How to Increase Credit Limit: Tips for Faster Approval

Reading Your Credit Profile Like a Lender Would

Before you even think about asking for a higher credit limit, you need to see yourself the way your bank does. Trust me, I've seen this go wrong so many times – people shooting themselves in the foot by asking for more credit at exactly the wrong moment. Lenders are looking for specific things. Understanding what those things are is the key to the whole game. So, let's talk about credit utilization, payment history, and the big red flags that tell a lender you're not ready.

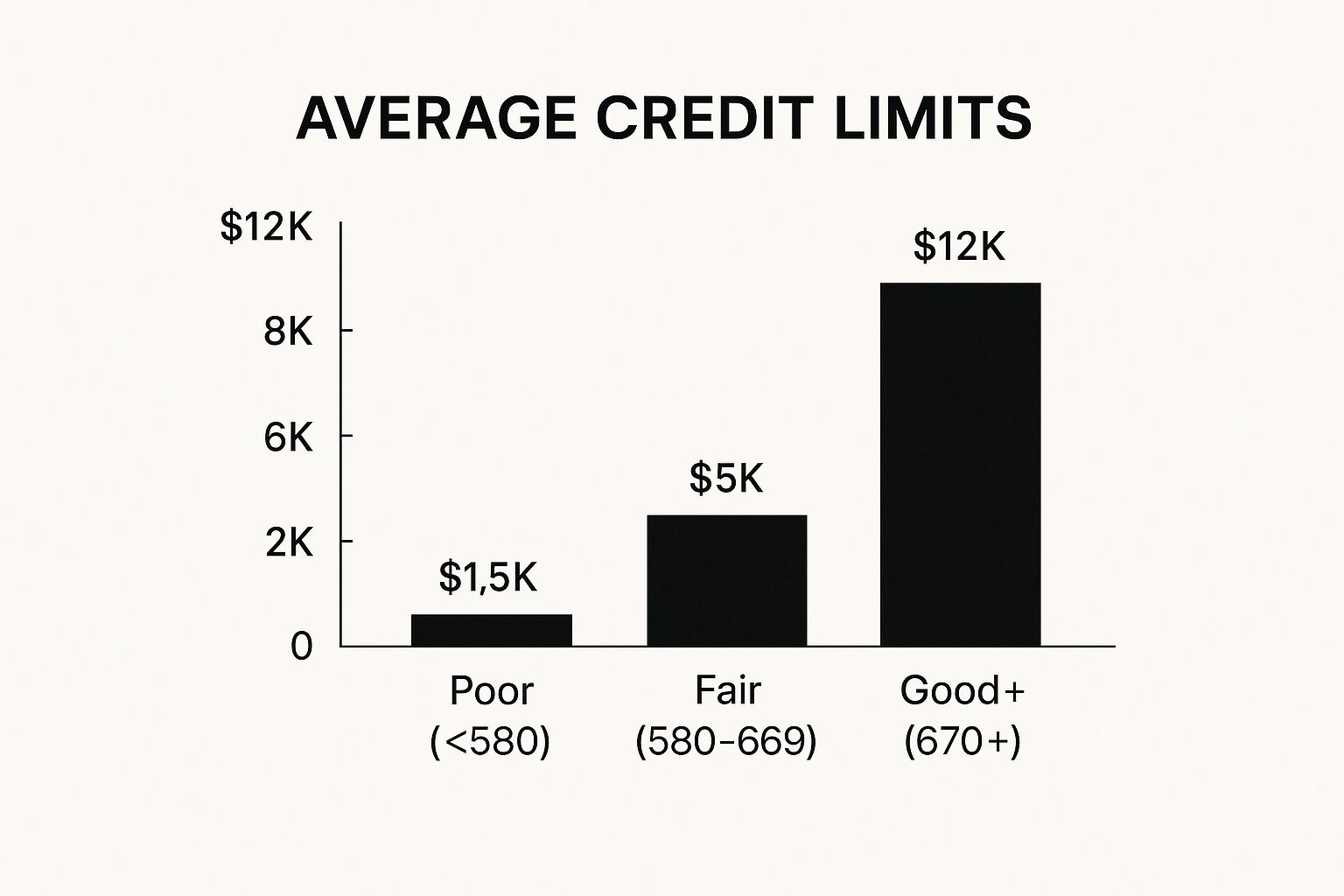

This infographic shows how average credit limits tend to move with credit scores. Higher score, higher limit – generally speaking. It really highlights how important a good credit score is if you're aiming for a higher credit limit. Keeping your credit utilization low, paying on time every single time, and not applying for tons of new credit all play a role. Someone with a long history of on-time payments and low utilization? They're in a much better position to get that limit increase. For more on the rising importance of credit cards, check out this article: 2025 Will Be the Year of the Credit Card. Also, understanding your ITIN credit report is super helpful – our guide can walk you through it: Check out our guide on ITIN credit reports.

