How to Read Credit Card Statements Without Confusion

Let's be honest, reading your credit card statement can feel like a chore. The temptation is to just find the balance, see the due date, and move on. But taking a few minutes to really scan it—starting with the account summary and then the transaction list—is one of the smartest money moves you can make. It's your first line of defense against fraud and costly mistakes, turning a page of numbers into a powerful financial tool.

Why Your Statement Is More Than Just a Bill

Most of us are guilty of glancing at our statement for two things: the minimum payment and the due date. But treating it as just another bill is a missed opportunity. This document is actually a detailed report card on your financial health. And with over 631 million active credit card accounts in the U.S. alone, knowing how to read it is a vital skill. Read more about the latest credit card statistics.

Think of your statement as a monthly financial check-in. It's your chance to spot suspicious charges before they escalate, notice that free trial that turned into a recurring subscription, and get a real, unfiltered look at where your money is going.

This simple habit goes way beyond just spotting fraud. It directly shapes your financial future by helping you:

Navigating Your Account Summary

Think of the account summary as the executive summary of your monthly spending. It’s always right at the top of your statement for a reason—it gives you the most critical information at a glance. This section pulls together all your activity, from payments and purchases to fees and interest, to show you exactly where your account stands.

Getting comfortable with this part of the statement is the first real step to understanding your credit card. Every number here tells a piece of your financial story for the month, so let's make sure you can read it fluently.

Breaking Down the Math

The numbers in the summary follow a pretty straightforward formula. Let's walk through a quick, real-world example to see how it all connects. Say you started the month with a previous balance of $500.

Here’s how the bank calculates your new balance:

Do the math (500 - 200 + 350 + 25), and your New Balance comes out to $675.00. This final number is hugely important because it's what your credit utilization is based on—a major factor in your credit score. If you're curious, you can play around with a credit utilization ratio calculator to see how different balances impact your ratio.

To help you get familiar with the lingo, here's a quick cheat sheet for the most common terms you'll find in this section.

Key Terms on Your Statement Summary

Understanding these terms is a foundational skill. In fact, once you get the hang of your credit card statement, you'll find it much easier to read other financial documents. If you want to expand your knowledge, you can master tips for reading financial statements and get even more confident with your money.

Understanding Your Payment Obligations

Once you've scanned the account summary, your next stop should be the payment information section. This is where the rubber meets the road, and it’s all about two critical dates: the statement closing date and the payment due date.

Think of the closing date as the end of a chapter; it finalizes all the transactions for that billing cycle. The due date, which usually falls 21-25 days later, is your deadline to act.

This window between the two dates is your grace period. If you pay your entire statement balance by the due date, you won't owe a single cent in interest on new purchases. Honestly, this is the secret to making credit cards work for you, not against you.

The Minimum Payment Trap

Right next to the due date, you'll find the minimum payment due. This number can be deceptive. While paying it technically keeps your account in good standing and avoids late fees, it’s one of the most common financial traps out there.

Card issuers typically calculate this as a tiny percentage of your balance (often just 1-2%) or a small flat fee. Paying just the minimum is a recipe for staying in debt for years—sometimes decades—as interest balloons and eats up most of your payment.

To combat this, statements now have a warning box showing exactly how long it will take to clear your balance by only paying the minimum. It's a stark reminder, especially when you consider the staggering $1.18 trillion in U.S. credit card debt. Getting a handle on your payments is the best way to avoid becoming part of that statistic. You can learn more about recent credit card debt trends to see the bigger picture.

