How to Negotiate with Creditors Like a Pro

That moment you realize you can't keep up with your bills is a tough one. It can feel like a punch to the gut. But here's the thing: negotiating with your creditors isn't admitting defeat. It's actually one of the smartest, most proactive things you can do to get back on solid financial ground. It’s you taking the wheel and steering your finances out of a tough spot.

Knowing When and Why to Negotiate With Creditors

Let's get one thing straight: needing to renegotiate your debt isn't a moral failing. It’s a practical response to a change in your financial reality. Life happens. The key is to spot the warning signs before the situation gets out of hand, giving you more leverage and options.

Clear Signs It’s Time to Act

You don’t need to wait for collection calls to start. In fact, you shouldn't. Being proactive shows good faith and often gets better results. Here are some tell-tale signs that it’s time to pick up the phone:

Let’s be real, many people are feeling this squeeze. With global debt hitting a mind-boggling $324 trillion in early 2025, it’s clear that managing debt is a worldwide challenge. This isn't just a personal problem; it's a widespread economic reality.

Why Creditors Are Usually Willing to Talk

It might feel like your lender holds all the cards, but that’s not entirely true. Remember, creditors are businesses. Their main objective is to get paid.

This is where your power lies. Once an account is seriously delinquent, the creditor knows the odds of collecting the full amount plummet. They might sell the debt to a collection agency for just pennies on the dollar. So, when you come to them with a reasonable offer, you're presenting a better business deal than their alternative.

Successful negotiations can lead to several positive outcomes. Each one directly improves your financial situation and is a step toward building a more secure future. After you've managed your current debts, you can start focusing on growth. It’s always a good idea to check out our guide on how to improve your credit score to continue your journey.

The goals of negotiation are straightforward and designed to provide you with immediate financial relief and a long-term path to stability.

Key Negotiation Outcomes and Their Financial Impact

Ultimately, reaching any of these agreements is a win. It puts you back in control, reduces stress, and creates a clear, manageable plan to get out of debt.

Getting Your Financial Story Straight Before the Call

Trying to negotiate with a creditor without doing your homework is a recipe for disaster. Before you even think about dialing their number, you have to get your financial story straight. This isn't about drumming up excuses. It’s about building a clear, honest case that lays out both your hardship and your genuine desire to make things right.

When you can present a well-organized case, you stop being just another person on a list and become a proactive partner looking for a business solution. Creditors are always more willing to work with someone who has done the prep work and can clearly explain their situation and what they propose to do about it. Honestly, this is the most powerful tool you have.

Collect Your Key Financial Documents

First things first, you need to become the world’s foremost expert on your own finances. You need every important number at your fingertips so you can answer any question with confidence, not panic. Think of it as putting together a case file.

Start by pulling together a financial dossier. It should include:

This part is absolutely crucial. Having these documents ready to go shows the creditor you’re serious and organized, and it keeps you from fumbling for answers on the call.

Create a Realistic Hardship Budget

With your documents in hand, the next step is to build what's called a hardship budget. This isn’t your typical budget for saving or investing. It's a specific financial snapshot designed to prove one thing: the absolute maximum amount you can afford to pay creditors each month after your essential living costs are covered.

Building it is straightforward. Just subtract your total essential monthly expenses from your total monthly income. That leftover number is your disposable income, and it's what's available for debt repayment. If that number is tiny, or even negative, that is the core of your financial story. It’s not a failure; it’s a fact, and it's the foundation of your entire negotiation.

Be Ready to Explain the "Why"

Numbers tell most of the story, but the "why" provides the crucial context. You need to be ready to briefly and professionally explain what happened to put you in this position. Creditors hear stories all day long, so your goal isn't to get sympathy—it's to establish a clear cause and effect.

Common, legitimate reasons often include:

Keep it concise and stick to the facts. A simple, "I was laid off three months ago and am still actively looking for work," is far more powerful than a long, emotional story.

It also helps to remember the bigger picture. The financial pressure on everyday people is real, with global public debt projected to climb past 95% of global GDP in 2025. This kind of large-scale strain often trickles down, making credit tighter for everyone. If you're interested in the details, the IMF offers a full analysis on global public debt. Knowing this helps you see that your personal hardship is often part of a much larger, more complex economic situation.

