How to Maintain Good Credit for Financial Health

When it comes to your credit, a few simple habits can make all the difference. Honestly, it all boils down to two core principles: paying your bills on time, every time, and keeping your credit card balances low. If you can master these, you're building a solid foundation for your financial future and showing lenders you're a responsible borrower.

6 Habits for Maintaining and Improving Your Credit Score

Thinking about how to maintain good credit can feel like a huge task, but it’s less about chasing a perfect score and more about mastering a few fundamental behaviors. These habits are the language lenders understand. When you get them right, you open doors to better loans, lower interest rates, and more financial opportunities.

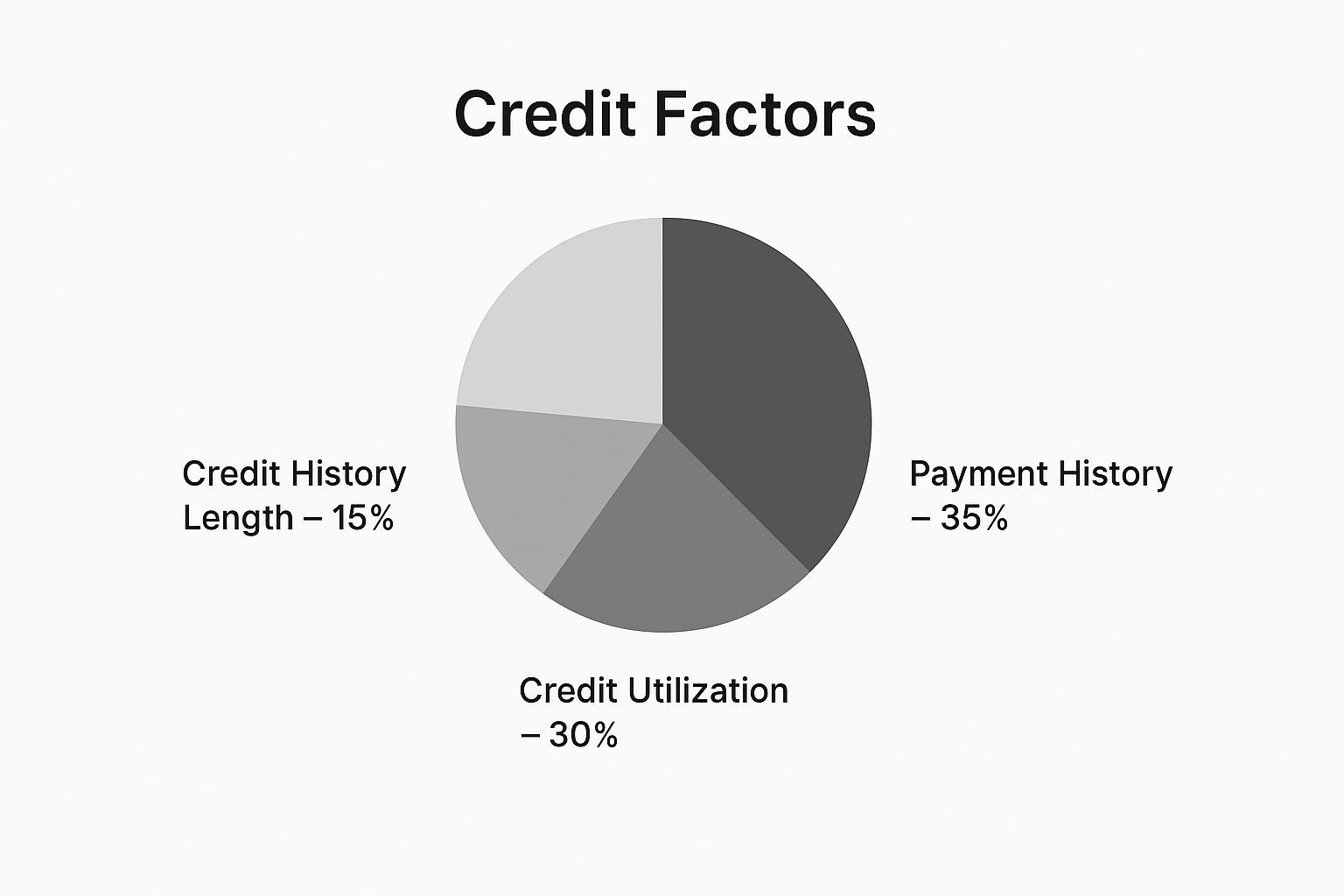

The two most powerful signals you can send are your payment history and how much of your available credit you're using.

As you can see, payment history and credit utilization together make up a massive 65% of a typical credit score. Let's dig into what that means for you.

To help you stay on track, I've put together a quick reference table that breaks down the key ingredients of a healthy credit score. Think of this as your roadmap.

The Pillars of Maintaining Good Credit

Focusing on the top two—payment history and utilization—will give you the most bang for your buck in maintaining a strong score.

1. The Power of Paying on Time

Your payment history is, without a doubt, the most important piece of your credit profile. Lenders want to see a consistent, reliable track record of on-time payments. It’s the clearest sign that you’ll pay back what you borrow.

