How to Monitor Credit: Easy Tips to Protect Your Score

Why Your Credit Monitoring Strategy Matters Right Now

Let's get straight to it: credit monitoring isn't just another task to add to your financial checklist. It's a fundamental defense for your financial identity, acting like a security alarm. With data breaches becoming more and more frequent, leaving your credit unchecked is a bit like leaving your front door wide open.

Having a solid plan for how to monitor credit can be the one thing that saves you from a financial headache. A friend of mine, Maria, got an alert about a new credit card opened in her name. Because she was on top of her credit monitoring, she caught it within hours, reported the fraud, and had the account closed before any real damage was done. If she hadn't received that alert, it could have been months before she knew, leaving her to deal with fraudulent charges and a credit score that would take ages to fix.

An Evolving Financial Necessity

This isn't just about playing defense against the worst-case scenarios. Staying on top of your credit also helps you spot opportunities. When the economy shifts and interest rates fall, that could be the perfect moment to refinance a loan and save some money. If you aren't paying attention to your credit and financial health, you could easily let these chances slip by.

The market shows just how important this has become. The global credit monitoring service industry was valued at around 15 billion** in 2025 and is projected to jump to **45 billion by 2033. This growth isn't just a fleeting trend; it’s a clear response to the very real threats of identity theft and the growing need for financial awareness. You can find more details about these market trends in reports from sources like Data Insights Market.

From Defense to Offense

At the end of the day, a good monitoring strategy shifts you from being a passive bystander to an active participant in your financial life. It gives you the power to:

By making credit monitoring a regular part of your routine, you’re doing more than just protecting yourself—you're actively building a stronger financial future.

Decoding Your Credit Environment Like a Pro

Before you can start to effectively monitor your credit, you need to get a clear picture of the landscape. Your credit environment is an ecosystem where every detail is connected. While your credit score gets all the attention, your credit report tells the full story—every account, every payment, and every inquiry. Learning how to monitor credit is about looking past that single number and understanding the story your report tells lenders about your financial habits.

It's also important to realize that not all debt is the same in the eyes of a lender. A mortgage, for instance, is generally seen more positively than a high-interest credit card balance because it's a secured, long-term loan tied to a valuable asset. On the flip side, maxed-out credit cards can look like a red flag for financial trouble. Knowing these differences helps you decide which debts to tackle first. You can dive deeper into the factors affecting your credit score in our other guide.

The Impact of Different Debt Types

Every financial product you use leaves a different kind of mark on your credit report. An auto loan demonstrates that you can manage a sizable installment loan, and having a healthy mix of credit types is usually a good thing. Some debts, however, have a bigger impact simply because of their size. For example, student loan debt in the U.S. reached a staggering $1.315 trillion in early 2025, which was a 13.1% jump from previous periods. This huge increase shows why keeping a close eye on your credit—especially with large debts—is so vital for managing payments and preventing missed ones from hurting your score. You can see the complete data on these global consumer credit trends at Equifax.com.

Why Your Life Stage Matters

How you monitor your credit should change as your life evolves. Your financial priorities and needs are different at various stages, so your credit monitoring strategy should be, too.

Building Your Personal Credit Monitoring Command Center

Now that you have a good handle on your credit environment, it's time to set up a system that actively protects it. Think of this as your personal security network, watching over your financial identity. The goal is to find a way to how to monitor credit that fits your life without costing a fortune or overwhelming you with pointless notifications.

Your first move should always be to get the free annual credit report you're entitled to from each of the three major bureaus—Equifax, Experian, and TransUnion. But for day-to-day protection, a dedicated service is a much better option. For ITIN holders, who often run into unique hurdles, a specialized service like ItinScore offers tools made just for you, making sure all your hard work to build credit is tracked correctly. If you're just starting your credit journey with an ITIN, our guide on your ITIN credit report is a great resource.

To help you decide what's best, here’s a quick comparison of the different types of credit monitoring services available.

This table shows there’s a good option for everyone, whether you’re just starting or need detailed, around-the-clock monitoring.

Customizing Your Alert System

The secret to making a monitoring service work for you is to set up alerts that actually matter. A good place to start is with notifications for new inquiries and significant score changes. An alert about a new inquiry could be the first sign someone is trying to open an account with your information. A sudden, large drop in your score is another huge red flag that you need to look into right away.