Mastering the Negotiation Conversation

You've done the prep work, and now it’s time for the main event: the actual call. This is where all that preparation pays off. The secret isn't to sound emotional or desperate; it’s to be calm, confident, and treat this like a business discussion. You're aiming for a structured, professional chat that ends in a solution that works for everyone.

Remember, the person on the other end of the phone is just doing their job. A little respect goes a long way and can turn them into an ally. You're not begging for a handout—you're proposing a new business arrangement that's better than the alternative.

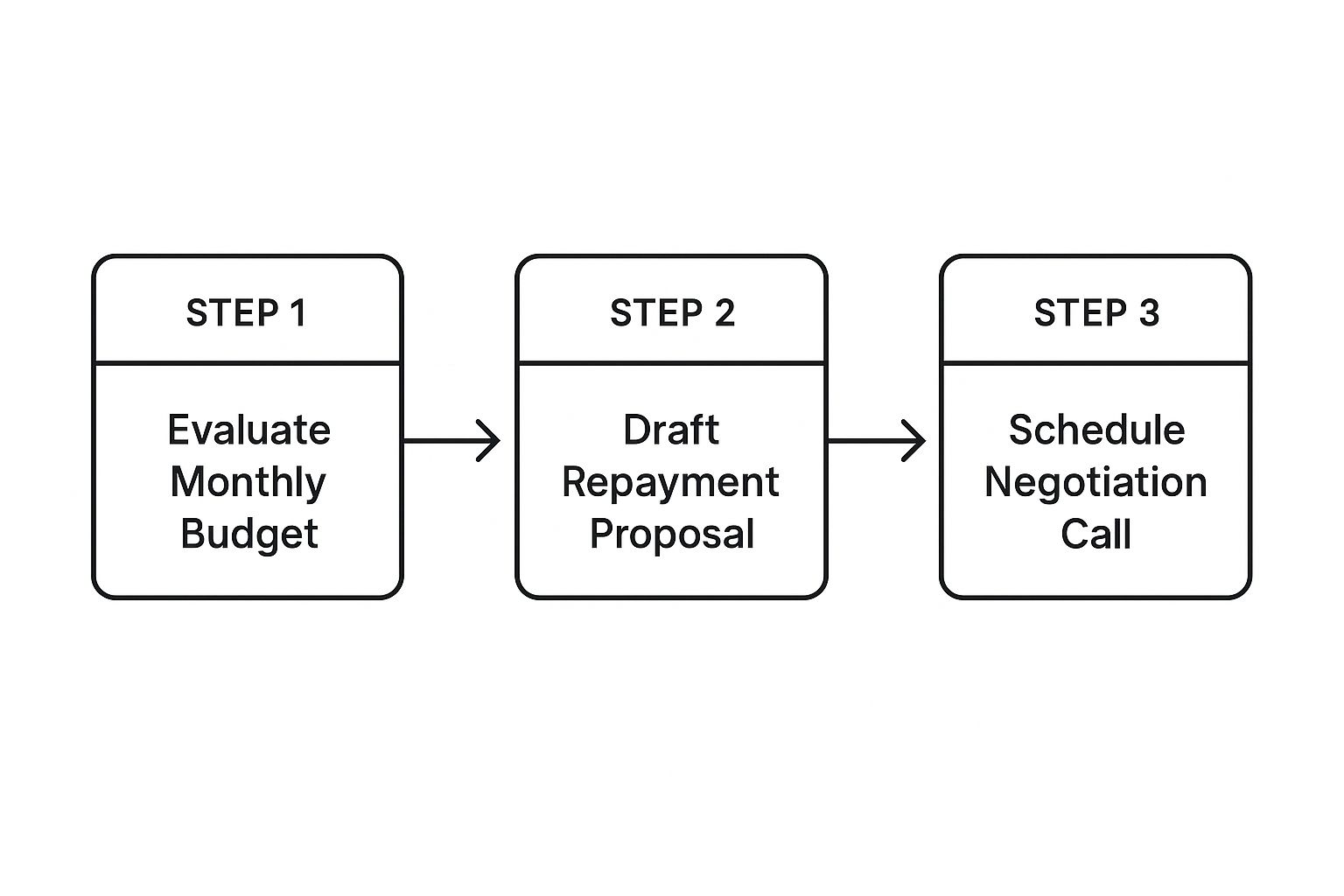

This visual gives you a quick rundown of the pre-call workflow, making sure you’re ready to present your case like a pro.