Just one payment reported as 30 days late can cause a serious dent in your score, and that negative mark can stick around for years. This one factor makes up about 35% of your FICO score's calculation, which is why setting up automatic payments or calendar reminders isn't just a good idea—it's an essential strategy.

2. Keep Your Balances Low

Right behind your payment history is your credit utilization ratio. This is simply the amount of credit you're using compared to your total credit limit. A low ratio signals that you aren't maxing out your cards or relying too heavily on debt to get by.

The standard advice is to keep your utilization below 30%, but from my experience, the lower, the better. Lenders get nervous when they see high balances, even if you pay them off in full each month.

Mastering these habits is central to your financial well-being. Of course, managing your credit goes hand-in-hand with smart spending, and these essential budgeting tips can help you get a better handle on your money.

If you're just starting your journey and want to understand the basics, our guide on what credit building is is a great place to begin.

Getting Smart About Your Credit Utilization Ratio

You've probably heard the classic advice: keep your credit utilization below 30%. It’s a solid rule of thumb, but if you really want to build and maintain excellent credit, you need to understand the story this number tells lenders.

Your credit utilization ratio—the amount you owe compared to your total credit limit—is the second biggest piece of your credit score. Lenders look at it to gauge how much you rely on debt. A high ratio can be a red flag, even if your payment history is perfect.

The tricky part is that timing is everything. Even if you pay your balance in full every single month, your score can still take a hit. Why? Because card issuers usually report your balance to the credit bureaus just once a month, right around your statement closing date. If you make a big purchase and the statement closes before you pay it off, the report shows a high balance. A few days later you might pay it down to zero, but the damage is already done for that month.

Don't Fall Into the Timing Trap

Let's walk through a real-world scenario. Maria is great with her money. She uses her credit card, which has a 5,000 limit**, for all her monthly expenses to rack up rewards points. She spends about **2,500 a month and always pays the full balance on time.

Here's the problem: her statement closes on the 28th, but her payday isn't until the 30th. She always makes her full payment on the 1st of the next month. To the credit bureaus, it looks like Maria is using 50% of her credit (2,500** out of **5,000). This high utilization makes her seem like a riskier borrower, even though she's incredibly responsible.

Simple Strategies for a Healthier Ratio

The good news is that avoiding this trap is pretty straightforward. A few proactive moves can make sure your credit report shows your true, low-risk habits.

Actively managing your balances like this is not just good for you; it's part of a larger, positive economic picture. Recent analyses show a predicted slowdown in credit card debt growth, with delinquency rates also expected to level off. You can explore these global consumer credit trends from Equifax to see how individual habits contribute to the overall health of the credit system.

By being proactive, you're not just playing the credit score game—you're demonstrating the kind of financial discipline that lenders truly value.

Mix It Up: Using Different Kinds of Credit

A healthy credit profile is more than just having one credit card and paying it on time. When lenders look at your history, they want to see that you can handle different financial responsibilities. This is what's known as your credit mix, and it makes up about 10% of your credit score.

That might not sound like a lot, but a good credit mix can be the very thing that bumps your score from "good" to "great." It shows financial maturity. The two big players here are revolving credit and installment loans.

Revolving Credit vs. Installment Loans

These two kinds of credit work in completely different ways. Proving you can handle both sends a really strong message to any potential lender.

Let's imagine two people. The first has five different credit cards and pays them all on time. That's good. The second person has one credit card and a small car loan, and they're also making all their payments on time. To a lender, that second person often looks like a better risk because they've shown they can successfully manage both revolving and installment debt.

Using Installment Loans to Your Advantage

Now, I would never tell someone to take out a loan just for the sake of their credit score. That's a bad move. You should only borrow money when you actually need it.

But when you do need a loan—say, for a car—it can be a fantastic opportunity to strengthen your credit profile for the long haul.

Think about it: financing a car and making every single payment on time for three, four, or five years creates an incredibly positive track record. It demonstrates a completely different skill than managing the fluctuating balances on a credit card. It proves you can be trusted with a serious, predictable financial commitment.

As you think about your own financial strategy, it helps to get a solid understanding of the distinctions between a line of credit and a traditional mortgage, since they play very different roles. Building out this diverse credit history takes time, but every on-time payment you make—on any type of account—is another brick in the foundation of your financial future.

Staying on Top of Your Credit: A Proactive Approach

Building good credit is one thing; keeping it is another. You can't just set it and forget it. I like to think of it like tending a garden—it needs regular attention to flourish. Staying on top of your credit means you're always in the driver's seat, able to spot small issues before they snowball into major headaches.

This involves keeping a close eye on both your credit report and your credit score. They’re two sides of the same coin. Your score is the quick headline—a single number that gives lenders a snapshot of your credit risk. Your report is the full story, detailing every account, payment, and inquiry that shapes that score.

