How to Raise Credit Score 50 Points Fast & Easy

If you're wondering how to raise your credit score 50 points, it almost always boils down to two things: paying every single bill on time and getting your credit card balances down. These are the heavy hitters in any credit scoring model, so putting your energy here will give you the fastest, most noticeable results.

You can get started this week. Just figure out which cards have the highest balances and set up some kind of payment reminder so nothing gets missed.

Your Game Plan to Boost Your Credit Score by 50 Points

Seeing a big jump in your credit score isn't some complex financial mystery. It’s actually more straightforward than most people think. The secret is knowing exactly where to focus your efforts for the biggest impact. Don't try to do everything at once. Just zero in on a couple of key areas, and you'll have a clear path to that 50-point boost.

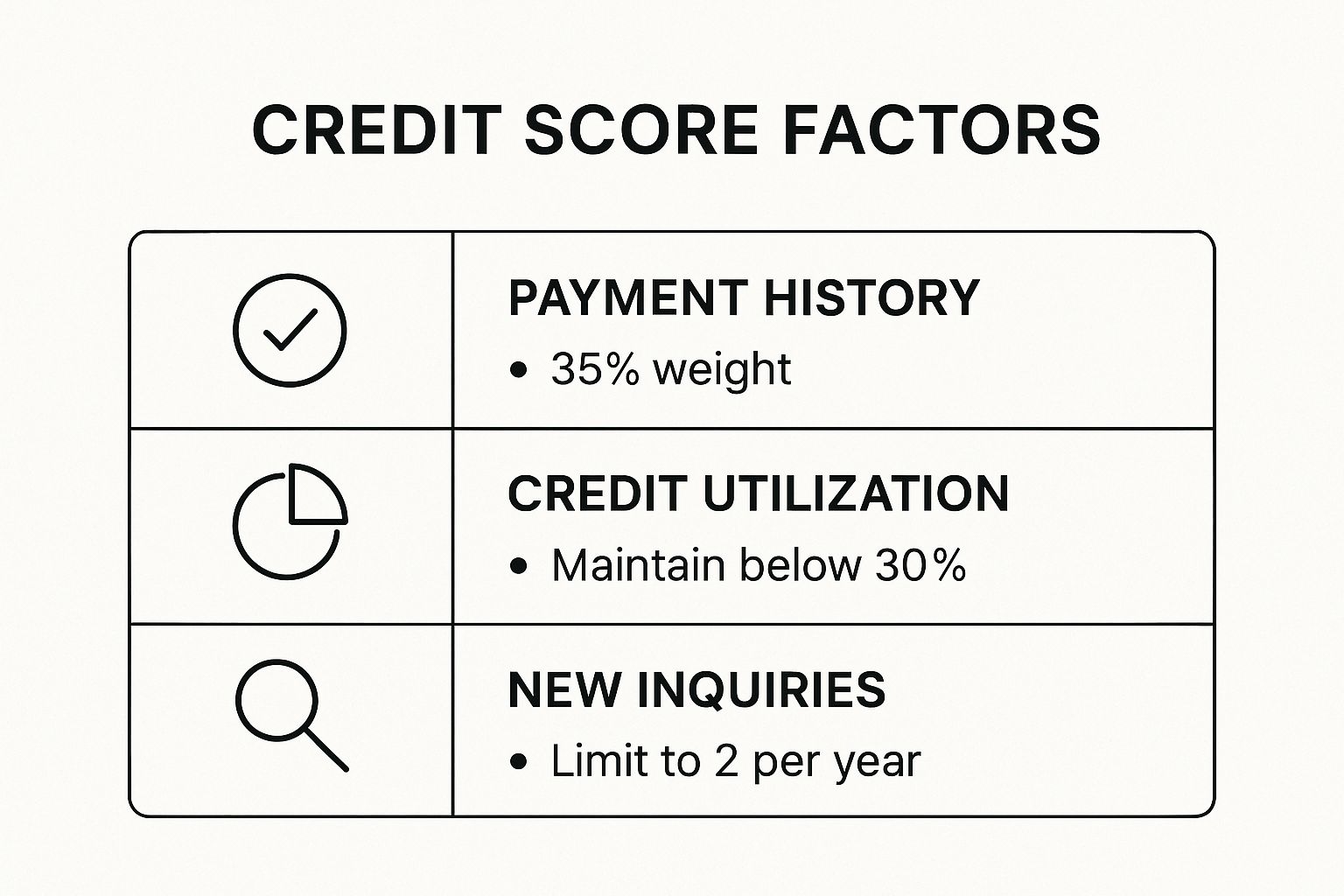

The two absolute pillars of a great credit score are your payment history and your credit utilization. Think of it this way: your payment history is your track record of reliability, and it makes up a massive 35% of your FICO® Score. Lenders just want to see that you consistently pay on time. Right behind that is your credit utilization ratio, which is simply how much of your available credit you’re actually using.

Here's your immediate action plan:

The Core Factors You Actually Control

Your credit score is really just a snapshot of your financial habits. When you improve those habits, you directly improve the score. Lenders are trying to figure out how risky it is to lend you money, and your actions tell that story. A solid history of on-time payments and low balances screams "responsible borrower."

This breakdown shows you exactly what matters most and where you should be putting your attention.

As you can see, if you can master your payment history and keep your credit utilization in check, you’re already controlling the biggest pieces of the credit score pie.

Creating a Foolproof Payment System

Life happens. It's incredibly easy to let a due date slip by. But even one late payment can tank your score and hang around on your credit report for years. The solution is to build a system that you don't have to think about. I always recommend setting up automatic payments for at least the minimum amount due on every single account.

This simple strategy acts as a safety net, guaranteeing you're never marked as late. You can—and should—still log in before the due date to pay more, which will help chip away at your balance and save you a ton on interest.

