How to Pay Off Credit Card Debt Quickly: Easy Tips

If you want to get out of credit card debt fast, you have to start by facing the numbers. I know, it's the part everyone wants to skip. But you can't fight an enemy you can't see. Your first step is to create a complete list of everything you owe—the exact balance, the interest rate (APR), and the minimum payment for every single card.

This single act transforms that vague, heavy feeling of anxiety into a concrete, actionable roadmap. From here, you can finally choose a powerful repayment strategy and start making real progress.

Get a Clear Picture of Your Debt

Before you can throw a single extra dollar at your debt, you need to stop guessing and start knowing. It’s so easy to fall into the trap of thinking, "I just owe a lot," but that kind of vague stress is paralyzing. The only way to move forward is to get brutally honest and specific.

This means it’s time to gather up every single credit card statement, whether they’re stuffed in a drawer or sitting in your email. Don't just glance at the total. You need to dig a little deeper for the details that actually matter. Think of it less like an accounting chore and more like gathering intelligence to plan your attack.

What to Look For on Each Statement

For every card you have, you're hunting for three key pieces of information. These numbers will become the foundation of your entire debt-free plan.

Once you have these three numbers for each card, get them organized in one central place. A simple spreadsheet, a notes app on your phone, or even a sheet of paper from a legal pad works perfectly. Don't overthink the tool; just get it done.

Your Personal Debt Assessment Dashboard

To see this in action, let's use a pretty common scenario. Maybe you have a store card with a small balance but a ridiculously high APR, a major bank card carrying your biggest balance, and another card somewhere in the middle.

Here’s a simple template you can use. Seeing all the numbers laid out like this is the first step toward creating an effective payment strategy.

Instantly, the fog lifts. You know your total debt is 11,000**, and your required minimum payments add up to **265. But more importantly, you can see that the tiny $1,200 store card balance is actually your most expensive debt because of that 28.99% APR. That's a game-changing insight.

This clarity is more important than ever. The average credit card debt for an American household climbed to 6,580** by the end of 2024, a **3%** jump from the previous year. Depending on where you live, that average can be much higher—over **8,000 in some states. These figures show that you're definitely not alone in this fight.

With your own debt dashboard complete, you're now armed with the information you need to choose the right strategy and finally start winning.

