How to Qualify for Mortgage: Your Ultimate Guide

When you're trying to get a mortgage, lenders are really just looking at four main things to decide if you're a good candidate for a loan. They want to see your credit history, know you have a stable income, check that you have enough assets for the down payment, and look at your current debt load. If you can get these four areas in good shape, you're well on your way to getting approved.

Your Quick Guide to Mortgage Qualification

Getting a mortgage can feel like a huge, complicated puzzle, but it really boils down to one simple question for the lender: are you able to reliably pay back this loan for years to come? To figure that out, they look at your financial life from a few key angles.

Think of it like building a case for yourself. The stronger your evidence of financial responsibility, the more likely you are to get approved—and at a much better interest rate, too.

Understanding the Four Pillars of Mortgage Approval

Your entire mortgage application really stands on these four legs. Let’s break down what lenders are looking for in each.

Lenders use these components to get a full picture of you as a potential borrower. To put it in perspective, a homebuyer in a high-cost area like California might need an income over $142,000 just for an entry-level home. This shows how income and DTI are directly tied to what you can realistically afford.

To make this clearer, here’s a quick summary of what lenders are evaluating.

Core Pillars of Mortgage Qualification

By understanding how these pieces fit together, the mortgage process becomes a lot less mysterious. This guide will walk you through exactly how to strengthen each of these areas to build your strongest possible case for approval.

Building a Strong Financial Profile for Your Application

Before you even start looking at mortgage applications, the real work begins with your personal finances. Lenders are searching for a clear, predictable pattern of financial responsibility. Taking the time now to deliberately build this profile will set you up for a much smoother underwriting process later.

Your goal is to tell a financial story that’s easy for a lender to understand and, most importantly, trust. This comes down to organized documents, a consistent savings habit, and a stable work history. When you prepare these elements in advance, you’re not just answering questions—you're proactively proving you’re a reliable borrower.

Create a Clean and Verifiable Savings History

Lenders need to see that you have the money for a down payment and closing costs, but they also have to verify where that money came from. The absolute best way to do this is with a savings account that shows regular, automated deposits.

This consistency screams financial discipline. What gives underwriters heartburn? Sporadic, large cash deposits. These are major red flags that raise questions about undisclosed loans or unstable income, which can stall or even kill your application.

Instead, get ahead of the issue. Start depositing your savings into a dedicated bank account at least three to six months before you plan to apply. This simple step creates the clean paper trail you need and "seasons" the funds, making them fully acceptable to the lender.

Stabilize and Document Your Employment

A steady job is the bedrock of any mortgage application. Lenders typically want to see a two-year history of stable employment, ideally within the same industry or line of work. This consistency assures them that your income is likely to continue, meaning you can handle the payments for the life of the loan.

If you’re self-employed or work as a freelancer, the documentation requirements get even tougher. You’ll need to have these ready:

It is absolutely crucial to keep your personal and business finances separate. When funds are commingled, it becomes a nightmare for an underwriter to verify your true income, and that means delays for you.

Organize Your Financial Paperwork Like a Pro

Being organized is your single best defense against a frustrating underwriting experience. When the lender requests documents, you want to be able to hand them over quickly and cleanly. Think of it as putting together your financial portfolio.