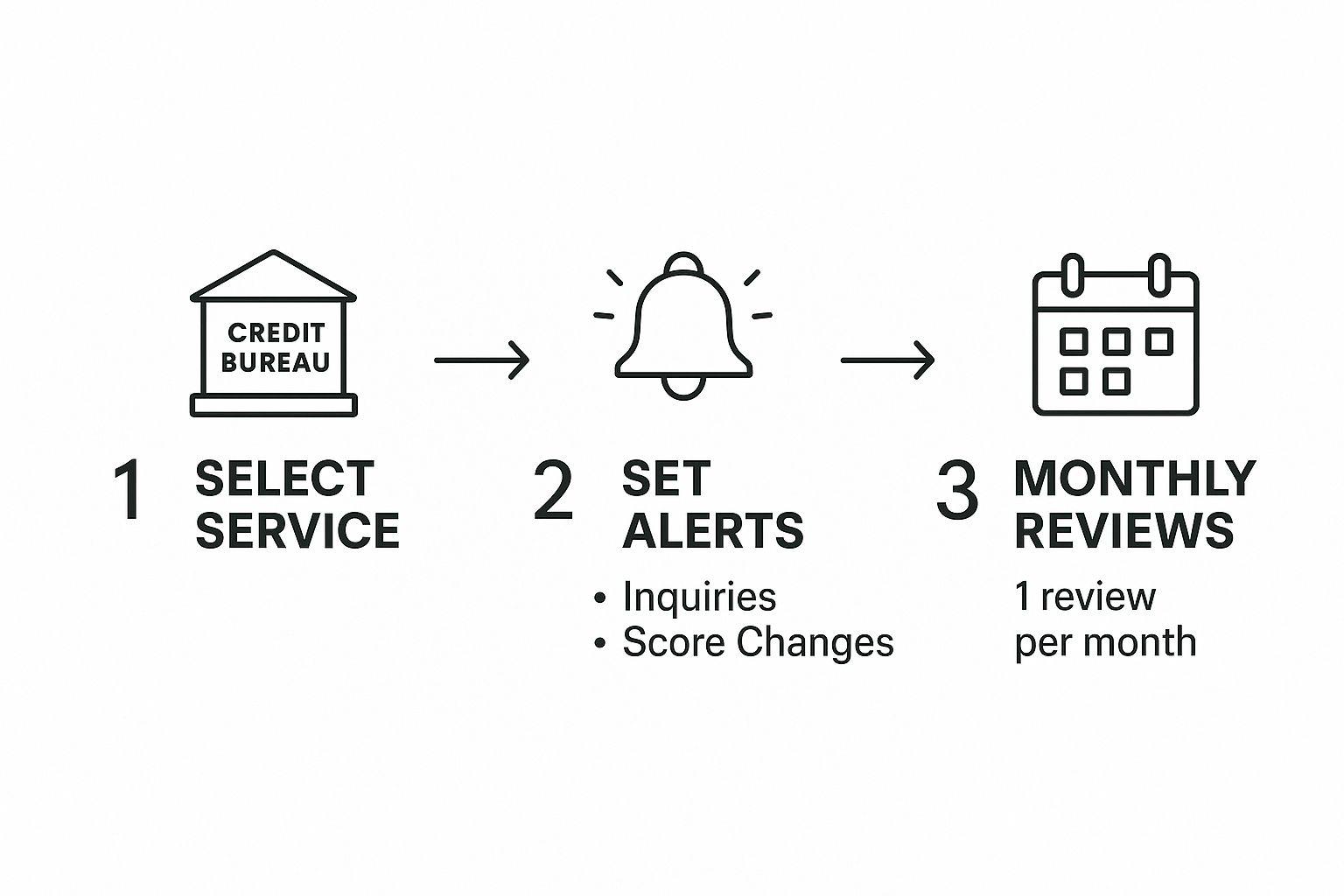

The infographic below shows a straightforward way to get your system set up.

As you can see, good monitoring isn't about complexity. It’s about being consistent and paying attention to the most important pieces of information.

Organizing Your Monitoring Routine

Once your alerts are live, get into a simple routine. A quick check-in once a month is often all you need to spot developing trends. For example, you might see your credit utilization ratio slowly increasing each month, which is a signal to start paying down your balances. By keeping an eye on your information and reviewing it regularly, you shift from just reacting to problems to actively managing your financial well-being.

Reading Credit Signals That Others Miss

Getting a credit alert is a great start, but understanding what it truly means is where the real power lies. Think about it: seeing your score drop by five points might send a jolt of panic. But if you just finished paying off a loan, this is often a normal adjustment as the account's status changes. Knowing how to monitor credit means you can spot the difference between everyday financial activity and a real cause for concern.

For instance, an alert for a hard inquiry from a bank you've never dealt with requires your immediate attention. This isn't just a small change; it's a major red flag that someone might be trying to get a loan in your name. Another critical signal is a change to your personal details, like a new address or phone number you didn't authorize. These are often the first steps an identity thief takes before they start opening fraudulent accounts.