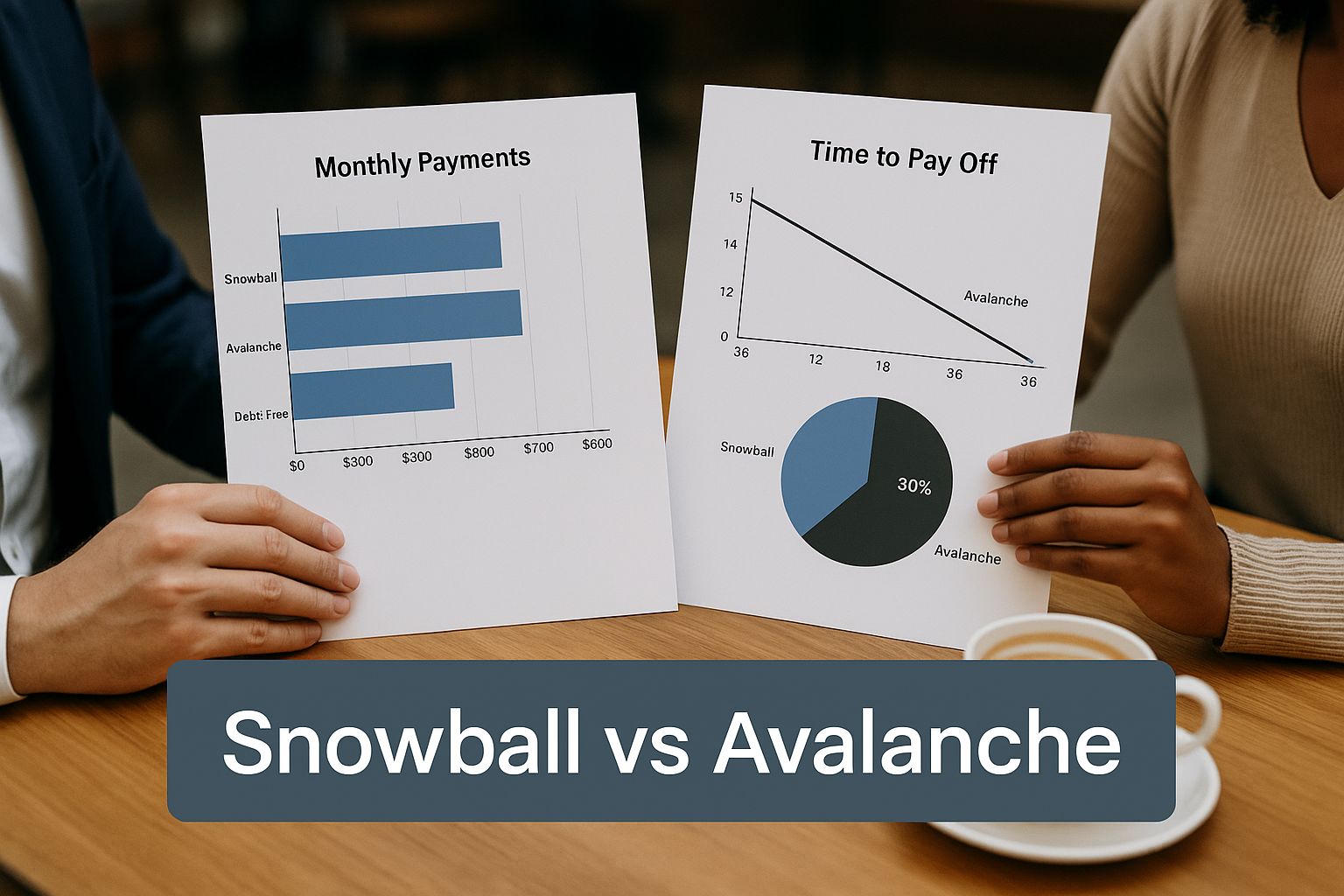

Choosing Your Attack Plan: Avalanche vs. Snowball

Alright, you’ve laid out all your debts and are staring the enemy in the face. Now it's time to choose your weapon. This isn’t about just throwing random amounts of cash at your balances; it’s about picking a focused strategy that fits your personality and keeps you in the fight.

Two tried-and-true methods have helped millions of people get out of credit card debt: the Debt Avalanche and the Debt Snowball.

One is a masterclass in financial efficiency, saving you the most money. The other is a powerful psychological tool designed to keep your motivation sky-high. Let's break them down.

Ultimately, the best choice hinges on what drives you more: saving every possible dollar on interest (Avalanche) or getting those quick, satisfying wins to keep you going (Snowball).

The Debt Avalanche: For Financial Efficiency

Think of the Debt Avalanche as the strategist's move. It's designed purely to minimize the total interest you pay over the life of your debt, making it the most cost-effective path. The logic is simple but incredibly effective: you attack the debt with the highest interest rate first, no matter the balance.

Here’s the game plan:

This is how the "avalanche" builds. Your payment power grows with each debt you eliminate, systematically crushing your most expensive balances first.

A Real-World Avalanche Example

Let's go back to our example. Imagine you’ve found an extra $150 a month in your budget to throw at your debt.

Your list looks like this:

With the Avalanche method, there's no question—the Store Card at a whopping 28.99% APR is enemy number one. You’ll hammer it with 195** each month (45 minimum + 150 extra) while making minimums on the others. After it’s paid off, that entire **195 gets added to the Gas Card's payment, and the avalanche continues to roll.

The Debt Snowball: For Motivational Power

While the Avalanche is all about math, the Debt Snowball is all about psychology. This strategy is built on the power of momentum. By knocking out your smallest debts first, you score quick wins that keep you motivated for the long haul.

The process is almost identical, but the target changes:

A Real-World Snowball Example

Using the same debt and that extra $150, the Snowball method shifts your focus.

Your smallest balance is the 1,200** Store Card. In this particular case, it happens to be the same first target as the Avalanche method. You’d pay **195 toward it. The real difference comes after it’s paid off. You would then target the Gas Card (2,300) before the Bank Card (7,500), even though it has a higher interest rate.