How to Get Your Hands on Your Credit Reports

Good news. You are legally entitled to a free copy of your credit report from each of the big three bureaus—Equifax, Experian, and TransUnion—every 12 months. The only place to get these official, no-strings-attached reports is AnnualCreditReport.com.

Here’s what the homepage of the official, government-authorized site looks like:

Stick to this site. It's the only one mandated by federal law to provide your reports for free, so you can be sure your information is safe.

Once you’ve downloaded your reports, it's time to put on your detective hat. You're looking for anything that doesn't quite add up.

Why a Monitoring Service is Your Best Friend

Pulling your reports once a year is a solid baseline, but a lot can change in 365 days. For anyone serious about building and protecting their credit, a monitoring service is a non-negotiable tool. Think of it as an around-the-clock alarm system for your financial identity.

This is where platforms like itinscore really shine. Instead of you having to remember to check, they actively watch your file and send you real-time alerts about important changes. You might get a ping on your phone if:

This constant vigilance is the secret sauce to maintaining great credit. By combining your annual report review with a tool that provides instant alerts, you ensure your credit history is always an accurate reflection of your hard work and financial responsibility.

How Economic Shifts Can Affect Your Credit

It's easy to think of your credit score as something that exists in a vacuum, but the truth is, it’s deeply connected to the ups and downs of the wider economy. Things like interest rate changes from central banks can ripple out and directly impact your wallet, creating both new challenges and smart opportunities for your credit.

When the economy is booming and central banks raise interest rates to cool things down, you'll feel it most with any variable-rate debt. Think credit cards. A higher rate means your monthly minimum payment can inch up, and carrying a balance suddenly costs you more. It's a subtle change that can easily strain your budget if you're not paying attention.

On the flip side, when the economy slows and interest rates drop, that’s your cue to pay attention. Lower rates make borrowing cheaper, and that can be a golden opportunity to make some strategic moves.

Turning Economic Change into a Win

Imagine a homeowner with a mortgage. If interest rates take a dive, they have a chance to refinance—swapping their old, expensive loan for a new one with a much better rate. Just that one decision could slash their monthly payment, freeing up a significant chunk of cash.

What do they do with that extra money? They could use it to aggressively pay down high-interest credit card debt. This not only saves them money on interest but also hammers down their credit utilization, which is a fantastic boost for their credit score. By recognizing and acting on that economic shift, they’ve improved their entire financial picture.

This isn't just a hypothetical scenario; it's a well-documented pattern. For a real-world example, look at what happened in Australia. After the first interest rate cut since 2021 occurred in early 2025, mortgage refinancing shot up by 20% compared to the year before. People saw their chance to lock in lower payments and jumped on it. You can explore more of these global trends and consumer behaviors over at Equifax.

How to Prepare for Any Economic Weather

You can’t steer the economy, but you can absolutely prepare your own ship for whatever waves come your way. A well-stocked emergency fund is your best friend here. If a downturn hits and your income takes a dip, having that cash cushion means you can still cover your bills without racking up high-interest debt and damaging your credit.

Whether interest rates are going up or down, the fundamentals never change. The goal is always to keep your debt manageable and never miss a payment.

For ITIN holders focused on building a strong, resilient financial foundation, adapting to the economic climate is a powerful skill. Our guide on how to improve your credit score is packed with actionable steps that work, no matter what the forecast says.

Common Questions About Maintaining Credit

Once you have a good handle on the basics, you'll still run into specific situations where the "right" move isn't so clear. It's totally normal. Let's walk through some of the most common questions and tricky spots people encounter while trying to keep their credit in top shape.

One of the first things people worry about is slipping up. How bad is one late payment, really?

The good news is that a payment that's a few days late usually won't show up on your credit report. Lenders typically don't report it to the bureaus until it's at least 30 days past due. But once it hits your report, the damage can be swift and serious—potentially dropping a good score by dozens of points. That black mark can stick around for seven years, though its impact does fade over time.

To Close or Not to Close Old Accounts

Here's a classic dilemma: you have an old credit card you never use. It feels responsible to close it and tidy up your finances, but that instinct can actually hurt your credit.

My advice? In most cases, it's best to keep old credit card accounts open, especially if they don't have an annual fee. Closing an account can sting your score in a couple of ways:

If you're stuck with an unused card that has a hefty annual fee, don't just close it. Call the issuer first and ask if you can downgrade to a no-fee card. You get to keep the credit line and history without paying for a card you don't use.

When you check your own credit, it’s called a soft inquiry, and it has zero effect on your score. A hard inquiry is what can cause a small, temporary dip. That only happens when a lender pulls your report because you've officially applied for new credit, like a mortgage or an auto loan. Knowing all the different https://www.itinscore.com/blog/factors-affecting-credit-score/ is key to demystifying the whole process.

Beyond Loans and Credit Cards

Building great credit isn't just about getting better loan terms. It trickles down into other parts of your financial life in ways you might not expect.

For instance, many people are surprised to learn how your credit rating can influence insurance rates. Insurers often use credit-based scores to set premiums for auto and home policies, giving you yet another powerful reason to keep your financial house in order. Good credit can literally save you money every month.