How to Protect Against Identity Theft: Essential Tips

Protecting yourself from identity theft isn't about one single trick. It's a layered approach, almost like building a fortress around your life. You need to secure your digital world, keep your physical documents safe, and stay vigilant by monitoring your accounts. The whole idea is to make your personal information so difficult to get that thieves simply move on to an easier target.

Why Identity Theft Is a Clear and Present Danger

It’s tempting to think, "that won't happen to me," but that's an increasingly dangerous gamble. Identity thieves have moved far beyond clumsy scams. Today, they're exploiting massive data breaches from companies you do business with every day. They're crafting phishing emails so convincing they could fool a security expert and even using AI to fake phone calls and messages.

This isn't some far-off threat; the consequences are real and can be devastating. Imagine waking up to find your bank account empty, discovering loans you never applied for in your name, or learning the IRS sent your tax refund to a criminal. The cleanup is a nightmare of paperwork and phone calls that can drag on for months, costing you hundreds of hours and causing unbelievable stress.

The Modern Scope of the Threat

The sheer scale of this problem is staggering. We've seen a massive surge in identity theft, with the U.S. Federal Trade Commission receiving 1.4 million complaints—a number that has nearly tripled over the last decade. Think about this: an identity theft incident happens every 22 seconds in the United States alone. The odds are not in our favor. You can explore the full identity theft statistics yourself to see just how these trends are shifting.

This isn't just about statistics; it's about the real-world impact on people's lives.

Understanding these modern risks is the first critical step. It helps you move from a place of fear to one of empowerment. Knowing how to protect yourself from identity theft is no longer a "nice-to-have" skill; it's essential for navigating our connected world with confidence.

Building Your Digital Fortress

When it comes to identity theft, your digital life is the main battlefield. This is where thieves prowl for the easiest targets—accounts with flimsy passwords, unsecured Wi-Fi connections, and those moments where we're just not paying close enough attention. To truly protect yourself, you need to think less about single tips and more about building layered, robust defenses around your sensitive information.

Think of it like securing your home. A simple password is the standard lock on your front door. It’ll stop a casual passerby, but a determined thief will get through it. Building a digital fortress is like upgrading to a deadbolt, installing a security system, and adding cameras. Each layer you add makes you a much tougher, less appealing target.

This isn't just theoretical. The problem is getting bigger and more sophisticated. Globally, identity fraud is on track to become a $50 billion problem, with cases climbing by roughly 12% annually since 2020. With over 70% of these thefts now originating online, scammers are even using AI to make their attacks more personal and convincing. You can see just how fast these threats are evolving on snappt.com.

Reinforce Your Passwords (Your First Line of Defense)

The old advice—"use a complex password with numbers and symbols"—is dangerously outdated. Modern brute-force attacks can chew through those in minutes. The gold standard today is the passphrase. This is a longer, memorable series of words that's incredibly difficult for a computer to guess.

For example, forget P@ssw0rd1!. Instead, try something like blue-guitar-runs-fast-88. It's far easier for you to recall but exponentially harder for a machine to crack.

Of course, you can't be expected to remember a unique passphrase for every single online account. That's where a password manager becomes absolutely essential. I consider it non-negotiable. These tools generate and store all your unique passphrases, so you only have to remember one single master password.

Turn On Multi-Factor Authentication Everywhere

If your password is the lock on your door, multi-factor authentication (MFA) is the security guard who asks for a second form of ID. Even if a thief manages to steal your password, they're stopped cold because they don't have that second piece of the puzzle—usually a code sent to your phone.

At a minimum, you should have MFA enabled on these accounts right now:

Spot and Sidestep Phishing Scams

Phishing is a confidence game. Scammers create a sense of urgency or fear, tricking you into handing over your information without thinking. Keep an eye out for any email or text message that:

When in doubt, don't click. My rule is simple: I close the message and go directly to the company's official website or app to log in and check my account status. That one habit has saved me from a lot of potential trouble.

To get started, here is a quick-reference checklist covering the fundamental actions you should take to secure your digital presence against the most common threats.

Essential Digital Security Checklist

Running through this checklist is a fantastic starting point. By implementing these core practices, you'll have built a solid foundation for your digital fortress, making you a much harder target for identity thieves.

Don't Forget the Real World: Securing Your Physical Life from Thieves

It’s easy to get caught up in digital threats, but a surprising amount of identity theft still happens the old-fashioned way. Thieves are more than willing to rummage through your trash or swipe mail from an unlocked box. A single discarded credit card offer or an old bank statement can be the key a criminal needs.