Debt Avalanche vs. Debt Snowball: A Side-by-Side Comparison

Choosing the right strategy is a personal decision. This table breaks down the core differences to help you decide which approach will work best for you.

At the end of the day, both methods are powerful tools for getting out of debt. The "best" one is the one you will actually follow through with.

No matter which path you choose, the goal is always to pay more than the minimum. Recent data from the Philadelphia Fed shows a heartening trend: the number of accounts making only minimum payments dropped by nearly 0.6 percentage points in early 2025. This shows more people are getting serious about aggressive repayment—and it works.

If you want to see exactly how these methods play out with your own numbers, plugging them into a debt repayment calculator can give you a clear picture of your timeline and total interest costs for each strategy.

Find Extra Money to Accelerate Your Payments

Choosing a powerful repayment strategy like the Avalanche or Snowball method is a fantastic start. But even the best plan needs fuel, and that fuel is extra cash. We're talking about money you can find right now within your existing finances to throw at your debt and seriously shorten your repayment timeline.

This isn't about making drastic, miserable lifestyle changes. It’s about becoming a financial detective and uncovering hidden funds you didn’t even realize were there. The goal is to turn small, consistent savings into a powerful force that chips away at your high-interest balances every single month.

Conduct a Line-Item Audit of Your Spending

The first place to hunt for extra cash is in your last three months of bank and credit card statements. Most of us think we know where our money goes, but seeing it all laid out, line-by-line, is often a wake-up call.

Print out your statements or pull them up in a spreadsheet. As you go through each transaction, ask yourself one simple question: "Was this truly a need, or was it a want?" Be brutally honest. That daily $5 coffee, the handful of streaming services you barely watch, or the takeout you ordered out of convenience—it all adds up.

For instance, you might discover you’re spending 75** a month on various subscriptions you’d completely forgotten about. Canceling just a few could free up **30-50** on the spot. That's an extra **360-$600 a year you can apply directly to that high-interest credit card.

Once you’ve found these spending leaks, it’s time to act. Make a list of everything you can cut or reduce, even if it's just for a little while.

This audit isn't about shaming yourself. It's about empowering your future self with more financial firepower.

Renegotiate Your Recurring Bills

Believe it or not, many of your fixed monthly bills aren't as "fixed" as you think. Companies would much rather give you a small discount than lose you as a customer entirely. Set aside an afternoon to make a few phone calls—it could be the most profitable few hours of your entire year.

Start with your biggest recurring expenses:

A single successful negotiation could easily save you 20-50 a month. When you combine that with the money you found in your spending audit, you could be looking at an extra $100+ to put toward your debt, all without really changing your day-to-day life.

Generate a Quick Income Boost

Beyond cutting costs, you can put your progress into overdrive by bringing in a little more income. Even a small, temporary boost can be enough to completely knock out a small credit card balance or make a huge dent in a larger one.

Here are a few ideas for a fast cash injection:

Here’s a crucial tip: when you earn this extra money, don't let it touch your regular checking account. Make an immediate, direct payment to your target credit card. This simple trick prevents the new income from getting absorbed into your daily spending and ensures it goes exactly where you intended.

Lower Your Interest and Speed Things Up

Picking a repayment strategy is a great first step, but high interest rates are like trying to run into a strong headwind. You're working hard, but something is constantly pushing back. With the average credit card APR now around 21.59%, a huge chunk of your payment gets eaten by interest before it even makes a dent in what you actually owe.

If you really want to get ahead, you have to find a way to lower that rate.

Thankfully, there are some great financial tools out there designed to do just that. Using them correctly can feel like turning that headwind into a tailwind, pushing you toward your debt-free goal much, much faster. Let's talk about the two most effective options: 0% APR balance transfer cards and debt consolidation loans.

The 0% APR Balance Transfer Card

Imagine hitting the pause button on interest. That's essentially what a balance transfer card does. These cards give you an introductory window—usually 12 to 21 months—where you pay 0% APR on balances you move over from your high-interest cards.

This is a golden opportunity. Every single dollar you pay above the minimum goes directly toward wiping out your principal balance, not just feeding the interest beast. It's one of the most powerful moves you can make if you're serious about getting out of credit card debt quickly.

Making a Balance Transfer Work for You

This strategy requires discipline to pull off correctly.