Let’s look at a real-world example. Say you have a card with a 5,000 limit and you've got a 2,000 balance on it. Your utilization is 40%, which the scoring models see as high. If you can pay down just 501, your balance drops to 1,499. Suddenly, your utilization is just under 30%. That one move can trigger a noticeable score increase the next time your lender reports to the bureaus.

When you combine that with a perfect on-time payment record, you've got a powerful one-two punch for improving your credit score fast.

To help you stay focused on what truly matters for your score, this table breaks down the most influential factors and the best actions you can take right now.

Key Factors for a 50-Point Credit Score Increase

Focusing on the top two items in this table—Payment History and Credit Utilization—is your most direct route to a significant score increase. The other factors are important for long-term health, but for a quick 50-point boost, those first two are where the magic happens.

Make On-Time Payments Your Top Priority

If you're serious about figuring out how to raise your credit score 50 points, this is where it all begins. Your payment history isn't just a piece of the puzzle; it's the entire foundation. Think of it as your financial reputation—every on-time payment tells lenders you're a responsible borrower they can trust.

Just one late payment can tank your score and hang around on your report for up to seven years. But the great news is that building a rock-solid history is completely in your hands. It’s all about creating a system that makes it almost impossible to forget.

Build Your Never-Late System

Life gets busy. Don't rely on your memory to manage due dates. The real secret is to automate your reliability so that paying on time becomes a reflex, not a chore.

The first step is a game-changer: set up automatic payments for at least the minimum amount due on every single account you have. This one move acts as a safety net, guaranteeing you'll never get dinged with a late fee or a negative mark because you forgot a date.

But don't stop there. Add a second layer of defense by setting a calendar reminder a few days before the actual due date. This little nudge gives you a chance to log in and pay more than the minimum—or even the full balance. This helps you knock down your debt faster and lowers your credit utilization.

This two-pronged approach gives you the security of automation and the financial control of manual payments. It's one of the most effective habits you can build for a perfect payment history.

What To Do About Past Mistakes

Have a late payment already on your record? Don't panic. While it takes time for negative marks to lose their sting, you might have an option: the goodwill letter.

This is simply a polite, well-written letter you send to your creditor. In it, you explain what happened and ask them to remove the late payment from your credit report as a courtesy.