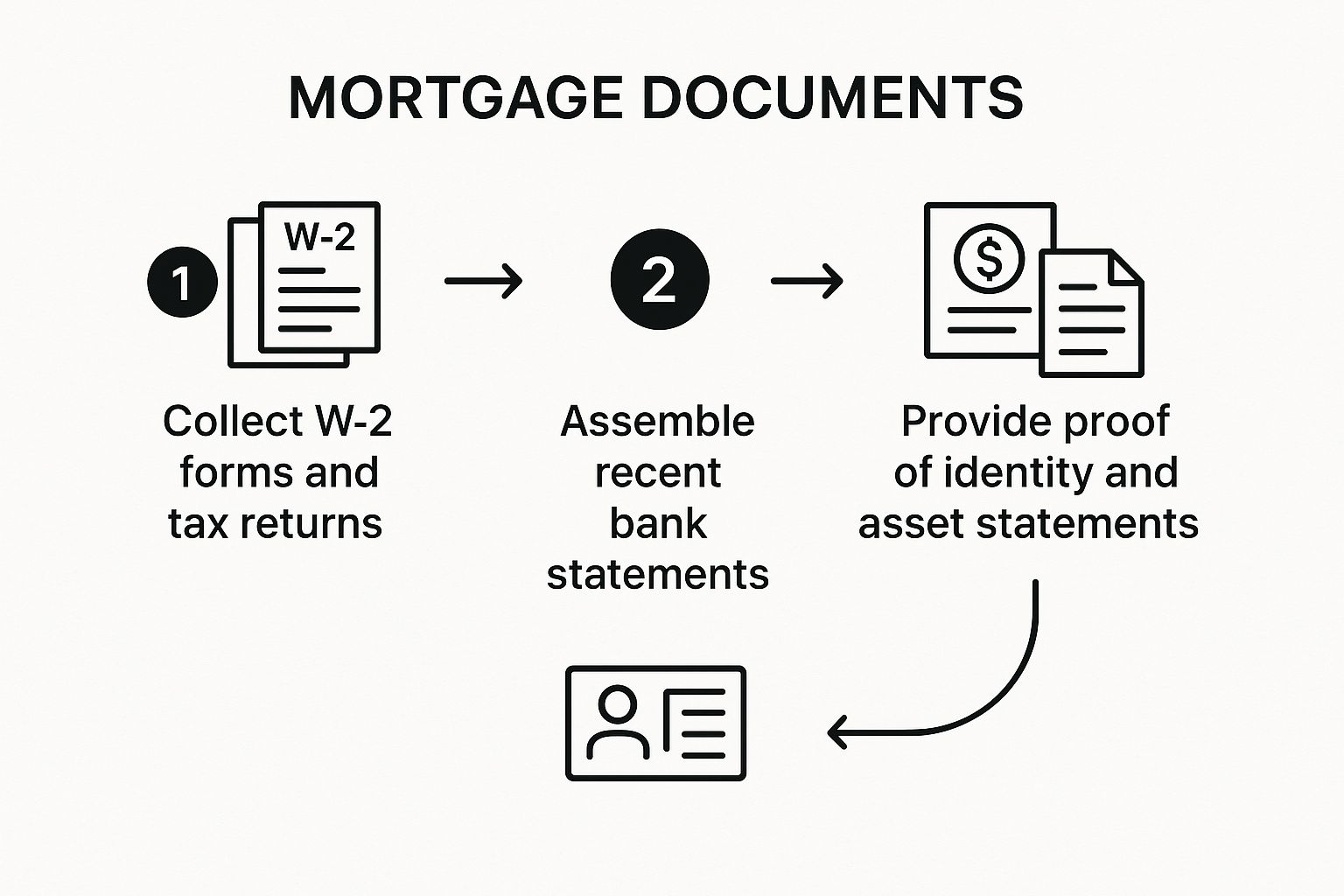

Start gathering these key documents well before you need them:

By preparing this documentation ahead of time, you take control of the narrative. You’re showing the lender you’re a serious, organized, and low-risk applicant, which is a massive part of knowing how to qualify for mortgage approval. This proactive approach can turn a stressful process into a straightforward one.

Understanding and Improving Your Credit Score

Your credit score is far more than just a three-digit number. Think of it as your financial reputation—the key that can unlock better interest rates and more favorable loan terms. While "pay your bills on time" is the advice everyone gives, the reality is that lenders dig much, much deeper. They comb through the fine print of your credit report to truly understand how reliable you are as a borrower.

Getting familiar with these details is the first real step toward building a credit profile that gives lenders confidence. It's about learning to see your credit history through the eyes of an underwriter and focusing on the metrics they care about most.

Beyond the Basics of Credit Health

Lenders are trained to look past simple payment history. To figure out how to qualify for mortgage approval with the best possible terms, you need to master the components they scrutinize.

Here's what they're really looking at:

Taking Action to Boost Your Score

Improving your credit isn't something that just happens; you have to be proactive. It means taking deliberate steps to manage your debts and clean up your report in a way that directly benefits your score.

A fantastic place to start is by pulling your credit reports from all three major bureaus: Equifax, Experian, and TransUnion. Go through each report line by line, looking for mistakes. Inaccuracies like an incorrect payment status or an account you don't recognize can seriously drag down your score and should be disputed right away.