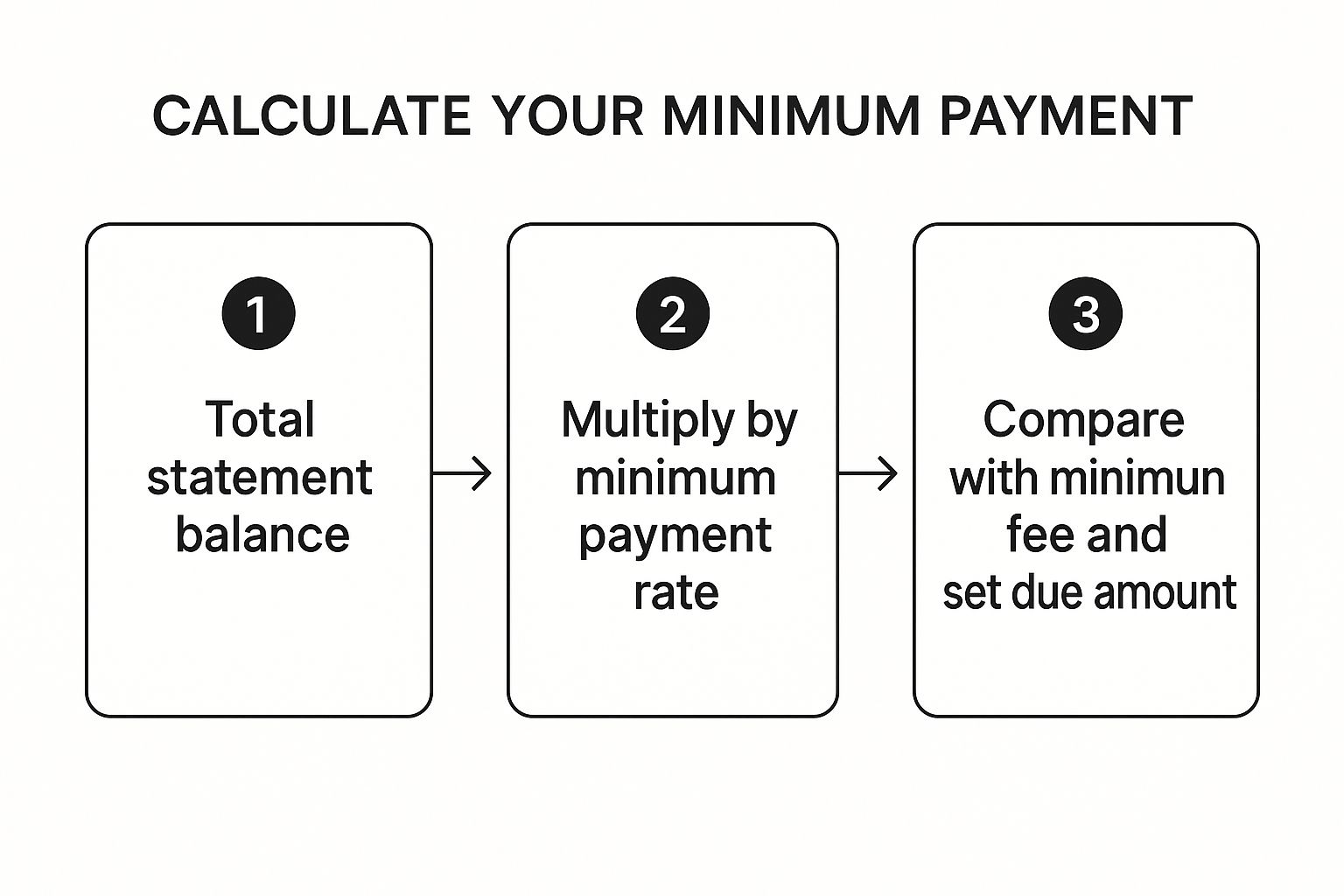

This breakdown shows how that minimum payment is usually calculated.

As you can see, the formula is designed to ensure the lender gets paid, but it also maximizes the interest you'll pay over the long haul.

Now, what if you bumped that payment up to just 120** a month? You’d be completely debt-free in under three years and pay only around **900 in interest. That small adjustment saves you thousands of dollars and shaves 14 years off your debt sentence.

How to Spot Problems in Your Transaction History

Think of your transaction list as a financial diary. It's the story of where your money went this month, and just like any good story, it's worth a quick read-through. This detailed log shows every single purchase, payment, and credit, making it your first line of defense against errors and fraud.

When you're scanning the list, you'll see a transaction date (the day you swiped your card) and a posting date (when the bank officially processed it). There's usually a slight delay between the two, which is perfectly normal. Just keep that in mind if you're making purchases right at the end of your billing cycle.