For this to work, you need to have been a model customer since the slip-up. A strong goodwill letter should:

Creditors aren't required to do this, but many will for a customer in good standing. It costs you nothing but a little time to ask, and it could give your score a serious boost. For a deeper dive, exploring effective debt management strategies can provide a more holistic view of financial wellness.

The True Impact of Payment History

Your payment history accounts for a massive 35% of your FICO score, making it the single heaviest factor. Consistently paying on time is, without a doubt, one of the most powerful things you can do to see that 50-point jump.

Every on-time payment you make is another positive mark on your record, building a powerful history of reliability over time. To get a better handle on how it all works, check out our guide on what a payment history is. This is the core habit lenders care about most, making it the essential skill to master on your credit-building journey.

Drop Your Credit Utilization for a Quick 50-Point Win

Once you've got a solid handle on making every payment on time, the next big lever you can pull for a major score boost is your credit utilization ratio (CUR). It sounds technical, but it’s really just the percentage of your available credit you’re using at any given time. This ratio carries a lot of weight—it’s the second biggest factor in your credit score—and getting it right can deliver results, fast.

Think of it this way: if you have a credit card with a 5,000** limit and you're carrying a **2,500 balance, your utilization for that card is 50%. To lenders, a high utilization ratio can look like you're overextended or struggling financially, which makes you seem like a riskier borrower. Bringing those balances down is a cornerstone strategy if you're serious about figuring out how to raise your credit score by 50 points.

You’ll hear a lot of advice about keeping your CUR below 30%, and that’s a great start. But if you want to make a real dent in your score, you should aim even lower. The folks with the highest credit scores? They often keep their utilization in the single digits—we're talking below 10%. This sends a powerful signal to lenders that you manage your credit responsibly and don't need to rely on it to get by.

The Power of Strategic Payments

Here’s a tactic that’s incredibly effective but often overlooked: making payments before your statement closing date. Most of us wait for the bill to show up and then pay it off. The problem is, your credit card company usually reports your balance to the credit bureaus right around that statement closing date.

This means that even if you pay your balance in full every single month, a high balance on that specific reporting day can make it look like your utilization is sky-high.

Let’s walk through a real-world example. Say you have a card with a 2,000** limit that you use for about **1,500 in expenses each month. Even if you pay that $1,500 off religiously, your reported utilization for that month could still be a whopping 75%!

This simple timing tweak can make a massive difference, and you don't have to spend any less or pay a penny more than you normally would.

Ask for a Credit Limit Increase

Another fantastic way to improve your ratio is to get more available credit. When your credit limit goes up but your spending doesn't, your utilization ratio automatically drops. It’s simple math.

For instance, a 1,000** balance on a card with a **2,000 limit puts you at 50% utilization. But if you get that limit increased to $4,000, your utilization on that card instantly plummets to 25%—without you making a single extra payment.

Before you pick up the phone, keep a few things in mind:

If you’ve been a responsible cardholder for at least six months, this is a brilliant move to boost your score.

How to Prioritize Your Payments

If you’re carrying balances on a few different cards, which one should you pay down first to get the biggest bang for your buck? The answer is always the card with the highest utilization ratio.

Scoring models look at your overall utilization (your total debt across all cards divided by your total credit limits), but they also weigh the utilization on each individual card. A single maxed-out card can be an anchor on your score, even if your other cards have zero balances.

To put this into action, pull up your credit report and make a quick list of each card's balance and limit. If you need help with the math, our free credit utilization ratio calculator makes it easy. Zero in on the card that's closest to its limit. Paying that one down below the 30% or 10% threshold will almost always give you the most significant point jump.

The data doesn't lie: there's a direct line between lower utilization and higher scores. For example, people with 'Poor' credit scores often have utilization rates as high as 91%. In stark contrast, those in the 'Good' and 'Very Good' ranges typically hover around 40% and 15%, respectively. By actively managing this one number, you take back control of a huge piece of your credit profile.

Diversify Your Credit and Lengthen Your History

Alright, you've mastered the fundamentals. Your payments are consistently on time, and you're keeping your credit utilization nice and low. Now, we move on to the more nuanced part of credit building: adding strength and diversity to your profile. This is about showing lenders you’re not just a one-trick pony; you can responsibly manage different kinds of debt over time.