I had a friend who bumped their credit score up by 50 points just by paying down their balances. They already had a great payment history, so that combined with the lower utilization led to a massive credit limit increase. Lenders love to see responsible behavior like that. It's not about magic; it's about showing you can handle credit. These small steps can make a big difference in how a lender sees you. A good credit history significantly increases your chances of getting approved for a limit increase.

Credit Profile Assessment Checklist

Before we go any further, take a look at this checklist. It summarizes the key things lenders look at when you ask for a higher limit.

This checklist is a great starting point for evaluating your own credit profile. By focusing on these key factors, you can increase your chances of getting approved for a higher credit limit. Remember, building good credit is a marathon, not a sprint!

Mastering the Perfect Timing Strategy

Timing your credit limit increase request isn't just helpful—it's essential. I've seen practically identical credit profiles get completely different outcomes simply because of when they asked. Credit card companies have their rhythms, and knowing how to work with them gives you a real leg up.

Think of it like the stock market. Sometimes the market's up and companies are eager to invest; other times, they're holding back. The same principle applies to credit limit increases. Historically, some months just have better approval rates. Knowing when to ask can significantly boost your chances.

For example, after opening a new card, it's generally wise to wait at least six months before requesting a higher limit. This demonstrates responsible credit management to the bank. Also, give yourself some breathing room between requests – ideally six months to a year. Constantly asking your issuer can actually backfire.

Credit limit increases are also affected by the overall credit market. Keeping an eye on broader economic trends can be surprisingly helpful. TransUnion's 2025 Consumer Credit Forecast is a great resource for this. As we've seen in recent years, lenders become more cautious when the economy slows down. During boom times, they're often more open to extending credit.

Finally, watch for cues from your own account. Things like an automatic credit limit increase, special promotional offers, or even changes in your credit monitoring alerts can signal that your issuer is primed to give you a higher limit. These are like little insider tips from your bank, hinting at the perfect moment. Learning to spot these signals is a real game-changer when it comes to successfully increasing your credit limit.

The Conversation That Gets Results

Let's talk about actually asking for a credit limit increase. It's that moment of truth, right? I've been there, and I've also talked to tons of customer service reps to get the inside scoop. The key? Present yourself as a valuable customer, not like you're begging for a favor. Think strategic, not manipulative.

This screenshot from the Chase credit card management portal shows where you might find the option to request a credit limit increase. Most banks have similar online portals, making it super convenient. Having these tools at your fingertips really puts you in control.

So, what are they looking for? They're trained to ask about your income and expenses, so have those numbers ready. Be accurate! They might also ask about your employment history. This isn't about tricking anyone; it's about being prepared with the information they need. Knowing common red flags like "recent inquiries" or "high utilization" can help you anticipate potential issues. And if they ask for documentation, have pay stubs or bank statements handy.

What happens if they say no? How you handle it matters. Ask why. This is invaluable intel for your next attempt. Was it your utilization? Payment history? Knowing the reason lets you address it directly. A "no" today doesn't mean a "no" forever. It's just information you can use to improve your chances later. For example, if high utilization is the issue, paying down your balance and waiting a few months can make a huge difference.

Finally, even if you're approved, don't stop there! Ask how much they're increasing your limit. Sometimes, asking for a bit more can actually work. Remember, this is a two-way conversation. Be polite, professional, and strategic, and you’ll significantly boost your odds of getting the credit limit you deserve.

Proving Your Income and Usage Patterns

It's great when your income goes up, but it doesn't help your credit score much if you can't prove it. Same goes for responsible spending – if lenders can't see it, it doesn't exist in their eyes. This is a real stumbling block for many. People assume their credit card company knows everything about their finances, but it's just not that simple.

So, how do you actually document income changes so lenders understand and accept them? Let's dive in. This applies whether it's a regular job, side hustle, or even investment income. This can be particularly important for ITIN holders. For more tips relevant to ITINs, check out this helpful article: how to check your credit score with an ITIN.