Spotting What’s Not Obvious

Beyond the major alerts, your credit report contains subtle clues that are easy to overlook. Keep an eye out for small, strange changes in your credit card balances or a new account from a store you've never shopped at. While they might seem minor, these can be the earliest signs of fraudulent activity.

Here’s a practical guide to making sense of common alerts:

By getting comfortable with what these signals mean, you shift from simply getting notifications to actively interpreting them. This changes credit monitoring from a passive task into a strong defense for your financial identity.

Taking Action When Your Credit Gets Attacked

Finding a problem on your credit report can really shake your sense of financial security. But if you have a plan, you can turn a scary situation into something you can handle. When you’re figuring out how to monitor credit, knowing how to respond is just as crucial as spotting the issue in the first place. Acting fast is your best weapon against long-term damage.

Let's say you get an alert for an account you never opened. The first thing to do is call the creditor listed and then immediately freeze your credit with all three major bureaus. This move slams the door on thieves trying to open more accounts using your information. After that, you'll want to file a report with the Federal Trade Commission (FTC) to get an official record of the identity theft.

Correcting Errors and Disputing Fraud

Even within a healthy global credit market, things like high borrowing costs and fraud can still hit home, which is why keeping a close eye on your credit is so important. For a bigger picture on these economic trends, you can check out the Ares Global Credit Monitor. When you spot an error—whether it's fraud or just a simple mix-up—you need to file a formal dispute with the credit bureaus.

Your dispute letter should be straightforward and contain a few key things:

By law, the credit bureaus generally have 30 days to look into your claim. If they can't confirm the information is accurate, they have to remove it. It might sound like a lot, but taking these steps puts you back in the driver's seat. For a more detailed walkthrough, feel free to read our guide on how to dispute credit report errors. Dealing with these problems quickly not only resolves the immediate issue but also strengthens the good credit habits that will protect you down the road.

Transforming Monitoring Into Financial Opportunity

Think of credit monitoring as more than just a shield against fraud. It’s actually a powerful tool you can use to get ahead financially. When you actively look at the information in your credit reports, you can move from just fixing problems to actively creating opportunities. It’s all about using the data to make smarter financial moves.

Let's imagine you're planning to buy a car in the next six months. By keeping an eye on your credit utilization ratio (how much credit you're using compared to your limit), you can make a plan to pay down your balances. Doing this right before you apply for a loan can give your score a nice bump. That small action could mean qualifying for a lower interest rate, which might save you hundreds or even thousands over the life of the loan. This is how you monitor credit with an offensive mindset—turning data into a real advantage.

From Data Points to Actionable Insights

People who are good with their finances don't just wait for an alert to pop up. They regularly pull their full credit reports to get a clear view of their entire financial situation. A great place to start is by getting your free reports.

You can request them from the official, government-authorized site.

This site is your direct link to free weekly reports from the three major bureaus—Equifax, Experian, and TransUnion. These reports give you the raw data you need to build your financial strategy.

Once you have your reports, it helps to create a simple monthly routine to stay on top of things. To make it easier, here’s a checklist you can follow.

Monthly Credit Health Checklist

This table breaks down the essential tasks to perform each month to keep your credit in top shape.

This kind of proactive approach turns your credit report from a static document into a dynamic roadmap for your finances. It helps you time big purchases, negotiate better loan terms, and find financial products that fit your long-term goals. By making this a regular habit, you shift credit monitoring from a chore into a core part of your financial success.

Your Personal Credit Monitoring Action Plan

Watching your credit score is one thing, but actively managing it is where the real power lies. Let's move beyond just observing and create a practical roadmap that makes credit monitoring a regular habit, not just a one-time chore. The aim here isn't just to see your score go up; it's about building a stronger financial foundation for the long haul.

This plan needs to be personal because your financial situation is unique. How you monitor your credit will depend entirely on what you're trying to accomplish.

Tailor Your Monitoring to Your Goals

Your strategy should be a direct reflection of your financial ambitions.

Know When to Escalate and Upgrade

A good action plan also has clear "what if" scenarios. For instance, if you get an alert for a hard inquiry that you don't recognize, that’s your cue to immediately freeze your credit and figure out what’s going on. Similarly, if you know you’re about to apply for a major loan, it might be a good time to upgrade from a free monitoring service to a more detailed tool that offers daily updates. This gives you an extra layer of insight when it matters most.

Keeping a simple log or spreadsheet of your progress can be really motivating. It shows you exactly how your actions are affecting your score, turning your plan from a static document into a dynamic tool for your financial journey.

Ready to build a credit history that opens doors? Sign up for ItinScore today to get free, unlimited credit monitoring designed specifically for ITIN holders and start your journey toward financial freedom.