This isn’t about paranoia; it's about smart, practical habits. After all, why would a thief bother with complex hacking when they can just pull your life story out of the recycling bin? Let's walk through the simple yet powerful ways you can lock down your physical world.

Know What to Keep and What to Shred

Think about what you carry in your wallet or keep in your filing cabinet. Some items are just too sensitive to have on you every day.

Your wallet is for daily essentials, not a lifetime archive. Your Social Security card, for instance, should never be in your wallet. It's the master key to your financial identity. Keep it locked away at home in a safe or a secure file cabinet. There is absolutely no reason to carry it around.

The same goes for other foundational documents.

Make it a routine. Before anything with your name and address on it goes into the trash or recycling, it should meet the shredder. This is especially true for:

Lock Down Your Mailbox

Your mailbox is a prime target. Crooks engage in "mailbox fishing," where they literally steal incoming and outgoing mail, hoping to find checks, financial statements, or anything else they can exploit. It's a low-tech but highly effective tactic.

The best defense is a locking mailbox. It's a straightforward, one-time purchase that pays for itself in peace of mind. If that's not feasible where you live, get into the habit of retrieving your mail promptly after it's delivered. Never let it sit overnight.

When sending mail, especially bills or anything with personal information, don't leave it in your residential mailbox with the flag up. That's an open invitation. The safest move is to drop it off inside a Post Office or use an official USPS collection box. By taking these simple offline steps, you’re closing a major loophole that criminals love to exploit.

Staying Vigilant with Proactive Monitoring

Building a fortress around your digital and physical life is a fantastic start, but let's be realistic: even the best defenses can be breached. This is where you shift from a passive, "set-it-and-forget-it" mindset to one of active, ongoing vigilance. You need to become the first person to know if something is wrong, and that means turning financial diligence into a consistent habit.

This isn’t about waiting for a scary-looking letter to arrive in the mail informing you of a problem that's already spiraled out of control. It’s about creating your own early warning system. By regularly keeping an eye on your key financial accounts, you can spot the subtle signs of fraud long before they become a full-blown crisis.

Let's face it, data breaches are just a part of modern life now. In the first half of a recent year, the Identity Theft Resource Center tracked a staggering 1,732 data breaches in the U.S. alone. That resulted in nearly 166 million victim notifications. You can read more about how these breaches are fueling identity theft on Fortune.com. This isn't to scare you, but to underscore a simple truth: you can't just assume your data is safe out there.

Make Checking Your Credit Reports a Routine

Think of your credit report as the official story of your financial life. It lists every loan, every credit card, and every line of credit opened in your name. If a thief tries to open a new account, they'll leave tracks here first, making it an incredibly powerful tool for spotting trouble early.

By law, you are entitled to a free credit report from each of the three major bureaus—Equifax, Experian, and TransUnion—every single week.

Turn On Real-Time Transaction Alerts

Waiting a whole month for a paper statement to arrive is ancient history in the fight against fraud. It’s far too slow. Today, nearly every bank and credit card company offers real-time alerts sent straight to your phone or email. This is your immediate line of defense.

Go into your banking app or website right now and set up alerts for any and all activity. If you do nothing else, at least enable notifications for:

These simple alerts turn your phone into a powerful fraud detection tool. The second a fraudulent charge is even attempted, you'll know. That lets you call your bank immediately, shut down the card, and stop a thief dead in their tracks. It's all about closing that critical gap between when fraud happens and when you find out about it.

Choosing the Right Identity Protection Service

While building strong habits is your first line of defense, technology can provide a powerful safety net. But let's be honest: deciding whether to pay for an identity protection service is confusing. Every company promises total peace of mind, making it hard to see what you’re actually buying. The trick is to understand the different levels of protection available.

At the most basic level, you have simple credit monitoring. This service just alerts you to changes on your credit reports—things like a new account opening or a hard inquiry. It’s a useful feature, but much of what it does are things you can handle yourself for free. For a deeper look, you can learn more about what's typically included in free credit monitoring services.

True identity protection services, however, go much deeper. They offer a whole suite of tools that scan for threats far beyond your credit files. These comprehensive plans are built to be a proactive shield, not just a reactive alarm.

Comparing Identity Protection Service Levels

The real difference boils down to the scope of the monitoring and the level of support you get if the worst actually happens. A basic plan might only keep an eye on your credit, while a premium service acts more like a full-time digital bodyguard for your personal information.

To help you decide, let's compare what these services typically offer.

Comparing Identity Protection Service Levels

Here’s a look at the common tools and services available, so you can figure out what level of security makes sense for your needs.