Smart credit card usage is key, too. Using your card regularly and paying it off on time demonstrates you can handle a higher credit limit. It’s about showing responsibility, not maxing out your card every month.

Real-World Examples of Proving Income

I know someone who doubled their income with a big freelance project. When they requested a credit limit increase, they brought copies of their contracts and invoices. That extra step proved to the lender that the income boost was stable and reliable. This kind of detailed documentation can be a game-changer for freelancers and small business owners. It builds credibility and really strengthens your case.

Another friend negotiated a higher limit after changing jobs. They simply provided their new offer letter showing the updated salary. That one document made all the difference. It clearly demonstrated a legitimate jump in earning power.

Common Mistakes to Avoid

The biggest documentation mistake? Not having the right paperwork. Vague statements or unverified claims won't get you anywhere. You need solid evidence. Think pay stubs, bank statements, tax returns, or official letters from employers.

No matter how complex your income situation, a solid paper trail is essential. It dramatically increases your chances of getting approved. It simplifies things for the lender and proves you’re serious about managing your credit responsibly.

Here’s a handy table summarizing effective ways to document income, especially helpful when you're trying to demonstrate an increase:

Income Documentation Methods Effective ways to prove income increases to credit card companies

This table gives you a quick overview of the best documentation for various income types, the typical verification time, and the general success rate. While these are estimates, it highlights the importance of using the most relevant documents to prove your income. Strong documentation makes a significant difference in getting your credit limit increase approved.

Understanding Market Conditions and Regional Trends

Your local credit environment plays a surprisingly big role in whether you snag that credit limit increase you're after. Most people don't even think about it, but the credit landscape is constantly changing depending on your location, the overall economic climate, and even individual bank policies in your area. Think of it like the weather—sometimes conditions are ripe for growth, and sometimes they're just not.

Things like local employment rates, the housing market, and regional economic policies might seem totally unrelated to your credit limit, but they actually do influence lenders' decisions. For instance, if unemployment is rising in your region, banks might get a little skittish about handing out increases, even if your personal finances are stellar.

The global economy has a hand in this too. The S&P Global Ratings' Credit Cycle Indicator (CCI) keeps tabs on credit conditions worldwide. Projections suggest that by 2025, the CCI will be positive in some areas, like the eurozone, which could signal smoother sailing for credit limit increase approvals. However, other regions, like China, might see tougher conditions with a declining CCI. Discover more insights about the CCI. This just goes to show how larger economic forces can shape your local lending scene.

It's also worth noting that different lenders react differently to economic pressures. Some banks are more cautious when things are uncertain, while others maintain their regular lending practices. Knowing which institutions in your area are more open to granting increases can give you a serious advantage. You might be interested in checking out banks that accept ITINs.

Understanding these regional nuances and how lenders operate lets you approach your request strategically. It’s all about being savvy—knowing when and where to apply. This knowledge can truly be the deciding factor in getting the credit limit increase you want.

Your Strategic Action Plan

So, let's map out a plan to boost your credit limit. This isn't one-size-fits-all advice; it’s tailored to your specific situation and goals. We'll cover timelines, benchmarks, gathering the necessary documents, and even what to do if you're denied (and how to prep for your next attempt).

Setting realistic expectations is key. Where are you starting from? What's your current credit score? This helps create a practical timeline. If your score is below 670, for example, focus on raising it first. Remember that checklist we talked about earlier? Those factors—utilization, payment history, and inquiries—are your foundation.

Let’s say high utilization is holding you back. Aggressively paying down your balances over the next two billing cycles can make a real difference. Track your progress closely – a budgeting app or even a spreadsheet can work wonders. Seeing those numbers improve not only motivates you but also shows lenders you’re committed.

Planning for Potential Roadblocks

Think about potential bumps in the road, too. What happens if you’re denied? It's perfectly alright! Ask the lender why. Their feedback offers valuable insight into what needs improvement. Maybe they’re looking for more consistent income or a longer credit history. Use that feedback to strengthen your next request.

Aiming for Automatic Increases

In the long run, aim for automatic increases. Consistent responsible credit use – keeping your utilization low and making on-time payments – often leads to lenders automatically raising your limit. It’s a reward for good financial habits! Later, we’ll explore advanced strategies, like product changes and relationship banking, to potentially speed up this process.

This isn’t just about getting more credit; it's about building long-term financial health. A higher credit limit can lower your utilization, potentially boosting your score and giving you more financial flexibility. It’s a step towards achieving bigger financial goals. Ready to take control of your credit journey? Join itinscore today!