Walking through these steps—nailing down your budget, creating a solid proposal, and scheduling the call—is the foundation of a good negotiation. It gives you the clarity and confidence you need when you pick up the phone.

Setting the Stage for the Call

When you dial that number, be ready for a little runaround. It’s pretty common to not get the right person on the first try. The agent who answers first usually doesn't have the authority to greenlight a settlement or a workout plan. Your first mission is simply to get to the right department.

Politely ask to speak with someone in the "hardship department" or the "loss mitigation department." Using these exact phrases signals that you know the ropes.

Once you’re connected, calmly introduce yourself and have your account number handy. Then, get straight to the point.

Here’s a simple script to start:

This kind of direct, professional opening sets the right tone and gets the agent thinking about solutions right away.

Presenting Your Case and Proposal

Now it’s time to share that financial story you prepared. Briefly explain your situation using the factual "why" you worked out earlier. Stick to the facts and steer clear of overly emotional appeals.

Next up, deliver your proposal. This needs to be a specific ask, grounded in the hardship budget you built. Vague requests won't get you far. Whether you're asking for a lower interest rate, a temporary payment pause, or offering a lump-sum settlement, state it clearly.

For example, if you're negotiating a credit card bill:

This is a powerful approach because it’s not just an emotional plea; it's a concrete plan backed by your own financial data. You're showing them the problem and offering a workable solution.

The strategy you choose depends entirely on your financial situation—whether you have a lump sum of cash available or need to adjust your monthly payments.

Choosing Your Negotiation Approach

This table breaks down the two main strategies to help you decide which one is the right fit for you.

Ultimately, whether you're offering a one-time payment or proposing a new payment plan, the key is to be clear about what you can realistically afford.

Handling Pushback and Finding Middle Ground

Let's be real: it's incredibly rare for a creditor to say "yes" to your first offer. Expect some pushback. They might counter with their own offer or tell you what you're asking for is impossible. This is a totally normal part of the process, so don't get discouraged.

Your job here is to practice active listening.

If they flat-out reject your offer, stay calm and pivot. Ask, "I understand. Given my situation, what options are available to help me?" This keeps the door open and shows you're willing to be flexible. If they reject your settlement offer of 30% of the balance, maybe you can counter with a slightly higher figure that’s still within your budget.

Remember, this is a give-and-take. Your goal is to find that sweet spot that both you and the creditor can live with. By staying cool, being persistent, and knowing your numbers inside and out, you drastically improve your odds of reaching a deal.

How to Finalize and Document Your Agreement

You’ve made it through the tough conversation and have a verbal agreement. That's a huge win, but don't celebrate just yet. A handshake deal over the phone is a great start, but it offers you absolutely zero protection if the creditor changes their mind or the agent you spoke with leaves.

This final stage is all about making your hard-fought negotiation official and legally sound. There's one critical rule here that people often forget in the excitement of the moment.

This written document is your shield. It’s your proof against any future collection attempts and ensures the creditor has to honor their side of the deal. Without it, you're just gambling on someone's memory, and that's a risk you can't afford to take.

Get It All In Writing

Right after you hang up, your immediate next step is to ask the representative to send you a formal letter or email that details everything you just agreed on. Be polite but firm—insist on receiving this before you do anything else. This document isn't optional; it's the key to locking in your success.

Make sure the confirmation letter comes on the creditor’s official letterhead. A quick, informal email from a representative isn’t good enough. You need something formal that clearly outlines the terms.

Here’s your checklist for what the written agreement must include:

If the letter they send is missing any of these details, get back on the phone and request a revised version. Don't move forward until that document is perfect.

Keep Meticulous Records of Everything

From your very first phone call to your final payment, keep a detailed log of every single interaction. Think of it as building a case file to protect yourself. A simple notebook or a digital document works perfectly, as long as you keep it organized.

For every phone call, email, or letter, make sure you document:

Hold onto copies of absolutely everything: the final signed agreement, your proof of payment (like a canceled check image or bank statement), and any other correspondence. This file is your best defense if a collector mistakenly resurfaces years from now trying to collect on the same debt.