Common Issues to Look For

It's surprisingly easy for little mistakes to sneak onto your statement. I’ve seen it happen all the time—a restaurant accidentally runs a card twice, or a free trial for a streaming service you forgot about suddenly turns into a recurring charge. Sometimes the merchant name is so weird and abbreviated that you don't even recognize it. A quick search online usually clears that right up.

Here are the most common red flags to keep an eye out for:

With the global credit card market expected to grow to over $1.4 trillion, our statements are getting more crowded. They’re filled with everything from tiny tap-to-pay coffee purchases to cashback rewards being credited. Discover more insights about the growing credit card market. This complexity makes giving your transaction history a thorough once-over more important than ever.

Decoding Interest Charges and APR

Let's be honest, the interest charges section is where most people's eyes glaze over. It can feel like you need a finance degree to make sense of it, but it all boils down to one thing: the Annual Percentage Rate (APR). Think of it as the price you pay to borrow money.

Here's the good news: if you pay your statement balance in full and on time every single month, you can completely sidestep interest charges. But if you carry a balance from one month to the next, this is the section that determines how much that debt will cost you. Getting a handle on it is crucial for your financial health.

Why You Have Multiple APRs

The first thing that trips people up is seeing a whole list of different APRs. It’s not a mistake—your card has several rates, and each one kicks in for a specific kind of transaction. It’s a common industry practice that often catches cardholders off guard.

You'll almost always see a few different rates listed:

How Interest Is Really Calculated

So, how does the bank actually figure out your interest charge? They don't just take your final balance and multiply it by your APR. It's a bit more involved. They use what’s called the average daily balance method.

This means they track your balance every single day of the billing cycle, add up all those daily totals, and then divide by the number of days in that cycle.

For example, say you started a 30-day cycle with a 1,000** balance. For the first 15 days, it stayed there. Then, you made a **400 payment, which dropped your balance to 600** for the final 15 days. Your average daily balance for that month wouldn't be **1,000 or 600**—it would be **800.

This shows that every day counts. Making a payment mid-cycle, rather than waiting for the due date, can actually lower your average daily balance and reduce the interest you owe. It’s a small, savvy move that can save you real money over time.

Got Questions About Your Credit Card Statement? We've Got Answers.

Even after you get the hang of reading your credit card statement, some situations can leave you scratching your head. Let's tackle some of the most common questions people have.

Think of this as your personal FAQ for those "what if" moments that always seem to pop up.

What Should I Do If I Find a Charge I Don't Recognize?

First off, don't panic. The name on the statement might not be what you expect. Do a quick online search for the merchant name; it could be a parent company or a third-party payment processor with a different name than the store you visited.

If you still don't recognize it, call your credit card issuer immediately. Use the phone number on the back of your card.

When you call, report the transaction as a potential unauthorized charge. This kicks off a dispute process, which usually puts the charge on hold while they investigate. Acting fast is crucial here—it’s the best way to protect yourself.

Why Is My Interest Charge So High If I Made a Payment?

This is a really common point of confusion, and it all comes down to how interest is calculated. Most credit cards calculate interest based on your average daily balance.

So, if you carried any balance over from the previous month, interest started piling up every single day on that amount. Your payment lowered the principal, but it didn't retroactively erase the interest that had already built up before you paid.

The only foolproof way to avoid interest on new purchases is to pay your full statement balance by the due date, every single month.

How Is a Closing Date Different From a Due Date?

It’s easy to mix these two up, but they play very different roles in your billing cycle.

Can I Ignore My Statement If It Has a Zero Balance?

I wouldn't recommend it. It’s always a good habit to give it a quick look, even when you don't owe anything.

A quick scan can confirm there are no surprise fraudulent charges or unexpected fees (like an annual fee you forgot about). It’s also a good way to double-check that your last payment was applied correctly, giving you peace of mind that your account is in good standing.

Ready to build your credit with confidence? itin score provides the tools ITIN holders need to establish and monitor their financial health. Get your free, real-time credit report and personalized action plan today. Sign up in minutes and take control of your financial future.