For ITIN holders, the path can have a few extra twists. For more targeted strategies, you can check out our dedicated guide on how to improve your credit score.

After you've scrubbed your report clean, turn your attention to paying down high-interest debt, especially credit card balances. This directly affects your credit utilization ratio, making it one of the quickest ways to see a real jump in your score.

Adapting to a Changing Lending Environment

The mortgage industry is always in motion, with new rules and technologies changing how lenders evaluate applicants. This is often good news for aspiring homeowners, as these shifts can create new pathways to approval.

For example, some banks are now rethinking how they view certain kinds of debt. In Australia, the Commonwealth Bank started excluding some student loan debts from its calculations, which has helped younger buyers in expensive cities like Sydney get approved for larger loans. We're seeing similar trends in the U.S., where the number of Gen Z first-time homebuyers is on the rise, thanks in part to flexible FHA lending. These changes prove that lenders are constantly finding new ways to assess risk.

Ultimately, presenting a strong credit profile isn't just about chasing a high score. It’s about building a consistent, long-term pattern of responsible financial habits that shows lenders you’re a safe bet.

Mastering Your Debt-to-Income Ratio

When you're trying to get a mortgage, one of the first numbers a lender will zoom in on is your Debt-to-Income (DTI) ratio. Think of it as a quick financial health check. It simply shows how much of your monthly income is already committed to paying off existing debts.

From a lender's perspective, a lower DTI is always better. It signals that you have enough financial breathing room to comfortably take on a new mortgage payment without stretching yourself too thin. Getting this number under control is a non-negotiable step toward mortgage approval. A high DTI can shrink the loan amount you qualify for, or worse, lead to an outright denial.

How Lenders See Your DTI

Lenders actually look at two different DTI figures, but one carries a lot more weight than the other.

So, what do they count as "debt"? They'll tally up the minimum monthly payments for things like:

The DTI Sweet Spot for Lenders

While every lender is a little different, there's a general consensus on what makes a strong DTI. For a conventional loan, the gold standard is a back-end DTI of 36% or less. Some lenders might stretch to 43% if you have other strengths, like a fantastic credit score or a lot of cash in savings.

Government-backed loans, like FHA loans, often provide more wiggle room and might approve a DTI as high as 50%. Still, you should always aim for the lowest DTI possible. It doesn't just make you look like a responsible, low-risk borrower—it often unlocks better interest rates and terms.

Getting your documents in order is the first step to helping a lender accurately calculate your DTI.

Having all this paperwork ready to go makes the process smoother and shows the lender you're serious and organized.

Proven Ways to Lower Your DTI

Is your DTI higher than you'd like? Don't worry, it's not a deal-breaker. You just need a solid game plan. Here are a few strategies I've seen work time and again.

To get a clear picture of how different payoff plans could impact your ratio, playing around with a debt repayment calculator can be incredibly helpful. It lets you see which strategy gives you the most bang for your buck.

A Look at the Bigger Picture

The focus on debt isn't just a local concern; it’s a fundamental part of lending everywhere. For example, recent data from the United Kingdom showed some interesting shifts. In Q1 2025, lending to single-income borrowers with high loan-to-income ratios (4.0 or more) actually climbed to 10.8%. Meanwhile, lending to joint-income borrowers with a similar high ratio (3.0 or more) dropped to 34.4%.

What does this tell us? It shows that lenders are constantly adjusting their risk levels based on the economy. But no matter how the market shifts, one thing remains true: a lower debt ratio will always put you in a stronger position to get approved for the home you want.

Finding the Right Mortgage and Lender

The mortgage world can feel overwhelming at first. It’s not a one-size-fits-all situation; it's a vast marketplace with different loans and lenders, each designed for a specific type of homebuyer. Your mission is to sift through the options and find the perfect match for your financial story.

Whether you're a first-time buyer with a modest down payment, a veteran ready to use your hard-earned benefits, or someone with a stellar financial record, there’s a loan and a lender out there for you. The real trick is knowing what you're looking for and where to find it.

Major Types of Mortgage Loans

Most home loans you'll come across fall into one of a few main categories. Each has its own rulebook, benefits, and qualification standards. Let's break down the most common ones.