Think of it this way: your credit report is telling a story about you. A report with only one or two credit cards is a short story. A report with a mix of accounts tells a much more compelling tale of financial reliability.

A big piece of this puzzle is your credit mix, which is just a fancy term for the different types of credit accounts you have. Lenders love to see a healthy blend of revolving credit (like your credit cards) and installment loans (like an auto loan, personal loan, or a credit-builder loan).

Having both shows you can handle the discipline of a fixed monthly payment (installment loan) just as well as you manage a flexible credit line (credit card). For an ITIN holder building credit from the ground up, this is a powerful signal to send.

The Power of an Installment Loan

If your entire credit profile consists of credit cards, adding a small installment loan can give your score a serious boost. For many, a credit-builder loan is the perfect place to start. These are designed specifically for this purpose. You don't get the money upfront; instead, it's held in a savings account while you make small, regular payments.

Every single one of those on-time payments gets reported to the credit bureaus. It's a low-risk, high-reward strategy that simultaneously adds to your positive payment history and diversifies your credit mix. According to research from the Philadelphia Fed, adding and responsibly managing a new installment loan can realistically raise a score by 50 points over 6 to 12 months for someone building their credit file.

As your financial world expands, it’s wise to get comfortable with different financial concepts, including understanding long-term debt. This knowledge will help you make smarter moves as you build out your credit profile.

Whatever You Do, Don't Close Your Oldest Credit Card

I see this happen all the time. Someone gets a new card with better rewards and decides to "clean up" their wallet by closing an old, unused card from years ago. This is almost always a mistake that can undo a lot of your hard work.

Why? It all comes down to the length of your credit history, a factor that makes up about 15% of your FICO Score. Lenders see a long, established history as a sign of stability and experience.

Let's look at a quick example:

Right now, your average age of accounts is 6 years ( (10 + 2) / 2 ). If you close that 10-year-old card, your average account age instantly drops to just 2 years. That's a huge change, and your credit score will likely take a significant hit as a result.

The better move? Keep that old card open. Use it for a tiny recurring purchase—like your Netflix or Spotify subscription—and set up autopay. This keeps the account active and in good standing, preserving all that valuable history you've built.

Patience is the name of the game here. Building a deep, diverse credit file is what opens doors to the best loans, rates, and financial products. To dive deeper into this topic, take a look at our guide on what credit mix is. When you combine these long-term strategies with stellar payment and utilization habits, you’re creating a credit profile that speaks volumes about your financial trustworthiness.

Protect Your Progress by Monitoring Your Credit

You’ve been disciplined about your on-time payments and you've worked to keep your credit utilization low. Fantastic. The next crucial move is shifting from offense to defense—it's time to protect the score you've built.

Think of credit monitoring as the security system for your financial reputation. It's the only way to make sure all your hard work isn't undone by a simple error or, worse, outright fraud. After all, what’s the point of learning how to raise your credit score 50 points if an inaccurate late payment on your report erases all that progress overnight?

Getting into the habit of checking your credit regularly keeps you in control. It's not just about watching a number go up or down; it’s about making sure the story your report tells lenders is the right one.

Getting Your Hands on Your Free Credit Reports

First things first: you need to see what the bureaus are saying about you. Federal law gives you the right to a free credit report every single week from each of the three major bureaus: Equifax, Experian, and TransUnion. The official, government-authorized place to get them is AnnualCreditReport.com.

Here’s a pro tip: instead of pulling all three at once, try staggering them. You could check your Experian report in January, Equifax in May, and TransUnion in September. This gives you a regular peek into your credit file throughout the year.

Remember, not every creditor reports to all three bureaus, so the information can vary slightly. That’s why looking at all three is the only way to get the full picture of your credit standing.

What to Look For When You Review Your Report

When you get that report, don't just glance at it. You need to become a bit of a detective, looking for anything that seems out of place. Errors are surprisingly common and can be incredibly damaging.