instead of an SSN. You should also be ready to provide:

Sometimes, they might ask you to mail in your request along with copies of documents to prove who you are and where you live, like a recent utility bill and a government-issued ID. It might feel like an extra hoop to jump through, but it’s a standard and manageable part of the process.

Making Sense of Your Report

Once you have your reports, it's time to put on your detective hat. The report itself won't show a three-digit credit score, but it has all the ingredients that go into creating one. Think of it as the complete biography of your financial life.

Your job is to figure out what's working for you and what's holding you back. A credit report is usually divided into a few main sections.

What to Scan For

As you go through your tradelines, keep an eye out for any late payments. These are usually flagged as 30, 60, or 90 days past due and are major dings on your record. Also, make a note of any accounts that were sent to collections; these are serious issues you'll need to tackle head-on. If you're starting from square one, our guide on how to build credit with an ITIN number is a great resource.

The itinscore platform was built to make this whole thing easier. Instead of trying to decipher dense, confusing reports, our dashboard gives you a clean, real-time summary. It automatically highlights the problem areas, so you can quickly spot what needs fixing and start tracking your progress. This is the first step toward rewriting your financial story from one of setbacks to one of success.

Building a Positive Payment History

Alright, now that you have a clear picture of where your credit stands, it's time for the real work to begin. This is where you start writing a new story for lenders—one that shows you're reliable, consistent, and trustworthy.

The single most important thing you can do is build an undeniable track record of positive, on-time payments. It’s not about big, dramatic moves. It's about the small, steady habits you form over time. For ITIN holders, this is especially crucial because it proves you can handle U.S.-based credit products responsibly. The objective is simple: open new lines of credit that report your good behavior to the major bureaus and lay a fresh foundation for your financial future.

Use Secured Credit Cards as Your Foundation

For anyone rebuilding their credit, a secured credit card is your best friend. It’s often the easiest and most effective tool to get your foot in the door. Unlike a standard unsecured card, a secured card asks for a small, refundable security deposit when you sign up. That deposit usually sets your credit limit.

So, if you put down 300**, you get a credit card with a **300 limit. This simple exchange removes the risk for the bank, making them far more likely to approve someone with a rocky credit past or no history at all. And the best part? On your credit report, a secured card looks just like any other credit card to the bureaus.

When you use it the right way, it’s a powerful tool for proving you’re financially responsible. Every on-time payment you make gets reported each month, actively building a positive history from scratch.

How to Maximize a Secured Card

Just getting a secured card isn't the whole story. You have to use it strategically to get the best results. The real key is to show that you can manage credit without actually needing it.

Here’s a practical game plan that I’ve seen work time and time again:

This disciplined approach tells the exact story the credit bureaus want to see: reliability.

Explore Credit-Builder Loans

Another fantastic tool designed specifically for this situation is the credit-builder loan. It works in reverse compared to a normal loan. Instead of getting cash upfront, the loan amount is placed into a locked savings account for you. You then make small, fixed monthly payments.

After you’ve made all the payments over the loan term (typically 6 to 24 months), the money is released to you, sometimes with a little interest you've earned. All along the way, your on-time payments are reported to the credit bureaus, strengthening your credit profile.

I'm a big fan of these loans because they force a savings habit while simultaneously fixing your credit. It's a true win-win for proving financial discipline.

A Real-World Scenario

Let's look at a practical example. Imagine Maria, an ITIN holder, is focused on rebuilding her credit. She takes out a $500 credit-builder loan with a 12-month term.

In just one year, Maria has built a solid payment history on a new account and saved $500. This is a low-risk, high-impact strategy for anyone serious about rebuilding their credit. Platforms like itinscore are great for this, as they often highlight curated offers for these products from lenders who understand and work with ITIN holders.

Managing Debt and Credit Utilization

When you're working to rebuild your credit, it's easy to focus only on opening new accounts and making on-time payments. While that's a huge piece of the puzzle, what you do with your existing credit and debt is just as important—maybe even more so. This is where your credit utilization ratio enters the picture.

Simply put, this ratio is the percentage of your available credit that you're actually using. Think of it as a snapshot for lenders. Low utilization suggests you're financially stable and not reliant on debt. High utilization, on the other hand, can be a major red flag, signaling that you might be stretched too thin. It can seriously weigh down your score, even if you’ve never missed a payment.

The Magic Number for Credit Utilization

I’ve seen it time and time again: understanding and controlling this one number can be a game-changer. The credit scoring models pay very close attention to your utilization, especially on revolving accounts like credit cards. It’s a powerful signal of how you handle your finances.

You’ve probably heard the common advice to keep your utilization below 30% of your total credit limit. That’s a good start. But if you really want to put your credit-building journey on the fast track, aim for under 10%. This shows lenders you’re in complete control—that you use credit as a convenient tool, not a financial crutch.

Because lenders usually report this every month, mastering your utilization is one of the fastest ways to see a positive change in your score.

Smart Strategies to Lower Your Balances

Here’s a common mistake I see people make: they assume that as long as they pay their bill by the due date, they’re fine. But most credit card companies report your balance to the credit bureaus on your statement closing date. This means you could use your card, rack up a big balance, and then pay it off in full, but the credit bureaus might still see that high balance for a whole month.

To get ahead of this, you need to be a bit more proactive.

These small habits really do add up. If you want to dig deeper into the math, check out our detailed guide on how to calculate credit utilization.

Tackling Existing Debt Head-On

For many of us, past financial struggles have left behind some debt. Staring at those balances can feel overwhelming, but creating a clear plan turns that mountain into a series of manageable steps. Two popular methods can give you the structure you need.

The Debt Snowball Method

This strategy is all about momentum and psychology. You focus on paying off your smallest debts first, no matter what their interest rates are.

This method feels great because you score quick wins, which builds the motivation you need to keep going.

The Debt Avalanche Method

This approach is for the number-crunchers who want the most mathematically sound plan. Here, you focus on knocking out the debts with the highest interest rates first.