Ultimately, a paid service bundles convenience, advanced tools, and expert support into one package, saving you time and giving you a direct line to help when you need it most.

Here are a few of the key features that really separate a basic plan from a comprehensive one:

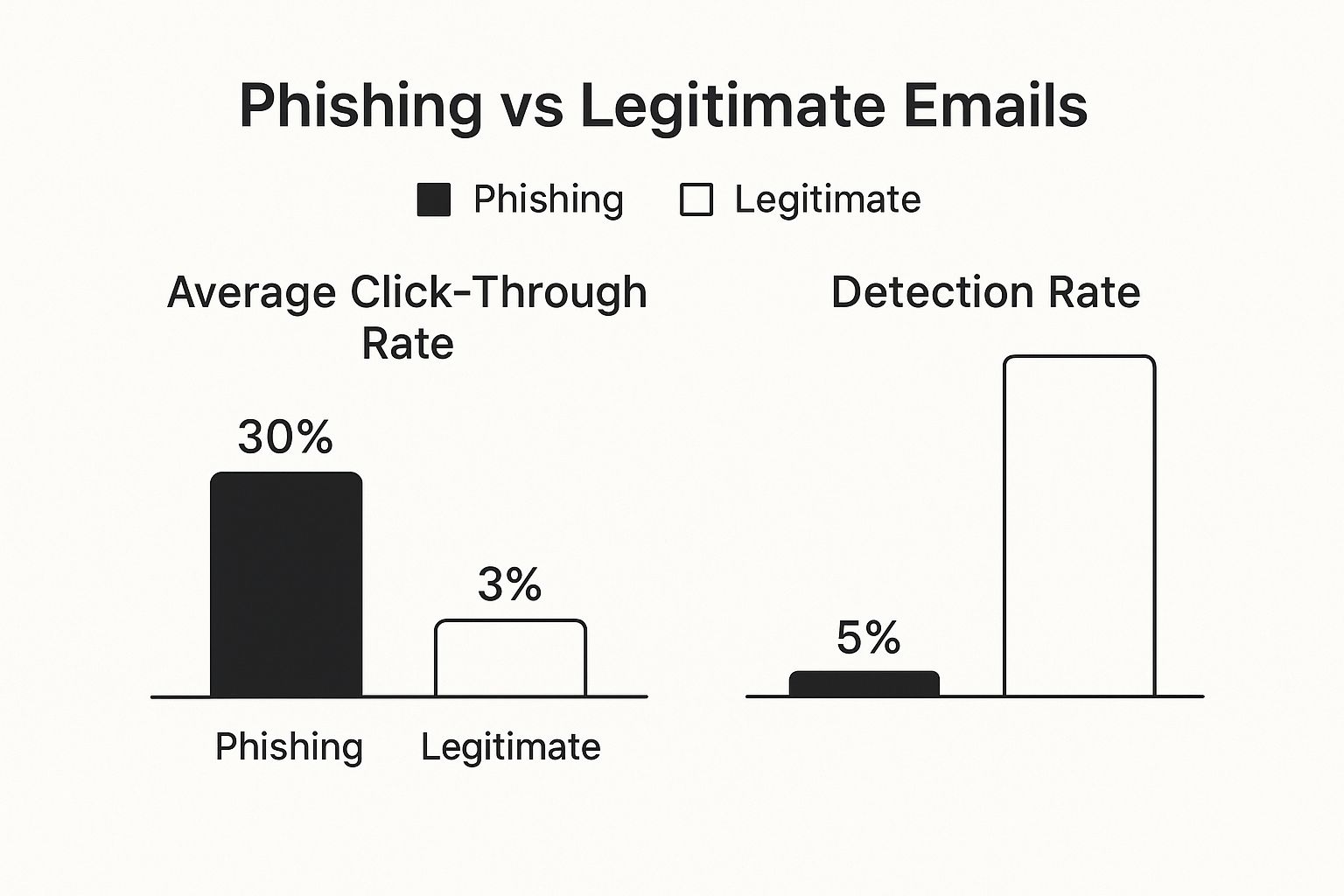

This image highlights just how tricky it can be to spot scams—a primary method thieves use to get their hands on your data in the first place.

As you can see, phishing attempts are incredibly common and often slip past automated filters, which reinforces the need for both personal vigilance and a robust monitoring service watching your back.

So, is a paid service really worth it? If you're diligent about checking your own credit, have transaction alerts set up on all your accounts, and practice good digital hygiene, you might feel comfortable without one.

However, if you value a powerful safety net, want access to advanced monitoring tools, and need the assurance of expert help with recovery, then a paid service can be a very smart investment in your financial security.